For your review: Principles of Macroeconomics Take

advertisement

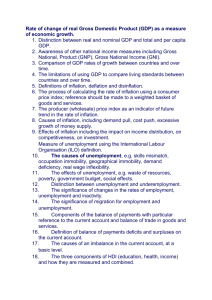

ECON 303 Intermediate Macroeconomics Principles Exam Due: Professor Malamud September 24, 2012 (2/3 points each correct answer) 1) Home Depot sells new and used doors to contractors who build new homes. Home Depot also sells new and used doors to homeowners. Which of the following would be counted in GDP? A) the sale of a used door to a homeowner B) the sale of a new door to homeowner C) the sale of a used door to TapKon construction for installation into a new home D) the sale of a new door to TapKon construction for installation into a new home 2) Investment spending includes spending on A) stocks B) food C) changes in business inventories 3) Consumption expenditures do not include household purchases of A) medical care B) education C) new houses D) transfer payments. D) durable goods 4) A full-time student who is not working is categorized as A) unemployed B) employed C) not in the labor force D) a discouraged worker E) frictionally unemployed. 5) Jack just received a promotion at work and now works 50 hours per week instead of 35. As a result, A) the unemployment rate decreased B) the labor force participation rate increased. C) all of the above D) none of the above 6) Sarah is a full-time student who is not looking for work. What kind of unemployment is Sarah experiencing? A) cyclical B) structural C) frictional D) all of the above E) none of the above 7) When the labor market is at full employment A) there is only cyclical unemployment in the economy C) the unemployment rate is 0% D) all of the above B) there is only structural unemployment E) none of the above 8) The U.S. unemployment insurance program A) increases the amount of time the unemployed spend searching for a job. B) decreases the level of frictional unemployment C) eliminates structural unemployment D) all of the above E) none of the above 9) Efficiency wages cause unemployment because A) firms pay wages that are below the market wage, causing labor demand to be greater than labor supply. B) firms pay wages that are below the market wage, causing labor demand to be less than labor supply. C) firms pay wages that are above the market wage, causing labor demand to be greater than labor supply. D) firms pay wages that are above the market wage, causing labor demand to be less than labor supply. 10) If consumers purchase fewer of those products that increase most in price and more of those products that decrease in price as compared to the CPI basket, then A) changes in the CPI accurately reflect the true rate of inflation. B) changes in the CPI understate the true rate of inflation. C) changes in the CPI overstate the true rate of inflation. D) none of the above 11) You earned $30,000 in 1980, and your salary rose to $90,000 in 2006. If the CPI rose from 82 to 202 between 1980 and 2006, which of the following is true? A) There was deflation between 1980 and 2006. B) The purchasing power of your salary fell between 1980 and 2006. C) The purchasing power of your salary remained constant between 1980 and 2006. D) The purchasing power of your salary increased between 1980 and 2006. 12) During a deflationary period, A) the nominal interest rate is less than the real interest rate. B) the real interest rate is less than the nominal interest rate. C) the price level rises. D) the nominal interest rate does not change. 13) If inflation is higher than expected, this helps borrowers (by reducing the real interest rate they pay) and hurts lenders (by reducing the real interest rate they receive). A) True B) False 14) Which of the following goods would see the largest decline in demand during a recession? A) automobiles B) food C) clothing D) haircuts 15) Inflation usually increases during a recession and decreases during an expansion. A) True B) False 16) If aggregate expenditure is greater than output, how will the economy reach macroeconomic equilibrium? A) Inventories will decline, and output and employment will decline. B) Inventories will rise, and output and employment will decline. C) Inventories will decline, and output and employment will rise. D) Inventories will rise, and output and employment will rise. 17) A decrease in Social Security payments will A) decrease consumption spending. B) decrease investment spending C) decrease government purchases of goods and services. D) all of the above E) none of the above 18) Which of the following will raise consumer expenditures? A) a decrease in interest rates B) an increase in expected future income D) all of the above E) none of the above C) a decrease in the price level 19) If disposable income increases by $100 million, and consumption increases by $90 million, then the marginal propensity to consume is A) 0.9. B) 0.8. C) 0.75. D) 0.6. 20) If inflation in the United States is higher than inflation in other countries, what will be the effect on net exports for the United States? A) Net exports will rise as U.S. exports increase. B) Net exports will rise as U.S. imports decrease. C) Net exports will decrease as U.S. exports decrease. D) Net exports will decrease as U.S. imports decrease. 