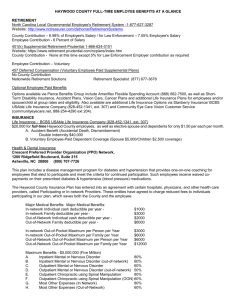

Voluntary 403(b) Plan

advertisement

Florida State College At Jacksonville 2015 Employee Benefits Guide College President Dr. Cynthia Bioteau Eligible employee benefits are effective the first day of the month following date of hire. The information provided herein is a summary of benefits for full-time employees and should not be construed as part of any provider contract. Possession of this guide does not imply coverage nor does it guarantee benefits. TABLE OF CONTENTS I. Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 II. Eligibility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 III. Section 125 and Benefit Election Changes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 IV. Health Plans A. Health Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B. Medical Premiums by Employee Salary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. Discounted Programs and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. Uninsured Children Coverage Option . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-6 7 8 9 Dental Plans A. Delta Care (DHMO) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B. Delta (PPO) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 11 Vision Care Plan A. Humana . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 V. VI. VII. Florida College System Risk Management Consortium Dental and Vision Plan (DV) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 VIII. Tax Advantaged Plans A. MEDCOM - Flexible Spending Account (FSA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . B. Voluntary 403(b) Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. Voluntary 457(b) Deferred Compensation Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. Mandatory 403(b) Terminal Leave Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 15-16 15-16 17 Retirement Plans A. Florida Retirement System Pension Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B. Florida Retirement System Investment Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. Community College Optional Retirement Program . . . . . . . . . . . . . . . . . . . . . . . . . 18 18 18 X. Life Insurance Coverage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 XI. Long Term Disability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . 20 XII. Employee Assistance Program (EAP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 XIII. Additional Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21-23 XIV. Contact Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24-25 IX. *The summary plan documents are located at www.fccj.org/campuses/mccs/humanresources/ Introduction FSCJ is committed to our employees and is pleased to offer challenging and fulfilling careers, as well as an excellent benefits package. This guide will help you make the best informed decisions regarding your coverage by providing information about: Eligibility requirements Benefits plans Important contact information Eligibility Full-time employees are eligible to participate in the benefits plans described in this guide. Benefits are effective on the first day of the month following the employee’s date of hire for both the employee and their dependents (employees must enroll in their benefits within 30 days of their hire date). Dependent verification documentation will be required prior to coverage effective date. Employee and dependent premiums are paid one month in advance. Listed below are additional eligibility rules: Up to age 26 in the medical, dental and vision plans, (terminates on the last day of the calendar year in which child reaches age 26) Age 26 up to age 30 employee pays the full cost of coverage (terminates on the last day of the calendar year in which the dependent child reaches age 30) Disabled dependent children beyond the age of 30 (reference Eligibility for Coverage section 10-2 Blue Options Booklet) Section 125 and Benefit Election Changes Under Section 125 of the Internal Revenue Service (IRS) code, you are allowed to pay for certain group insurance premiums with pretax dollars. This means your premium deductions are taken before Federal Income and Social Security taxes are calculated. Depending on your tax bracket, your savings could be significant. You should carefully decide on your benefit elections, including the choice to decline coverage. Your pretax elections will remain in effect until the next annual open enrollment period, unless you experience an IRS-approved qualifying life event. Qualifying life events include, but are not limited to: * Marriage, divorce or legal separation *A spouse or domestic partner’s employment begins or ends *Death of Spouse, domestic partner or legal dependent child(ren) *Birth or adoption of a child Employees may make changes to their health, dental and vision plans (i.e., add/drop dependents) as well as modify their Flexible Spending Account deductions within 30 days of a qualifying event. For changes made due to ANY qualifying event, supporting documentation is required. Please contact a Benefits Specialist for assistance at benefits@fscj.edu. 2 2015 Medical Benefits Plan Options Cost Sharing - Member's Responsibility BlueCare 51 (HMO Plan) BlueOptions 03769 (Base PPO Plan) BlueOptions 03559 (PPO Plus Plan) Health Care Reform Compliant Health Care Reform Compliant Health Care Reform Compliant Deductible (DED) Per Calendar Year (Per Person/Family Aggregate) In-Network NA $600 / $1,800 $600 / $1,800 Out-of-Network Coinsurance (BCBSF pays/Member pays) In-Network Out-of-Network Out of Pocket Maximum (OOP) (Per Person/Family Aggregate) NA Combined w/ INN Combined w/ INN NA NA 80% / 20% 60% / 40% 80% / 20% 70% / 30% Includes Pharmacy Includes Pharmacy Includes Pharmacy $5,000 /$10,000 N/A $6,000 / $12,000 Combined w/ INN $6,000 / $12,000 Combined w/ INN $200 Combined with Preferred OOP NA $200 Combined with Preferred OOP NA $30 $50 Not Covered $30 $50 Ded + 40% $10 $10 Not Covered $10 $10 Ded + 40% DED + 30% $30 Not Covered $30 Ded + 40% DED + 30% $0 Not Covered $100 $100 In-Network (includes deductible; co-insurance; copays and pharmacy) Out-of-Network Medical Pharmacy OOP Maximum (Per Person Per Calendar Month) In-Network (Preferred) In-Network (Non-Preferred) Out-of-Network $200 Combined with Preferred OOP NA Medical / Surgical Care by a Physician Office Services In-Network Family Physician In-Network Specialist Out-of-Network Allergy Injections (Office) In-Network Family Physician In-Network Specialist Out-of-Network Convenient Care Center (Minute Clinics) In-Network Out-of-Network Physician Services at Hospital In-Network Out-of-Network Preventive Services (Adult & Well Child) All Locations of Services In-Network Family Physician In-Network Specialist Out-of-Network Mammograms In-Network Out-of-Network Colonoscopies (preventive and diagnostic) In-Network Out-of-Network $30 $50 DED + 30% $10 $10 $30 DED + 20% INN DED + 20% Subject to the US Preventive Care Guidelines $0 $0 Not Covered $0 $0 40% $0 $0 30% $0 Not