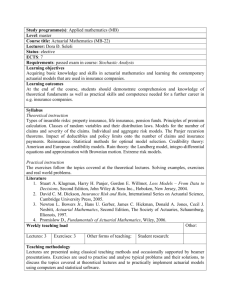

CV - University of the Witwatersrand

advertisement

PROFESSOR ROBERT JOHN THOMSON, Ph.D., F.A.S.S.A. CURRICULUM VITAE Date of birth: 28 July 1945 EDUCATION Matriculated: St Stithians College, 1962 first class Suid-Afrikaanse Akademie: Afrikaanse Taaleksamens: Hoёr eksamen, 1962 University: UCT 8/12/1966: B.Sc., mathematics and mathematical statistics Wits 25/11/2004: Ph.D.: The Development and Application of Models in Actuarial Science Professional: Fellow of the Institute of Actuaries, London, 9/10/1972 CAREER 1967–72 1972–76 1976–81 1981–93 1993– Old Mutual: Department Head, Actuarial Development, with effect from 1971 Africa Enterprise: responsible for administration, finance and certain ecumenical liaison functions Chamber of Mines of South Africa: Actuary J A Carson & Partners: partner with effect from 1982 School of Statistics and Actuarial Science, University of the Witwatersrand: Positions held: 1993–2001 visiting professor 2001–2010 professor 2011– professor emeritus Committee service: 1996–2003 Science Faculty Research Committee 1997–1999 Senate Committee on Salaries and Conditions of Service 1998–2010 Senate 1998–2002 Director, Stochastic Solutions ARTICLES Recognised journals 1 Stochastic investment models: the case of South Africa, British Actuarial Journal 2(3), 1996, 765–801; 2 Non-parametric likelihood enhancements to parametric graduations, British Actuarial Journal 5(1), 1999, 197–236; 3 A re-evaluation of the South African bond exchange-actuaries indices, Investment Analysts Journal, 53, 2001, 19–28; 4 Assets, liabilities and risk, Orion 17 (1/2), 2001, 29–54 5 The management of risk by burial societies in South Africa, South African Actuarial Journal 2, 2002, 83–128 (co-author: Deborah Posel) 6 The use of utility functions for investment channel choice in defined-contribution retirement funds: I: defence, British Actuarial Journal 9(3), 2003, 653–709 7 8 13 14 15 The use of utility functions for investment channel choice in defined-contribution retirement funds: II: a proposed system, British Actuarial Journal 9(4), 2003, 903–958 The pricing of liabilities in an incomplete market using dynamic mean–variance hedging, Insurance: Mathematics and Economics 36, 2005, 441–55 9 A typology of models used in actuarial science, South African Actuarial Journal 6, 2006, 19–36 10 Stochastic models for actuarial use: the equilibrium modelling of local markets. ASTIN Bulletin 39(1), 2009, 339–70 (co-author: Dmitri Gott) 11 The application of expected-utility theory to the choice of investment channels in a defined-contribution retirement fund. ASTIN Bulletin 39(2), 2009, 615–47 (principal author: Shaun Levitan) 12 Modelling the market in a risk-averse world: the case of South Africa. South African Actuarial Journal 10, 2010, 109–36 The arbitrage-free equilibrium pricing of liabilities in an incomplete market: application to a South African retirement fund. South African Actuarial Journal, 11, 1–41, 2011 The CAPM reconsidered: tests in real terms on a South African market portfolio comprising equities and bonds. South African Actuarial Journal, 11, 43–84, 2011 (principal author: T.L. Reddy) The capital-asset pricing model reconsidered: tests in real terms on a South African market portfolio comprising equities and bonds. forthcoming in South African Actuarial Journal, 13 (co-author: T.L. Reddy) Conference papers1 1 Preservation of pension rights, 31st Annual Conference, Association of Pension and Provident Funds of South Africa, 1981 2 The determination of the deduction for remarriage from the pecuniary loss of a widow, Proc. 10th Conf. Int. Ass. of Consulting Actuaries, 1986 and Transactions of the Actuarial Society of South Africa 7(1), 1987; 3 Supplementation of low pensions, Transactions of the Actuarial Society of South Africa 7, 1989, 138–64; 4 AIDS and the valuation of pension funds, Transactions of the Actuarial Society of South Africa 8, 1990; 5 A stochastic investment model for actuarial use in South Africa, Transactions of the Actuarial Society of South Africa 10, 1994, 72–143; 6 A methodology for the modelling of interest rates and other economic variables with reference to the money and capital markets of South Africa, 5th International AFIR Colloquium, 1995(II), 905–26; 7 The immunisation of the results of the valuation of a pension fund against changes to the valuation rate of