CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

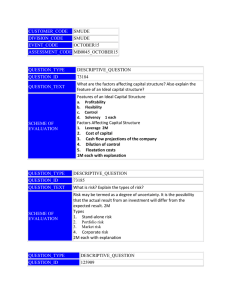

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE SMUAPR15 ASSESSMENT_CODE MB0045_SMUAPR15 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 9547 QUESTION_TEXT What is capital budgeting decision? Highlight its types SCHEME OF EVALUATION Meaning of capital budgeting: Capital budgeting is a blue–print of planned investments in operating assets. Thus, capital budgeting is the process of evaluating the profitability of the projects under consideration and deciding on the proposal to be included in the capital budget for implementation. Types: ●Decision to replace the equipments for maintenance of current level of business or decisions aiming at cost reductions, known as replacement decisions ●Decisions expansion through improved network of distribution or on expenditure for increasing the present operating level ●Decisions for production of new goods or rendering of new services ●Decisions on penetrating into new geographical area ●Decisions to comply with the regulatory structure affecting the operations of the company, like investments in assets to comply with the conditions imposed by Environmental Protection Act ●Decisions on investment to build township for providing residential accommodation to employees working in a manufacturing plant QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 73180 QUESTION_TEX Critically examine the NPV method. T SCHEME OF EVALUATION (4 + 2 + 1 + 2 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 73184 QUESTION_TEXT What are the factors affecting capital structure? Also explain the feature of an Ideal capital structure? Features of an Ideal Capital Structure SCHEME OF EVALUATION a. b. c. d. Profitability Flexibility Control Solvency 1 each Factors Affecting Capital Structure 1. Leverage 2M 2. Cost of capital 3. Cash flow projections of the company 4. Dilution of control 5. Floatation costs 1M each with explanation QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125904 QUESTION_TEXT Explain the concepts of working capital. a. b. SCHEME OF EVALUATION c. d. Gross working capital Net working capital Permanent working capital Temporary working capital (3 marks) (3 marks) (2 marks) (2 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125908 QUESTION_TEXT Explain the steps in Financial Planning. There are six steps in Financial Planning 1. Establish corporate objectives (2 marks) 2. Formulate strategies (1 mark) 3. Assign responsibilities SCHEME OF EVALUATION (1 mark) 4. Forecast financial variables (2 marks) 5. Develop plans (2 marks) 6. Create flexible economic environment (2 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125914 QUESTION_TEXT What do you mean by capital rationing? Mention the types of capital rationing. Explain the different approaches to capital rationing Meaning:- 2 marks; types 2 marks; approaches 6 marks (3 each) Meaning: - capital rationing refers to a situation in which the firm is under a constraint of funds, limiting its capacity to take up and execute all the profitable projects Types: - hard capital rationing Soft capital rationing Approaches:SCHEME OF EVALUATION Programming approach: - there are mainly two programming approaches: - linear and integer programming. Linear programming approach to capital rationing, tries to achieve maximum NPV subject to many constraints. Here the objective function is maximization of sum of the NPVs of the projects Integer programming: - LP may give an optimal mix of projects in which there may be a need to accept the fraction of project. Accepting a fraction of a project of a project is not feasible. Therefore the optimum may not be attainable. The actual implementation of the projects may be suboptimal