File - Becky Winsor

advertisement

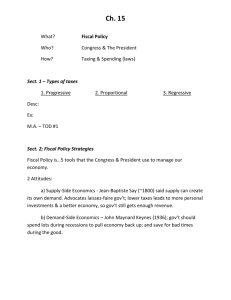

Role of Government Fiscal Policy Government uses its powers of expenditure, taxation, and borrowing to alter the size of the circular flow of income in the economy to bring about greater consumer demand, more employment, inflationary restraint and other economic goals. Leakages and Injections Circular flow of income Sees the GDP as a total of all money payments in the economy Leakages – any uses of income that cause money to be taken out of the income-expenditure stream of the economy (e.g. less money to be spent) Taxes Savings Imports Leakages and Injections (cont’d) Injection – any expenditure that causes money to be put into the income-expenditure stream (e.g. MORE money to be spent) Government Spending Investment Spending Exports What does this mean? The relationship between the leakages and the injections determine whether overall demand is growing or shrinking. If sum OF LEAKAGES is greater than sum of INJECTIONS – demand will shrink. Equilibrium – when they are equal amounts leakages and injections Discretionary fiscal policy Deliberate government action to stabilize the economy in the form of taxation or spending policies Expansionary fiscal policy Government policies to increase aggregate demand through tax cuts, increased spending, or both. Contractionary fiscal policy Govt policies to decrease aggregate demand through tax increases and/or decreased spending Tools of Fiscal Policy Changes in spending Increase general spending ( to stimulate economy) Infrastructure programs Changing in taxation Change the amount of tax collected to stimulate economic activity, or restrain economic activity Automatic stabilizers Things that already exist and are built into the economy EI/welfare – examples of automatic stabilizers Government Budget Options Deficit budget Govt spends more than it collects in tax revenue. It must borrow the money to cover the shortfall. Surplus budget When the government collects more tax revenue than it spends. There is money left over. Balanced budget When the government spends an amount equal to what it has collected in tax revenue What role does government play? During the Great Depression, Canada thought the market would just “correct itself” After 3 years, it didn’t so they had to try something else Government also didn’t have any responsibility to the people to help them (because there was no formal social welfare system) Canada became a welfare state after the 1950s The govt tries to help its citizens economically Role of Government Very different opinions on role of government (Liberal/Left vs. Conservative/Right) Complete “Matter of Opinion on p. 288-289 (#1) Collect tax dollars from citizens/residents and spend money on various programs and services Transfer payments from federal to provincial government Most of the tax revenue is spent on 3 pillars: Health Social Services Education Assignment How does the government use taxing and spending decisions (fiscal policy) to promote price stability, full employment, and economic growth? Predict the consequences of government debt on the individual and the economy. How do you think the decision of government to spend more or less money on health and education would affect your standard of living and quality of life? A matter of opinion – p. 288/289 #1