interest, Transactions of the Actuarial Society of South Africa 11, 1996 640–87; 8 Whittaker-Henderson likelihood enhancements to parametric graduations, Transactions of the Actuarial Society of South Africa 11(2), 1996, 418–36; 9 Strategies for the management of a defined contribution retirement fund, Transactions of the Actuarial Society of South Africa 11(3), 309–43; 10 Investment channel choice in defined contribution retirement funds: the use of 1 Whilst the acceptance of these papers has been subject to review and the proceedings of these conferences have all been published or made available to participants in bound or electronic form, the rigour of reviewing varies. Some of these papers are prior versions of papers listed under “Recognised journals” above. 11 12 13 14 15 16 17 18 19 23 24 25 26 27 28 29 utility functions, 8th International AFIR Colloquium, 1998, 489–508; A defence of expected utility theory for certain actuarial applications, Transactions of the Actuarial Society of South Africa 12(1), 1998, 174–234; An analysis of the utility functions of members of retirement funds, 10th International AFIR Colloquium, 2000, 615–30; A re-evaluation of the South African Bond Exchange–Actuaries Indices, convention of the Actuarial Society of South Africa, 24 October 2000 Burial societies in South Africa: risk, trust and commercialisation, convention of the Actuarial Society of South Africa, 31 October 2001, with DB Posel The pricing of the liabilities of a defined-benefit retirement fund, convention of the Actuarial Society of South Africa, 31 October 2002 The pricing of liabilities in an incomplete market using dynamic mean–variance hedging with reference to an equilibrium market model, 13th International AFIR Colloquium, 2003, 1, 221–35, convention of the Actuarial Society of South Africa, 19 November 2003 A typology of actuarial models, convention of the Actuarial Society of South Africa, 14 October 2004 Report of the Public Interest Task Group, convention of the Actuarial Society of South Africa, 9 November 2005, with M Lowther et al Stochastic models for actuarial use: the equilibrium modelling of local markets, convention of the Actuarial Society of South Africa, 12 October 2006, 17th International AFIR Colloquium, 2007, with D.V. Gott 21 The application of expected-utility theory to the choice of investment channels in a defined-contribution retirement fund, 17th International AFIR Colloquium, 2007, convention of the Actuarial Society of South Africa, 13 November 2007, with S. Levitan 22 Modelling the market in a risk-averse world, 18th International AFIR Colloquium, 2008, convention of the Actuarial Society of South Africa, 23 October 2008 The arbitrage-free equilibrium pricing of liabilities in an incomplete market: application to a South African retirement fund, convention of the Actuarial Society of South Africa, 20 May 2009, 19th International AFIR Colloquium, 2009 The capital-asset pricing model: the case of South Africa, International Congress of Actuaries, 2010 with T.L. Reddy Prudence revisited: the use of expected-utility theory for decision-making by the trustees of a retirement fund. 21st International AFIR Colloquium, 2011; Retirement Matters Seminar, Actuarial Society of South Africa, 6th June, 2011 The CAPM reconsidered: tests in real terms on a South African market portfolio comprising equities and bonds. 21st International AFIR Colloquium, 2011, Convention of the Actuarial Society of South Africa, 8th November 2011, with T.L. Reddy Long run se voet: debunking the mantra of the equity cult. Convention of the Actuarial Society of South Africa, 8th November 2011 The capital-asset pricing model rises from the dead: elliptical symmetry of real returns in South Africa and its implications for long-term actuarial modelling. 