PENSIONS

advertisement

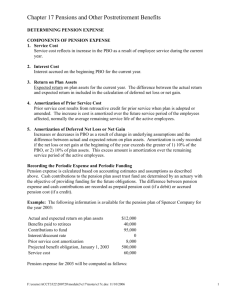

Pensions p. 1 PENSIONS (revised October 2012) On 1/2/01, we form a company and adopt a pension plan for our employees(Iris). We meet with a pension plan administration company that has actuaries working for it. They suggest we adopt one of two plans: Plan A: A defined contribution plan - we pay $600/year into the pension fund January 2 of each year. The pension fund invests the money, when the employee retires, she gets an annuity (purchased by the fund) of some amount of money. The amount depends on how well the pension fund has invested the money we put in it. Plan B: A defined benefit plan - We promise that Iris will receive (for life) pension payments equal to: 2% x the number of years she worked for us x his/her highest salary. We elect Plan B. The following is a very condensed version of what happens in a company’s defined benefit pension plan. ACCOUNTING FOR PENSIONS: This is a broad picture of what we will be discussing: 1/2/01 on 1/2/03 12/31/03 12/31/31 12/31/42 | | | | | We start a we modify the we find out some the employee employee company pension plan, of our early is expected to is originally and adopt pension retire expected a pension assumptions to die plan were incorrect | 31 years | 11 years | 12/31/43 | revised date of death 1 year | The whole idea is that we will pay money into the pension fund each year and the pension fund will invest that money so that when the employee retires the pension fund will have enough money to pay the employee the necessary pension benefits. FASB's view is that we have a liability to the employee for the pension payments we have to make. One problem in accounting for pensions is that there are lots of estimates involved: how long will employees work prior to retirement, how long will employees live after retirement, what return the pension fund will earn, what will be the employee's highest salary, etc? For our plan, actuaries and others agree with these assumptions for the average employee who is covered: works 31 years lives 11 years after retirement discount rate (settlement rate)-implicit in an annuity purchased for an employee - FASB says it should approximate the rate on a long term highly rated bond - may vary from year to year: 6% long term rate of return on plan assets: 8% highest salary will be $100,000 payments will be made into the pension fund January1st of each year, and retirement payments made December 31 of each year. Pensions p. 2 Iris will, therefore, receive an annuity of retirement benefits of (2% x $100,000) $2,000 for each year she works for us (if 31 years is right, she will get $62,000/year in retirement benefits). Currently pension expense for defined benefit pension plans is the sum of several elements: Pension expense= 1. service cost 2. + interest on projected benefit obligation 3. - expected return on plan assets 4. + amortization of prior service cost 5. + / - amortization of gain/loss 6. + / - amortization of transition amount 7. + / - some things we won’t discuss we will ignore these We will go though several years of the company’s accounting for its pension for Iris and explain the terms above. YEAR 2001: SERVICE COST is how much we owe her pension fund because Iris will work for us in 2001. Determining this amount is a two step calculation. Given our assumptions on 1/2/2001: / / / | | 1/2/01 1/2/02 adopt plan 2nd and 1st paypayment ment into fund $488,986 on 12/31/31 | \ / | \ / | \ | \ | \ | \ | | | | 1/2/31 12/31/31 12/31/32 12/31/2042 last payment Iris Iris gets Iris gets into fund retires 1st check last pension from fund check and dies 1. find present value of retirement payments out of the fund: PVA = RENT (2,000) x PVFA (n=11, i=6%) PVA = $15,774 (this amount should be in her pension fund the day she retires in order for her to get $2,000/year until she dies) 2. find present value of $15,774 discounted for 31 years: PV = FV (15,774) x PVF (n=31, i=6%) PV = $2,591 that is the "service cost" for 2001. This is the amount we need to put into her fund on 1/2/01 to pay her pension for working in 2001. INTEREST ON THE PROJECTED BENEFIT OBLIGATION (PBO): The projected benefit obligation is the amount of money that should be in the employees’ pension fund on any date. On 1/2/01, the PBO is $2,591 (the service cost we calculated above). Interest on that PBO is the amount of the PBO at the beginning of the year times the “discount rate” that we used in the present value calculation above. $2591 * 6% = $155 | 1/2/01 | 12/31/01 Pensions p. 3 RETURN ON PLAN ASSETS (PA) – now the funding question. Let's assume the company really pays $3,000/year into the pension fund on January 2 of each year: If the company earned the 8% it expected on the plan assets, it would earn $240 in 2001. +240 int = 3,240 | 3,000 | | 1/2/01 12/31/01 2001 PENSION EXPENSE: service cost + interest on projected benefit obligation - expected return on plan assets + amortization of prior service cost + / - amortization of gain/loss 2,591 155 ( 240) -0-02,506 (we will only consider the first 5 elements of pension expense) Notice that there are two separate things going on – the PBO – which is the company’s liability to the employee for her pension benefits and the Plan Assets – which is what the employee really has accumulated in their pension. Journal entry on 1/2/01: from worksheet we’ll do in class YEAR 2002: SERVICE COST We do the same thing for 2002 that we did in 2001: ask how much should be put into the fund on 1/2/02 to pay her an additional $2,000 because she worked for us in 2002? Working for us in 2002 would add $2,000 to her annuity from 12/31/32 till 12/31/42. 