DGMZ

advertisement

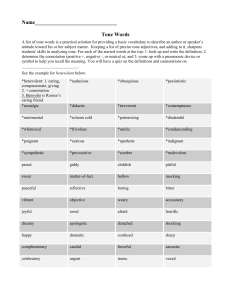

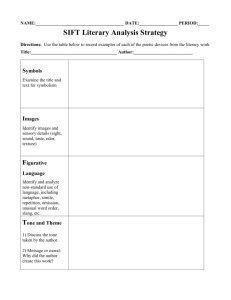

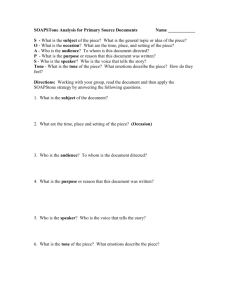

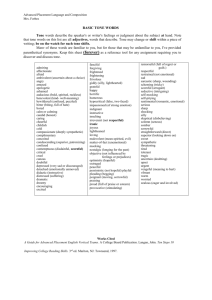

The Effect of Managerial “Style” on the Tone of Earnings Conference Calls Angela Davis Weili Ge Dawn Matsumoto Jenny Li Zhang April 27, 2011 Research Questions Does a manager’s “style” impact the tone expressed in conference calls? • What is “style”? • What is “tone”? Does the market react to the portion of tone that is manager-specific? 2 We are a company known for being conservative. —Greg Maffei, Microsoft CFO 1997-2000 3 We are a company known for being conservative. —Greg Maffei, Microsoft CFO 1997-2000 I believe in being disciplined but aggressive. —Chris Liddell, Microsoft CFO 2005-2009 4 Motivation Recent interest in the use of language to convey (or obscure) information to the capital markets • Readability of annual report disclosures (Li 2008) • Deceptive language in conference calls (Larcker and Zakolyukina 2010) • “Tone” in corporate disclosures (Davis et al. 2010; Demers and Vega 2010; Frankel et al. 2009; Price et al. 2010) Overall conclusion: tone conveys information beyond concurrent, quantifiable information • Market reaction to tone, controlling for current performance 5 Motivation BUT: other factors likely influence tone • Incentives to bias (Lang and Lundholm 2000) • Unintentional bias Recent studies have shown manager-specific effects in financial reporting choices: • Dyreng et al. 2010 -- Tax avoidance behavior • Bamber et al. 2010 & Yang 2010 – Disclosure behavior • Ge et al. 2011 – Accounting choices 6 Contribution Evidence that manager-specific factors influence tone • Separate from current performance, future performance, firm and quarter effects • Manager effects are large relative to other contexts • Suggests tone is more than just a function of economic events Some evidence that the market reacts to the managerspecific component of tone for optimistic managers but not pessimistic managers • Consistent with the market identifying and discounting manager-specific pessimism but not manager-specific optimism 7 What is “style”? Systematic choice made by a manager across situations • “Upper echelons” theory (Hambrick and Mason 1984) • Contrary to “neoclassical” view of the firm Operationalization: Manager fixed effects controlling for firm and time effects Determinants of style • Prior experiences • Personality/disposition 8 What is “tone”? Optimism/pessimism expressed in corporate disclosures Operationalization: Counts of words deemed positive/negative Determinants of tone • Positive/negative economic events (content) • Manager choice of how to describe these events (language) 9 Does manager style impact tone? Style impacts choices more when manager discretion is higher • Hambrick 2007 • Ge et al. 2011 Choice of language relatively unconstrained • Not subject to GAAP, audits, SEC regulation • Particularly in conference calls 10 Does manager style impact tone? But style impacts choices more when optimal decision is ambiguous (bounded rationality) • Systematic over/under optimism can be costly • Optimistic language increases probability of class action lawsuits (Rogers et al. 2010) But bias may be unintentional • Dispositional optimism Prediction: Style impacts tone 11 Does the market react to style? Some evidence the market differentially prices tone • Cross-sectional variation