File

advertisement

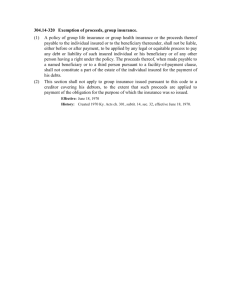

CHAPTER 12 LIFE INSURANCE CONTRACTUAL PROVISIONS - FACT “Few policyholders ever read a life insurance contract with any effort to understand its provisions” -Mehr and Gustavson Life insurance: Theory and Practice Ownership Clause • The ownership clause states that the policy owner possesses all contractual rights in the policy while the insured is living. • The owner of a life insurance policy can be the insured, the beneficiary, a trust, or another party. • Rights can be naming and changing the beneficiary, surrendering the policy for its cash value, borrowing the cash value etc. Entire-Contract Clause • The entire-contract clause states that the life insurance policy and attached application constitute the entire contract between the parties. • All statements in the application are considered to be representations rather than warranties. • The insurer cannot change the policy terms unless the policy owner consents to the change. • It also protects the beneficiary from denying a claim. Incontestable Clause • The incontestable clause states that the insurer cannot contest the policy after it has been in force two years during the insured’s lifetime. • The insurer cannot later contest a death claim on the basis of a material misrepresentation, concealment, or fraud. • The insurer has two years to discover any irregularities in the contract. Suicide Clause • The suicide clause states that if the insured commits suicide within two years after policy is issued, the face amount of insurance will not be paid; there is only refund of the premiums paid. • If the insured commits suicide after the period expires, the policy proceeds are paid just like any other claim. Grace Period • A life insurance policy also contains a grace period during which the policy owner has a period of 31 days to pay an overdue premium. • The purpose is to prevent the policy from lapsing by giving the policy owner additional time to pay an overdue premium. • The policy owner may be temporarily short of funds or may have forgotten to pay the premium. Reinstatement Clause • The reinstatement provision permits the owner to reinstate a lapsed policy. • A policy may lapsed if the premium has not been paid by the end of the grace period, or if an automatic premium loan provision is not in effect. • There are some requirements must be fulfilled to reinstate a lapsed policy; Requirements of reinstatement • Evidence of insurability. • All overdue premiums plus interest must be paid from their respective due dates. • Any policy loan must be repaid or reinstated, with interest from the due date of the overdue premium. • The policy must not have been surrendered for its cash value. • Etc. Advantage and Disadvantage of reinstatement Read Misstatement of Age or Sex Clause • If the insured’s age or sex is misstated, the amount payable is the amount that the premiums paid would have purchased at the correct age or sex. See example Beneficiary Designation • The beneficiary is the party named in the policy to receive the policy proceeds. – Primary and contingent – Revocable and irrevocable – Specific and class Primary and Contingent Beneficiary • A primary beneficiary is the beneficiary who is first to receive the policy proceeds on the insured’s death. • A contingent beneficiary is entitled to the proceeds if the primary beneficiary dies before the insured. ……read further …… Revocable and Irrevocable Beneficiary • A revocable beneficiary means that the policy owner reserves the right to change the beneficiary designation without the beneficiary’s consent. • An irrevocable beneficiary is one that cannot be changed without the beneficiary’s consent. Specific and Class Beneficiary • A specific beneficiary means the beneficiary is specifically named and identified. • Under a class beneficiary, a specific person is not named but is a member of a group designated as beneficiary, such as “children of the insured.” Change of Plan Provision • It allows policy owners exchange their present policies for different contracts. • It provides flexibility to the policy owner. • Changing from an ordinary life to a limited payment policy will require higher premium. • A lower premium policy is allowed for changing from a limited-payment policy to an ordinary life policy. Exclusions and Restrictions • A life insurance policy contains remarkably few exclusions and restrictions, such as; – Suicide – War clause – Aviation exclusions – Certain undesirable activities or hobbies Payment of Premiums • Life insurance premiums can be paid annually, semiannually, quarterly, or monthly. • If the policy is paid other than annually, the policy owner must pay a carrying charge, which can be relatively expensive when the true rate of interest is calculated. Check the example Assignment Clause • Absolute assignment transfers all ownership rights in the policy to a new owner. • Under a collateral assignment, the policy owner temporarily assigns a life insurance policy to a creditor as collateral for a loan. – Only certain rights are transferred to the creditor to protect its interest, and the policy owners retain the remaining rights. Policy Loan Provision • Cash-value life insurance contains a policy loan provision that allows the policy owner to borrow the cash value. • The interest rate is stated in the policy. • Interest on a policy loan must either be paid annually or added to the outstanding loan if not paid. Advantage of Policy Loans • Relatively low rate of interest • Substantially lower than credit cards rates. • No credit checks on the policy owner’s ability to repay the loan. • No fixed repayment schedule. • Policy owner has complete financial flexibility to determine the amount and frequency of loan repayments. Disadvantage of Policy Loans This is for you to read Automatic Premium Loan • An overdue premium is automatically borrowed from cash value after the grace period expires, provided the policy has a loan value sufficient to pay the premium. • It prevents policy from lapsing because of nonpayment of premiums. • The policy owner may be temporarily short of funds or may forget to pay the premiums. DIVIDEND OPTIONS • If the policy pays dividends, it’s known as a participatory policy. • The dividend represents largely a refund of part of the gross premium if the insurer has favorable experiences with respect to mortality, interest, and expenses. Sources of Dividends 1. The differences between expected and actual mortality experience; 2. Excess interest earnings on the assets required to maintain legal services; 3. The difference between expected and actual operating expenses. – But dividends cannot be guaranteed. Types of Dividends • • • • • Cash Reduction of premiums Dividend accumulations Paid-up additions Term insurance (5th dividend option) Cash • A dividend is usually payable after the policy has been in force for a stated period, typically one or two years. • The policy owner receives a check equal to the dividend, usually on the anniversary date of the policy. Reduction of Premiums • The dividend can be used to reduce the next premium coming due. • This option is appropriate whenever premium payments become financially burdensome. • It can also be used if the policy owner has a substantial reduction in income and expenses must be reduced. Dividend Accumulation • The dividend can be retained by the insurer and accumulated at interest. • The accumulated dividends generally can be withdrawn at any time. • If not withdrawn, they are added to the amount paid when policy matures as a death claim. • The dividend generally is not taxable for income tax purposes. Paid-up Additions • The dividend is used to purchase a small amount of paid-up whole life insurance. • Advantages are; – The paid-up additions are purchased at net rates, not gross rates; there are no loading for expenses. – Evidence of insurability is not required. • Disadvantages; – Paid-up additions are a form of single premium whole life insurance Term Insurance (5th Dividend Option) • The dividend can be used to purchase oneyear term insurance equal to the cash value of the basic policy, and the remainder of the dividend is then used to buy paid-up additions or is accumulated at interest. • A second form of this option to use the dividend to purchase yearly renewable term insurance. NONFORFEITURE OPTIONS • The payment to a withdrawing policy owner is known as a NONFORFEITURE value or cashsurrender value. • If a cash-value policy is purchased, the policy owner pays more than is actuarially necessary for the life insurance protection. • Thus the policy owner should get something back if the policy is surrendered. NONFORFEITURE options • Cash value • Reduced paid-up insurance • Extended term insurance Cash Value • The policy can be surrendered for its cash value, at which time all benefits under the policy cease. • The cash-surrender option can be used if the insured no longer needs life insurance. • If an insured is retired and no longer has any dependents to support, the need for substantial amounts of life insurance may be reduced. Reduced Paid-up Insurance • The reduced-up policy is the same as the original policy, but the face amount of insurance is reduced. • The cash-surrender value is applied as a net single premium to purchase a reduced paid-up policy. • This option is appropriate if life insurance is still needed but the policy owner does not wish to pay premium. Extended Term Insurance. • The net cash-surrender value is used as a net single premium to extend the full face amount of the policy into the future as term insurance for a certain number of years and days. • That means, the cash value is used to purchase a paid-up term insurance policy equal to the original face amount for a limited period extended.. SETTLEMENT OPTION • Settlement options refer to the various ways that the policy proceeds can be paid. • The policy owner can elect the settlement option prior to the insured’s death, or the beneficiary may be granted the that right. SETTLEMENT OPTION…. • The most common settlement options are as follows; • Cash • Interest option • Fixed-period option • Fixed-amount option • Life income options Cash • When insureds die, cash may be needed immediately for funeral expenses and other expenses. • The policy proceeds can be paid in a lump sum to a designated beneficiary. • Interest is paid on the policy proceeds from