(DEFERRALS) PROCESS GUIDE (Revised 6-4

advertisement

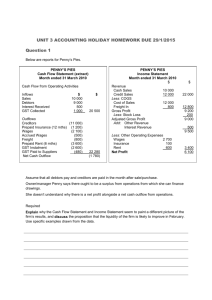

FY14/15 YEAR-END PREPAID EXPENSES (DEFERRALS) PROCESS GUIDE for the university Revised June 5, 2015 CY = FY14/15 I. Subsequent Years/Next Fiscal Year = FY15/16 Definition of Deferral In accounting deferral means to defer or to delay recognizing certain revenues or expenses on the income statement until a later, more appropriate time. Expenses are deferred to a balance sheet asset account until the expenses are used up, expired, or matched with revenues. At that time they will be moved to an expense on the income statement i.e. Prepaid Expense. Revenues are deferred to a balance sheet liability account until they are earned in a later period. When the revenues are earned they will be moved from the balance sheet account to revenues on the income statement i.e. Deferred Revenue. (This is rare & will be addressed with individual departments as it arises) Types of Prepaid Expenses (some posted to *LEGAL but rest to GAAP): II. *Travel (includes registrations fees) Insurance (insurance accounts only) Licenses (use same account # of item purchased that is being licensed) *Memberships (account # 660804 – except Library Acquisitions) Maintenance Agreements (use same acct # of item purchased agreement for) Postage (accounts # 660014, 660015 & 660016 - depends on type) Rent (account # 660831) Services accounts (613001-613816 contractual and non-contractual service accts) Space Rental (account # 660041) *Subscriptions (account # 660804-except CSUMB Library Acquisitions) Telephone bills external (account # 604001) Utilities bills external (account # 605001-605005 - depends on type) Warranties (use same account # of item purchased warranty for) Why is it Important to Departments? Deferrals recorded on the Legal basis can have an impact on how departments use their budgets, particularly at year-end. Currently, the impact is primarily payments for travel, registration fees, memberships (account # 660804) and subscriptions (account # 660804). For these types of payments, if the payment is made in the current year, but part of the benefit received is received in the subsequent year, the part related to the subsequent year is recorded as a prepaid expense, rather than a regular expense. That portion will reduce your budget in the subsequent year, rather than the current year. (Think of it as the opposite of an expense accrual at year-end, in that it moves the expense for a payment into the subsequent year). In addition to the travel, memberships and subscriptions, the accounting department also makes adjustments for other prepaid expenses, but does so as GAAP adjustments, to reduce the impact on departmental budgeting. GAAP adjustments do not affect departmental BBA, but are used exclusively to correctly present the activity on the Systemwide financial statements. However, we do require assistance from the departments in identifying these prepaid expenses. 1|Page III. How and When do Prepaid Expenses affect your Departmental Budgets? Only when prepaid expenses are posted to the LEGAL books does it affect Departmental Budgets. Current Year: An order was placed, goods and/or services will not be received until after 6/30/XXXX but the bill was prepaid (paid in the current year). Cash is credited (decreased) and the expense sits on the books for the current year. At year-end the Accounting Department will post a journal entry clearing the expense in the current fiscal year and offsetting prepaid expense (an Asset account, # 107809). Since the expense is not posted against the Departmental Budget for MB500, the Department has more spending power in the current fiscal year. Reminder: only certain types of prepaid activity is posted to LEGAL (more below). Next Fiscal Year: In the next fiscal year, on 7/1/XXXX, the deferral journal entry will be reversed posting the expense against the Departmental Budget for (MB500). Cash is not affected in the new fiscal year. The prepaid expense account is cleared with this reversal entry. The Departments have less spending power in the current fiscal year. REMEMBER: Prepaid Expenses are tracked for all funds, including trust funds. Only prepaid expenses in MB500 will affect your departmental operating budget. IV. Processes on Recording Prepaid Expense into LEGAL and GAAP YEAR ROUND TRACKING: Prepaid expenses have to be tracked year round. Departments must denote on the invoice, any time throughout the year, that there is prepaid expense included so that Accounts Payable (AP) will