in “tone response coefficient” based on firm-specific credibility measures (Demers and Vega 2010) Some evidence the market recognizes style • Greater market reaction to forecasts of high forecast accuracy managers (Yang 2010) 12 Does the market react to style? Difficult to identify “unwarranted” optimism ex ante • Pricing of discretionary accruals (Xie 2001); pro forma earnings (Doyle et al. 2003) • Increased shareholder litigation consistent with markets being misled (Rogers et al. 2010) Experimental evidence investors react to language • Vivid vs. pallid language (Hales et al. 2011) Identifying “language style” more difficult than “accuracy of forecast style” 13 Measures of Tone Frequency counts of positive vs. negative words • Separate presentation from Q&A • Use only comments in Q&A spoken by specific manager Three dictionaries used: • TONE_D: Diction (Davis et al. 2010) • TONE_H: Henry (2006, 2008); Henry and Leone (2009) • TONE_LM: Loughran and McDonald (2009) TONE_i = (positive words – negative words) ÷ total words 14 Examples of Differences between Wordlists Diction Henry L&M Growth Yes Yes Yes Pleased Yes Yes Yes Proud Yes No No Thrilled Yes No No Bad Yes No Yes Excited Yes No Yes Great Yes No Yes Harsh Yes No Yes Achieve, Achieving No Yes Yes Opportunities No Yes Yes Exceeding No Yes No 15 Excerpts from transcripts: “We’re excited about the accelerator, but we’re even more excited about by Flash.” (John East, CEO, Actel 7/23/02) “During the call today, I’m going to focus my comments on the excitement, the opportunities, the optimism and the commitment to achieving results that are being created within this new enterprise.” (Bob Wood, CEO, Chemtura 7/29/05) “I am very proud of the remarkable growth and progress Yahoo! has demonstrated throughout this past year.” (Terry Semel, CEO, Yahoo 1/17/06) “We’re really thrilled by the way customers are responding to these stores as they’re performing extremely well and they’re exceeding our sales expectations.” (George Jones, CEO, Borders 5/27/08) 16 Sample Construction Identify CEOs/CFOs who have occupied the CEO/CFO position in at least two companies for at least one year in each firm between 2002 and 2009 Gather conference call transcripts for firm quarters between 2002 and 2009 Eliminate managers who did not participate in at least two quarterly conference calls at each firm • 104 CEOs and CFOs in our sample (69 CFOs, 31 CEOs, 4 CEO/CFOs) 17 Sample Construction “Manager-firm matched sample” are firm-quarters of those managers who move firms (for which we measure fixed effects) “Filler quarters” are firm-quarters for which we do not estimate a manager fixed effect (because manager does not move firms) 2002 2003 2004 2005 2006 2007 2008 2009 CEO: Steve Odland Autozone Autozone Autozone Filler Qtrs Filler Qtrs Filler Qtrs Filler Qtrs Filler Qtrs Filler Qtrs Filler Qtrs Filler Qtrs Office Depot Office Depot Office Depot Office Depot Office Depot Disentangle CFO-specific effects from firm-specific and time-specific effects 18 Effect of Style on Tone – Research Design (1) Relation btw tone and current and future performance: TONEit 0 1MBE it 2 SURPit 3 LOSS it 4 RETURN it 5 ROAit 6 ROAit 1 7 ROAit 2 8 ROAit 3 9 ROAit 4 it Current Performance Future Performance (2) Manager-specific effect: RESIDUALit 0 FIRM i YEARt QTR k MANAGER j it 19 Relation between Tone and Current and Future Performance Table 4 Tone_D Tone_H Tone_LM Intercept 1.44*** 