Other Investment Criteria

advertisement

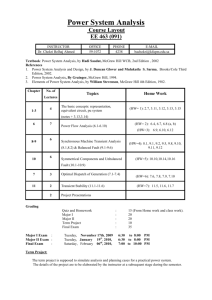

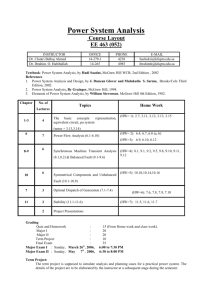

Fundamentals of Corporate Finance Third Canadian Edition prepared by: Sujata Madan McGill University Copyright © 2006 McGraw Hill Ryerson Limited 2-1 Chapter 7 NPV and Other Investment Criteria Net Present Value (NPV) Other Investment Criteria Mutually Exclusive Projects Capital Rationing Copyright © 2006 McGraw Hill Ryerson Limited 2-2 Net Present Value Capital Budgeting Decision Which investments should the firm invest in? Known as the capital budgeting decision or the investment decision. This chapter discusses various criteria used to evaluate investments. Copyright © 2006 McGraw Hill Ryerson Limited 2-3 Net Present Value Capital Budgeting Decision Suppose you had the opportunity to buy a building for $350,000 today. Assume that you could sell it for $400,000 guaranteed next year. Copyright © 2006 McGraw Hill Ryerson Limited 2-4 Net Present Value Capital Budgeting Decision 0 1 r% -$350,000 $400,000 ? What discount rate do we use to value this stream of cash flows? What else could we have done with the $350,000? What other opportunity are we giving up by investing in the building? Copyright © 2006 McGraw Hill Ryerson Limited 2-5 Net Present Value Capital Budgeting Decision Assume the interest rate on the risk-free T-bill is 7%. 0 1 7% -$350,000 $400,000 $4,000/(1+0.07) = $373,832 NPV = $23,832 Copyright © 2006 McGraw Hill Ryerson Limited 2-6 Net Present Value Net Present Value Present value of cash flows minus initial investment. Opportunity Cost of Capital Expected rate of return given up by investing in a project. Copyright © 2006 McGraw Hill Ryerson Limited 2-7 Net Present Value NPV = PV - required investment C1 C2 Ct NPV C0 ... 1 2 t (1 r ) (1 r ) (1 r ) where Ct = Cash flow at time t r = Opportunity cost of capital Copyright © 2006 McGraw Hill Ryerson Limited 2-8 Net Present Value Risk and Net Present Value The discount rate used to discount a set of cash flows must match the risk of the cash flows. Instead of being risk-free, if the building investment was estimated to be as risky as the stock market yielding 12%, the NPV would be: NPV = PV – C0 = [$400,000/(1+.12)] - $350,000 = $357,143 - $350,000 = $7,143 Copyright © 2006 McGraw Hill Ryerson Limited 2-9 Net Present Value Valuing long lived projects The NPV rule works for projects of any duration. The critical problems in any NPV problem are to determine: The amount and timing of the cash flows. The appropriate discount rate. Copyright © 2006 McGraw Hill Ryerson Limited 2-10 Net Present Value Net Present Value Rule Managers increase shareholders’ wealth by accepting all projects that are worth more than they cost. Therefore, they should accept all projects with a positive net present value. Copyright © 2006 McGraw Hill Ryerson Limited 2-11 Other Investment Criteria Net Present Value vs Other Criteria Use of the NPV criterion for accepting or rejecting investment projects will maximize the value of a firm’s shares. Other criteria are sometimes used by firms when evaluating investment opportunities. Some of these criteria can give wrong answers! Some of these criteria simply need to be used with care if you are to get the right answer! Copyright © 2006 McGraw Hill Ryerson Limited 2-12 Other Investment Criteria Payback Payback is the time period it takes for the cash flows generated by the project to cover the initial investment in the project. Payback Rule Accept a project if its payback period is less than the specified cutoff period. Copyright © 2006 McGraw Hill Ryerson Limited 2-13 Other Investment Criteria Payback A company has the following three investment opportunities. The company accepts all projects with a 2 year or less payback period and uses a 10% discount rate. a Cash Flows in Dollars Project: C0 C1 C2 C3 A -2,000 +1,000 +$1,000 +10,000 B -2,000 +1,000 +$1,000 - C -2,000 - +$2,000 - Copyright © 2006 McGraw Hill Ryerson Limited 2-14 Other Investment Criteria Payback Project: C0 C1 C2 C3 Payback NPV @10% a A -2,000 +1,000 +$1,000 +10,000 2 $7,249 B -2,000 +1,000 +$1,000 - 2 -$ 264 C -2,000 +$2,000 - 2 -$ 347 - Copyright © 2006 McGraw Hill Ryerson Limited 2-15 Other Investment Criteria Payback Project: C0 C1 C2 C3 Payback NPV @10% a A -2,000 +1,000 +$1,000 +10,000 2 $7,249 B -2,000 +1,000 +$1,000 - 2 -$ 264 C -2,000 +$2,000 - 2 -$ 347 - Only Project A increases shareholder value and should be accepted! Copyright © 2006 McGraw Hill Ryerson Limited 2-16 Other Investment Criteria Discounted Payback Discounted payback is the time period it takes for the discounted cash flows generated by the project to cover the initial investment in the project. a Although better than payback, it still ignores all cash flows after an arbitrary cutoff date. Therefore it will reject some positive NPV projects. Copyright © 2006 McGraw Hill Ryerson Limited 2-17 Other Investment Criteria Book Rate of Return Book rate of return equals the company’s accounting income