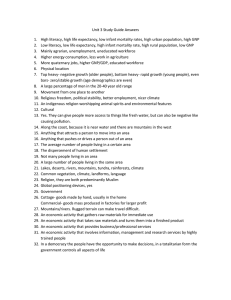

Economic Factors

advertisement

COUNTRY ANALYSIS • Important - world trade grows - greater competition • Strong prosper and weak (inefficient) must change • Those who understand the world and various business cultures have a competitive advantage • Predict future country behavior and performance marginalist • Used by CIA, Foreign Offices, State Departments, International Banks, foreign bond buyers STRUCTURE - CONDUCT - PERFORMANCE MODEL • Structure – main supports – don’t often change • Conduct – goals, strategies, and policies • Performance –GNP, employment, inflation, Deficits • CHANGE IN STRUCTURE MAY LEAD TO A CHANGE IN CONDUCT AND THUS A CHANGE PERFORMANCE • EXAMPLE: Venezuela – Socialist Government Wins Prediction – more taxes and more inflation - lower profits and stock prices INDUSTRY ANALYSIS - MODEL STRUCTURE - CONDUCT - PERFORMANCE More difficult to separate structure and conduct for an industry than a country because industry structures change faster. FOUR STRUCTURE-CONDUCT FEATURES • Intensity of competition (structure diagram) • Cost and profitability conditions • Technology & research • Long term or short term demand INDUSTRY PERFORMANCE • profitability -stock vs. accounting • risk - return volatility • debt • liquidity • growth QUESTION: What determines the intensity of industry competition? ANSWER: industry structure Industry Structure Determines the Competitive Intensity Potential Entrants Entry Costs Bargaining Power Suppliers Bargaining Power Industry Competition Exit Costs Substitutes Customers ECONOMY ANALYSIS IMPORTANT VARIABLES TO FORECAST • GNP - gives cash flows • Interest rates - gives discount rate • Both used to get present value of cash flows QUESTION: Why try to predict the near future in the business cycle? Because different investments are best performers in each part / few can successfully predict the business cycle. STOCK PRICES FLUCTUATE MORE THAN GNP QUESTION: Why? • firm profits swings are usually amplified in comparison to GNP swings. • profit margin fluctuates - input costs rise faster than output price heading into a recession. • input prices fall or rise slower than output prices heading into an expansion. PROFIT MODEL = PQ - CQ where = Total profit P = output price per unit Q = output in units C = input price per unit of output Profit margin = P - C C fluctuates with capacity and labor utilization rates and technology. MONETARY MODEL OF GNP - QUANTITY THEORY GNP = MV = PQ GNP = GROSS NATIONAL PRODUCT M = MONEY SUPPLY V = GNP/M = VELOCITY OR TURNOVER some assume V is constant P = OUTPUT PRICE Q = QUANTITY OF OUTPUT QUESTION: What happens when fed increases M? • Q rises, P rises, or both • larger Q increase when capacity is underutilized • otherwise if at full capacity then only P increases inflation. • watch Fed numbers for money supply in WSJ Credit Market section. Example: Exchange candy bars faster and faster. Add more money and keep candy the same. Then add more candy. INTEREST RATES INTEREST RATES HAVE 3 COMPONENTS Rg =Rr + I + P where Rg = gross nominal interest rate Rr = real interest rate - compensation for saving I = expected inflation rate - compensation for expected inflation P = compensation for business, financial, liquidity, and exchange rate risks EXAMPLES Tbill Tbond Junk Rg .005 = .030 = .100 = Rr I .005 + .000 + .020 + .010 + .020 + .010 + P .00 .00 .07 DEFICIT EFFECTS ON INTERNATIONAL TRADE TWO DEFINITIONS PRODUCT (GNP) OF GROSS NATIONAL output GNP = C + I + G + EX income GNP = C + S + T + IM C = CONSUMPTION I = INVESTMENT EX = EXPORTS G = GOVERNMENT SPENDING S = SAVINGS T = TAXES IM = IMPORTS 1. What is the output definition of GNP? • The total dollar value of everything produced in the nation, including services, in one year. • This is the most commonly understood and used definition. • Goods are produced for consumers, for investment (plant and equipment), for government, and for export. 