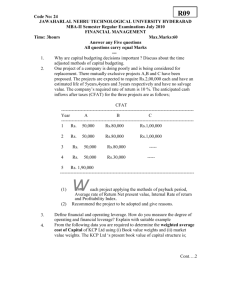

Accountancy Model Question Paper Class XII

advertisement