INFRASTRUCTURE, GOVERNMENT AND

HEALTHCARE

External Audit: Annual

Audit Letter 2006-07

The Shrewsbury and Telford

Hospital NHS Trust

August 2007

AUDIT

Content

Page

The contacts at KPMG

in connection with this

report are:

Key messages

2

Will Carr

Partner

Key issues arising from use of resources work

3

Tel: 0121 232 3308

will.carr@kpmg.co.uk

Key issues arising from the audit of the accounts

4

Helen Dempsey

Senior Manager

KPMG LLP (UK)

Appendices

Tel: 0121 232 3901

helen.dempsey@kpmg.co.uk

1.

Key recommendation themes

2.

Reports issued in relation to the 2006-07 audit

KPMG LLP (UK)

Simon Stanyer

Assistant Manager

KPMG LLP (UK)

Tel: 0121 232 3694

simon.stanyer@kpmg.co.uk

Purpose

The purpose of this Annual Audit Letter (the letter) is to summarise the key issues arising from the work that we have

carried out during 2006-07 at The Shrewsbury and Telford Hospital NHS Trust.

Although this letter is addressed to the directors of the Shrewsbury and Telford Hospital NHS Trust (‘you’), it is also

intended to communicate those key issues to key external stakeholders, including members of the public. The letter will

be published on the Audit Commission website at www.audit-commission.gov.uk. It is the responsibility of the Trust to

publish the letter on the Trust website at www.sath.nhs.uk.

Responsibilities of the auditor and the Trust

We have been appointed by the Audit Commission as your independent external auditor. The Audit Commission has

issued a document entitled Statement of Responsibilities of Auditors and Audited Bodies which is available from

www.audit-commission.gov.uk. This summarises where the responsibilities of auditors begin and end and what is

expected from you as the audited body. External auditors do not act as a substitute for the audited body’s own

responsibility for putting in place proper arrangements to ensure that public business is conducted in accordance with

the law and proper standards, and that public money is safeguarded and properly accounted for, and used economically,

efficiently and effectively.

The scope of our work

The statutory responsibilities and powers of appointed auditors are set out in the Audit Commission Act 1998. Our main

responsibility is to carry out an audit that meets the requirements of the Audit Commission’s Code of Audit Practice (the

Code). Under the Code we are required to review and report on:

•the use of resources - that is whether you have made proper arrangements for securing economy, efficiency and

effectiveness (‘value for money’) in your use of resources

•the accounts – that is the financial statements and the Statement on Internal Control.

If you have any concerns or are dissatisfied with any part of KPMG’s work, in the first instance you should contact Will Carr who is the engagement

director to the Trust, telephone 0121 232 3308email will.carr@kpmg.co.uk who will try to resolve your complaint. If you are dissatisfied with your

response please contact Trevor Rees on 0161 246 4000, email trevor.rees@kpmg.co.uk, who is the national contact partner for all of KPMG’s work with

the Audit Commission. After this, if you still dissatisfied with how your complaint has been handled you can access the Audit Commission’s complaints

procedure. Put your complaint in writing to the Complaints Team, Nicholson House, Lime Kiln Close, Stoke Gifford, Bristol, BS34 8SU or by e mail to:

complaints@audit-commission.gov.uk. Their telephone number is 020 7166 2349, textphone (minicom) 020 7630 0421.

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

1

Section One

Key messages

This letter summarises the significant issues arising from our audit work in 2006/07. We highlight both areas of good performance and provide recommendations to

support areas where you could improve performance. A summary of our key recommendations drawn from our previous reports is summarised in Appendix 1. The

issues summarised in this letter have previously been reported to you and a list of all reports issued to you in relation to the 2006/07 audit is provided in Appendix 2.

Financial Management

The Trust has experienced severe financial pressures since its establishment. The financial plan for 2006/07 included a £9.4 m Cost Improvement Programme (CIP), of

which £2.2m was unidentified at the start of the year. In addition, the budget also included £2.8 m financial support from the West Midlands NHS bank. The audited

deficit was £2.84m for the year ended 31st March 2007.

