presentation

advertisement

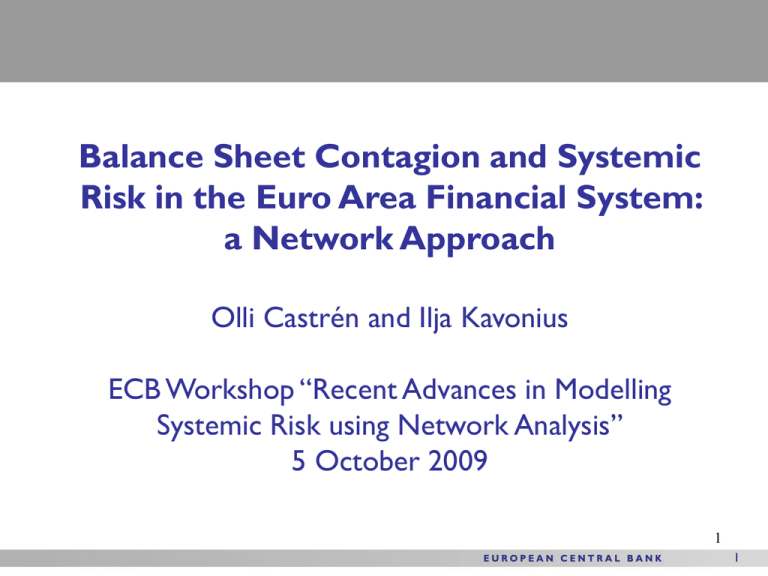

Balance Sheet Contagion and Systemic Risk in the Euro Area Financial System: a Network Approach Olli Castrén and Ilja Kavonius ECB Workshop “Recent Advances in Modelling Systemic Risk using Network Analysis” 5 October 2009 1 1 Outline of the presentation • Key concepts and literature • Part I: Accounting-based network of sector-level exposures • Data issues • Constructing the network • Simulating balance sheet contagion • Part II: Risk-based balance sheets and transmission of risk • The contingent claims approach • Calculation of sector level credit risk indicators • Contagion of risk exposures in the risk-based network • Discussion and outlook for future work 2 2 Key concepts • The role of balance sheet interlinkages, leverage and asset volatility as key financial vulnerabilities at the sector level • At the macro-level, contagion and shock propagation can take place via balance sheet cross-exposures, as someone’s assets are someone else’s liabilities • But accounting-based balance sheet say nothing about accumulation and transmission of risk exposures • For a richer analysis, a framework is needed to move to risk-based balance sheets 3 3 Some related literature Theory contributions to analysis of balance sheet linkages • Credit chains and balance sheet contagion • Kiyotaki and Moore (JPE 1997, AER 2002) • Liquidity shocks and systemic risk • Brunnermeier and Pedersen (RFS, 2009), Shin (JFI 2008) Empirical applications: • Aikman et al (BoE WP #372, 2009), plus work at BIS, IMF • Interbank contagion literature • Growing literature on financial networks Work on risk-based balance sheets • Gray, Merton and Bodie (2007), Gray and Malone (2008) Main contributions of this paper: apply sector level data to balance sheet networks and to analysis of risk contagion 4 4 Part I: Accounting-based network of sector-level exposures 5 5 Data issues • Euro area financial accounts (EAA): Holdings of various financial instruments by the various sectors, both on the asset and the liability sides • Use 8 main financial instrument categories and 7 sectors (based on the ESA95 classification) • Quarterly data for the euro area from 1999 Q1 • A closed system (using the rest of the world sector): each financial liability of a sector is an asset for some other sector • The financial accounts are linked to the real accounts via the net lending/borrowing positions (net financial wealth) • Non-financial assets (including housing) have no counterparties on the liability side and are not available on a quarterly basis; excluded from this analysis 6 6 Some illustrations of the EEA data Breakdown of financial instrument holdings by sector, % Currency and deposits Debt securities Loans Shares and other equity Net equity in life insurance and in pension funds Prepayments of insurance premiums Evolution of sector-level net financial wealth NFC MFI OFI INS GOV HH RoW 12.5 Other accounts 10 100% 7.5 90% 80% 5 70% 60% 2.5 50% 0 40% 30% -2.5 20% -5 10% 0% NFCNFC A L MFI MFI A L OFI OFI A L INS INS A L GOVGOV A L HH HH L A RoWRoW A L -7.5 -10 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 7 7 Constructing the network of exposures • The data provide instrument-specific total holdings of assets and liabilities by each sector • Can use information on the relative distribution of the sum elements ai,k and lj,k to estimate the individual elements Xi,j for each instrument category => provides the who-to-whom links • We get bilateral linkages for all 8 instrument categories • Works nicely with non-consolidated data x11 X k xi1 x N1 x1 j xij x Nj N x i 1 ij x1N N xiN xij j 1 x NN l j ,k ai ,k 8 8 Constructing the network of exposures Cross-sector gross balance sheet exposures in the euro area financial 2009 Q1 system HH ROW OFI The key role played by the banking sector NFC HH MFI ROW GOVT INS OFI NFC MFI GOVT 1999 Q1 HH ROW OFI NFC INS MFI GOVT INS 9 9 