21) If planned aggregate expenditure is less than total production, firms will experience an unplanned decrease in inventories. A) True B) False 22) Refer to the above figure. Potential GDP equals $100 billion. The economy is currently producing GDP1 which is equal to $90 billion. If the MPC is 0.8, then how much must autonomous spending change for the economy to move to potential GDP? A) -$10 billion B) -$2 billion C) $2 billion D) $10 billion 23) When the economy enters a recession, your employer is ________ to reduce your wages because ________. A) unlikely; output and input prices generally fall during recession B) unlikely; lower wages reduce productivity and morale C) likely; wages and prices always fall during recession. D) likely; it would be hard to replace you during a recession. 24) Which of the following is one explanation as to why the aggregate demand curve slopes downward? A) Increases in the price level lower the interest rate and decrease consumption spending. B) Increases in the price level lower the interest rate and decrease investment spending. C) Increases in the U.S. price level relative to the price level in other countries lowers net exports. D) Increases in the price level raise real wealth which lowers consumption spending. 25) If aggregate demand just increased, which of the following may have caused the increase? A) an increase in government purchases B) an increase in the interest rate C) an increase in the price level D) all of the above E) none of the above 26) On the long-run aggregate supply curve, A) an increase in the price level increases the aggregate quantity of GDP supplied. B) an increase in the price level reduces the aggregate quantity of GDP supplied. C) an increase in the price level has no effect on the aggregate quantity of GDP supplied. D) an increase in the price level increases the level of potential GDP. 27) Workers and firms both expect that prices will be 3% higher next year than they are this year. As a result, A) workers will be willing to take lower wages next year. B) the purchasing power of wages will rise if wages increase by 3%. C) the short-run aggregate supply curve will shift up as wages increase. D) aggregate demand will increase by 3%. 28) An increase in aggregate demand causes an increase in ________ only in the short run, but causes an increase in ________ in both the short run and the long run. A) the price level; real GDP B) real GDP; real GDP C) the price level; the price level D) real GDP; the price level 29) Suppose the economy is at a short-run equilibrium GDP that lies above potential GDP. Which of the following will occur because of the automatic mechanism adjusting the economy back to potential GDP? A) Short run aggregate supply will shift up as wages increase. B) Prices will rise. C) Unemployment will increase. D) all of the above E) none of the above 30) Refer to the above figure. Suppose the economy is at point A. If investment spending increases in the economy, where will the eventual long-run equilibrium be? A) A B) B C) C D) D 31) Stagflation occurs when aggregate supply decreases. A) true B) false 32) People who do not have a lot of money are necessarily poor. A) true B) false 33) When you open a checking account deposit money at Bank of America, Bank of America A) has more reserves and more excess reserves. B) has more reserves, but excess reserves remain unchanged. C) has more deposits and less in excess reserves. D) has more deposits, but excess reserves remain unchanged. 34) If the bank of Wachovia receives a $10,000 deposit, and the reserve requirement is 10 percent, how much can the bank loan out? (Assume that before the deposit this bank is just meeting its legal reserve requirement.) A) $1,000 B) $9,000 C) $10,000 D) $90,000 35) A cash withdrawal from the banking system A) decreases reserves. B) decreases deposits. C) decreases the availability of credit D) all of the above E) none of the above 36) If bankers become more uncertain regarding future deposits and withdrawals and choose to hold more excess reserves against deposits, the money multiplier will increase. A) true B) false 37) Which of the following is not a major function of the Federal Reserve System? A) lender of last resort B) clearing checks between banks C) setting income tax rates D) controlling the money supply 38) If the Federal Open Market Committee wants to decrease the money supply through open market operations it will A) buy U.S. Treasury Securities B) sell U.S. Treasury Securities. C) increase the discount rate. D) increase loans to banks 39) If the rate of growth in real GDP exceeds the rate of growth in the money supply, the quantity theory of money predicts price deflation. A) true B) false 40) In the figure above, the money demand curve would move from MD1 to MD2 if A) real GDP increased. C) the interest rate increased. B) the price level decreased. D) the Federal Reserve sold Treasury securities on the open market. 41) In the figure above, the movement from point A to point B in the money market would be caused by A) an increase in the price level. B) a decrease in real GDP. C) an open market sale of Treasury securities by the Federal Reserve. D) a decrease in the required reserve ratio by the Federal Reserve. 