File - Barren County High School Program Review

advertisement

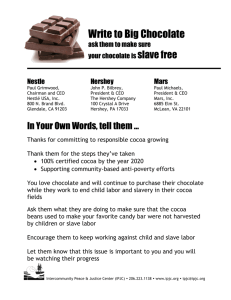

Accounting Business Ownership Activity The Chocolate Farm: Learn about Elise MacMillan and her brother Evan who co-founded The Chocolate Farm in Englewood, Colorado, in the late 1990s. www.csmonitor.com/2001/0207/p13s1.html Hershey Foods Corporation: Hershey's website containing business and product information. www.hersheys.com/ History of M&M's Chocolate- Forrest Mars: Provides information on how Forrest Mars the inventor of the M&M developed his idea into a business. inventors.about.com/od/mstartinventors/a/ForrestMars.htm Mars: Homepage of Mars, Inc. the company behind some of our favorite candies like M&M's. www.mars.com/global/index.aspx Famous Amos Cookies: Provides company and product information for Famous Amos Cookies. www.famous-amos.com/ Hoover’s Online Directory: If a company has incorporated and is publicly traded, with website will provide more information. www.hoovers.com/ Keebler Foods Company: Keebler's website, which provides information on the company and its products. www.keebler.com/ National Confectioners Association: This website will help students research different candy companies, and can direct them to the home pages of these companies. www.candyusa.com/ Activity 3: Sweet Success Divide students into four groups. Have each group research what has happened to the founders and businesses featured in the case studies. PowerPoint slide presentations are an ideal way for students to share with classmates what they discover. Encourage them to use images as well as text. Client 1: Elise MacMillan and her brother Evan co-founded The Chocolate Farm in Englewood, Colorado, in the late 1990s. Client 2: Milton Hershey broke ground for his chocolate factory near Lancaster, PA in 1903. It was the beginning of what would become Hershey Foods Corporation . Client 3: Forest Mars invited Bruce Murrie, an investment banker and son of the Hershey company president, to be his partner in M&M Ltd. The M&Ms we still eat today were first sold to the public in 1941. The letters in "M&M" stand for Mars & Murrie. Eventually, Murrie left the business but Forest Mars became the owner of Mars, Inc. Client 4: Wally Amos launched the Famous Amos Cookie Company in a Hollywood, CA storefront on Sunset Boulevard in 1975. Have the students read about one of these persons and the business he or she created. Then report their findings about what happened to the entrepreneur and the business. Be sure to have them include answers to the following questions. 1. 2. 3. 4. 5. 6. 7. What has happened to the founder of the business? Is he or she still involved with the company? What other things has he or she done? Who owns the business? How has the business changed? Has the company been involved in any mergers or acquisitions? What products does the company sell? If students need additional information to help them make their recommendations, they can click on the titles below: "Should You Have a Partner” "What Type of Business Organization is Best for You?" What accounts for the differences in your recommendations? [The weight advisor's and clients give to various decision factors varies; also, with most problems there is more than one solution.] What are the negatives you identified and what are your solutions for dealing with them? [Answers will vary. Particularly savvy students may suggest the use of limited partnerships or subchapter S corporations.] Why do you think most new businesses are sole proprietorships and partnerships? [These forms of ownership are easier and less expensive to start.] What do you see as the biggest disadvantages of sole proprietorships and partnerships in the long term? [Disruptions caused by the death/disability of an owner; potential for disagreements over operations; difficulty transferring ownership; acquisition of resources for expansion are limited to owner assets, income and debt.] What are the advantages of setting up a limited versus general partnership? [The partners can limit their liability to their investment in the business. A limited partnership can also be used to establish who has the authority to make decisions.] Are there any disadvantages? [Partners unable to provide input in the decision process may be unhappy.] Under what circumstances might a business operating as a sole proprietorship or partnership decide to incorporate? [Potential answers include when a company wants to insure there is no disruption to business if an owners dies; to reduce liability; to offer ownership shares as a means to get money for expansion or motivational incentive for employees.]