CMA - Part 2 SU 2.4

advertisement

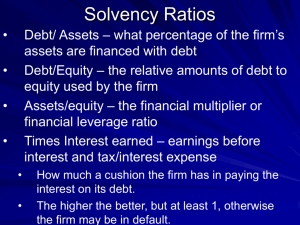

CMA - Part 2 Financial Decision Making Study Unit 2 – Ratio Analysis Study Tip • Look at your weekly routine (schedule) and see what can be eliminated or at least suspended for a while. I.e. watching a TV show that you can really live without. Once you have created more time in your schedule, see about rearranging your schedule to allow for some quality study time (and place). • Find a comfortable and quiet place to study with good lighting and little distractions (try avoiding your own bed; it is very tempting to just lie down and take a nap). • f you have a family, you will need to make them a part of this process. They need to be supportive of what you are doing. 2.4 – Solvency • Solvency is a firm’s ability to pay its noncurrent obligations as they come due… • Long-run as opposed to liquidity which focuses on short-term (current items) • Firms capital structure incl. • Liabilities (external) – Long-term and short-term debt • Equity – (internal) – Residual • Capital decisions have consequences • > debt = > risk = > cost of capital • > equity = < ret. on equity • Which det. deg. of leverage 2.4 – Solvency • Debt = creditors interest • = contractual obligations • Ret > cost of debt = > equity • Equity = permanent capital • Ret. uncertainty even with Pre. Stock 2.4 – Solvency • Capital Structure Ratios • Total Debt to Total Capital Ratio • TTL Debt/TTL Capital (Debt & Equity) = total leverage • Debt to Equity Ratio • TTL Debt/Equity = total amount (X) that debt exceeds equity • Long-term Debt to Equity Ratio • Long-term debt/Equity • ??? – which is better, increase or decrease of Long-term Debt to Equity Ratio, year over year? • Debt to Total Asset Ratio • TTL Liabilities/ TTL Assets • ??? – how is the same as the debt to total capital ratio? 2.4 – Solvency • Earnings Coverage • Times interest earned ratio • EBIT/Interest Expense • ??? – What does this tell a creditor • Most common mistake – not to add back that years interest payment to NI before taxes • Earnings to Fixed Charges Ratio • EBIT + Interest portion of operating leases/Int. exp. + Int. portion of operating leases + Div. on Pre. Stock • More conservative; shows all fixed charges 2.4 – Solvency • Cash Flow to Fixed Charges Ratio • Pre-tax operating cash flow/Int. exp. + Int. portion of operating leases + Div. on Pre. Stock • Eliminates issues associated with accrual accounting • Quiz Study Tip • Try to identify if you are missing most MC questions because you did not know the material or because you did not correctly understand the questions and/or answers. We need to eliminate the later and isolate missed question largely due to lack of material. There is a finite amount of material to know, particularly when you narrow down most common asked questions. • Learn the general concepts first, don't worry about learning the details until you have learned the main ideas. 2.5 – Leverage • Gleim Success Tip • Types of Leverage • Leverage = relative of fixed cost • ??? – which fixed cost? • ??? – what financial statement do we find on? • Deg. of leverage = Pre-fixed-cost income amount/Post-fixed-cost income amount 2.5 – Leverage • Distinguish between variable costing and full-costing • Why do we have to have variable costing for measuring the DOL • Degree of Op. Lev. – Single-Period Version • DOL = Contribution Margin/Operating Income or EBIT • Contribution Margin = ??? • Example page 72 2.5 – Leverage • Degree of Operating Leverage – Perc.-Change Version • %Chng. in Op. Inc. or EBIT/%Chng. in Sales • Example page 72 • Degree of Financial Leverage – Single-Period Version • EBIT/EBT • A variation is the Percentage-change Version • Quiz Study Tip • It is best to review the material right after class when it's still fresh in your memory.