Propagation of shocks in the network Transmission of a P&L shock to sector A under mark-to-market accounting Assets Debt Equity Disinvestment Loss of equity Channels of transmission A A … B A B B … C C C … Period 0 1 2 3 10 10 Propagation of shocks in the network Example: a cash-flow shock on the NFC sector that corresponds to a 20% loss in shareholder equity 20% NFC cash flow shock Round NFC HH MFI INS OFI GOVT ROW Average EUR bn 783 318 189 122 405 114 278 315.57 1 % of financial assets 5.54 3.00 0.81 1.98 4.13 3.97 3.34 3.25 EUR bn 632 256 152 98 327 92 224 254.43 2 % of financial assets 4.47 2.42 0.65 1.60 3.33 3.20 2.99 2.67 EUR bn 541 220 130 84 280 77 192 217.71 3 % of financial assets 3.83 2.07 0.56 1.37 2.85 2.74 2.78 2.31 Average % of financial assets EUR bn 652.00 4.61 264.67 2.50 157.00 0.67 101.33 1.65 337.33 3.44 94.33 3.30 231.33 3.04 11 11 Propagation of shocks in the network • In a multi-period framework, agents are expected to balance their accounts after the shock • In the current context, this would amount to asset dis-investment, or a de-leveraging process • Need to specify rules for: • Target level of leverage • Assets to be shed • The purchasing party • The impact on the asset price • The framework allows for simulation of such processes once the rules have been defined 12 12 Part II: Risk-based balance sheets and transmission of risk 13 13 The role of risk-based balance sheets • The accounting-based network neatly illustrates shock transmission in the system but it says nothing about risk exposures and systemic risk •Yet financial crises are typically a result of accumulated vulnerabilities in the form of risk exposures, triggered by sudden bursts of volatility • To have early warning properties, the framework should include these characteristics • A solution is to construct stochastic risk-based balance sheets which encompass the deterministic accounting-based model 14 14 The contingent claims approach to macrofinancial risk analysis • Contingent claims analysis (CCA) measures the expected losses of balance sheet items • Idea: model debt of the sector as a put and equity as a call option, and estimate the market value of assets • The balance sheet of sector i then becomes Ai= Bi - Pi+ Ji Ai = market value of assets Bi = book value of debt (distress point) Pi = expected loss on debt (put option) Ji = junior claim (equity, call option) • The model captures several key financial stability factors: leverage, volatility and non-linearity •By assuming that volatility is zero, the framework collapses to 15 the accounting-based model 15 Input data • To estimate the risk-based balance sheets, we need balance sheet data on equity and other liabilities, plus market data on equity volatility, asset returns and interest rates • Using the techniques developed by Moody’s KMV, market value of assets and asset volatility are estimated at an intermediate stage, once distress points have been estimated • Equity is measured by shareholder equity plus net financial wealth. Data on equity volatility are implied volatilities of the relevant sector-level stock indices. • For the household and government sector (no equity issued), government bond yield volatility is used 16 16 Output: Distance to distress MFI (banks) Non-financial firms 14 12 12 10 10 8 8 6 6 4 4 2 0 1999Q1 2 2001Q1 2003Q1 2005Q1 2007Q1 2009Q1 0 1999Q1 2001Q1 2003Q1 2005Q1 2007Q1 2009Q1 Households Government 30 18 16 25 14 12 20 10 15 8 6 10 4 5 2 0 1999Q1 2001Q1 2003Q1 2005Q1 2007Q1 2009Q1 0 1999Q1 2001Q1 2003Q1 2005Q1 2007Q1 2009Q1 17 17 Output: “Network” of pair-wise correlations between sector-level distances-to-distress 2007-2008 HH ROW OFI NFC MFI GOVT INS 1999-2006 HH ROW OFI NFC MFI GOVT INS Note: The thick link shows correlation between sector-specific distance-to-distress measures that exceeds 0.75, the intermediate link shows correlation between 0.5 and 0.75 and the thin link between 0.25 and 0.5. 