Covered $0 $0 $0 $0 1 every 10 years for preventive/1 every 2 years if high risk $0 $0 Not Covered $0 3 $0 $0 Medical Benefits Plan Options, cont’d Cost Sharing - Member's Responsibility BlueCare 51 (HMO Plan) BlueOptions 03769 (Base PPO Plan) BlueOptions 03559 (PPO Plus Plan) Health Care Reform Compliant Health Care Reform Compliant Health Care Reform Compliant Medical / Surgical Care at a Facility Ambulatory Surgical Center (ASC) In-Network Out-of-Network Inpatient Hospital Facility (per admit) In-Network Out-of-Network $200 Not Covered $250 per day up to $1,250 Max Ded + 20% Ded + 40% Ded + 30% Option 1: Ded + 20% Option 2: Ded + 20% Option 1: $750 Option 2: $1,500 Not Covered Ded + 40% $200 Not Covered Option 1: Ded + 20% Option 2: Ded + 20% Ded + 40% $75 $2,500 Outpatient Hospital Facility (per visit) (Surgical) In-Network Out-of-Network Outpatient Hospital Facility (per visit) (Non-Surgical) In-Network Out-of-Network Non-Routine Colonoscopy (Medically Nec.) In-Network Out-of-Network $0 Not Covered Included with Surgical Services $0 Not Covered Option 1: $150 Option 2: $250 Ded + 30% Included with Surgical Services $0 Ded + 40% DED + 30% $0 DED + 20% INN DED + 20% $100 + 20% $100 + 20% Emergency and Urgent Care Emergency Room Facility (per visit) (No surgery performed or not admitted) In-Network Out-of-Network $100 $100 In-Network Out-of-Network $0 $0 $100 $100 DED + 20% INN DED + 20% $0 $0 $100 $100 DED + 20% INN DED + 20% Physician Services at ER (Surgery performed or with admit) Physician Services at ER (No surgery performed or not admitted) In-Network Out-of-Network Urgent Care Centers In-Network Out-of-Network $80 Not Covered $65 Ded + 40% DED + 30% $50 DED + 20% INN DED + 20% DED + 20% INN DED + 20% Ambulance In-Network Out-of-Network Diagnostic Testing (e.g., Lab, x-ray) Physician Office In-Network Family Physician In-Network Specialist Out-of-Network Independent Clinical Laboratory In-Network Out-of-Network 20% 20% $30 $50 Not Covered $0 Not Covered $30 $50 Ded + 40% QUEST is the In-Network Lab $0 Ded + 40% $30 $50 DED + 30% $0 DED + 30% Independent Diagnostic Testing Center In-Network Out-of-Network $50 Not Covered $50 Ded + 40% In-Network Out-of-Network $0 Not Covered Option 1: Ded + 20% Option 2: Ded + 20% Ded + 40% DED + 20% DED + 30% Outpatient Hospital Facility 4 Option 1: $150 Option 2: $250 $350 Medical Benefits Plan Options, cont’d Cost Sharing - Member's Responsibility BlueCare 51 (HMO Plan) BlueOptions 03769 (Base PPO Plan) BlueOptions 03559 (PPO Plus Plan) Health Care Reform Compliant Health Care Reform Compliant Health Care Reform Compliant Outpatient Therapy Physician Office In-Network Family Physician In-Network Specialist Out-of-Network $5 $5 Not Covered $30 $50 Ded + 40% $30 $50 DED + 30% In-Network Out-of-Network $30 Not Covered $50 Ded + 40% DED + 30% In-Network Out-of-Network $30 Not Covered Option 1: $30 Option 2: $50 Ded + 40% Option 1: $45 Option 2: $60 DED + 30% Outpatient Rehabilitation Facility $50 Outpatient Hospital Facility Mental Health and Substance Dependency Services All location of Service In-Network Family Physician In-Network Specialist Out-of-Network $0 $0 Not Covered $0 $0 40% $0 $0 30% 1 Per lifetime 1 Per lifetime 1 Per lifetime In-Network Combined (INN & OON) 1 / 2 years N/A N/A 1 / 2 years 1 / 2 years In-Network Combined (INN & OON) 1 / 10 years N/A N/A 1 / 10 years 1 / 10 years N/A N/A 35 Visits PBP 35 Visits PBP 90 Days Per year N/A N/A 60 Days Per year N/A N/A N/A 26 Per year N/A N/A Benefit Maximums Gastric Bypass High Risk Colonoscopy N/A Preventive Colonoscopy Outpatient Therapy & Spinal Manipulations Combined (In-Network/Out of Network) Combined (INN & OON) Skilled Nursing Facility In-Network Combined (INN & OON) Spinal Manipulations In-Network Combined (INN & OON) N/A N/A 60 Days Per year N/A 26 Per year Prescription Drugs Deductible In-Network - Retail N/A Generic/Brand/Non-Preferred $10 / $60 / $100 $15 / $45 / $65 $15 / $60 / $100 Generic/Brand/Non-Preferred $30 / $120 / $200 $30 / $90 / $130 $30 / $120 / $200 Generic/Brand/Non-Preferred 50% 50% 50% Generic/Brand/Non-Preferred 50% 50% 50% - Mail Order Out-of-Network - Retail - Mail Order Definitions: INN = In-network; OOP = Out-of-Pocket; OON = Out-of-Network; PBP = Per Benefit Period This is a summary of benefit only. The written terms of the contract prevail. 5 Hospital Options Option 1 Hospitals Include: Baptist Medical Centers; Memorial Hospital of Jacksonville; St. Vincent’s Medical Centers; Wolfson Children’s Hospital; Orange Park Medical Center; Mayo Clinic* and Flagler Hospital. Option 2 Hospitals Include: Shands Jacksonville Medical Center and Hospitals are outside the Jacksonville surrounding areas. *Mayo Clinic does not accept the BlueCare (51) HMO Plan. Florida Blue. FloridaBlue.com is your 24 access to your personal health information to videos that show you how to save money and much more. Find doctors, hospitals, pharmacies in Florida and worldwide. Participating network providers can be located at www.bcbsfl.com Out-of-network benefits are available for some plans. However, when an out-of-network provider is used you will incur an annual deductible and a lower level of benefit coverage. Detailed plan summary documents can be found on the Human Resources website/Benefits by going to Artemis at www.fscj.edu; log into the faculty and staff portal; click on “College” at the top of the webpage, then click on Human Resources; or go to www.fccj.org/campuses/mccs/HumanResources/ . 6 Medical Premiums by Employee Salary Monthly Active Employee Deductions from January 1 - December 31, 2015 Employee and Dependent Monthly Cost – BlueOptions 03769 Base PPO Plan Employee Salary Employee < $30,000 $30,000 - $39,999 $40,000 - $49,999 $50,000 - $59,999 $60,000 - $69,999 > $70,000 $0 $0 $0 $0 $0 $0 Spouse/Partner $302 $336 $378 $414 $452 $502 Legal Dependent Child(ren) $208 $232 $262 $288 $314 $348 Family Spouse/Partner & Legal Dependent Child(ren) $458 $512 $574 $632 $688 $764 Employee and Dependent Monthly Cost – BlueOptions 03559 PPO Plus Plan Employee Salary < $30,000 $30,000 - $39,999 $40,000 - $49,999 $50,000 - $59,999 $60,000 - $69,999 > $70,000 Employee $59 $59 $59 $59 $59 $59 Spouse/Partner $350 $384 $426 $462 $500 $550 Legal Dependent Child(ren) $244 $268 $296 $322 $348 $384 Family Spouse/Partner & Legal Dependent Child(ren) $534 $588 $650 $706 $764 $840 Employee and Dependent Monthly Cost – BlueCare 51 HMO Plan Employee Salary < $30,000 $30,000 - $39,999 $40,000 - $49,999 $50,000 - $59,999 $60,000 - $69,999 > $70,000 Employee $36 $36 $36 $36 $36 $36 Spouse/Partner $312 $348 $388 $426 $464 $514 7 Legal Dependent Child(ren) $216 $240 $268 $296 $322 $356 Family Spouse/Partner & Legal Dependent Child(ren) $478 $532 $594 $652 $710 $786 HEALTH PLAN Discounted Programs & Services Effective January 1, 2015 Additional Benefits and Features Access to valuable health information and resources, including care decision support, an online provider directory to find doctors, hospitals, pharmacies