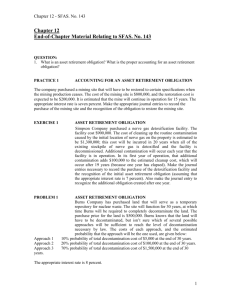

SFAS No. 143: Accounting for Asset Retirement Obligations

advertisement

ASC 410 (FAS No. 143) Accounting for Asset Retirement Obligations ASC 410 (FAS 143): OVERVIEW A business must recognize an asset retirement obligation for a long-lived asset at the point an obligating event takes place, provided it can reasonably estimate its fair value (or at the earliest date it can make a reasonable estimate). ASC 410 (FAS 143): OVERVIEW Obligating Event An offshore oil-and-gas-production facility typically incurs its removal obligation when it begins operating. ASC 410 (FAS 143): OVERVIEW The entity must record the obligation at its fair value, either the amount at which the liability could be settled in a current transaction between willing parties in an active market, or-more likely-at a substitute for market value, such as the present value of the estimated future cash flows required to satisfy the obligation. ASC 410 (FAS 143): OVERVIEW To offset the credit portion of the asset retirement liability entry, businesses must capitalize the asset retirement costs as an increase in the carrying amount of the related long-term asset. ASC 410 (FAS 143): OVERVIEW Businesses must include certain costs in the income statement during the asset's life, namely: Depreciation on the asset, including additional capitalized retirement costs, and Interest for the Accretion of the asset retirement liability due to the passage of time. Accretion expense shall not be considered to be interest cost. SFAS 143: RECOGNITION ISSUES Businesses may incur retirement obligations at the inception of an asset's life or during its operating life. For example, -an offshore oil-and-gas-production facility typically incurs its removal obligation when it begins operating. -A landfill or a mine, however, may incur a reclamation obligation gradually over the life of the asset as space is consumed with waste or the mine is dug. A mere plan or intention to dispose of an asset does not require recognition. Obligations-such as environmental remediation liabilitiesrelated to the improper operation of an asset are not covered. Overview Issued: June 2001 This Statement amends FASB Statement No. 19, “Financial Accounting and Reporting by Oil and Gas Producing Companies. Prior Practice (under SFAS 19) -Income-statement approach: Recognizing the costs related to such obligations ratably over an asset's life as a component of depreciation or expensing the obligations as they are incurred. FASB Statement no. 143 -Balance Sheet approach: Balance-sheet based LIABILITY approach, requiring businesses to recognize a liability for a retirement obligation when they incur it and an associated asset retirement cost, -even if that is far in advance of the asset's planned retirement. ASC 410 (FAS 143): MEASUREMENT ISSUES Under ASC 410, an entity must recognize an asset retirement obligation (a liability) at its fair value. However, since market for settling such obligations may not exist, FASB permits entities to estimate the obligation's fair value using the discounted cash flow techniques. Companies must also estimate the amount and timing of the related cash flows, incorporating explicit assumptions about: -inflation, -technology advances, -profit margins, -offsetting cash flows and -other factors. ASC 410 (FAS 143): MEASUREMENT ISSUES A company must determine the extent to which the amounts or the timing would vary under different future scenarios and the relative probabilities of each. Companies must discount the estimated future cash flows using a credit-adjusted risk-free rate -a rate (such as that for zero-coupon U.S. Treasury instruments) adjusted upward for the effect of the entity's credit standing. ASC 410 (FAS 143): MEASUREMENT ISSUES SFAS Paragraph 3: An entity shall recognize the fair value of a liability for an asset retirement obligation in the period in which it is incurred if a reasonable estimate of fair value can be made. If a reasonable estimate of fair value cannot be made in the period the asset retirement obligation is incurred, the liability shall be recognized when a reasonable estimate of fair value can be made. ASC 410 (FAS 143): MEASUREMENT ISSUES SFAS Paragraph 11: Upon initial recognition of a liability for an asset retirement obligation, an entity shall capitalize an asset retirement cost by increasing the carrying amount of the related long-lived asset by the same amount as the liability. An entity shall subsequently allocate that asset retirement cost to expense using a systematic and rational method over its useful life. =>Depreciation Expense Application of a systematic and rational allocation method does not preclude an entity from capitalizing an amount of asset retirement cost and allocating an equal amount to expense in the same accounting period. ASC 410 (FAS 143): MEASUREMENT ISSUES SFAS Paragraph 14: An entity shall measure changes in the liability for an asset retirement obligation due to passage of time by applying an interest method of allocation to the amount of the liability at the beginning of the period. The interest rate used to measure that change shall be the credit-adjusted risk-free rate that existed when the liability, or portion thereof, was initially measured. That amount (change in the amount of the liability) shall be recognized as an increase in the carrying amount of the liability and as an expense classified as an operating item in the statement of income, hereinafter referred to as accretion expense. Accretion expense shall not be considered to be interest cost.