An introduction to Macroeconomics

An introduction to

Macroeconomics

Chapter 6

Catherine Boulatoff (section 02)

Macroeconomics

• Focuses on the performance of the economy as a whole

– Particularly concerned with long-run growth and short-run fluctuations (business cycles)

• Economic growth refers to an increase in output per person.

– The vast differences in living standards seen today between rich and poor countries are mainly the result of the fact that some countries have experienced greater economic growth.

.

Birth of Macroeconomics

• 1776: Start of the science of Economics with

A. Smith, The Wealth of Nations.

• 1936: Birth of macroeconomics with J. M.

Keynes, The General Theory of Employment,

Interest, and Prices.

– Understanding why economies experience episodes such as Great Depression and why employment and production grow and fluctuate over time.

– Classical (or neoclassical) economics andKkeynesian economics

Catherine Boulatoff

.

Major issues in macroeconomics

• Economic Growth and living standards

– Standard of living: Access to the goods and services that make people ’ s lives easier, healthier, safer, and more enjoyable

– Output per person is a better indicator of the average living standard over time ( real Gross Domestic Product/capita )

– Nominal GDP measures the value of all g&s produced in a country in a year, using current prices.

– Real GDP measures the value of final g&s produced within the borders of a country during a psecific time period (typically a year), using constant prices.

• Video: “200 Countries, 200 Years” (2010)

Catherine Boulatoff

Major issues in macroeconomics

• To raise living standards over time an economy must devote at least some fraction of its current output to increasing future output

• Savings refers to the accumulation of funds that results when people in an economy spend (consume) less than their incomes during a given time period

– Savings fund Investment

• Investment refers to spending for the production and accumulation of capital and additions to inventories.

.

Major issues in macroeconomics

• Economic Growth and living standards

– Standard of living: Access to the goods and services that make people ’ s lives easier, healthier, safer, and more enjoyable

– Output per person is a better indicator of the average living standard over time (GDP/capita)

• Productivity

– Average labor productivity: output per employed worker.

– If productivity grows slowly, living standards will improve slowly.

– 1973-2010: productivity grew at 1% per year.

Catherine Boulatoff

.

Major issues in Macroeconomics (cont.)

• Business cycles

– The term “ business cycle ” refers to the short-run ups and downs in output.

– While output tends to rise over time, it does not rise at a steady rate: there are expansions (periods of rapid growth) and recessions (periods of negative growth).

– A depression is a very severe and long-lasting recession.

• Unemployment

– Unemployment rate: the fraction of the labor force that is looking for a job but cannot find one.

Catherine Boulatoff

.

Major Issues in Macroeconomics (end)

• Inflation

– An increase in overall level price level in the economy

– Inflation and unemployment are often linked together in policy discussions

– Unemployment can be reduced only at the cost of higher inflation and vice versa (Philip’s Curve)

• Average inflation rate in Canada for 2015: . 1.08% (Typicaly Bank of Canada aims for less than 2%).

• Economic interdependence among nations

– Trade balance relates to exports minus imports

– A trade surplus occurs if exports exceed imports.

– A trade deficit occurs if imports exceed exports.

Catherine Boulatoff

.

Discussion

• Over the next 50 years, the Japanese population is expected to decline, while the fraction of the population that is retired is expected to increase sharply. What are the implications of these populations changes for total output and average living standards in

Japan, assuming that the average labor productivity stagnates?

Boulatoff, Dalhousie University 9

Uncertainty, Expectations, Shocks and

Short-Run Fluctuations

• Expectations : The anticipations of consumers, firms, and others about future economic conditions.

– Ex: Expecting to lose job?

– Expectations have a large effect on economic growth (self-fulfilling prophecy?)

Uncertainty, Expectations, Shocks and

Short-Run Fluctuations (end)

• Shocks : Occur when events unfold in ways that people were not expecting.

– Demand (or supply ) shocks: Take place when demand (or supply) ends up being either higher or lower than expected.

• Economists believe that most short-run fluctuations are the result of demand shocks.

Example: An auto manufacturer’s production of electric cars

• In 2013: high oil prices, the producer expects a high demand for electric cars for the following year.

– Sets production at 1Million cars (each sold at a price of $40,000)

– Grpahically,

• Unexpected change:

Oil price in 2014 decreases considerably.

Now what?

• The demand for electric cars decrease!

– Graphically,

• Two possible scenarios:

– Prices adjust: Lower prices of electric cars

• Quantity demanded still = the factory’s optimal output rate.

• Note also, the manufacturer gets less money/ lower profits)

– Prices do not adjust (typically, sticky in the short run): Fewer cars are sold! ( inventories build up…) [2]

From the individual firm to the Entire

Economy

• When prices are sticky, the economy will adjust to demand shocks mostly through changes in output and employment (rather than through changes in prices)

– In this example, production will decrease, unemployment will increase (recession)

• Key to understanding business cycles!

• Note: “in the Long Run, we are all dead”. Keynes

What Causes Sticky Prices?

• Companies selling final goods and services know that consumers prefer stable, predictable prices that do not fluctuate rapidly with changes in demand.

• In certain situations a firm may be afraid that cutting its price may be counterproductive because its rivals might simply match the price cut.

– A situation often referred to as a price war.

How Sticky?

• Prices become more flexible over time.

– If unexpected changes in demand begin to look permanent, many firms will allow their prices to change so that price changes (in addition to quantity changes) can help to equalize quantities supplied with quantities demanded.

• Prices go from stuck in the extreme short run to fully flexible in the long run.

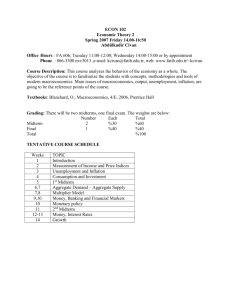

TABLE 6-1

Average Number of Months Between price

Changes for Selected Goods and Services

LO5

Item

Coin-operated laundry machines

Newspapers

Haircuts

Taxi fare

Veterinary services

Magazines

Computer software

Beer

Microwaves ovens

Milk

Electricity

Airline tickets

Gasoline

Months

14.9

11.2

5.5

4.3

46.4

29.9

25.5

19.7

3.0

2.4

1.8

1.0

0.6

Source: Mark Bils and Peter J. Klenow, “Some Evidence on the Importance of Sticky Prices”, Journal of Political Economy,

October 2004, pp 947-985, Used with permission of The University of Chicago Press.

© 2016 McGraw ‐ Hill Education Limited

6-20

The Great Recession (2008-09)

• Worst financial and economic crisis for Canada and other countries (U.S. in particular) since the Great

Depression (1929)

• Triggered by a steep decline in the U.S. housing prices (housing bubble) and a crisis involving mortgage loans and the financial securities built on them.

• In Canada: Unemployment rate rose from 6.1%

(2008) to 8.3% (2009)

Causes of the Great Recession and best Ways to Speed a Recovery?

• Economists disagreed:

– The Minksy Explanation: Euphoric Bubbles

– The Austrian Explanation: Excessively Low Interest

Rates

– The Stimulus Solution

– The Structural Solution

Additional problem:

• A mathematical approximation called the Rule of 70 tells us that the number of years it will take something that is gorwing to double in size is approximately equal to the number 70 divided by its percentage rate of growth.

– Thus, if Mexico’s real GDP per person is growing at 7% per year, it will take about 10 years (70/7) to double.

• If GDP per person in Mexico was $11,000 in 2008, while it was $44,000 per person in Canada, and if real

GDP per person in Mexico grows at a rate of 5% per year, how long will it take Mexico’s real GDP per person to reach the level that Canada was at in 2008?