1. find present value of and additional $2,000 payment out of the fund: PVA = RENT (2,000) x PVFA (n=11, i=6%) PVA = $15,774 [must be the same as2001] 2. find present value of $15,774 discounted for 30 years: PV = FV (15,774) x PVF (n=30, i=6%) PV = $2,746: that is the "service cost" for 2001 (note: the actuaries would use 30 years because the payment into the fund on January 2, 2002 will earn interest for 30 years until Dec. 31, 2031.) INTEREST ON THE PROJECTED BENEFIT OBLIGATION (PBO): The projected benefit obligation is the amount of money that should be in the employees’ pension fund on any date – see the amounts in bold italics below. PBO increases each year by the amount of the service cost and the interest the service cost should earn; it decreases when money is paid to retirees. PBO on 1/2/02 $5,492 * 6% = 330 interest on PBO in 2002 | 2,746 [SC for 2002] 2,591*6%=155 int. 2,746 PBO on 12/31/01 $2,591 [SC for 2001] | | | 1/2/01 12/31/01 1/2/02 Pensions p. 4 RETURN ON PLAN ASSETS (PA) – the company again puts $3,000 into the pension fund on 1/2/02 Let's look at plan assets given $3,000/year payments 6,240*8%= 499 int interest expected to be earned in 2002 3,000 (1/2/2002 payment) +240 int = 3,240 | 3,000 (1/2/01 payment) | 1/2/01 | 12/31/01 2002 PENSION EXPENSE: service cost + interest on projected benefit obligation - expected return on plan assets + amortization of prior service cost + / - amortization of gain/loss | 1/2/02 | 12/31/02 | 1/2/03 2,746 330 ( 499) -0-02,577 Journal entry on 1/2/02: from worksheet we’ll do in class YEAR 2003: On 1/2/03, the company amends the pension plan to pay retirement benefits of 5% per year instead of 2%. The company agrees to retroactive coverage. Note this will not change any calculations of pension expense prior to 2003, but will mean that there is a change in the calculation of the service cost for 2003 and an addition to the PBO on 1/2/2003. SERVICE COST We do a similar thing for 2003 that we did in 2001 and 2002: ask how much should be put into the fund on 1/2/03 to pay her an additional $5,000 (5% * $100,000) from 12/31/32 till 12/31/42? 1. find present value of an additional $5,000 payment out of the fund: PVA = RENT (5,000) x PVFA (n=11, i=6%) PVA = $39,434 – this is how much should be in her plan on her retirement date to pay her $5,000/year until she dies. 2. find present value of $39,434 discounted for 29 years: PV = FV (39,434) x PVF (n=29, i=6%) PV = $7,278: that is the service cost for 2003 INTEREST ON THE PROJECTED BENEFIT OBLIGATION (PBO): The company would need to calculate what its projected benefit obligation should have been on 1/2/03 had they known on 1/2/01 that Iris would get retirement benefits of 5% upon retirement. 21,834 new PBO on 1/2/03 7,278 [SC for 2003] $13,732 * 6% = 824; 14,556 new PBO on 12/31/02 ** | 6,866 [what SC for 2002 should have been] 6,477 * 6%=389 int; 6,866 what PBO should have been on 12/31/01 $6,477 [what SC for 2001 should have been] | | | | | 1/2/01 12/31/01 1/2/02 12/31/02 1/2/03 ** the old PBO was $5,822, so the PSC is $8,734 Pensions p. 5 RETURN ON PLAN ASSETS (PA) – the company again puts $3,000 into the pension fund on 1/2/02 Let's look at plan assets given $3,000/year payments 9,739 on 1/2/03 * 8% = 799 int. in 2003 + 2,000 + 499 int. in 2002 = 6,739 + 3,000 contribution 1/2/02 +240 int. in 2001 = 3,240 | 3,000 | | | | 1/2/01 1/2/02 1/2/03 1/2/04 AMORTIZATION OF PRIOR SERVICE COST (PSC) Prior service cost is the difference between the PBO under the old pension agreement (2% of her highest salary) and the PBO under the new agreement (5% of her highest salary) on the day the plan is modified. In our example that difference is $8,734. That Prior Service Cost (PSC) should be amortized over Iris’s remaining work life (29 years). This amount is amortized each year for 29 years. [Note: PBO on 12/31/02 under 2% pension plan = $5,822 PBO on 12/31/02 under 5% pension plan = $14,556, the difference is 8,734] AMORTIZATION OF GAINS/LOSSES: On December 31, 2003, we get two phone calls: one from Mutual of Omaha, the company handling our pension fund and the second from our actuaries. 