track (on an excel spreadsheet) and record in either LEGAL or GAAP for the current fiscal year. EXAMPLE OF HOW TO CALCULATE: If invoice service dates straddle two (or more) fiscal years, for example FY14/15 and FY15/16, the service amount for FY15/16 needs to be recorded as prepaid expenses if invoice is paid in full for FY14/15. If not easily determined then can estimate (attach your calculations to the invoice). AT YEAR-END CLOSE FINAL ACCRUAL AMOUNT TO DEFER: On June 5 Accounting will send to Departments a listing (on an Excel spreadsheet) for the current fiscal year of all of your departmental prepaid expenses up through May 31 that have been tracked by AP (Accounts Payable) and Accounting, with your help via year round tracking. See Sections V. Prepayment on ProCard. Please review the ‘Prepaid Spreadsheet’ to make sure the Accounting Department has caught all of your prepaid expenses. Notify AP of any prepaid expenses that still need to be deferred prior to closing the LEGAL books, no later than June 12 at 5:00 p.m. To notify, by sending back the marked up ‘Prepaid Spreadsheet’ and DW Departmental Report(s) identifying the expense(s) that should be deferred (highlighted). Notate how much to defer, all or partial amount, and attach any calculations. Hand deliver the marked up spreadsheet with support to AP (hard copies) or email with support. 2|Page Process repeats again on June 17. Departments will receive a final listing thru June 11 to be verified and returned by June 19 (as instructed above). Only the LEGAL prepaid expenses up through June 11 will be posted to GL by June 21. Departments will do a final LEGAL review of the General Ledgers and send any changes to Accounting by June 22, noon. The Accounting Department will try to post into LEGAL as time permits. On July 2, Accounting and the Departments will go through the exercise once more. A final ‘Prepaid Spreadsheet’, with prior requested changes, will be sent to the Departments to verify the prepaid expenses that will be posted into GAAP since LEGAL is closed. This is an opportunity to identify what prepaid expenses were not posted into LEGAL (June 12-30). On July 9, Departments are to returned marked up ‘Prepaid Spreadsheet’ with their support as instructed above. Notate how much to defer, all or partial amount, and attach any calculations. Hand deliver the marked up spreadsheet with support to AP (hard copies) or email with support. Prepaid expenses will be posted into GAAP by July 17. V. Prepayments on ProCard - >= $250/item charge Departments need to be tracking prepaid expenses on the ProCard for May and June because of the two month lag before the Accounting Department will be able to identify. This is for items charged of $250 and over. On June 17, AP will send out the ‘Prepaid Spreadsheet’ for verification. Departments will add the May/June ProCard Prepaid activity. Departments to return corrections on June 19 to guarantee recording into the Ledgers by June 21. Depending on the type of activity and timing, it will either be posted into LEGAL or GAAP. On July 2 a final ‘Prepaid Excel Spreadsheet’ will be sent to the Departments to verify the prepaid expenses that will be posted into GAAP only since LEGAL is closed. This is an opportunity to identify what prepaid expenses were not posted into LEGAL and return to AP by July 9 to post into GAAP by July 17. VI. Justification Requirements on Processing Prepayments Prepayments must be justified demonstrating a significant cost benefit to the campus in prepaying, etc. Prepayments usually have to be pre-approved by Procurement since they are contractual and represent a commitment on behalf of the university. Exceptions include travel, registration, memberships and some types of subscriptions (only those subscriptions posted to account # 660804 named ‘membership and subscription’). VII. Mailing Instructions Send ‘Prepaid Spreadsheet’ and support to: HARD COPY University Accounting Department (Attn: Accounts Payable) Mountain Hall (84C) ELECTRONICALLY accounts_payable@csumb.edu 3|Page VIII. Reference Materials University ‘Glossary of Terms, Abbreviations & Acronyms’ on the Accounting website: https://csumb.edu/finance/glossary-terms-abbreviations-acronyms 2014-2015 YEAR-END PREPAID EXPENSES (DEFERRALS) PROCESS GUIDE (Revised 6-4-2015) https://csumb.edu/finance/end-fiscal-year-university 2014-2015 YE TIMELINES AND GUIDANCE CHART https://csumb.edu/finance/end-fiscal-year-university Accrual/Deferral Training Materials https://csumb.edu/finance/end-fiscal-year-university 4|Page