2. What is the income definition of GNP? • The total dollar value of income spent in the nation in one year. • This definition is seldom used by the public and less understood. • Production generates income for the factors of production and that income is spent on consumer goods, savings, taxes, and imported good. IMPLICATIONS OF GNP DEFINITIONS SET THE TWO DEFINITIONS EQUAL GNP = C + I + G + EX = C + S + T + IM I + G + EX = S + T + IM or (EX - IM) = (T - G) + (S - I) trade (def / surplus) = gov (def / surplus) + household (def / sur) This shows that the trade, government, and household budgets are connected. (EX - IM) Simple Example: -$600 = (T - G) + (S - I) = -$400 + ? More Complex Example: Consider the following information. Recently, the U.S. Treasury announced that it expects tax revenues to be $300 billion smaller this year than last year. Also, the recession is causing people to save more this year, by about $100 billion. Furthermore, government spending is expected to increase by $300 billion and companies are expected to invest $100 billion less than last year. What change can we expect for the trade deficit? What might happen to interest rates and the dollar’s value given this scenario? Adding the Capital Budget – International Financial Flows (EX - IM) = (T - G) + (S - I) = (capital out - capital in) = capital(surplus/deficit) Example: Suppose that our President throws up on the Chinese President and the next day the Chinese President decides to sell $100 billion U.S. Treasury bonds. What will happen to the U.S. trade deficit assuming that U.S. investors hold their foreign investment constant? What might happen to U.S. interest rates and the dollar? This shows that the trade, government, and household budgets are also connected to capital flows into deficit countries and out of surplus countries. Note: Capital flows move quicker than goods flows so trade and capital accounts may not match exactly on a quarterly basis but should be close on an annual basis. Note: There could be a difference between the trade account balance and the capital account balance due to unrecorded transactions or mis-measured transactions. This could involve illegal or black market transactions. Like MV = PQ, financial side = goods side of transaction. But otherwise, the models are not related even though they both start with GNP. Ordinarily, when a country has a trade surplus (deficit) its currency appreciates (depreciates). What is going on at the micro level? Illustration 1: Assume that Japan’s Toyota exports $50 billion in cars to the U.S. They could take the cash and buy $50 billion in parts from U.S. manufactures. If they don’t do this, they need to spend the $50 billion somehow, say by buying U.S. real estate, stocks or bonds. Hence, a deficit in goods trade implies a surplus in financial flows. Illustration 2: The U.S. government has recently made it clear that it wants to reduce the value of the dollar. How might Toyota’s decision change if Toyota believes this? Question: U.S. investors are buying more foreign stocks because they have high returns. What could be the effects? Trivia Question: Why are there so many old sunken ships with gold in them, which salvagers try to recover? Steps in the 1997-1998 Asian Financial Crisis 1. Thailand experiences major financial collapse 2. Russia defaults on government debt 3. World-wide rush to buy U.S. Treasury bonds (caused ITCM collapse – Fed - banks - bail out). 4. Dollar appreciates – intermediate mechanism 5. Real U.S. export (import) prices increase (decrease) 6. U.S. exports (imports) fall (rise) 7. U.S. interest rates fall – intermediate mechanism 8. U.S. consumption (savings) rises (falls), investment rises Graphing the relevant data for Asian Financial Crisis 1. Go to economagic.com, click on Federal Reserve, St. Louis 2. Click U.S. Balance of Payments Data 3. Click Balance on Current Account (this is quarterly) 4. Click Gif Chart or PDF Chart (see recent – and to 1960) 5. Click Foreign Assets in the United States, Net Capital Inflows (US Assets Abroad, Net Outflows) 6. Click U.S. Interest Rate Data. Then click on 30-Year Treasury Constant Maturity – or another maturity 7. Click Exchange Rate Data. Then click Trade-Weighted Exchange Index: Broad 8. For Export and Import Prices – go to www.bls.gov 9. Click Databases & Tables tab 10. Go to Prices – International and click on Top Picks 11. Select Imports – All Comodities 12. Select Exports – All Comodities 13. Click Retrieve Data. 14. Click Include Graphs and then click Go. 15. Click More Formatting Options. 16. Select 12-Month Percent Change and Retrieve Data. 17. You can see that import prices fell faster than export prices around 1997-1998