in Florida and worldwide at www.bcbsfl.com and additional interactive web-based support tools. Expert advice on call. We encourage you to call BCBSFL care consultants team at 1-888-476-2227 to find out how much they can help you SAVE. Whether comparing the cost of your medications between local pharmacies or researching the quality and cost of treatment options before you make a decision, care consultants can help you shop for the best value for you and your family. Online access to participating physician offices for e-office visits, consultations, appointment scheduling or cancellation, prescription refills and much more. Members will receive a Member Health Statement that summarizes their health care activity for the preceding month. Physician Discount Many NetworkBlue physicians offer BlueOptions members a rate which is at least 25 percent below the usual fees charged for services that are not Covered Services under your health plan. By taking advantage of this discount, you get the care you need from the doctor you trust. However, Florida Blue does not guarantee that a physician will honor the discount. Since you pay out-of-pocket for any non-covered services, it is your responsibility to discuss the costs and discounted rates for non-covered services with your physician before you receive services. ‘Physician Discount’ is not part of your insurance coverage or a discount medical plan. For more information, please refer to the online Provider Directory at www.bcbsfl.com. FloridaBlue.com FloridaBlue.com is your online gateway to everything about your health benefit plan as well as all self-service tools, now including an enhanced WebMD website especially for our members only. A 24/7 online member self-service tool with interactive web-based options. Through the FloridaBlue.com website at www.bcbsfl.com employees can: View/Request Benefit Booklet Visit Living Healthy with WebMD Compare Drug Prices Pharmacy Claims & Drug Information View/Print Forms Find a Doctor/Facility View Claim Activity View Current Benefits View Health Statements Print/Request Health Insurance Card Visit the Health Resource Center 8 HEALTH PLAN Uninsured Children Coverage Option Effective January 1, 2015 Florida KidCare Through Florida KidCare, the state of Florida offers health insurance for children from birth through age 18, even if one or both parents are working. It includes four different parts. When you apply for the insurance, Florida KidCare will check which part your child may qualify for based on age and family income. For additional information or to receive an application, visit their Web site at www.healthykids.org or call their toll free number 1-888-540-5437. Some of the services Florida KidCare covers are: Doctor visits Check-ups and shots Hospital Surgery Emergencies Vision and Hearing Dental Mental Health Prescriptions Eligibility Florida KidCare is for children, not adults. To qualify for premium assistance, a child must: Not be eligible for Medicaid Not be the dependent of a state employee eligible for health insurance Not be in a public institution Be under age 19 Be uninsured Meet income eligibility requirements Be a U.S. citizen or qualified non-citizen 9 DeltaCare (DHMO) Effective January 1, 2015 Eligibility Employee, spouse, domestic partner and legal dependent children up to age 26 if the dependent (1) depends on the employee for support (2) is living in your household or a fulltime or part-time student and otherwise not eligible for employer group coverage. Deductibles No deductibles Maximums No annual or lifetime dollar maximums Office Visit Fee $5.00 Basic Benefits 0 Months Waiting Period(s) Benefits and Covered Services Major Benefits 0 Months Delta Dental DHMO Preventive Services Oral Exam Complete x-rays Prophylaxis (1 per 6 month period) Fluoride (1 per 6 month period) Sealant – per tooth (permanent molars through age 15) Restorative Services Amalgam Resin (one surface) Endodontics Root Canal Therapy (anterior) Root Canal Therapy (molar) $110.00 $245.00 Oral Surgery Extraction, erupted tooth $18.00 No cost No cost $28.00 Major Services Crown (porcelain/ceramic) $485.00 Orthodontics Evaluation Records/Treatment Planning Orthodontic Treatment (up to 19 yrs.) Orthodontic Treatment (adult) Delta Dental Insurance Company 1130 Sanctuary Parkway, Suite 600 Alpharetta, GA 30009 Orthodontics 0 Months $25.00 $100.00 $2,100.00 $2,250.00 Customer Service 800-422-4234 Claims Address P.O. Box 1809 Alpharetta, GA 30023-1809 This benefit information is not intended or designed to replace or serve as the plan’s Evidence of Coverage or Summary Plan Description. If you have specific questions regarding the benefits, limitations or exclusions for your plan, please contact a Benefit’s Specialist. PREMIUMS: JANUARY 1, 2015– DECEMBER 31, 2015 Employee Coverage (Employer paid) Family (Spouse/Domestic Partner and/or Legal Dependent Child/ren) 10 $13.71 $15.86 Preferred Provider Organization (PPO) Effective January 1, 2015 Eligibility Employee, spouse/ domestic partner and legal dependent children up to age 26 if the dependent (1) depends on the employee for support (2) is living in your household or a full-time or part-time student and otherwise not eligible for employer group coverage. Deductibles $50 per person / $100 per family each calendar year Deductibles waived for Diagnostic & Preventive Maximums Yes D & P counts toward maximum? Waiting Period(s) Benefits and Covered Services* Diagnostic & Preventive Services ( Diagnostic & Preventive ) Exams, cleanings, x-rays Basic Services Fillings, simple tooth extractions Endodontics (root canals) Covered Under Basic Services Periodontics (gum treatment) Covered Under Basic Services Oral Surgery Covered Under Basic Services Major Services Crowns, inlays, onlays and cast restorations, bridges and dentures Orthodontic Benefits Legal dependent children age 19 or to age 26 if they meet eligibility rules Orthodontic Maximums Lifetime Delta Dental Insurance Company 1130 Sanctuary Parkway, Suite 600 Alpharetta, GA 30009 $1,500 per person each calendar year No Basic Benefits 0 Months Delta Dental PPO dentists** Major Benefits 0 Months Orthodontics 0 Months Non-Delta Dental PPO dentists** 100 % 100 % 80 % 80 % 80 % 80 % 80 % 80 % 80 % 80 % 50 % 50 % 100 % 100 % $ 1,500 Lifetime $ 1,500 Lifetime Customer Service 800-521-2651 Claims Address P.O. Box 1809 Alpharetta, GA 30023-1809 * Limitations or waiting periods may apply for some benefits; some services may be excluded from your plan. Reimbursement is based on Delta Dental maximum contract allowances and not necessarily each dentist’s submitted fees. ** Reimbursement is based on PPO contracted fees for PPO dentists, Premier contracted fees for Premier dentists and PPO contracted fees for non-Delta Dental dentists. This benefit information is not intended or designed to replace or serve as the plan’s Evidence of Coverage or Summary Plan Description. If you have specific questions regarding the benefits, limitations or