Jordan

advertisement

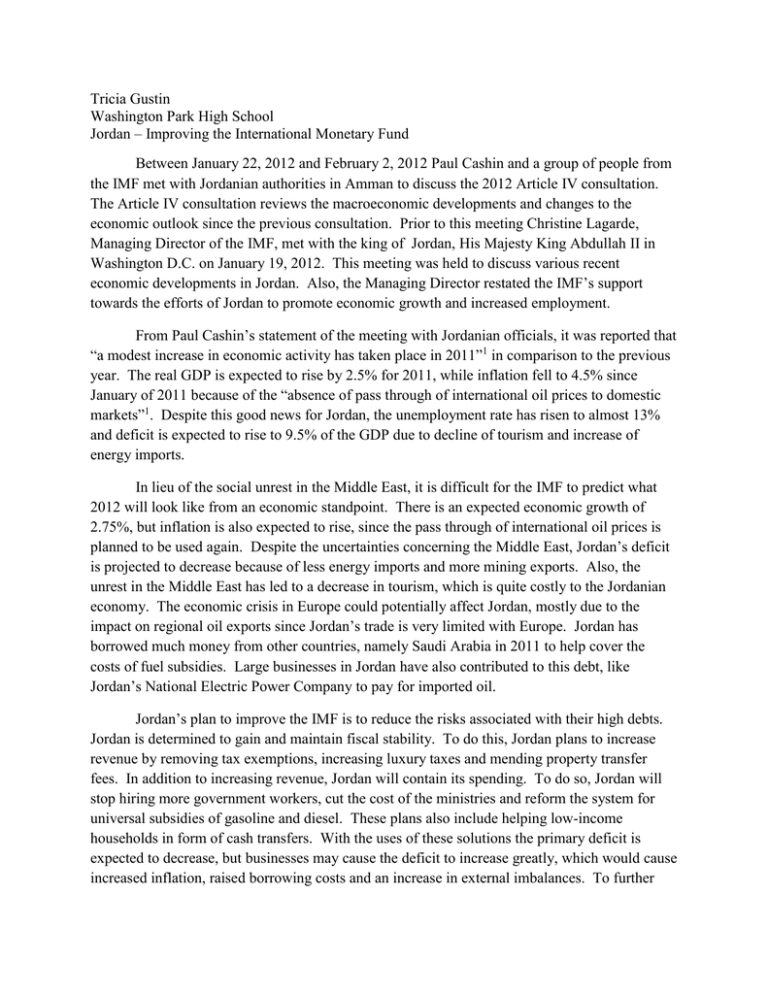

Tricia Gustin Washington Park High School Jordan – Improving the International Monetary Fund Between January 22, 2012 and February 2, 2012 Paul Cashin and a group of people from the IMF met with Jordanian authorities in Amman to discuss the 2012 Article IV consultation. The Article IV consultation reviews the macroeconomic developments and changes to the economic outlook since the previous consultation. Prior to this meeting Christine Lagarde, Managing Director of the IMF, met with the king of Jordan, His Majesty King Abdullah II in Washington D.C. on January 19, 2012. This meeting was held to discuss various recent economic developments in Jordan. Also, the Managing Director restated the IMF’s support towards the efforts of Jordan to promote economic growth and increased employment. From Paul Cashin’s statement of the meeting with Jordanian officials, it was reported that “a modest increase in economic activity has taken place in 2011”1 in comparison to the previous year. The real GDP is expected to rise by 2.5% for 2011, while inflation fell to 4.5% since January of 2011 because of the “absence of pass through of international oil prices to domestic markets”1. Despite this good news for Jordan, the unemployment rate has risen to almost 13% and deficit is expected to rise to 9.5% of the GDP due to decline of tourism and increase of energy imports. In lieu of the social unrest in the Middle East, it is difficult for the IMF to predict what 2012 will look like from an economic standpoint. There is an expected economic growth of 2.75%, but inflation is also expected to rise, since the pass through of international oil prices is planned to be used again. Despite the uncertainties concerning the Middle East, Jordan’s deficit is projected to decrease because of less energy imports and more mining exports. Also, the unrest in the Middle East has led to a decrease in tourism, which is quite costly to the Jordanian economy. The economic crisis in Europe could potentially affect Jordan, mostly due to the impact on regional oil exports since Jordan’s trade is very limited with Europe. Jordan has borrowed much money from other countries, namely Saudi Arabia in 2011 to help cover the costs of fuel subsidies. Large businesses in Jordan have also contributed to this debt, like Jordan’s National Electric Power Company to pay for imported oil. Jordan’s plan to improve the IMF is to reduce the risks associated with their high debts. Jordan is determined to gain and maintain fiscal stability. To do this, Jordan plans to increase revenue by removing tax exemptions, increasing luxury taxes and mending property transfer fees. In addition to increasing revenue, Jordan will contain its spending. To do so, Jordan will stop hiring more government workers, cut the cost of the ministries and reform the system for universal subsidies of gasoline and diesel. These plans also include helping low-income households in form of cash transfers. With the uses of these solutions the primary deficit is expected to decrease, but businesses may cause the deficit to increase greatly, which would cause increased inflation, raised borrowing costs and an increase in external imbalances. To further improve the IMF, Jordan will make the monetary conditions tighter to maintain the appeal of the Jordanian Dinar (JD). Jordan’s banking system, the Central Bank of Jordan, will continue to be regulated and supervised carefully, and keep a conservative approach in their funding practices, in order to “remain profitable and well capitalized”1. The IMF supports Jordan’s efforts to increase its banking system under Basel II, “which regulates finance and banking internationally”2. Sources: 1. "Press Release: Statement at the Conclusion of the 2012 Article IV Mission to Jordan." Document Moved. The International Monetary Fund, 7 Feb. 2012. Web. 29 Feb. 2012. <http://www.imf.org/external/np/sec/pr/2012/pr1240.htm>. 2. "Basel II." Investopedia. Investopedia.com. Web. 29 Feb. 2012. <http://www.investopedia.com/terms/b/baselii.asp>.