Midterm and Key practice

advertisement

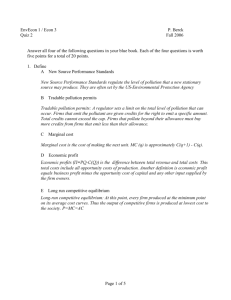

Midterm Examination Managerial Economics 300-1 October 24, 2001 Brother Bryson __________________________ Student Name Part I. Diagrams (20 points). In the space below, show a TC (not TVC) curve, then demonstrate how one derives geometrically from that curve the TFC curve, the TVC curve, the AVC curve and the MC curves. You may use more than one diagram to do this if necessary. Additional space may be used on the back of this page. Draw a production box with half a dozen isoquants and a conflict curve. Show an inefficient point and an efficient point, and the associated isoquants. Part II. Multiple-choice Matching (15 points) For the first six items, find the single, best possible match from the Answers for numbers 1-6 (a through e) given directly below item 6, “Brittleness.” 1. Law of diminishing returns 2. Imperfect commitment 3. Coxswains 4. Leontief 5. Central planning 6. “Brittleness” of information processes Answers for numbers 1-5 a. hierarchy b. transactions costs d. material balances e. Input-Output analysis c. variable and fixed factors of production Answers: 1c, 2b, 3a, 4e, 5d, 6a Part III. Multiple Choice. Choose the single best answer. 7. In a perfectly competitive industry suppose that current producers are earning positive economic profits, which of the following can be expected to occur? a. There will be a decrease in market demand for the product b. There will be an increase in market demand for the product c. There will be an increase in the market supply of the product d. There will be a decrease in the market supply of the product Answer: c 8. The slope of a line a. is unrelated to rates of change. b. is not the ratio rise/run. c. is not equal to the derivative of the function that underlies the line (curve). d. is not the value of a marginal quantity. e. is not constant for a curvilinear function. Answer: e 9. Which of the following is not considered a public good for citizens in any large U.S. city? a. national defense b. health care c. police protection d. fire protection. Answer: b 10. When there is an allocation of goods or services such that there exists no feasible alternative allocation that lowers the well being of any party and raises the well being of (at least) one party, it (that allocation) is said to be: a. Profit-maximizing b. A virtual corporation c. Efficient d. In equilibrium Answer: c 11. A cost or benefit imposed involuntarily on another party which is not regulated by any system of prices is referred to as: a. Transaction cost b. A tax deduction c. Moral hazard d. An externality e. A bottleneck Answer: d 12. Which of the following causes a movement along a market demand curve, but not a shift of the demand curve? A change in a. technology b. the number of buyers in the market c. the price of the product d. the price of other, related goods. e. the incomes of buyers Answer: c 13. When demand increases, buyers are a. willing to buy more at each price than before but not willing to pay more for each given quantity than before. b. willing to buy more at each price than before and/or willing to pay more for the same quantity as before. c. signaling sellers that if price falls they will increase purchases. d. signaling sellers to increase the supply. e. none of these. Answer: b 14. Price ceilings outlaw continued price increases by dictating a maximum legal price. Which of the following effects will not result from such a policy. a. a shortage will result if demand continues to grow and an increased price cannot elicit larger supplies of the product. b. producers will seek ways to earn a profit other than through higher prices c. a black market will appear if shortages continue for long. d. producers will seek profits through quality improvements since they cannot increase profits through price increases. e. If the shortage persists the government may arbitrarily change distribution of the product through rationing Answer: d 15. The manager at the campus bookstore reduced prices on pens and pencils in order to increase total revenue from sales of these items. The manager believed demand (with respect to price) must be a. Inelastic b. Perfectly inelastic c. Unit elastic d. Elastic Answer: d 16. The market demand for Cracow sausage is as shown below. Px Qx $5.00 600 4.00 700 3.00 800 2.00 900 1.00 1,000 The elasticity of demand between $3 and $4 is a. -2.143 b. -.466 c. -1.33 d. -1.0 e. -23.34 Answer: b 17. In a certain production process, two inputs A and B yield an output of Q, whereas 3A and 3B yield an output of 4Q. This illustrates the principle of a. increasing marginal returns to variable input. b. diminishing returns to scale. c. increasing returns to scale d. increasing average returns to variable input. e. none of the above. Answer: c 18. Some business enterprises that use mass production can gain a cost advantage from producing related but slightly different goods. This is called a. economies of scope, b. economic costs c. law of supply d. economies of scale e. the old “related but slightly different” production cost advantage Answer: a 19. The slope of an isoquant is called the a. Marginal rate of transformation c. The marginal rate of technical substitution e. The slopoquant Answer: c b. Marginal rate of implicit tact d. The degree of substitution 20. A given isoquant shows a. All the combinations of inputs that yield the same level of output if used efficiently. b. All combinations of inputs yielding lower levels of output than other input combinations. c. That substitution between inputs in a production function is impossible. d. That inputs can be combined by clever managers so that costs always decline e. That all of the above are true. Answer: a 21. When Total profit, TP = -2,000 + 450Q - 50Q2, the average profit function is given by a. -2000Q-1 + 450 - 50Q. b. -2000 + 450 - 50Q. c. -2000Q + 450 - 50Q2. d. $-2000. e. -2000 + 450Q. Answer: a. 22. If average total cost is less than marginal cost at its profit-maximizing output, a perfectly competitive firm will a. make pure profits. b. operate at a point to the right of the ATC minimum point. c will not discontinue production. d. all of the above. e. none of the above. Answer: d 23. A competitive firm earning net revenues of zero a. may want to exit from the industry immediately, in the short run. b. may be forced to cease production in the short run. c. will exit from the industry as soon as it can, but this is a long-run proposition. d. can stay in business, since its total cost includes an opportunity cost return to all productive factors. e. should engage in price discrimination. Answer: d 24. In perfect competition a. a firm can attract more customers by lowering its price. b. the additional revenue from selling one more unit of output is less than price. c. market-wide demand is perfectly elastic. d. entry will cause the market demand curve to shift outward e. none of the above. Answer: e Part IV. Essay (20 points) Write on one essay only. 1. Give an intuitive explanation that the relationship MPa/Pa = MPb/Pb = ... = Mpn/Pn must hold if the firm is to obtain maximum production from its budget for productive inputs. Then show algebraically that this is the same as saying that the slope of the isoquant must be equal to the slope of the isocost line if the firm is to obtain maximum production from its budget for productive inputs. 2. Write a brief essay (in the space below) on the principle/agent problem as it applies to the American system of corporate governance. Answers Part IV. 1. When one input has a higher MP/P, it’s return, being very high, indicates it is being underused. You use less of other inputs so you can afford more of this input, thereby driving its productivity down, until all the marginal productivities (per last dollar spent) are equal. Note; MRTSxy = Px/Py where the isoquant and isocost lines are tangent. This can be rewritten as MRTSxy = y/ x = MPx/MPy = Px/Py Rewriting the last two terms, we get MPx/Px = Mpy/Py. 2. The owner of the firm is the shareholder, or in other words the “principal.” The manager of the firm does not own it, he is merely the hired “agent” to represent the principal in the use of the firm’s resources. But the shareholder has little control over the manager. The shareholder doesn’t really hire the “controlling” body, the Board of Directors, which is usually more determined by the CEO. The CEO also controls the firm’s information (although some, by law, is made public) and agenda, so the Board of Directors is often a rather powerless group. The principal/agent problem is getting the CEO and his staff to pay attention to the wishes and interests of the shareholders.