18 18 Discussion and future work • Network models applied to the macro level provide new information about sector-level linkages and shock transmission channels • Can detect important risks and vulnerabilities that might go undiscovered in sector-specific analysis • Including risk exposures shows how correlations and contagion risk change over time • Complements the outputs from other models, including those using sector and firm-level information • More work is needed to refine the propagation mechanisms and the CCA balance sheets 19 19 Thank you 20 20 Background 1: Output: Market leverage Non-financial corporations 0.9 OFI M FI Households 0.7 0.75 0.3 0.74 0.8 0.73 0.65 0.25 0.72 0.7 0.71 0.6 0.7 0.2 0.6 0.69 0.68 0.55 0.15 0.5 0.67 0.66 0.4 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 INS 1 0.5 0.65 0.1 Govt 0.3 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 NFC MFI INS ROW RoW 0.55 HH OFI GOVT 1 0.95 0.8 0.9 0.25 0.5 0.6 0.85 0.8 0.2 0.45 0.75 0.4 0.2 0.7 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 0.15 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 0.4 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 0 1999Q1 2000Q3 2002Q1 2003Q3 2005Q1 2006Q3 2008Q1 21 21 Background 2: Output: Asset volatility Non-financial corporations 0.14 M FI Households 0 .0 6 0.4 OFI 0.1 0.09 0.35 0.12 0 .0 5 0.08 0.3 0.1 0.07 0 .0 4 0.25 0.06 0.08 0 .0 3 0.2 0.05 0.06 0.04 0.15 0 .0 2 0.03 0.04 0.1 0 .0 1 0.02 0.02 0.05 0.01 0 19 9 9 Q1 2 0 0 0 Q3 2 0 0 2 Q1 2 0 0 3 Q3 2 0 0 5Q1 2 0 0 6 Q3 2 0 0 8 Q1 0 0 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 Insurance 0 .14 0 .12 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 Government 0 .0 6 0 .0 4 NFC Rest of the world 0.05 0.2 0.045 0.18 0.04 0.16 0.035 0.14 0.03 0.12 0.025 0.1 0.02 0.08 0.015 0.06 0.01 0.04 HH MFI OFI INS GOVT 0 .4 0 .3 5 0 .3 0 .1 0 .0 8 0 0 .2 5 0 .2 0 .15 0 .1 0 .0 2 0.005 0 19 9 9 Q1 2 0 0 0 Q3 2 0 0 2 Q1 2 0 0 3 Q3 2 0 0 5Q1 2 0 0 6 Q3 2 0 0 8 Q1 0.02 0 1999Q1 0 2000Q3 2002Q1 2003Q3 2005Q1 2006Q3 2008Q1 1999Q1 2000Q2 2001Q3 2002Q4 2004Q1 2005Q2 2006Q3 2007Q4 0 .0 5 0 19 9 9 Q1 2 0 0 0 Q2 2 0 0 1Q3 2 0 0 2 Q4 2 0 0 4 Q1 2 0 0 5Q2 2 0 0 6 Q3 2 0 0 7Q4 22 22 ROW Background 3: Use of networks for broader financial stability analysis How the dislocation of a bank’s balance sheet can spread ROW Macrofinancial HH ii) sectors OFI NFC MFI GOVT iii) countries Firm-level data INS i) interbank market Currency Deposit s Debt securit ies Short -term loans Long-term loans Shares and other equit y Other account s 100% 90% 80% Bank A 70% 60% 50% 40% 30% 20% 10% 0% Asset s Liabilit ies 23 23 Background 4:The structure of integrated accounts Non-financial accounts Uses A Domestic economy/an invidual sector Resources B All the received transactions from the production account to the secondary distribution of income account All the paid transactions from the production account to the secondary distribution of income account B-A=C Disposable income D E All the paid transactions of the use of disposable income account All the received transactions of the use of disposable income account I K=I*J+G Capital stock in period t C-D+E=F Saving Capital stock in period t-1 G J All the paid transactions of the capital account H Other changes All the received transactions of the capital account F-G+H=L Assets Net lending/borrowing Liabilities M-N=L All the received (credit) transactions of financial accounts M N All the paid (debit) transactions of financial accounts O=R*S+M P=T*U+N Asset stock in period t Liablity stock in period t Net wealth R S Stock in period t-1 Other changes O-P=Q T U Stock in period t-1 Other changes Financial accounts 24 24 Background 5:The CCA model in brief Key drivers of distress risk: leverage, volatility and asset return Distribution of market value of assets Expected market value of assets at time h Distance-to-default Default point (value of liabilities) 0 h Probability of default Time 25 25