the date of death to the date of payment. • Interest is especially important in those cases where the proceeds are large, and the proceeds are paid several weeks or months after the insured’s death. Interest Option • Under the interest option, the policy proceeds are retained by the insurer, and interest is periodically paid to the beneficiary. • The interest can be paid monthly, quarterly, semiannually, or annually. • The beneficiary can be given withdrawal rights, by which part or all of the proceeds can be withdrawn. • It can be effectively used if the funds will not be needed until some later date. Fixed-Period Option • The policy proceeds are paid to a beneficiary over some fixed period of time. • The fixed-period option can be used in those situations where income is needed for a definite time period, such as; – During the readjustment, – Dependency, and – Blackout periods. Fixed-Amount Option • A fixed amount is periodically paid to the beneficiary. • The payments are made until both the principal and interest are exhausted. – E.g., assume that the death benefit is $50,000, the credit interest rate is 4 percent annually, and the desired monthly benefit is $3,020. – In this case, the beneficiary would receive $3,020 monthly for 17 months. Life Income Options • Death benefits can also be paid to the beneficiary under a life income option. • The major life income options are as follows; – Life Income – Life Income with Guaranteed Period – Life Income with Guaranteed Total Amount – Joint-and-Survivor Income Life Income • Installment payments are paid only while the beneficiary is alive and cease on the beneficiary’s death. • There is no refund feature or guarantee of payments. • The options provides a highest amount of installment income. Life Income with Guaranteed Period • The beneficiary receives a life income with a guaranteed period of payments. • If the primary beneficiary dies before receiving the guaranteed number of years of payments, the remaining payments are paid to a contingent beneficiary. – E.g., assume that Megan is receiving $2,000 monthly under a life income option, and the guaranteed period is 10 years. If Megan dies after receiving only one year of payments, the remaining 9 years of payments will be paid to a contingent beneficiary. Life Income with Guaranteed Total Amount • Under the option, the beneficiary receives a lifetime income, and the total amount paid is guaranteed. • If the beneficiary dies before receiving installment payments equal to the total amount of insurance placed under the option, the payments continue until the total amount paid equals the total amount of insurance. Joint-and-Survivor Income • Under this option, income payments are paid to two persons during their lifetimes, such as a husband and wife. – E.g., Richard and Margo may be receiving $1,200 monthly under a joint-and-survivor income annuity. – If Richard dies, Margo continues to receive $1,200 monthly during her life time. Advantage of Settlement Options • Periodic income is paid to the family; – Settlement options can restore part or all of the family’s share of the deceased earnings. • Principal and interest are guaranteed; – The insurer guarantees both principal and interest. • Settlement options can be used in life insurance planning; – Life insurance can be programmed to meet the policy owner’s needs and objectives. • An insurance windfall can create problems for the beneficiary; – Insurers now offer money market accounts for investment of the death proceeds so that beneficiaries are not forced to make immediate decisions concerning deposition of the funds. Disadvantages of Settlement Options • Higher yields often can be obtained elsewhere; – Interest rates are offered by other financial institutions may be considerably higher. • The settlement agreement may be inflexible and restricted; – The beneficiary may not have the withdrawal rights in an emergency may rise. • Life income options have limited usefulness at the younger ages; – life income option is useful for older people rather than younger people. Use of Trust • The policy proceeds can also be paid to a trustee, such as the trust department of a commercial bank. • Under certain circumstances, it may be desirable to have the policy proceeds paid to a trustee rather than disbursed under the settlement options. ADDITIONAL LIFE INSURANCE BENEFITS • • • • • • Waiver-of-Premium Provision Guaranteed Purchase Option Accidental Death Benefit Rider Cost-of-Living Rider Accelerated Death Benefits Rider Vertical Settlement Waiver-of-Premium Provision • If the insured becomes totally disabled from bodily injury or disease before some stated age, all premiums coming due during the period of disability are waived. • During the period of disability, death benefits, cash values, and dividends continue as if the premiums had been paid. Waiver-of-Premium Provision…. • Before any premiums are waived, the insured must meet the following requirements; – Become disabled before some stated age, such as before age 60 or 65. – Be continuously disabled for six months or may be less. – Satisfy the definition of total disability. – Furnish proof of disability satisfactory to the insurer. Waiver-of-Premium