1.66*** 0.43*** MBE 0.19*** 0.33*** 0.21*** SURP -0.55 -1.36 3.13** LOSS -0.23*** -0.26*** -0.25*** RETURN 0.11* 0.29*** 0.31*** ROA 0.50 3.23*** 2.32*** ROAt+1 -0.63 3.49*** 1.78*** ROAt+2 0.40 2.30*** 1.51** ROAt+3 0.23 1.52** 0.34 ROAt+4 0.15 -0.13 0.14 Adj R2 2.40% 9.3% 8.8% 20 Manager Effect on Residual Tone Table 5, Panels A & B Tone_D Tone_H Tone_LM Base Adj R2 38% 37% 36% Full Adj R2 44% 41% 41% F-stat 4.72 3.39 4.05 p-value 0.001 0.001 0.001 5% level 29% 20% 22% 10% level 37% 31% 31% Percent negative 46% 46% 42% Significant effects: 21 Market Reaction to Tone – Research Design Relation btw 3-day returns and tone: CARit 0 1MBE it 2 SURPit 3 LOSS it 4 RETURN it 5 ROAit 6 ROAit 1 7 ROAit 2 8 ROAit 3 9 ROAit 4 10TONE FULLit 11MANAGERj it Current Performance Residual Tone Manager Effect Future Performance 22 Market Reaction to Tone Table 6, Panel B Tone_D Tone_H Tone_LM Intercept -0.050*** -0.037*** -0.032*** MBE 0.039*** 0.040*** 0.038*** SURP 0.816*** 0.799*** 0.765*** LOSS 0.015** 0.014** 0.015* -0.059*** -0.058*** -0.061*** ROA 0.054 0.051 0.31 ROAt+1 -0.049 -0.047 -0.070 ROAt+2 0.102 0.107 0.091 ROAt+3 0.146 0.141 0.131 ROAt+4 0.028 0.028 0.039 0.012*** 0.005* 0.015*** RETURN TONEFULL 23 Market Reaction to Manager Specific Tone Table 6, Panel C Tone_D Tone_H Tone_LM Intercept -0.049*** -0.036*** -0.032*** MBE 0.039*** 0.040*** 0.038*** SURP 0.827*** 0.803*** 0.802*** LOSS 0.015** 0.014* 0.014** -0.059*** -0.058*** -0.061*** ROA 0.053 0.053 0.025 ROAt+1 -0.048 -0.044 -0.064 ROAt+2 0.103 0.108 0.094 ROAt+3 0.147 0.143 0.135 ROAt+4 0.027 0.029 0.038 TONE 0.011*** 0.004 0.014*** 0.001 0.001 0.006 RETURN MANAGER 24 Market Reaction to Manager Specific Tone Table 6, Panel D Tone_D Tone_H Tone_LM Intercept -0.052*** -0.037*** -0.033*** MBE 0.038*** 0.040*** 0.038*** SURP 0.882*** 0.803*** 0.819*** LOSS 0.015** 0.014* 0.014** -0.059*** -0.058*** -0.061*** ROA 0.043 0.049 0.023 ROAt+1 -0.046 -0.045 -0.062 ROAt+2 0.106 0.108 0.096 ROAt+3 0.152 0.142 0.137 ROAt+4 0.031 0.028 0.038 TONE 0.010** 0.004 0.013* MANAGERPOS 0.012 0.004 0.011 MANAGERNEG -0.011 -0.002 0.000 RETURN 25 Robustness checks Use only effects that are significant at the 10% level • Significantly smaller sample (500 obs) • No overall relation between returns and manager specific component of tone • Positive relation for optimistic managers but only using Diction measure Use decile ranks of manager effects • Positive coefficient using L&M at 10% level • Positive coefficient on top decile indicator for Diction (1% level) and L&M (5% level) 26 Summary and Conclusion Manager “style” has a significant impact on tone of presentation and Q&A • Impact is larger than “style” effects in other contexts Some evidence that the market prices the managerspecific component of tone for optimistic managers but not pessimistic managers • BUT, need to check robustness of results Next steps: • • Intraday trading data to measure price reactions Increase sample size 27 28 Manager-firm matched sample (Table 2A) Firm-quarters Firms Mgrs Initial 3,326 415 206 No Transcripts (658) (93) (46) Fewer than 2 qtrs per firm (836) (128) (56) Manager Firm Matched Sample 1,832 194 104 29 Sample Selection (Table 2B) N of quarters in each firm 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 and above Total N of manager-firm pairs 18 22 19 23 18 17 18 13 2 5 8 5 8 4 5 5 2 6 11 209 Percentage (%) 8.61 10.53 9.09 11 8.61 8.13 8.61 6.22 0.96 2.39 3.83 2.39 