The Urban Infrastructure Challenge in Canada

advertisement

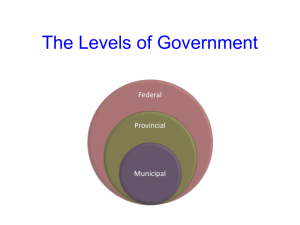

The Urban Infrastructure Challenge in Canada: Focusing on Housing Affordability and Choice Presentation by CHBA – [Name] to The Municipal Council of [Name] June, 2008 Background to this presentation: Major report on infrastructure financing prepared for CHBA by economic consulting firm Altus Clayton…The Urban Infrastructure Challenge in Canada: Perceptions and Realities. Our aim is to get key findings out. Report analyzes municipal funding and governance in Canada in a balanced way. Uses data from Statistics Canada and Infrastructure Canada regarding respective financial participation of different levels of government and of the private sector. The Urban Infrastructure Challenge 2 Key questions addressed: 1. What is “basic urban infrastructure”? 2. What have patterns of urban infrastructure investment been over recent decades? 3. Who is paying for what? 4. What financing arrangements would be most suitable to enhance housing affordability and choice in the future? The Urban Infrastructure Challenge 3 1. What is “basic urban infrastructure”? Why we need to define this term according to Altus Clayton: Wide range of definitions of “public infrastructure”, many of which include items better described as “amenities”. This takes focus off basic urban infrastructure as a key component of public sector stewardship of urban growth and community well-being. Policy development will benefit from a focus on assets most closely affecting health and safety of population. Facilitates setting priorities and achieving measurable results. The Urban Infrastructure Challenge 5 Priorities for inclusion in “basic or ‘core’ urban infrastructure”: Roads and highways Bridges Public transportation system structures and equipment Water supply systems Sewerage collection and treatment systems (The term “core infrastructure” is used by the National Round Table on Sustainable Infrastructure as well as Infrastructure Canada and the National Research Council of Canada. ) The Urban Infrastructure Challenge 6 Why should these be priorities for infrastructure investment? Focus on facilities essential to human beings functioning effectively in modern cities. Give highest priority to public health, safety, natural environment, and future prosperity. Stress infrastructure typically owned by municipalities/local utilities. Recognize that such infrastructure is vital to quality of life and must be built well, operated efficiently, and maintained to a high standard. The Urban Infrastructure Challenge 7 Risks of a lack of focus on basic urban infrastructure… Walkerton deaths due to faulty water supply system Montreal overpass collapse The Urban Infrastructure Challenge 8 2. What have patterns of urban infrastructure investment been over recent decades? Investment in basic urban infrastructure on per household basis declined after 1973: Basic Urban Infrastructure Investment, Per Household, 1961-2006 Constant 2006 Dollars 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 2006 2003 2000 1997 1994 1991 1988 1985 1982 1979 1976 1973 1970 1967 1964 1961 0 Source: Altus Clayton based on data from Statistics Canada: Fixed Capital Flows and Stocks (Table 031-0002) and household statistics The Urban Infrastructure Challenge 10 Average age of basic infrastructure has increased: Average Age of Basic Urban Infrastructure, by Asset Types, Canada, 1963-2007 Average Age (Years) 26 24 22 Roads and Highways Sewer Systems Wastewater Treatment Bridges 20 18 16 14 12 1963 1967 1971 1975 1979 1983 1987 1991 1995 1999 2003 2007 Source: Altus Clayton based on data from Statistics Canada, “The Age of Public Infrastructure in Canada” (2006 and 2008) Catalogue no. 11-621-MIE The Urban Infrastructure Challenge 11 After a period of less investment in basic urban infrastructure, it has been growing again in recent years, in part due to federal return to funding programs for local infrastructure. Investment in Basic Urban Infrastructure, Governments*, 1961-2006 Billion (2006$) 18 15 12 9 6 3 2006 2003 2000 1997 1994 1991 1988 1985 1982 1979 1976 1973 1970 1967 1964 1961 0 Source: Altus Clayton based on data from Statistics Canada: Fixed Capital Flows and Stocks (Table 031-0002) *Including water and sewer utilities The Urban Infrastructure Challenge 12 Users not charged full cost of infrastructure they are using: User Fee Revenue Per Household*, Selected Cities, 2005 Dollars 2,400 2,004 2,000 1,623 1,600 1,243 1,585 1,369 1,349 1,146 1,194 1,200 913 882 800 657 652 400 Vaughan London Hamilton Ottawa Toronto Abbotsford Halifax Winnipeg Saskatoon Calgary Edmonton Vancouver 0 * Based on Occupied Private Dwelling 2006 Census Source: Altus Clayton based on data from Ontario FIRs and Various Annual Financial Statements The Urban Infrastructure Challenge 13 Small proportion of municipal revenues comes from user charges: Municipal Revenue by Source, 2006 Others 11.4% Government Grants 17.3% Property Taxes 48.9% User Fees 22.4% Source: Altus Clayton based on data from Statistics Canada (Cansim 385-0024) The Urban Infrastructure Challenge 14 Tax bases of income, consumption and property taxes have all increased at about the same rate… Growth in Tax Base for Income, Sales and Property Taxes in Canada, 1990-2006 1990=100 250 Personal Income Personal Spending on Consumer Goods & Services 225 Market Value of Buildings & Land 200 175 150 125 100 1990 1992 1994 1996 1998 2000 2002 2004 2006 Source: Altus