1. M of O says the pension assets actually had a return of $6,700 in 2003 (a number I made up), prior to 2004 actual returns on plan assets equaled expected returns) and 2. actuaries now estimate Iris will live 12 years after retirement, not the originally expected 11 years. These two items give rise to a gain (the return on plan assets was more than we expected in 2003) and a loss (we haven’t expensed enough to pay Iris’s retirement benefits for 12 years). These are different than Prior Service Cost which we just discussed (PSC is caused by changes in the plan itself) – unexpected gains and losses are differences between our estimates and what really happened. The FASB's preference would be to ignore them in the hopes that some years there are gains and in some years there will be losses, but that they would average out to zero over time, because the FASB doesn't like causing fluctuations in a company's income. In 2003, we have $5,901 in unexpected return or unexpected gain [the actual return was $6,700, but we expected a return of $799 (8% * 9,739)] from the plan assets in that year. There is also unrecognized liability loss because Iris is expected to live an extra year. That means the PBO on 12/31/03, based on her living 11 years after retiring is too low. We would need to calculate a new PBO on 12/31/03 given her new retirement expectation – that amount would be $24,602. The old PBO (using the 11 year expectation) was $23,144; therefore there is a liability loss of the difference: $1,458. The net unrecognized gain is $4,443 (=$5,901 – 1,458). FASB said, if a company has unexpected gains/losses, take these unrecognized gains or losses into consideration if: 1. they existed at the beginning of the year and 2. they are “large” - FASB defined large as: greater than 10% of the larger of Plan Assets or PBO at the beginning of the year. In our case, since the gain and loss did not exist at the beginning of the year, we ignore them in 2003. Pensions p. 6 Journal entry on 1/2/03: from worksheet we’ll do in class: 2003 PENSION EXPENSE: service cost 7,278 + interest on projected benefit obligation 1,310 (21,834 * 6%) - expected return on plan assets ( 799) (9,739 * 8%) + amortization of prior service cost 301 (8,734 / 29 years) + / - amortization of gain/loss -0- (since the PA gain and the PBO loss do not exist on 8,090 1/1/03 we do not amortize anything.) YEAR 2004 SERVICE COST We do a similar thing for 2004 that we did before: ask how much should be put into the fund on 1/2/04 to pay her an additional $5,000 from 12/31/32 till 12/31/43 (it is now 2043 because we expect her to live 12 years after retiring) because she worked for us in 2004? 1. find present value of and additional $5,000 payment out of the fund: PVA = RENT (5,000) x PVFA (n=12, i=6%) PVA = $41,919 2. find present value of $41,919 discounted for 28 years: PV = FV (41,919) x PVF (n=28, i=6%) PV = $8,201: that is the service cost for 2004 INTEREST ON THE PROJECTED BENEFIT OBLIGATION (PBO): 6% * PBO ON 1/2/04. RETURN ON PLAN ASSETS (PA): this will, again, be the expected return on plan assets on 1/2/2004. AMORT. OF PRIOR SERVICE COST: The Prior Service Cost from 1/2/03 will continue to be amortized. AMORTIZATION OF GAINS/LOSSES FASB said, if a company has unexpected gains/losses, take these unrecognized gains or losses into consideration in calculating pension expense if: 1. they existed at the beginning of the year (now the case, the gain and loss existed on 1/1/04) and 2. they are “large” - FASB defined large as: greater than 10% of the larger of Plan Assets or PBO at the beginning of the year. If the absolute value of the net unrecognized gains or losses is large, amortize the “excess” over the remaining service life. If the absolute value of the net unrecognized gains or losses is not large amortize nothing, accumulate gains and losses from this year. Since this gain exists at the beginning of 2004, we need to see if this net gain is large. To do that we look at the PA and PBO at the beginning of 2004: Plan assets: PBO: $19,439 (16,439+3,000) $32,803 PBO is larger, so FASB said take 10% * $32,803 = $3,280; the net unrecognized gain is said to be large, because the absolute value of the net gain on 1/1/2004 ($4,443) is larger than $3,280. Since the gain is large we must amortize the “excess” – the amount by which the net gain exceeds the $3,280 which is [$4,443 – $3,280 =] $1,163. That $1,163 is amortized over Iris’s remaining working service life – 28 years; since we are amortizing a gain, we will subtract the amortization amount from pension expense. (If we were amortizing a loss, we would add the amortization amount.) Pensions p. 7 The unamortized loss is carried over to 2005, any gain or loss that came about in 2004 is netted with that figure and compared to the larger of PBO or PA at the beginning of 2005, etc. 2004PENSION EXPENSE: service cost + interest on projected benefit obligation - expected return on plan assets + amortization of prior service cost + / - amortization of gain/loss 8,201 1,968 (32,803 * 6%) (1,555) (19,439 * 8%) 301 (8734 / 29 years) ( 42) ($1,163 / 28) 8,873 Journal entry on 1/2/04: from worksheet we’ll do in class