Chapter 8

advertisement

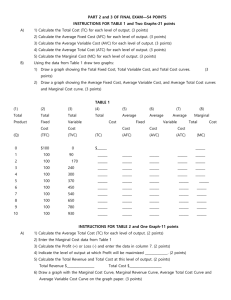

Chapter 8 Cost Types of Cost Firm’s total cost is the expenditure required to produce a given level of output in the most economical way Variable costs are the costs of inputs that vary with output level Fixed costs do not vary as the level of output changes, although might not be incurred if production level is zero Avoidable versus sunk costs FC is avoidable if it is =0 when Q=0 FC is sunk if it is >0 when Q=0 Production Costs: An Example Table 8.1: Fixed, Variable, and Total Costs of Producing Garden Benches Number of Benches Produced per Week Fixed Costs (per Week) Variable Cost (per Week) Total Cost (per Week) 0 $1,000 $0 $1,000 33 $1,000 500 1,500 74 $1,000 1,000 2,000 132 $1,000 2,000 3,000 Economic Costs Some economic costs are hidden, such as lost opportunities to use inputs in other ways Example: Using time to run your own firm means giving up the chance to earn a salary in another job An opportunity cost is the cost associated with forgoing the opportunity to employ a resource in its best alternative use Short Run Cost: One Variable Input If a firm uses two inputs in production, one is fixed in the short run To determine the short-run cost function with only one variable input: Identify the efficient method for producing a given level of output This shows how much of the variable input to use Firm’s variable cost = cost of that amount of input Firm’s total cost = variable cost + any fixed costs Can be represented graphically or mathematically Figure 8.1: Variable Cost from Production Function Figure 8.2: Fixed, Variable, and Total Cost Curves Dark red curve is variable cost Green curve is fixed cost Light red curve is total cost, vertical sum of VC and FC if SR production function is Q=F(L)=2L the firm needs Q/2 units of labor to produce Q units of output if w=$15, then variable cost function: VC(Q)=wL, or 15(Q/2) if sunk fixed costs=$100, the firm’s total cost is: C(Q)=100+15(Q/2) Worker-out-problem 8.1 Long-Run Cost: Cost Minimization with Two Variable Inputs In the long run, all inputs are variable Firm will have many efficient ways to produce a given amount of output, using different input combinations Which efficient combination is cheapest? Consider a firm with two variable inputs K and L, and inputs and outputs that are finely divisible Figure 8.5: Isoquant Example While All these input combinations are associated with efficient production methods, their costs are not all equal A B C Figure 8.5: Isoquant Example W=$500 and r=$1 - A and B costs the same - D is cheaper - What are other costs combinations?? A D B Isocost Lines An isocost line connects all input combinations with the same cost If W is the cost of a unit of labor and R is the cost of a unit of capital, the isocost line for total cost C is: Rearranged, The level of K associated with each level of L on ISOC line Thus the slope of an isocost line is –(W/R), the negative of the ratio of input prices Isocost lines closer to the origin represent lower total cost A family of isocost lines contains, for given input prices, the isocost lines for all possible cost levels of the firm Note the close relationship between isocost lines and consumer budget lines Lines show bundles that have same cost Slope is negative of the price ratio Sample Problem 1: Plot the isocost line for a total cost of $20,000 when the wage rate is $10 and the rental rate is $40. How does the isocost line change if the wage rises to $20? Least-Cost Production How do we find the least-cost input combination for a given level of output? Find the lowest isocost line that touches the isoquant for producing that level of output No-Overlap Rule: The area below the isocost line that runs through the firm’s least-cost input combination does not overlap with the area above the isoquant Again, note the similarities to the consumer’s problem Garden Bench Example, Continued In the long run, the producer can vary the amount of garage space they rent and the number of workers they hire An assembly worker earns $500 per week Garage space rents for $1 per square foot per week Inputs are finely divisible Figure 8.7: Least-Cost Method, NoOverlap Rule Example Square Feet of Space, K A 2500 2000 D 1500 B 1000 Q = 140 C = $3500 500 C = $3000 1 2 3 4 5 6 Number of Assembly Workers, L Interior Solutions A least-cost input combination that uses at least a little bit of every input is an interior solution Interior solutions always satisfy the tangency condition: the isocost line is tangent to the isoquant there Otherwise, the isocost line would cross the isoquant Create an area of overlap between the area under the isocost line and the area above the isoquant This would not minimize the cost of production Boundary Solutions That’s if the least cost input combination excludes some inputs Such inputs may not be used (not productive compared to other inputs) College Edu L Q=100, slope= -(MPH/MPC)= -1 slope= -(MPH/MPC) > -1 A Least cost combination A, (MPH/MPC) > (W H/WC) High School L Least-Cost Production and MRTS Restate the tangency condition in terms of marginal products and input prices: Slope of isoquant = -(MRTSLK) MRTS = ratio of marginal products Slope of isocost lines = -(W/R) Thus the tangency condition says: Marginal product per dollar spent must be equal across inputs when the firm is using a least-cost input combination Least-Cost Input Combination How can we find a firm’s least-cost input combination? If isoquant for desired level of output has declining MRTS: Find an interior solution for which the tangency condition formula holds That input combination satisfies the no-overlap rule and must be the least-cost combination If isoquant does not have declining MRTS: First identify interior combinations that satisfy the tangency condition, if any Compare the costs of these combinations to the costs of any boundary solutions Sample Problem 2: Suppose the production function for Gadget World is Q = 5L0.5K0.5. The wage rate is $25 and the rental rate is $50. What is the least-cost combination of producing 100 gadgets? 