Clayton based on data from Statistics Canada The Urban Infrastructure Challenge 15 But effective property tax rates have been declining for years now… Effective Tax Rate for Consumption, Income and Property Taxes in Canada, 1990-2005 Percent of Income/Retail Sales Percent of Property Value 18 Consumption Tax (LHS) Personal Income Tax (LHS) Property Tax (RHS) 1.5 16 1.3 14 1.2 12 1.0 1990 1993 1996 1999 2002 2005 Source: Altus Clayton based on data from Statistics Canada The Urban Infrastructure Challenge 16 Especially in Ontario, pressures on local budgets arise from provincial government “offloading” of social services onto property tax base. Provincial Program in Ontario Costs to Municipalities ($M) (Figures adapted from Association of Municipalities of Ontario 2003 2005 Public Health 266.4 292.0 Ambulance 312.7 394.7 1,330.9 1,500.6 Senior Services 242.5 302.7 Child Care 193.4 220.2 Social Housing 879.7 1,209.4 3,225.6 3,919.6 Social Assistance Total The Urban Infrastructure Challenge 17 3. Who is paying for what? Here are actual amounts provided by each investor: Basic Urban Infrastructure Investment by Funding Source, 2005-2006 Billions (Annual Average) Federal* $1.7 Total $14.3 Billion Private $5.1 Provincial* $4.5 Municipal* $3.0 Notes: *Net of Transfers. Source: Altus Clayton based on data from Fixed Capital Flows and Stocks (Cansim 031-0002), Transfer payments by Infrastructure Canada (Public Accounts of Canada) and National Accounts (Cansim 385-0024 and 385-0002), and consultation with StatCan staff The Urban Infrastructure Challenge 19 Largest single proportion of investment provided by private sector through direct works, taxes, fees, levies and charges. Basic Urban Infrastructure Investment by Funding Source, 2005-2006 (Annual Average) Federal 11.9% Private 35.7% Provincial 31.5% Municipal 21.0% Source: Altus Clayton based on Figures 7&8 The Urban Infrastructure Challenge 20 Here is how the different portions break down by source: Basic Urban Infrastructure Investment by Funding Source, 2005-2006 Total $14.3 Billion Billions (Annual Average) 6 5 4.5 Total Private Sector $5.1 Billion 4 3.0 3 2.1 2 1.7 1.8 1.2 1 0 Federal* Provincial* Municipal* (General Revenue***) Private Direct Development Investment** Charges Other Levies and Local Land Transfer Taxes Notes: *Net of Transfers. **On-site infrastructure to be transferred to municipalities. ***Including water and sewer charges. Source: Altus Clayton based on data from Fixed Capital Flows and Stocks (Cansim 031-0002), Transfer payments by Infrastructure Canada (Public Accounts of Canada) and National Accounts (Cansim 385-0024 and 385-0002), and consultation with StatCan staff The Urban Infrastructure Challenge 21 Development charges have been rising dramatically… Municipal Development Charge Revenue and Direct Investment in Infrastructure, 1988-2006 $ Million 2,000 Percent 30% Municipal DC Revenues (left axis) 1,800 DCs as % of Municipal Direct Infrastructure Investment (right) 1,600 25% 1,400 20% 1,200 1,000 15% 800 10% 600 400 5% 200 0 2006 2005 2004 2003 2002 2001 2000 1999 1997 1998 1996 1995 1994 1993 1992 1991 1990 1989 1988 0% Source: Altus Clayton based on data from Statistics Canada, Cansim (385-0024 and 031-0002) The Urban Infrastructure Challenge 22 Comments on Development Charges by Altus Clayton: Development Charges place a major burden on new home buyers, reducing affordability and choice. User charges and debt financing for infrastructure are more equitable and efficient. The local property tax base has increased, but is not being used effectively. Development Charges have detrimental impacts on urban form and efficiency. Social services program expenditures not appropriately borne by property tax base, but basic urban infrastructure is. The Urban Infrastructure Challenge 23 “Growth paying for itself”… the facts: All residents benefit from urban growth. Off-site infrastructure is used by all community residents, and by industrial concerns, not just by new residents. The Urban Infrastructure Challenge 24 Overall conclusion: Development Charges unfairly burden new home buyers, restrict affordability and choice. 4. What financing arrangements would most enhance housing affordability and choice in future? A rational funding model for core infrastructure would: 1. Be based on long-term planning and close links 2. 3. 4. 5. 6. 7. between planning and budgeting. Have industry fully engaged in infrastructure planning. Recognize that off-site infrastructure serves the entire community, not just newly-arriving residents. Ensure federal and provincial governments contribute to reflect their role in overall prosperity, health and safety. Charge appropriate user fees to maintain and upgrade basic infrastructure. Use debt-financing methods to spread payments over present and future generations of users of urban infrastructure. Upload social services and social housing expenditures to provincial, federal governments. The Urban Infrastructure Challenge 27 What the new home building industry is ready to do: Develop with municipalities alternative models for infrastructure financing. Support municipal presentations to federal and provincial governments seeking infrastructure funds. Support uploading social services and programs to provincial governments. Participate in community-wide planning processes. The Urban Infrastructure Challenge 28 Questions? For further information, contact: [Local Executive Officer coordinates] The Urban Infrastructure Challenge 29