exclusions for your plan, please contact a Benefit’s Specialist. PREMIUMS: JANUARY 1, 2015– DECEMBER 31, 2015 Employee Coverage (Employer paid) Spouse/Domestic Partner Legal Dependent Children Family (Spouse/ Domestic Partner and/or Legal Dependent Children) 11 $32.25 $31.03 $35.60 $48.10 VisionCare Plan (VCP) Effective January 1, 2015 LASIK – Vision correction is available through the Refractive Care Program to employees and covered dependents at substantially reduced fees. To take advantage of this significant plan enhancement, contact VisionCare to request a LASIK ID card and a list of network eye doctors for an initial screening. HOW MUCH YOU PAY When you select a doctor from the VisionCare Plan list, this plan covers the visual care described (examination, professional services, lenses and frames) at no expense to you except a deductible of $10.00 for the vision examination and separate deductible for any prescribed materials. Any additional care, service and/or materials not covered by this plan may be arranged between you and the doctor. Service Vision exam Prescribed materials Non-essential contact lenses 2nd pair of eyeglasses Service Frequency Vision exam: Lenses: Frame: Co-payment $10.00 deductible $15.00 deductible $120.00 flat allowance 20% discount Once every 12 months Once every 12 months Once every 24 months S AV I N G S ! S EE T H E D I FFE R EN C E You can save money two ways with VisionCare. First, the cost of plan services and materials is discounted a n d prepaid. So except for any co-payments, you have no out-of-pocket expenses for covered services and supplies when you use one of our network doctors. Second, your coverage costs are deducted from your pay before any federal income or FICA taxes are taken out. This makes your taxable wage base lower, so you would pay less tax. Refer to your Humana VisionCare Plan certificate for more important information about this employee benefit or call Customer Service at 1-800-865-3676. Certificates can be obtained at www.humanavisioncare.com PREMIUMS: JANUARY 1, 2015 – DECEMBER 31, 2015 Employee Coverage (Employer Paid) $4.40 Family (Spouse/ Domestic Partner and/or Legal Dependent Children) $5.25 12 Florida College System Risk Management Consortium Dental and Vision Plan (DV) Employees Who Opt-Out of Health Insurance Plans Effective January 1, 2015 DV Plan www.DeltaDental.com www.VSP.com Network PPO Network/Premier Network Well Vision Exam Deductible $50 per person, not to exceed $150 per family, per calendar yearapplies to Basic and Major Services Maximum Benefits Preventive Services Basic Services Major Services Missing Tooth Rule Orthodontics Prescription Glasses $1,000 Calendar Year Maximum No Deductible - provided at 100% of PPO provider fee schedule for Oral Examinations, Cleanings (two per calendar year) and Bitewings X-rays Full Mouth X-rays, Periodontics (Gum Treatment), Endodontic (Root Canals), Oral Surgery and Restorative Services (Fillings) are covered at 80% of the PPO provider fee schedule in-network and 50% non-PPO network Crowns, Bridges, Full Dentures, Partial Dentures and Implants are covered at 50% of the PPO provider fee schedule in-network and 50% out-of-network Teeth extracted prior to effective date are covered Child only, $1,000 max. The out-of-network benefits are increased for those seeking services from a Premier provider and Preventative Services are covered at 100% Frames Contacts (instead of glasses) Laser Vision Correction Rates Employee (Employer Paid) Spouse (Employee Paid) Choice Network $10 Co-payment every 12 months $10 Co-payment for lenses single vision, lined bifocal, and lined trifocal lenses every 12 months $150 allowance for a wide selection of frames or 20% off the amount over your allowance Every 12 months - up to $60 Co-payment for your contact lens exam (fitting and evaluation) and $120 allowance for contact lens material Average 15% off the regular price or 5% off the promotional price. Discounts only available from contracted facilities. Two Year Rate Guarantee thru 12/2016 Child(ren) (Employee Paid) Family (Employee Paid) Spouse/ Domestic Partner and/or Legal Dependent Children The DV Plan was designed as an alternative plan for employees with other adequate health insurance and is an employer paid benefit for employees only. Benefits may be extended to the participant’s eligible dependents. 13 $111.00 $33.14 $33.95 $73.75 TAX ADVANTAGED PLAN Flexible Spending Accounts (FSA) Effective January 1, 2015 An FSA is a pre-tax benefit under the IRS Code that allows employees to reduce their taxable income to pay for out-of-pocket medical, dental, vision and dependent care expenses without paying federal, state or FICA taxes, saving up to 30% in taxes on those dollars. Employees elect an annual amount to be set aside for their out-of- pocket health and dependent care expenses. Amounts are withheld in equal increments through payroll deductions. Any remaining funds left in your FSA medical account up to $500, as of December 31st will rollover to the next year. SPECIAL NOTE: If the employee verifies credible medical insurance coverage from a non-College source, the College may approve the voluntary withdrawal of the employee from the College’s medical insurance plans. In such cases, the College will deposit $720* to a Health Flexible Spending Account in the employee’s name. The employee may also contribute an additional amount up to the maximum amount of $2,500. *If the medical insurance coverage from a non-College source is an HSA Plan, the employee would not be eligible for the FSA Medical Flexible Spending Account and/or the $720.* *Employees hired after January 1, 2015 will have a prorated contribution based on date of hire. If you wish to contribute funds into the FSA, an enrollment form must be completed during the open enrollment period annually. You will not be allowed to cancel or change your election during the 12-month agreement period unless you have a qualifying life event. Flexible Spending Account Advantages: There are several reasons to take advantage of an FSA offered by the College. In addition to the tax savings, many employees also find an FSA is an easy and effective way to budget for medical expenses throughout the year, especially if you have maintenance medications or supplies you use on a regular basis. Another reason to take advantage of an FSA is it could actually increase your amount of take-home pay. This is because the money added to the FSA is not subject to payroll taxes, which could then lower your tax bracket and lower your annual income tax payments. If your taxable income is lowered, your take-home pay can go up! Medical Spending Account (Funds available upfront): Annual contribution limit of $2,500 Debit cards can be used to pay your group co-pays or out-of-pocket expenses where MasterCard is accepted Expenses include: eligible medical, vision and dental expenses Dependent Care Account (Funds available as deducted each pay period): Annual contribution limit of $5,000 Pay for dependent day care expenses (for your legal dependent child(ren)) up to age 13 and any other dependent claimed on your federal income tax return A dependent care account may only be used when both you and your spouse (if applicable) are gainfully employed Maximum Contribution: $5,000.00 if your filing status is Single or Married Filing a Joint Return. $2,500.00 if your filing status is Married Filing Separate Paper claims are not necessary following the electronic transaction; however, employees need to maintain all receipts to substantiate your claim. The IRS requires MEDCOM to audit and/or verify certain transactions, which will be done through a written request of you (the employee). You will only have to file a paper claim if a provider does not accept MasterCard or if you do not have your card at the time of purchase. www.medcom.net. 14 TAX ADVANTAGED PLANS Effective January 1, 2015 Voluntary 403(b) Plan The College offers employees the opportunity to participate in a tax-deferred retirement savings plan, provided by Section 403(b) of the Internal Revenue Service (IRS) Code. The salary reduction contributions may only be made to the 403(b) vendors who meet the new IRS requirements and are authorized by the College. The five authorized vendors are: Fidelity Investments Voya (ING) Retirement Plans Metropolitan Life Insurance Company (MetLife) TIAA-CREF Valic Eligible employees who wish to establish a voluntary 403(b) account should select and contact an authorized provider. Once an account has been established, employees sign a Salary Reduction Agreement and forward the agreement to the Payroll Department. Changes in the amount of the Salary Reduction Agreement may be processed by submitting a new agreement indicating the changes desired. TSA Consulting Group, Inc. (TSACG) serves as the plan administrator of the College’s 403(b) and 457(b) plans. All transactions for active accounts must be reviewed by TSACG using a transaction routing request found at www.tsacg.com. Basic Annual Limit: $18,000 Service-Based “Catch-up”: $21,000 (an additional $3,000 per year; must have 15 or more years with Florida State College at Jacksonville as well as an average contribution per year of less than $5,000.00). Age-Based Additional Amount: 50 or older by December 31: $18,000 + additional $6,000 = $24,000. Voluntary 457(b) Deferred Compensation Plan This is a non-qualified deferred compensation plan that works much like the 403(b) accounts. All employees may elect to participate in the plan with an annual maximum amount of $18,000. The 457(b) contributions do not reduce the FICA taxes (Social Security & Medicare). Eligible employees who wish to establish a voluntary 457(b) account should select and contact an authorized provider. Once an account has been established, employees sign a Salary Reduction Agreement and forward the agreement to the Payroll Department. Changes in the amount of the Salary Reduction Agreement may be processed by submitting a new agreement indicating the changes desired. Basic Annual Limit: $18,000 “Catch-up” Provisions: Unlike 403(b) accounts, “catch-up” provisions are only allowed during the final three (3) full calendar years of service prior to the year of retirement. Age-Based Additional Amount: 50 or older by December 31: $18,000+ additional $6,000 = $24,000. The salary reduction contributions may only be made to the 457(b) vendors who meet the new IRS requirements and are authorized by the College. The three authorized vendors are: Fidelity Investments TIAA-CREF Valic 15 403(b) vs. 457(b): Which is better? Both 403(b) and 457(b) retirement plans are deferred compensation plans. Under both plans, the employee contributes pretax income, and pays no taxes on monies held in the plan until separating from the employer and making withdrawals. Both plans offer a selection on investment opportunities through the plan sponsor. Talk to your financial advisor about which plan is a better fit for your particular situation. “How do the plans differ?” 403(b) 457(b) 403(b) It’s easier to access the funds while you are with the employer Less stringent withdrawal restrictions while you are employed, but a 10% federal early withdrawal penalty might apply. 457(b) You’re not subject to the 10% federal early withdrawal penalty once you leave the employer More stringent withdrawal restrictions while you are employed, but no 10% federal early withdrawal penalty after severance from employment [except in the case of rollovers from non-457(b) plans, including IRA’s]. Generally withdrawals made prior to severance from employment or the year you attain age 59½ can only be made due to financial hardship. Generally withdrawals made prior to severance from employment or the year in which you reach age 70½ can only be made for an unforeseeable emergency. A financial hardship withdrawal is considered less restrictive – while you are employed – than a 457(b) unforeseeable emergency. Examples of financial hardship include: An unforeseeable emergency is more restrictive – while you are employed – than a 403(b) hardship. Some examples: Unreimbursed medical expenses Payments to purchase a principal residence Higher education expenses Payments to prevent eviction or foreclosure of a mortgage. Withdrawals can be subject to a 10% federal early withdrawal penalty prior to age 59½. 16 A sudden and unexpected illness or accident for you or a dependent Loss of your property due to casualty Other similar extraordinary circumstances arising as result of events beyond your control. Sending a child to college or purchasing a home, two common reasons for 403(b) hardship withdrawals, generally are not considered unforeseeable emergencies. The 10% federal early withdrawal penalty, generally applicable to distributions prior to age 59½ from a 403(b) plan, does not apply to distributions from 457(b) plans except on amounts rolled into the plan from nono-457(b) plans (including IRAs). TAX ADVANTAGED PLANS cont’d Effective January 1, 2015 Mandatory 403(b) Terminal Leave Plan The FSCJ 403(b) Retirement Plan is provided as a means of maximizing tax advantages on terminal pay to College employees by deferring Federal withholding taxes and permanently avoiding Social Security and Medicare taxes on eligible accumulated sick and annual leave payments. The maximum Plan contribution limit is calculated each year. All Plan contributions are 100% vested when deposited. The 403(b) Terminal Leave Plan is: 1) Mandatory for employees who separate from the College and are due at least $7,000 in terminal “payout” for their unused sick and annual leave from Florida State College at Jacksonville; and 2) Mandatory for employees upon entry into the Deferred Retirement Option Program (DROP). For College employees who are not eligible for the Florida Retirement System Deferred Retirement Option Program (DROP) and who wish to gain additional federal income tax benefits for monies over the IRS annual limit, they may submit an irrevocable letter of separation to the District Board. The irrevocable letter of separation must be accepted by the Board in the Plan Year preceding the employee’s separation from the College. 