Although still in deficit, the Trust’s financial performance in 2006/07 represented a significant improvement over previous years. Whilst not achieving its full CIP, and

experiencing some areas of overspending, the Trust significantly over performed on activity. This resulted in a favourable variance to income. The Trust achieved

financial balance on its monthly run rate, i.e. the difference between income and expenditure, for the first time in February 2007 with an in-month surplus of £0.945m

being reported. This was followed by a surplus run rate in March 2007 of £0.325m. This trend has continued into 2007/08 and continues to be projected for the

remainder of the financial year.

The Trust Board approved the 2007/08 budget on 28th March 2007. The budgeted surplus for the year is £4.1m. This equals the amount required to repay the principal

due on the working capital loan of £12.299m which the Trust received in 2006/07 to underpin its cash position. The 2007/08 budget included a CIP of £7.5m, which is

a particular challenge given the £9.4m CIP included within the 2006/07 budget. At the time that the 2007/08 CIP was developed, £2.2m remained unidentified.

As at 30 June 2007 (the latest figures available at the time of drafting this letter) the Trust reported a in-year surplus of £0.175m which is consistent with budget and

based upon prudent assumptions on activity.. Although still at risk, the Trust’s financial health is improving, and based on current assumptions, the Trust’s forecast

remains £4.1m surplus for the full year.

Foundation Trust process

The Trust has met the initial eligibility requirements for Foundation Trust status and has entered into the Department of Health pre-admission phase of the application

process. The Trust is awaiting confirmation from the Department of Health that its assessment will be completed by Monitor as a wave 8 applicant in April 2008. If

successful in its Monitor assessment, the Foundation Trust licence would be granted from 1July 2008.

As part of the application process, the Trust must finalise a detailed integrated strategic business plan (IBP) for formal submission in March 2008.The IBP sets out the

Trust’s strategy for the next five years. This is an evolving document which should assist the Trust to plan for the risks and opportunities it will face as an independent

public benefit corporation.

As part of the process, the Trust is also required to prepare a long term financial model (LTFM). The financial projections will form the basis for the discussions of the

Trust’s future plans at the “Board to Board” meeting. At the Board to Board meetings the Trust will be required to present its IBP to the Monitor Board which will ask

questions and challenge the Trust’s application.

Taken alongside the financial recovery process, the Foundation Trust application process will prove a significant challenge in terms of management capacity to deliver

the workload required. The Board will need to ensure that its focus remains balanced between reviewing day to day performance issues, whilst developing and

challenging the future strategies and plans and levels of documentation and review which are needed to deliver the ambition to achieve Foundation Trust status.

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

2

Section Two

Key issues arising from use of resources work

The main elements of our use of resources work are:

•

Auditor’s Local Evaluation (ALE) - we are required to assess how well NHS bodies manage and use their financial resources by providing scored judgements on

•

Value for money conclusion – in part based on the ALE assessment above, we are required to issue a conclusion on whether we are satisfied that you have put in

•

Specific risk based work - we have not performed any risk based work to support our use of resources opinion.

your arrangements in five specific areas.

place proper arrangements for securing economy, efficiency and effectiveness in your use of resources.

The key findings from this work are summarised below.

Element of work

Key findings

Our assessment of The Shrewsbury and Telford Hospital NHS Trust against the five nationally specified areas resulted in the following

scores on a scale of one (inadequate) to four (excellent).

Area

Auditors Local Evaluation

Score

Financial reporting

2

Financial management

2

Financial standing

1

Internal control

3

Value for money

2

The Trust showed improvement in most of the ALE scores which represented both an improvement in the systems and processes in place

and the embedding of the culture of control.

The ALE scoring methodology means that a Trust in deficit will achieve a score of one on financial standing and, until the Trust has

recovered the cumulative deficit, the maximum score in this area will be two.

However, addressing the ALE requirements to achieve level three in the other four areas will assist the Trust in its Monitor assessment

process.

We issued an unqualified, “except for”, value for money conclusion for the 2006-07 year.

This means that we were not fully satisfied that you had put in place proper arrangements for securing economy, efficiency and

effectiveness in your use of resources because of:

Value for money conclusion

•

arrangements for the management of the assts base – the Trust had not finalised its estates strategy at the year end; and

arrangements to ensure that spending matches the available resources – as highlighted above, a reported deficit limits the financial

standing conclusion to inadequate.