42) The federal funds rate is A) the interest rate the Fed charges commercial banks. B) the interest rate a bank charges its best customers. C) the interest rate banks charge each other for overnight loans. D) the interest rate on a federal government bond 43) The Fed can decrease the federal funds rate by selling Treasury bills, which increases bank reserves. A) true B) false 44) As the prices of Treasury bonds fall, the interest yields on Treasury bonds rise. A) true B) false 45) In the figure above, if the economy is at point A, the appropriate countercyclical monetary policy by the Federal Reserve would be to A) sell bonds on the open market and lower interest rates B) buy bonds on the open market and lower interest rates. C) raise income taxes. D) all of the above E) none of the above 46) If the Fed lowers its target for the federal funds rate, this indicates that the Fed is attempting to combat inflation A) true B) false 47) Suppose that the economy is producing above potential GDP and the Fed implements the correct change in monetary policy after the economy has passed the peak of the boom and has begun to slow down. Then A) the Fed's contractionary policy will result in too large of a decrease in GDP. B) the Fed's contractionary policy will result in too small of a decrease in GDP. C) the Fed's expansionary policy will result in too small of a decrease in GDP. D) the Fed's expansionary policy will result in too large of an increase in GDP. 48) According to the Taylor rule, the Fed should set the target for the federal funds rate equal to the sum of the equilibrium real federal funds rate, the current inflation rate, one-half times the inflation gap and one-half times the output gap. A) true B) false 50) If government purchases increase by $100 billion and lead to an ultimate increase in aggregate demand as shown in the graph above, the difference in real GDP between point A and point B will be more than $100 billion A) true B) false 51) Suppose real GDP is $15 trillion, potential real GDP is $16 trillion, and Congress and the president plan to use fiscal policy to restore the economy to potential real GDP. Assuming a constant price level, Congress and the president would need to decrease taxes by A) $1 trillion. B) less than $1 trillion. C) more than $1 trillion D) None of the above is correct. Congress should raise taxes in this case. 52) An increase in government spending increases the price level which A) increases the interest rate and decreases investment spending B) decreases the interest rate and increases investment spending C) increases the interest rate and increases investment spending D) decreases the interest rate and decreases investment spending 53) An increase in government spending may expedite recovery from a recession in the short run, but in the long run this policy may A) reduce investment in new capital. B) make domestic businesses less competitive in international markets as the dollar appreciates in value. C) raise interest rates and reduce consumer expenditures on automobiles and new houses. D) all of the above E) none of the above 54) Which of the following best explains the negative slope of the short-run Phillips curve? A) Weak growth in aggregate demand keeps the economy below potential GDP, so unemployment rises but inflation falls. B) Aggregate demand grows so quickly that the inflation rate rises as unemployment rises. C) Long-run aggregate supply increases quickly enough that inflation falls as unemployment also falls. D) Short-run aggregate supply increases at the same pace as aggregate demand increases so that inflation and unemployment do not change. 55) An increase in the expected inflation rate will A) shift the short-run Phillips curve up and to the right. B) shift the short-run Phillips curve down and to the left. C) reduce the inflation rate. D) reduce the unemployment rate. 56) If expected inflation rises, the long-run Phillips curve will A) shift to the right. B) shift to the left. C) become more negatively sloped D) all of the above E) none of the above 57) The shift in the short-run Phillips curve shown in the figure above may be explained by an increase in the expected rate of inflation from 4.0 to 5.5 percent A) true B) false 58) If the Federal Reserve attempts to continue reducing unemployment by manipulating monetary policy, A) The Fed's policies will be deflationary. B) The Fed's policies will be inflationary. C) The rate of inflation will fall as the Fed tries to reduce the unemployment rate. D) The Fed will reduce the natural rate of unemployment. 59) Which of the following would increase the balance on the current account? A) an increase in foreign direct investment B) an increase in the amount of aid money the government sends abroad C) an increase in imports D) all of the above E) none of the above 60) Currency traders expect the dollar to appreciate. What impact will this have on equilibrium in the foreign exchange market? A) The dollar will appreciate, and the equilibrium quantity of dollars will decrease. B) The dollar will depreciate, and the equilibrium quantity of dollars exchanged will decrease. C) The dollar will appreciate, and the equilibrium quantity of dollars will increase. D) The dollar will appreciate, and the change in the equilibrium quantity of dollars exchanged cannot be determined. 61) If a country's real GDP is rising by 3% per year while its population is rising at 5% per year, the country's standard of living is falling. A) true B) false 62) Technological change is shown in the figure above by the movement from A) B to C. B) B to D. C) B to E. D) B to A. 63) Which of the following would cause an economy to move from a point like A in the figure above to a point like B? A) an improvement in technology B) a decrease in capital per hour worked C) an increase in capital per hour worked D) all of the above E) none of the above 64) Which of the following is a reason why low-income countries might experience low economic growth? A) The country has endured extended periods of war. B) The country fails to enforce a rule of law. C) The country has a low rate of saving and investment. D) all of the above E) none of the above