17 RETIREMENT PLANS Effective January 1, 2015 Florida Retirement System (FRS) Full-time and regular part-time employees are automatically enrolled in the Florida Retirement System on their first day of employment. FRS has two retirement plans from which employees may choose the Pension and the Investment. The choice to participate must be made within five (5) months after the month of hire or it defaults to the Pension Plan. Employees must contribute 3% of their salary, on a pre-tax basis, to FRS. This will automatically be deducted each pay period. Employee contributions in the Investment Plan will accumulate earnings, minus investment fees and administrative charges. Employee contributions in the Pension Plan will not earn interest. Your salary will be reduced by the amount of the employee contribution before determining the federal income tax deduction. Members must be separated for 3 calendar months to be eligible to receive a refund of their employee contribution (it would be the employee’s responsibility to contact FRS). Employees are given a one time, irrevocable choice to switch plans. These plans include: FRS Pension Plan – the traditional plan provides a formula-based income at retirement. This defined benefit plan also provides a disability and a death benefit. The vesting period is six (6) years of creditable service for members hired before July 1, 2011. The vesting period is 8 years of creditable service for members hired on or after July 1, 2011. Deferred Retirement Option Program (DROP) – this option, within the FRS Pension Plan, allows employees to retire and have their retirement benefits accumulate in the FRS Trust Fund, earning tax-deferred interest, while they continue to work for an FRS employer and receive their regular pay and benefits. To be eligible, an employee must meet the FRS Retirement definition*. If you are a DROP participant or a reemployed retiree who is not allowed to renew membership, you will not be required to make the 3% employee contribution. If you have an effective DROP begin date before July 2011, you will retain an annual interest rate of 6.5%. If you have an effective DROP begin date on or after July 1, 2011, you will have an annual interest rate of 1.3%. *Retirement Definition: If hired before July 1, 2011, requires 6 years of creditable service and age 62 or 30 years of service regardless of age. If hired on or after July 1, 2011, requires 8 years of creditable service and age 65 or 33 years of service regardless of age. FRS Investment Plan: – the plan allows employees to control how their retirement contributions are invested. The law defines the employer contributions, but your ultimate benefit depends in part on the performance of your investment funds. Employees will have five (5) months after the month of hire to elect an FRS Plan; if no election is made the choice defaults to the Pension Plan. Vesting period is one (1) year. FRS Senior Management – As defined by state law, employees must contribute 3% of their salary, on a pre-tax basis, to FRS. This will automatically be deducted each pay period. Members must be separated for 3 calendar months to be eligible to receive a refund of their employee contribution (it would be the employee’s responsibility to contact FRS). Employees are given a one time, irrevocable choice to switch plans. Community College Optional Retirement Program – CCORP: *Option eliminated for employees hired after August 31, 2011* Full-time faculty, administrator, and professional employees had the option to elect to participate in a 403(b) tax-sheltered annuity plan in lieu of the Florida Retirement System. Under this plan, the College contributes a percentage as defined by law, of a participating employee's gross salary to any one of five plans elected by the employee. Employees in the CCORP plan must contribute 3% of their salary, on a pre-tax basis. CCORP participants have a one-time opportunity to switch to a FRS Plan. These options may be exercised at a future time during your career under the CCORP. You may also choose to simply remain in the CCORP and take no further action. To review these options, please call the MyFRS Financial Guidance Line at 1-866-446-9377 or visit the Web site www.MyFRS.com. 18 The Hartford LIFE INSURANCE COVERAGE Effective January 1, 2015 The Hartford Insurance Company The term life insurance plan with Hartford Life Insurance Company provides a death benefit equal to your annual salary (basic coverage) rounded to the nearest $1,000. The College pays for the basic coverage. During the first 30 days of employment, employees have the option to buy, without evidence of insurability, guaranteed supplemental coverage of one, two, or three times this amount up to $350,000, which includes the College paid portion. After the first 30 days of employment, evidence of insurability may be required to purchase supplemental term life insurance. The employee is responsible for paying for supplemental term life insurance through payroll deductions at the cost of $.205 per $1,000 per month. Conversion is available with no proof of insurability if your employment ends. Please note, as of December 31, 2003, retirees and active employees who enrolled in the Deferred Retirement Option Plan (DROP) with irrevocable retirement dates are considered as Retiree-Closed Class. New employees retiring or starting DROP after January 1, 2004, will be considered as Retiree-Open Class and will not receive premium subsidization from the College. Full-Time Employees and Retirees may carry basic term life insurance coverage (annual salary rounded to nearest $1,000 at time of retirement) until age 70 at which time coverage is reduced to 50% of basic coverage. The retiree is responsible for payment of life insurance premiums: Retiree-Closed Class Premium - $ 1.07 per $1,000.00 Retiree-Open Class Premium $ 1.96 per $1,000.00 Full-time employees have the opportunity to purchase from Hartford Life Insurance Company supplemental life insurance for their spouse, domestic partner and eligible legal dependent children. To be eligible you must currently be paying for supplemental life insurance with the College. This benefit will allow you to insure your spouse/domestic partner for $25,000 at a cost of $7.64 per month with a two-year rate guarantee. The legal dependent child(ren) life insurance policy insures all eligible dependent children in a family unit with one monthly premium regardless of the number of children in the family. This is a $10,000 benefit per child at the monthly rate of $2.10 with a two-year rate guarantee. An employee must submit and pass an evidence of insurability review for spouse or domestic partner’s coverage. Employee and Retiree General Provisions: Upon the first day of the month following an insured employee 70th birthday, an insured