Chapter 6

advertisement

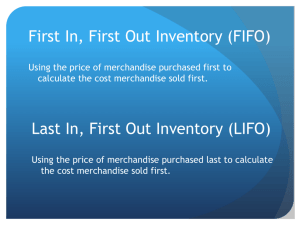

1 Click to edit Master title style 6 Inventories 1 2 Click to edit Master title style 6-1 Two primary objectives of control over inventory are: 1) Safeguarding the inventory, and 2) Properly reporting it in the financial statements. 2 3 Click to edit Master title style 6-1 Controls over inventory include developing and using security measures to prevent inventory damage or customer or employee theft. 3 4 Click to edit Master title style 6-1 To ensure the accuracy of the amount of inventory reported in the financial statements, a merchandising business should take a physical inventory. 4 5 Inventory Costing Methods Click to edit Master title style 6-2 5 10 6 Click to edit Master title style Inventory Costing Methods 400 6-2 371 299 300 Number of firms 200 (> $1B Sales) 130 100 0 Fifo Lifo Average cost 6 14 7 6-2 Example Exercise 6-1 Click to edit Master title style The three identical units of Item QBM are purchased during February, as shown below. Item QBM Units Feb. 8 Purchase 1 15 Purchase 1 26 Purchase 1 Total 3 Average cost per unit Cost $ 45 48 51 $144 $48 ($144/3 units) Assume that one unit is sold on February 27 for $70. Determine the gross profit for February and ending inventory on February 28 using (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) average cost methods. 7 15 8 6-2 Click to edit Master title style Follow My Example 6-1 Gross Profit Ending Inventory (a) First-in, first-out (FIFO): $25 ($70 – $45) $99 ($48 – $51) (b) Last-in, first-out (LIFO): $19 ($70 – $51) $93 ($45 + $48) (c) Average cost: $22 ($70 – $48) $96 ($48 x 2) $144/3 units For Practice: PE 6-1A, PE 6-1B 16 8 9 FIFO Perpetual Click to edit Master title style 6-3 Item 127B Jan. 1 4 10 22 28 30 Inventory Sale Purchase Sale Sale Purchase Units Cost 100 70 80 40 20 100 $20 21 22 9 31 10 6-3 - Click to edit Master title style Example Exercise 6-2 Beginning inventory, purchases, and sales for Item ER27 are as follows: Nov. 1 Inventory 40 units at $5 5 Sale 32 units 11 Purchase 60 units at $7 21 Sale 45 units Assuming a perpetual inventory system and the first-in, first-out (FIFO) method, determine (a) the cost of the merchandise sold for the November 21 sale and (b) the inventory on November 30. 10 36 11 6-3 Click to edit Master title style Follow My Example 6-2 a) Cost of merchandise sold: 8 units @ $5 $40 37 units @ $7 259 45 units $299 b) Inventory, November 30: $161 = (23 units x $7) For Practice: PE 6-2A, PE 6-2B 37 11 12 LIFO Perpetual Click to edit Master title style 6-3 On January 30, the firm purchased one hundred additional units of Item 127B at $22 each. Item 127B Jan. 1 4 10 22 28 30 Inventory Sale Purchase Sale Sale Purchase Units Cost 100 70 80 40 20 100 $20 21 22 12 51 13 6-3 - Click to edit Master title style Example Exercise 6-3 Beginning inventory, purchases, and sales for Item ER27 are as follows: Nov. 1 Inventory 40 units at $5 5 Sale 32 units 11 Purchase 60 units at $7 21 Sale 45 units Assuming a perpetual inventory system and the last-in, first-out (LIFO) method, determine (a) the cost of the merchandise sold for the November 21 sale and (b) the inventory on November 30. 13 56 14 6-3 Click to edit Master title style Follow My Example 6-3 a) Cost of merchandise sold: $315 = (45 units x $7) b) Inventory, November 30: 8 units @ $5 15 units @ $7 23 $ 40 105 $145 For Practice: PE 6-3A, PE 6-3B 57 14 15 Average Cost Click to edit Master title style 6-4 The weighted average unit cost method is based on the average cost of identical units. The total cost of merchandise available for sale is divided by the related number of units of that item. 15 16 Average Cost Click to edit Master title style Jan. 1 100 units @ $20 = $2,000 Jan. 10 80 units @ $21 = 1,680 Jan. 30 100 units @ $22 = 2,200 280 6-4 $5,880 Average unit cost: $5,880 ÷ 280 = $21 Cost of merchandise sold: 130 units at $21 = $2,730 Ending merchandise inventory: 150 units at $21= $3,150 16 68 17 6-4 - Click to edit Master title style Example Exercise 6-4 The units of an item available for sale during the year were as follows: Jan. 1 Inventory Mar. 20 Purchase Oct. 30 Purchase Available for sale 6 units @ $50 14 units @ $55 20 units @ $62 40 units $ 300 770 1,240 $2,310 There are 16 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by (a) the first-in, first-out (FIFO) method, (b) the last-in, first-out (LIFO) method, and (c) the average cost method. 17 70 18 6-4 Click to edit Master title style Follow My Example 6-4 a) First-in, first-out (FIFO) method: $992 (16 units x $62) b) Last-in, first-out (LIFO) method: $850 (6 units x $50) + (10 units x $55) c) Average method: $924 (16 units x $57.75) where average cost = $57.75 ($2,310 ÷ 40 units) For Practice: PE 6-4A, PE 6-4B 71 18 19 Lower-of-Cost-or-Market Method Click to edit Master title style 6-6 If the cost of replacing an item in inventory is lower than the original purchase cost, the lower-of-cost-ormarket (LCM) method is used to value the inventory. 19 20 Click to edit Master title style 6-6 Market, as used in lower of cost or market, is the cost to replace the merchandise on the inventory date. 20