Unit 3 Notes: The Stock Market

advertisement

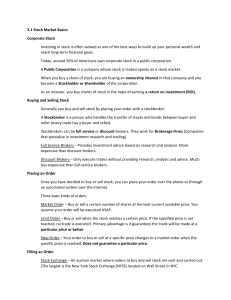

The Stock Market 3.1 STOCK MARKET BASICS Objectives Corporate Stock Investing in stock is often viewed as one of the best ways to build up your personal wealth and reach long-term financial goals. Today, around 50% of Americans own corporate stock in a public corporation. A Public Corporation is a company whose stock is traded openly on a stock market. When you buy a share of stock, you are buying an ownership interest in that company and you become a Stockholder or Shareholder of the corporation. As an investor, you buy shares of stock in the hope of earning a return on investment (ROI). Buying and Selling Stock Generally you buy and sell stock by placing your order with a stockbroker. A Stockbroker is a person who handles the transfer of stocks and bonds between buyer and seller (every trade has a buyer and seller). Stockbrokers can be full service or discount brokers. They work for Brokerage Firms (Companies that specialize in investment research and trading). Full Service Brokers – Provides investment advice based on research and analysis. More expensive than discount brokers. Discount Brokers – Only execute trades without providing research, analysis and advice. Much less expensive than full-service brokers. Placing an Order Once you have decided to buy or sell stock, you can place your order over the phone or through an automated system over the internet. Three basic kinds of orders: Market Order – Buy or sell a certain number of shares at the best current available price. You assume your order will be executed ASAP. Limit Order – Buy or sell when the stock reaches a certain price. If the specified price is not reached, no trade is executed. Primary advantage is it guarantees the trade will be made at a particular price. Stop Order – Your order to buy or sell at a specific price changes to a market order when the specific price is reached. Does not guarantee a particular price. Filling an Order Stock Exchange – An auction market where orders to buy and sell stock are sent and carried out. (The largest is the New York Stock Exchange (NYSE) located on Wall Street in NYC. Using computers, your order goes (in minutes) from your broker to the appropriate stock market. If listed on the NYSE, a Specialist there will handle your order. A Specialist acts as an agent matching buy and sell orders. Sometimes the Specialist will by or sell from his own account to maintain an orderly market. In the NASDAQ and over-the-counter markets, a Dealer handles buying and selling. Institutional Investors Institutional investors do approximately 75 to 80% of stock market trading. These include banks, bank trust departments, mutual fund companies, pension funds and insurance companies. Usually they are large companies with professional staffs dedicated to investment decisions. Because of the size of their purchases, they have a great deal of influence on stock prices. The Stock Market 3.2 OWNING STOCK AND EARNING RETURNS Objectives How Stockholders Earn Returns Remember…As an investor, you buy shares of stock in the hope of earning a return on investment (ROI). If the company does well, stockholders can potentially profit in two ways. Dividends – a portion of company profits that is allocated to stockholders on a regular basis (usually paid out quarterly). For example, If you own 100 shares of XYZ Bank and they pay an annual dividend of $1 per share, you would receive $100 per year ($25 per quarter) in dividends representing your share of company profits. You must hold the stock in order to earn dividends and NOT ALL publicly traded companies pay dividends to shareholders. How Stockholders Earn Returns Capital Gains – Besides dividends, the other way that stockholders could profit is through Capital Gains. This is an increase in the value of the stock over time. For example, if you bought 100 shares of XYZ Bank at $5 per share and the corporation did well driving the stock price up to $10 per share a year later, you could sell your 100 shares for $1000. Since your initial investment was $500 (100 x $5), you would have a Capital Gain (profit) of $500. You must sell the stock in order to earn Capital Gains and sometimes you sell for less than your investment (Capital Loss). Common vs. Preferred Stock Common Stock usually pays a variable dividend (sometimes no dividend) and gives the stockholder voting rights. Common stockholders vote on major policy decisions (issuance of additional stock, sale of company). Board of Directors (elected by stockholders) decide on dividends. Most shares purchased are Common shares. Preferred Stock pays a fixed dividend but has no voting rights. Less risky than common stock. If company fails, preferred shareholders are paid before common shareholders. Stock Categories Stocks are often classified into different categories to fit investment objectives. Some stocks may fall into more than one category. Income –Have a consistent history of paying high dividends. Popular choice for retirees. Growth – Companies that reinvest their profits into the business so that it can grow. These companies may pay little or no dividends. Blue Chip – Large, well-established companies with a solid record of profitability. Stock Categories (cont.) Emerging – Young, often smaller corporations that could be on their way to high profitability. (Uncertainty/Risk). Cyclical – Stocks that are much more affected by ups and downs in the economy. Defensive – Stocks that remain relatively stable during an economic decline. Valuing Stock A stock’s Market Value is the price for which the stock is bought and sold in the marketplace. Market Value of a stock reflects the price that investors are willing to pay for a stock based on current company performance, track record and future expectations. Stock Prices increase or decrease over time based on investor supply and demand at various prices in the market. Stock Analysts review detailed information about companies and rate stocks (buy, hold, sell). Stock prices can be heavily influenced by these ratings. Interest Rates and Market Conditions When interest rates are low, people who would normally put money in savings accounts and CDs look for more profitable places to invest their money. As interest rates rise, people tend to move their money to safer investments. Generally, when interest rates fall below the rate of inflation, people buy more stock and stock prices rise. The Stock Market goes through periods of rising and falling prices. A Bull Market is a prolonged period of rising stock prices and investor optimism. A Bear Market is a prolonged period of falling stock prices and a general feeling of investor pessimism.