employee’s amount of basic and supplemental, and retiree’s term life insurance shall be reduced to 50% of the amount in effect immediately prior to attaining age 70. Dependents General Provisions: Upon the first day of the month following an insured spouse’s 70th birthday, his or her amount of term life insurance shall be reduced to 50% of the amount in effect immediately prior to attaining age 70. Legal dependent children are eligible if they have not attained the age of 19, or have not attained the age of 25 if a full-time or part-time student in an accredited educational institution. Will Preparation Services – The Hartford Life Insurance Company provides assistance with the creation of wills, power of attorney, financial arrangements, etc. Visit their website at wwwestateguidance.com/wills; use code WILLHLF. You’ll have access to Guidance Resources by calling 1-800/964-3577. Travel Assistance – When traveling 100 miles or more away from home, The Hartford Life Insurance Company is partnered with Europ Assistance USA to provide 24-hour access to emergency assistance and resources. Contact 1-800-243-6108 (U.S. and Canada) or call collect at 1-202—828-5885 (other locations outside of the U. S. and Canada) or visit their website at www.europassistance-usa.com. 19 Long Term Disability (LTD) Effective January 1, 2015 The Hartford Company - Long Term Disability All full-time employees are eligible for long term disability insurance coverage. The College provides this coverage at no cost to full-time active employees. There is a 180-day elimination period. If approved, an employee would resign with the College and receive up to 60% of their monthly salary from Hartford. To apply, contact a Benefits Specialist to assist you with the process. HealthAdvocate Employee Assistance Program (EAP) EAP + Work/Life HealthAvocate Employee Assistance Program The Employee Assistance Program (EAP) through Health Advocate is a short-term, confidential counseling and/or crisis intervention service provided for employees. They offer professional support for personal and work/life issues. This program provides college employees with real support when you need it: Up to eight free sessions per year for you and your family. There is no cost to use the service 24-Hour CARELINE 877-240-6863 How can you find out more? Get short-term assistance to help you cope with personal, family and work issues, and the right resources to better balance your work and life. The Health Advocate staff follows careful protocols and complies with all government privacy standards. Your medical and personal information is strictly confidential. Your privacy is protected. Visit www.HealthAdvocate.com/members to find useful information on a wide range of topics or send an email to answers@HealthAdvocate.com 20 ADDITIONAL BENEFITS Annual Leave - Full-Time Employees Career employees earn vacation time as follows. First five years 12 days per year Six to 10 years 15 days per year 10 years and over 18 days per year Career employees may carry over annual leave into the next calendar year with a cap of 44 days (352 hours). Administrative and Professional employees earn vacation time as follows: First five years Six to 10 years 10 years and over 16 days per year 19 days per year 22 days per year Administrative and Professional employees may carry over annual leave into the next calendar year with a cap of 44 days (352 hours). Senior Management employees earn vacation time as follows: First five years Six to 10 years 10 years and over 20 days per year 22 days per year 24 days per year Senior Management employees may carry over annual leave into the next calendar year with a cap of 60 days (480 hours). Accrued vacation leave in excess of the maximum on December 31 shall be transferred to sick leave on January 1 of the following year. Such vacation leave transferred to sick leave will be classified as non-compensatory accrued sick leave and cannot be used in the calculation of terminal sick leave pay. Sick Leave All full-time employees earn eight hours of sick leave per month. Employees also have the option to use 32 hours per calendar year as personal leave. Employees may carry over unused sick leave into the next calendar year. Sick Leave Pool Full-time employees are eligible to enroll in the sick leave pool after they have been employed for one year and have a sick leave balance of at least 72 hours. The open enrollment period occurs during the College’s annual open enrollment; with a membership effective date of January 1. To enroll, an employee voluntarily contributes 16 hours of sick leave to the pool. If the employee has a catastrophic emergency/life threatening illness or injury and has depleted all of his or her own sick leave, they may apply for additional hours from the pool. The decision to grant hours is made by the Sick Leave Pool Committee. The application form to include the physician’s report may be obtained from a Benefits Specialist in Human Resources. 21 ADDITIONAL BENEFITS cont’d Worker’s Compensation All employees are covered by Workers’ Compensation. Workers’ Compensation provides partial wage continuation and pays the cost of medical treatment health care cost (if applicable) if an employee has been injured while on the job. Family Medical Leave Act (FMLA) The Family and Medical Leave Act (FMLA) of 1993 provides an entitlement of up to 12 weeks (480 hours) of job-protected, unpaid leave during a 12-month period to employees who have worked for the College for at least one year and have worked at least 1,250 hours during the previous 12-month period. Eligible employees may take FMLA leave for the following reasons: 1. Because of the birth of a son or daughter of the employee and in order to care for such son or daughter. 2. Because of the placement of a son or daughter with the employee for adoption or foster care. 3. In order to care for the spouse, son, daughter or parent of the employee who has a serious health condition. (Parent cannot be an “in-law”.) 4. Because of a serious health condition that makes the employee unable to perform the functions of his/her position. 5. To care for a covered service member (spouse, child, parent, next of kin) that has a serious health condition (up to 26 weeks of job-protected leave). For the purposes of this procedure, next of kin of a covered service member is the nearest blood relative, other than the current service member’s spouse, parent, son, or daughter in the order of priority as established under the U.S. Department of Labor guidelines. Support documentation paperwork for military FMLA shall be presented as soon as practicable. 