Electronic Payment Systems Investment Thesis Visa Inc.

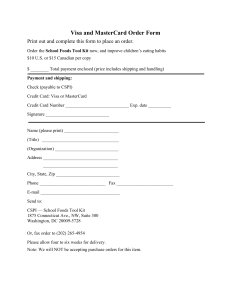

advertisement