3.83 1.91 2.39 2.39 0.96 2.87 5.27 100 30 Frequency of Firms based on the number of different Managers (Table 2C) No. of different Mgrs Freq of firms Percentage No. of Mgr-firm pairs 1 180 92.8 180 2 13 6.7 26 3 1 0.5 3 Total 194 100 209 31 Frequency of Managers based on the number of firm changes (Table 2D) No. of changes Freq of Mgrs Percentage No. of Mgr-firm pairs 1 103 99 206 2 1 1 3 Total 104 100 209 32 Descriptive statistics (Table 3) Variable N Min Q1 Mean Median Q3 Max Std. Dev. ASSETS 4123 113.27 883 29,296 2,201 10,298 1,022,237 122,281 ROA 4123 -0.1238 0.00183 0.00863 0.00860 0.01893 0.08281 0.02581 ROAt+1 4120 -0.1231 0.00173 0.00853 0.00858 0.01874 0.08103 0.02565 ROAt+2 4111 -0.1271 0.00174 0.00823 0.00859 0.01869 0.07894 0.02596 ROAt+3 4093 -0.1271 0.00183 0.00821 0.00871 0.01874 0.07894 0.02596 ROAt+4 4018 -0.1231 0.00173 0.00828 0.00871 0.01892 0.07891 0.02561 SURP 3628 -0.07 -0.0004 -0.0004 0.0005 0.002 0.03 0.01 MBE 3630 0 0 0.72 1 1 1 0.45 LOSS 4123 0 0 0.21 0 0 1 0.40 RETURN 4235 -0.39 -0.10 0.003 -0.005 0.09 0.52 0.18 TONE_D 4390 -0.35 0.87 1.53 1.45 2.11 4.07 0.91 TONE_H 4390 -0.57 1.18 1.94 1.89 2.65 4.92 1.11 TONE_LM 4390 -1.51 0.00 0.58 0.52 1.12 2.92 0.87 TONE_DFULL 4290 0.67 1.51 1.88 1.86 2.23 3.23 0.54 TONE_HFULL 4290 0.35 1.31 1.78 1.74 2.20 3.60 0.67 TONE_LMFULL 4290 -1.04 -0.03 0.33 0.33 0.68 1.71 0.55 CAR 1624 -0.25 -0.03 0.007 0.006 0.05 0.28 0.08 33 Comparsion to Compustat (Table 3) Our sample Compustat Difference in mean (sample vs. Compustat) Variable Mean Median Mean Median ASSETS 29,296.46 2,200.90 3,531.07 202.97 25,765.39*** ROA 0.00863 0.00860 -0.03491 0.00249 0.0435*** ROAt+1 0.00853 0.00858 -0.03490 0.00249 0.0434*** ROAt+2 0.00823 0.00859 -0.03496 0.00248 0.0432*** ROAt+3 0.00821 0.00871 -0.03491 0.00246 0.0431*** ROAt+4 0.00828 0.00871 -0.03408 0.00249 0.0424*** SURP -0.0004 0.0005 -0.003 0.0003 0.002*** MBE 0.72 1 0.65 1 0.07*** LOSS 0.21 0 0.42 0 -0.21*** RETURN 0.003 -0.005 0.022 -0.007 -0.02*** 34 Correlation Matrix TONE_D TONE_H TONE_LM VCAR MBE SURP LOSS RETURN ROAt+1 TONE_D 1.000 0.610 0.646 0.081 0.124 0.073 -0.154 0.054 0.057 TONE_H 0.614 1.000 0.682 0.100 0.191 0.106 -0.233 0.101 0.224 TONE_LM 0.655 0.684 1.000 0.114 0.183 0.136 -0.230 0.114 0.209 VCAR 0.068 0.085 0.098 1.000 0.284 0.341 -0.062 -0.055 0.066 MBE 0.123 0.194 0.183 0.242 1.000 0.777 -0.205 0.106 0.206 SURP 0.082 0.120 0.146 0.158 0.459 1.000 -0.145 0.162 0.102 LOSS -0.148 -0.234 -0.233 -0.033 -0.205 -0.279 1.000 -0.111 -0.460 RETURN 0.049 0.099 0.112 -0.050 0.107 0.090 -0.092 1.000 0.153 ROAt+1 0.084 0.224 0.199 0.061 0.168 0.149 -0.389 0.161 1.000 35 Summary Statistics on Manager Effects (Table 5c) Q1 Mean Median Q3 % Neg EFFECT_TONE_D -0.37 0.0002 0.05 0.35 46% EFFECT_TONE_H -0.29 0.030 0.03 0.37 46% EFFECT_TONE_LM -0.27 0.027 0.08 0.30 42% 36 Summary Statistics on Firm Effects (Untabulated) Overall Tone Q1 Mean Median Q3 EFFECT_TONE_D 0.16 0.63 0.59 1.04 EFFECT_TONE_H 0.01 0.47 0.44 0.86 EFFECT_TONE_LM 0.97 1.34 1.28 1.68 37 Relation between Tone and Current and Future Performance CFO vs. CEO (Tone_D only) Base CEO interaction Intercept 1.22*** 0.58*** MBE 0.14*** 0.14** SURP 0.64 0.16 LOSS -0.27*** 0.18** RETURN 0.12 -0.05 ROA 0.40 0.63 ROAt+1 -0.52 0.76 ROAt+2 -0.23 1.57 ROAt+3 0.40 -0.28 ROAt+4 -0.01 -0.59 38 Compute F-statistics F-statistics = (R2 – R2 *)/J (1-R2)/(N-J-K) For Tone_D: F-stat = (0.48656-0.412392)/99 = 4.72 (1-0.48656)/[3523-99-(177+7+3)] 39 40