6. For a “qualifying exigency” arising out of the fact that the spouse, child or parent is on active duty or called to active duty status in support of a contingency operation of the National Guard or Reserves . For additional information or for the forms to apply for FMLA, go to Artemis at www.fscj.edu; log into the faculty and staff portal; click on “College” at the top of the webpage, then click on Human Resources; or go to www.fccj.org/campuses/mccs/HumanResources/. Long Term Care (LTC) Insurance Employees have the option of purchasing Long Term Care (LTC) insurance through Unum. LTC is the assistance received when someone needs help with two or more Activities of Daily Living—such as dressing, bathing, going to the bathroom, eating or moving about—or when someone suffers a severe cognitive impairment. This care could be provided in the home, in an assisted living or residential care facility, or in a skilled nursing facility such as a nursing home. For additional information, please contact a Benefits Specialist. Newly hired employees will have 30 days, from date of hire, to sign up for Guarantee Issue coverage. Employees who enroll after the Guarantee Issue enrollment period will be required to fill out a medical questionnaire. Tuition Reimbursement The College will waive or reimburse tuition and matriculation fees for courses taken at the College for full-time employees and their dependents and regular part-time employees (refer to APM 03-0910). Undergraduate and graduate courses taken at accredited institutions other than the College are reimbursable up to $3,000 per fiscal year for undergraduate courses and up to $4,000 per fiscal year for graduate courses. (APM 121501). 22 ADDITIONAL BENEFITS cont’d COBRA The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives qualified beneficiaries (defined as employee, spouse and/or dependents) who lose their health benefits the option to elect to continue their health insurance, dental insurance, vision insurance and flexible spending account(s) for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between employers, death, divorce, and other life events. COBRA coverage begins on the date health care coverage would otherwise have been lost by reason of a qualifying event and may continue for a maximum of 18 months. Certain qualifying events, such as divorce or legal separation of an employee, or a second qualifying event during the initial period of coverage, may permit a beneficiary to receive a maximum of 36 months of coverage. Qualified beneficiaries that elect Cobra will be required to pay the entire premium plus a two percent administration fee each month to maintain coverage. Holidays The College President shall designate one (1) paid holiday in the annual operating calendar to total Ten (10) official paid holidays annually. New Year’s Day Martin Luther King, Jr. Day President’s Day Designated Holiday (May 6) Memorial Day Independence Day Labor Day Veteran’s Day Thanksgiving Day and Break You must be in an active pay status the day before and the day after an official College holiday to receive pay for that holiday. Employees who begin or terminate work during a pay period when the College is officially closed will be paid for the days worked should their employment not encompass the entire pay period. Administrator, professional and career employees work 250 days. Spring and winter breaks are not part of the 250 days’ work calendar. Benefits Election Changes Open Enrollment Employees may change their health, dental, or vision plans and enroll in the Flexible Spending Account, 403(b) plan, or Long Term Care plan during the designated open enrollment period. Qualifying Events Employees may make changes to their health, dental and vision plans (i.e., add/drop dependents) as well as modify their Flexible Spending Account deductions within 30 days of a qualifying event. Such events include marriage, divorce, birth, adoption, death, gain and loss of other coverage. For changes made due to ANY qualifying event, supporting documentation is required. Please contact a Benefits Specialist for assistance. 23 CONTACT INFORMATION Human Resources - Benefits Contact Email: Benefits@fscj.edu Health Insurance (Florida Blue) Group No: 16087 www.bcbsfl.com Claims Address: Florida Blue P. O. Box 1798 Jacksonville, FL 32231-1798 BlueCare 51 (HMO) www.bcbsfl.com Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . BlueOptions 03769 (PPO Base) Plan and BlueOptions 03559 (PPO Plus) Plan www.bcbsfl.com Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Mental Health Care . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Health Dialog . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . www.thedialogcenter.com/bcbsfl BlueCard Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-877-352-2583 1-800-664-5295 1-800-835-2094 1-877-789-2583 1-800-810-2583 Delta Dental Plan www.deltadentalins.com Delta Care Dental (HMO) Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Group No: 76894 1-800-422-4234 Delta Dental (PPO) Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Group No: 16724 1-800-521-2651 Humana (VisionCare Plan) www.humanavisioncare.com Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Group No: 207135 1-800-865-3676 Florida College System Risk Management Consortium D/V Plan Delta Care Dental (PPO) Group No: 16020 www.deltadentalins.com Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-800-521-2651 Vision Service Plan (VSP) www.vsp.com Group No: 30035956 Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-800-877-7195 24 The Hartford Life Insurance Company Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Will Preparation Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Travel Assistance (U.S. and Canada) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Travel Assistance (Other Location outside U.S. and Canada) . . . . . . . . . . . . . . . . . . . . . . . . . 1-888-563-1124 1-800-964-3577 1-800-243-6108 1-202-828-5885 Medcom (FSA) www.medcom.net Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 904-596-4500 Claims Address: MEDCOM Flex Division P. O. Box 10269 Jacksonville, Florida 32247-0269 Employee Assistance Program (EAP) Health Advocate www.HealthAdvocate.com/members Email: answers@healthadvocate.com 24 Hours/7 Days a Week Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-877-240-6863 Florida Retirement System (FRS) www.MyFRS.com Financial Guidance Line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Bureau of Retirement Calculations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-866-446-9377 1-888-738-2252 UNUM (Long Term Care) www.unum.com Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-877-225-2712 25 Florida State College At Jacksonville is an equal access/equal opportunity/affirmative action college. Florida State College At Jacksonville is a member of the Florida State College System. Florida State College At Jacksonville is not affiliated with any other public or private university or college in Florida or elsewhere. Florida State College At Jacksonville is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools to award the baccalaureate degree and the associate degree. Contact the Commission on Colleges at 1866 Southern Lane, Decatur, Georgia 30033-4097, or call (404) 679-4500 for questions about the accreditation of Florida State College At Jacksonville. 26