•

Specific risk based work

We have not completed any risk based work to support our use of resources opinion.

Wherever we identified an area to improve performance, we communicated this to the Trust as a ecommendation. A summary of the most important

recommendations raised, along with the Trust’s management’s response, has been provided at Appendix 1.

The Audit Commission is a signatory to the concordat between bodies inspecting, regulating and auditing healthcare. All recommendations from our use of resources

work will be loaded onto the concordat website at www.concordat.org.uk and an annual update of progress against these plans will be provided to the Audit

Committee.

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

3

Section Three

Key issues arising from the audit of the accounts

Opinion

We issued an unqualified opinion on your accounts on 25 June 2007. This means that we believe the accounts give a true and fair view of the financial affairs of The

Shrewsbury and Telford Hospital NHS Trust and of the income and expenditure recorded by the Trust during the year.

Before we give our opinion on the accounts, we are required to report to your Audit Committee any significant matters arising from the audit. We did this on 20 June

2007 and the key issues are summarised here.

Accounts production and adjustments to the accounts

We received a complete set of draft accounts by the deadline set by the Department of Health which were supported by good quality working papers..

We identified two adjustments required to the accounts which you did not agree to amend. These were reported to the Audit Committee. These adjustments were not

significant enough to have an impact on our opinion on the accounts.

To support our audit work on the annual accounts, we complete work on the financial systems and processes. This work is supported by that completed by your

internal audit function. In 2006/07, we undertook work on the financial and IT controls in place at the Trust. In addition, we undertook a review of the controls in place

during the Trust’s general ledger migration from the McKesson Integra system to the Oracle e-Business suite. No significant weaknesses were identified which

impacted on the accounts production although we identified several issues on the Trust IT controls in relation to the Trust’s network security arrangements, password

settings and system change controls. The Trust accepted our recommendations in this area.

Financial Standing

NHS bodies are given financial targets every year. One of these, the breakeven duty, is statutory, which means you must achieve it. The others are administrative,

which means you should achieve them. Your performance against the targets in 2006-07 is outlined below.

.

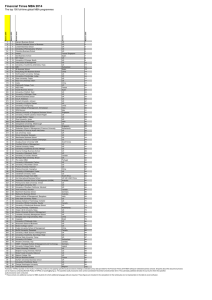

Target name

What it means

In-year breakeven

Keeping expenditure payable for the year

within the amount of income received for the

year

You reported a deficit of £2.84m. This deficit was underpinned by a further £2.8m, non

repayable financial support, to fund recovery actions, without which, the actual Trust deficit

would have been £5.64m. If the rules in relation to resource accounting (RAB) had not

changed during the year, the Trust’s deficit would have been £12.142m higher resulting in a

total deficit of £14.982m.

As above, over a three year period.

You reported a cumulative deficit of £34.2 m. This cumulative deficit includes the £2.84m

incurred during 2006/07. The cumulative deficit has increase each year since the Trust was

formed. As a result, the Trust has agreed a five year breakeven duty with the Strategic Health

Authority.

External Financing Limit

Keeping the requirement for cash financing

within a limit set by the Strategic Health

Authority

You remained within the EFL of £17.1m.

Capital Resource Limit

Keeping net capital expenditure within a

limit set by the Strategic Health Authority

You remained within the CRL of £11.3m by £1.3m.

Paying at least 95% of creditors within 30

days of receiving an invoice from them

You reported paying 91% of non-NHS and 69% of NHS creditors within 30 days. The poor

performance against NHS creditors was due to the implementation of the new general ledger

system.

Your performance [/]

Cumulative breakeven

Better Payment Practice

Code

During the year, the Trust entered into a three year loan agreement with the Department of Health for a working capital loan totalling £12.299m. This is to be

repaid over a three year period and is subject to a rate of interest of 5.5%. This loan underpinned the cash support required for the deficit incurred during

2005/06. The Trust also received a permanent cash adjustment, by way of Public Dividend Capital, of £5m from the West Midlands Strategic Health Authority.