22nd International AFIR Colloquium, 2012 How a single-factor CAPM works in a multi-currency world. Convention of the Actuarial Society of South Africa, 16th October 2012, with Ş. Şahin and T.L. Reddy 30 The quantification of type-2 prudence in asset allocation by the trustees of a retirement fund. Convention of the Actuarial Society of South Africa, October– November 2013, with T.L. Reddy Other journals 1 The determination of the deduction for remarriage from the pecuniary loss of a widow. De Rebus 241, 1988, 67–70 2 Human values in Africa today, SA Quaker News, 2003 3 Identity politics in South Africa: lessons from the people. Chiedza. Also at Centre for Civil Society, University of KwaZulu-Natal, www.ukzn.ac.za/ccs EDITORIALS IN RECOGNISED JOURNALS The launch of the South African Actuarial Journal. South African Actuarial Journal, 1, 2001, 139 The value of the liabilities of a financial institution. South African Actuarial Journal, 2, 2002, 147–50 The principles governing the function of a professional journal and the editor’s relationship with the publishing body. South African Actuarial Journal, 3, 2003, 113–6 Is actuarial science really a science? South African Actuarial Journal, 4, 2004, 97–103 African values and actuarial science. South African Actuarial Journal, 5, 2005, 169–72 Paradigm lost? South African Actuarial Journal, 6, 2006, 37–44 Geographical focus: an outmoded idea? South African Actuarial Journal, 7, 2007, 185–88 On changing jackets. South African Actuarial Journal, 8, 2008, 93–5 On writing actuarial science. Annals of Actuarial Science 5(1), 2011, 1–6 The long run se voet: debunking the mantra of the equity cult. South African Actuarial Journal 11, 2011, 135–47 Modelling the future: ergodicity and the science of the actuary. forthcoming in South African Actuarial Journal 13 POSTGRADUATE THESES, DISSERTATIONS AND RESEARCH REPORTS SUPERVISED Completed2 1998–2000 YS Stander 2004–2006 S Levitan M.Sc. Bond indices in South Africa MCRR A practical examination of Thomson’s expected utility framework and its application for investment channel choice in defined contribution funds 2003–2006 TA AbromowitzMCRR How to make hedge funds more accessible to the South African investor 2004–2007 A Asher Ph.D. The design of retirement schemes: possibilities and imperatives 2003–2008 S Metcalfe MCRR An empirical investigation of sector correlation forecasting techniques and the potential benefits to investors 2 This list comprises only those students who completed their postgraduate qualifications under my sole supervision. MCRR: M.Sc. by coursework and research report; my supervision was of the research component only. 2004–2009 D Gott M.Sc. A stochastic model of asset returns for use in life office applications (degree awarded with distinction) 2003–2010 M Greenwood M.Sc. Market valuation of pension liabilities 2003–2010 R Singh M.Sc. A comparison of the methods used to determine the portfolio credit loss distribution and the pricing of synthetic CDO tranches 2006–2011 C Zheng M.Sc. The market-consistent valuation of guaranteed annuity options PAPERS REFEREED FOR RECOGNISED JOURNALS 1998 1999 1999 2001 2002 2003 2004 2010 2011 British Actuarial Journal British Actuarial Journal Orion British Actuarial Journal Journal of Actuarial Practice Orion Computational Statistics and Data Analysis ASTIN Bulletin Annals of Actuarial Science EDITORSHIP 1999– 2007–2012 2010– Editor, South African Actuarial Journal (including an annual editorial; see above) Editorial Committee, Australian Actuarial Journal Associate Editor, Annals of Actuarial Science AWARDS 1962: 2000: 2004: 2006: St Stithians College: Actuarial Society of South Africa: Actuarial Society of South Africa: Actuarial Society of South Africa: 2007: Actuarial Society of South Africa: 2008: 2008: 2009: 2011: Actuarial Society of South Africa: Actuarial Society of South Africa: Actuarial Society of South Africa: Association of South African Black Actuarial Professionals Academic dux President's Award RGA prize for the best published paper Swiss Re prize for the best paper on risk (with Dmitri Gott) Swiss Re prize for the best paper on risk (with Shaun Levitan) RGA prize for the best convention paper Swiss Re prize for the best paper on risk RGA prize for the best convention paper Certificate of merit for contribution to excellence in the actuarial profession in South Africa PROFESSIONAL AND COMMUNITY INVOLVEMENT Actuarial Society of South Africa 1966– member 1996 1996–2000 1997–2000 1998–2001 1999–2008 2008–2011 2011– 2004– Continuous Statistical Investigations Committee Retirement Matters Committee Investments Committee Council Research Committee (convenor) Research Committee (secretary) Research Committee Enterprise & Financial Risks Committee Institute of Actuaries 1966–2009 member 2010– affiliate member International Actuarial Association 2009– AFIR Committee Other Ceasefire Campaign: steering committee convenor, arms reduction working group Religious Society of Friends (Quakers): Johannesburg Monthly Meeting