200? The Firm’s Cost Function To determine the firm’s cost function need to find least-cost input combination for every output level Firm’s output expansion path shows the least-cost input combinations at all levels of output for fixed input prices Firm’s total cost curve shows how total cost changes with output level, given fixed input prices Figure 8.10: Output Expansion Path and Total Cost Curve 8-21 Lumpy Inputs Output Expansion Path C=$2000 K C=$4000 Q=100 D C=$7000 Q=200 Q=300 E F 1 Output Expansion Path No Output L TC Curve TC C F C=$7000 E C=$4000 D C=$2000 C=$1000 Q=100 Q=200 Q=300 Q Average and Marginal Cost A firm’s average cost, AC=C/Q, is its cost per unit of output produced Marginal cost measures now much extra cost the firm incurs to produce the marginal units of output, per unit of output added As output increases: Marginal cost first falls and then rises Average cost follows the same pattern Cost, Average Cost, and Marginal Cost Table 8.3: Cost, Average Cost, and Marginal Cost for a Hypothetical Firm Output (Q) Tons per day Total Cost (C) (per day) Marginal Cost (per day) Average Cost (per day) 0 $0 $0 $0 1 1,000 1,000 1,000 2 1,800 800 900 3 2,100 300 700 4 2,500 400 625 5 3,000 500 600 6 3,600 600 600 7 4,300 700 614 8 5,600 1,300 700 8-23 AC and MC Curves When output is finely divisible, can represent AC and MC as curves Average cost: Pick any point on the total cost curve and draw a straight line connecting it to the origin Slope of that line equals average cost Efficient scale of production is the output level at which AC is lowest Marginal cost: Firm’s marginal cost of producing Q units of output is equal to the slope of its cost function at output level Q Figure 8.16: Relationship Between AC and MC AC slopes downward where it lies above the MC curve AC slopes upward where it lies below the MC curve Where AC and MC cross, AC is neither rising nor falling Marginal Cost, Marginal Products, and Input Prices Intuitively, a firm’s costs should be lower the more productive it is and the lower the input prices it faces Formalize relationship between marginal cost, marginal products, and input prices using the tangency condition: More Average Costs: Definitions Apply idea of average cost to firm’s variable and fixed costs to find average variable cost and average fixed cost: Since total cost is the sum of variable and fixed costs, average cost is the sum of AVC and AFC: Average Cost Curves Fixed costs are constant so AFC is always downward sloping At each level of output the AC curve is the vertical sum of the AVC and AFC curves Average cost curve lies above both AVC and AFC at every output level Efficient scale of production (Qe)exceeds output level where AVC is lowest Figure 8.18: AC, AVC, and AFC Curves Figure 8.20: AC, AVC, and MC Curves Effects of Input Price Changes Changes in input prices usually lead to changes in a firm’s least-cost production method Responses to a Change in an Input Price: When the price of an input decreases, a firm’s leastcost production method never uses less of that input and usually employs more For a price increase, a firm’s least-cost input production method never uses more of that input and usually employs less Figure 8.21: Effect of an Input Price Change Point A is optimal input mix when price of labor is four times more than the price of capital Point B is optimal when labor and capital are equally costly Short-run vs. Long-run Costs In the long run a firm can vary all inputs Will choose least-cost input combination for each output level In the short run a firm has at least one fixed input Produce some level of output at least-cost input combination Can vary output from that in short run but will have higher costs than could achieve if all inputs were variable Long-run average variable cost curve is the lower envelope of the short-run average cost curves One short-run curve for each possible level of output Figure 8.24: Input Response over the Long and Short Run In SR, increasing Q from 140 to160: Shift from B-F In LR, Shift from B-D A is least C combination Thus: CLR<CSR Figure 8.24: Input Response over the Long and Short Run In SR, decreasing Q from 140 to120: Shift from B-E In LR, Shift from B-A A is least C combination Thus: CLR<CSR Figure 8.25: Long-run and Shortrun Costs Figure 8.26: Long-run and Shortrun Average Cost Curves Economies and Diseconomies of Scale What are the implications of returns to scale? A firm experiences economies of scale when its average cost falls as it produces more Cost rises less, proportionately, than the increase in output Production technology has increasing returns to scale Diseconomies of scale occur when average cost rises with production Figure 8.28: Returns to Scale and Economies of Scale Sample Problem 3 (8.12): Noah and Naomi want to produce 100 garden benches per week in two production plants. The cost functions at the two plants are and , and the corresponding marginal costs are MC1 = 600 – 6Q1 and MC2 = 650 – 4Q2. What is the best output assignment between the two plants? Read: 8.9