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

4

Section Three

Key issues arising from the audit of the accounts (continued)

.Financial forecasts for 2007/08

The Trust Board approved a balanced budget on 28th March 2007 for the 2007/08 financial year. The budget includes income growth of £9m (4.4%), and, forecasts a

surplus of £4.1m which is the amount required to repay the principal and interest on the working capital loan received in 2006/07.

The budget is based upon the achievement of £7.5m CIPs of which, £2.2m (29%) of these savings were unidentified when the original CIPs was developed. The CIPs

represent 3.5% of the total Trust turnover and the Trust must continue to monitor the delivery of these CIPs and provide assurance to the Board and its stakeholders on

their delivery. This is challenging given the size of the CIP of £9.4m included within the 2006/07 Trust budget. In setting the 2007/08 financial plans, the Trust has

budgeted for a positive run rate throughout the year culminating in the forecast surplus of £4.1m at the year end.

However, the immediate challenge facing the Trust is the continued late phasing of the CIP. Although the phasing of the CIP is improved from previous years, 63% of

the CIP of £7.5m is due to be delivered in the final half of 2007/08.In addition, the Trust is forecasting that £2.74m (67%) of the year end surplus of £4.1m, will be

delivered in the final half of the year.

As at 30 June 2007 (the latest figures available at the time of drafting this letter) the Trust had reported a in-year surplus of £0.175m which is consistent with budget

and based upon prudent assumptions on activity.

Although the financial performance to date is broadly to plan, the challenge facing the Trust will be the ongoing delivery of challenging CIPs and run rates which

become greater during the latter part of the financial year.

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

5

Appendices

Appendix 1: Key recommendation themes

This appendix summarises the main recommendations that we have identified during the 2006-07 year, along with your response to them. Where recommendations

have reached their due date for implementation we provide an update of progress. The detail of the recommendations have been communicated to you during the

year.

Area for improvement

Management Response and timescale for implementation

Network security

Agreed

The Trust’s network security arrangements and system password settings do not currently

meet standards of recommended best practice. These should be improved by documenting

the procedures for setting up new users, ensuring that the network security policy is

appropriately communicated to staff and performing and annual review of user access

levels. In addition, the Trust’s network passwords should be enhanced.

The Trust is piloting chip and pin smart card which will give users a single PIN code to

access the system they are required to use.

Controls issues relating to final accounts

Agreed

Due by 31 July 2007

The chip and PIN cards are still being piloted across the Trusts.

All recommendations will be implemented by the end of the financial year.

The Trust should ensure the accuracy of its stock records by re-performing a sample of

stock valuations by an officer independent of the preparation. In addition, the Trust should

obtain periodic, independent confirmations from its solicitors on all litigation and claims

Due by 31st March 2008

outstanding. Finally, the Trust should ensure that its debt collection team is adequately

resourced to reduce the level of private patient debts outstanding.

Agreed

General ledger data migration

The Trust should document the procedures for setting up new users and for removing

leavers from the system. The number of users who have system administrator access

should also be restricted. In addition, the Trust should ensure that a physical and

environmental review of the server holding Trust data takes place as soon as possible.

Finally change management procedures for all key systems should be documented.

Due by 31st December 2007 (being the latest due date for recommendations made)

The Trust is proceeding with implementing all recommendations made. The final due

date will be adhered to.

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

6

Appendices

Appendix 2: Reports issued in relation to the 2006-07 audit

Report

Date issued to Audit Committee

Audit Plan

22 March 2006

Interim report and Auditor Local Evaluation (phase one)

18 April 2007

Audit Memorandum (to those charged with governance)

20 June 2007

Auditor Local Evaluation overall report

Draft due by 30 September . The report will then go forward to Audit Committee at the

next scheduled date of 12 December 2007

General ledger data migration review

20 June 2007

Annual Audit Letter

19 September 2007

© 2007 KPMG LLP, the U.K. member firm of KPMG International, a Swiss cooperative. All rights reserved. This document is confidential and its circulation and use are restricted. KPMG and the

KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. The Concordat logo is reproduced by permission of the Audit Commission.

KPMG LLP is not a signatory to the Concordat but supports the broad principles that are promoted by the Concordat.

7