Provision…. Read the examples Guaranteed Purchase Option • The guaranteed purchase option permits the policy owner to purchase additional amounts of life insurance at specified times in the future without evidence of insurability. • The insured may need additional life insurance in the future but unable to afford to buy today. Guaranteed Purchase Option…. • Amount of Insurance; – The typical option allows the policy owner to purchase additional amounts of life insurance every three years up to some maximum age without evidence of insurability. – E.g., the guaranteed purchase option of one insurer allows additional purchase of life insurance when the insured attains ages 25, 28, 31, 34, 37, 40, 43, and 46. Guaranteed Purchase Option…. • • Assume that Heather, age 22, purchase a $25,000 ordinary life insurance policy with a guaranteed purchase option and becomes uninsurable after the policy is issued. Assuming that she elects to exercise each options, she would have the following amounts of insurance; Age 22 $ 25,000 (basic policy) + Age 25 $ 25,000 Age 28 25,000 Age 31 25,000 Age 34 25,000 Age 37 25,000 Age 40 25,000 Age 43 25,000 Age 46 25,000 Total Insurance at age 46 $ 225,000 Although uninsurable, Heather has increased her insurance coverage from $25,000 to $225,000. Advance Purchase Privilege • Most insurers have some type of advance purchase privilege by which an option can be immediately exercised on the occurrence of some event. • If the insured – marries, – has a birth in the family, or – legally adopts a child, • an option can be immediately exercised prior to the next option due date. Other Consideration • An important consideration is whether the waiver-of-premium rider can be added to the new insurance without furnishing evidence of insurability. • The most liberal provision permits the waiverof-premium rider to be added to the new insurance if the original policy contains such a provision. Accidental Death Benefit Rider • The accidental death benefit rider doubles the face amount of life insurance if death occurs as a result of an accident. • In some policies, the face amount is tripled. – E.g., at one insurer, the rider costs $69 annually when added to a $100,00, policy issued to a male age 35. Thus, if the insured dies as a result of an accident, $200,000 will be paid. Rider = see page 198 for explanation Accidental Death Benefit Rider …. • Requirements for Collecting Benefits; • several requirements must be satisfied before a double indemnity benefit is paid. – Death must be caused directly, and apart from other cause, by accidental bodily injury. – Death must occur within 90 days of the accident. – Death must occur before some specified age, such as age 60, 65, or 70. Accidental Injury Must Be The Direct Cause Of Death. • E.g., assume that Sam is painting his two-story house. • If the scaffold collapses and Sam is killed, a double indemnity benefit would be paid because the direct cause of death is an accidental bodily injury. • However, if Sam died from a heart attack and fell from the scaffold, the double payment would not be made. – In this case, heart disease is the direct cause of death, not accidental bodily injury. Death Must Occur Within 90 Days Of The Accident • The purpose of this requirement is to establish the fact the accidental bodily injury is the proximate cause of death. • However, because modern medical technology can prolong life for extended periods, many insurers are using longer time periods, such as 120. 180, or 365 days. The Accidental Death Must Occur Before Some Specified Death • Insurers usually impose some age limitations to limit their liabilities. • Coverage usually terminates on the policy anniversary date just after the insured reaches a certain age, such as 70. Limitations/Objections Of The Rider • First, the economic value of a human life is not doubled or tripled if death results from an accident. • Second, most person will die as a result of a disease and not from an accident. • Finally, the insured may be deceived and believe that he or she has more insurance than is actually the case. Cost-of-Living Rider • The cost-of-living rider allows the policy owner to purchase one-year term insurance equal to the percentage change in the consumer price index (CPI) with no evidence of insurability. • the amount of term insurance changes each year and reflects the cumulative change in the consumer price index. Cost-of-Living Rider…. • E.g., assume that Luis, age 28, buys a $100,000 ordinary life insurance policy and that the CPI increases 5 percent during the first year. • He would be allowed to purchase $5,000 of oneyear term insurance, and the total amount of insurance in force would be $105,000. • The term insurance can be converted to a cashvalue policy with no evidence of insurability. Accelerated Death Benefits Rider • The accelerated death benefit rider allowed insureds who are terminally ill or who suffers from certain catastrophic disease to collect part or all of their life insurance benefits before they die, primarily to pay for the medical care they require. • They generally can be classified as follows; – Terminal illness rider – Catastrophic illness rider – Long-term-care rider