divided by its assets. a Book Rate of Return = Book Income / Book Assets Note: These components reflect historic costs and accounting income, not market values and cash flows. Copyright © 2006 McGraw Hill Ryerson Limited a 2-18 Other Investment Criteria Internal Rate of Return (IRR) IRR is the discount rate at which the NPV of the project equals zero. IRR Rule Accept a project if it offers a rate of return higher than the opportunity cost of capital. Copyright © 2006 McGraw Hill Ryerson Limited 2-19 Other Investment Criteria Internal Rate of Return (IRR) Revisiting our building example, we discovered the following: Discount Rate NPV of Project 7% $23,382 12% $7,143 At what rate of return will the NPV of this project be equal to zero? Copyright © 2006 McGraw Hill Ryerson Limited 2-20 Other Investment Criteria Internal Rate of Return (IRR) If we solve for “r” in the equation below, we find the IRR for this project is 14.3%: NPV = [C1/(1+r)] - C0 0 = [$400,000/(1+r)] - 350,000 r = 14.3% Copyright © 2006 McGraw Hill Ryerson Limited r 2-21 Other Investment Criteria Internal Rate of Return (IRR) Another way of solving for IRR is to graph the NPV at various discount rates. The point where this NPV profile crosses the “x” axis will be the IRR for the project. Copyright © 2006 McGraw Hill Ryerson Limited 2-22 IRR BY GRAPH NPV Profile for this Project NPV ($) $60,000 $50,000 IRR = 14.3% $40,000 $30,000 (occurs where NPV = 0) $20,000 $10,000 $0 ($10,000) 5% 10% 15% 20% ($20,000) Discount Rate Copyright © 2006 McGraw Hill Ryerson Limited 2-23 Other Investment Criteria Multi-period IRR You can purchase a building for $350,000. The investment will generate $16,000 in cash flows (i.e. rent) during the first three years. At the end of three years you will sell the building for $450,000. What is the IRR on this investment? Copyright © 2006 McGraw Hill Ryerson Limited 2-24 Other Investment Criteria Multi-period IRR 0 -$350,000 1 $16,000 2 $16,000 3 $466,000 16,000 16,000 466,000 0 350,000 1 2 (1 IRR ) (1 IRR ) (1 IRR ) 3 By trial and error; or using a financial calculator, IRR = 12.96% Copyright © 2006 McGraw Hill Ryerson Limited 2-25 Project Interactions Pitfalls with IRR – Lending vs Borrowing Project J involves lending $100 at 50% interest. Project K involves borrowing $100 at 50% interest. Which option should you choose? Copyright © 2006 McGraw Hill Ryerson Limited . 2-26 Project Interactions Pitfalls with IRR – Lending vs Borrowing According to the IRR rule, both projects have a 50% rate of return and are thus equally desirable. However, you lend in Project J, and earn 50%; you borrow in Project K, and pay 50%. Pick the project where you earn more than the opportunity cost of capital. Copyright © 2006 McGraw Hill Ryerson Limited . 2-27 Project Interactions Pitfalls with IRR – Multiple Rates of Return Certain cash flows can generate NPV=0 at more than one discount rate. The IRR rule would not work in this case; NPV works! Copyright © 2006 McGraw Hill Ryerson Limited . 2-28 Project Interactions Pitfalls with IRR – Mutually Exclusive Projects Two or more projects that cannot be pursued simultaneously are called mutually exclusive. When choosing amongst mutually exclusive projects, choose the one with the highest NPV. Copyright © 2006 McGraw Hill Ryerson Limited . 2-29 Project Interactions Pitfalls with IRR – Mutually Exclusive Projects Calculate the IRR and NPV for the following projects: Cash Flows in Dollars Project: H I C0 C1 C2 C3 -350 -350 400 16 16 466 IRR Copyright © 2006 McGraw Hill Ryerson Limited . NPV @ 6% 2-30 Project Interactions Pitfalls with IRR – Mutually Exclusive Projects Calculate the IRR and NPV for the following projects: Cash Flows in Dollars Project: H I C0 C1 C2 C3 IRR -350 -350 400 16 16 466 14.29% 12.96% NPV @ 6% $24,000 $59,000 Choose Project I since it makes a greater contribution to the value of the firm! Copyright © 2006 McGraw Hill Ryerson Limited . 2-31 Project Interactions Pitfalls with IRR Higher IRR for a project does not necessarily mean a higher NPV. You goal should be to maximize the value of the firm. NPV is the most reliable criterion for project evaluation. Copyright © 2006 McGraw Hill Ryerson Limited . 2-32 Project Interactions The Investment Timing Decision Sometimes you have the ability to defer an investment and select a time that is more ideal at which to make the investment decision. The decision rule is to choose the investment date that results in the highest NPV today. Copyright © 2006 McGraw Hill Ryerson Limited 2-33 Project Interactions The Investment Timing Decision You can buy a computer system today for $50,000. Based on the savings it provides to you, the NPV of this investment ~ $20,000. However, you know that these systems are dropping in price every year. When should you purchase the computer? Copyright © 2006 McGraw Hill Ryerson Limited 2-34 Project Interactions Year of Purchase t=0 t=1 t=2 t=3 t=4 t=5 Cost $50 $45 $40 $36 $33 $31 PV of Savings $70 $70 $70 $70 $70 $70 NPV at Year of Purchase $20 $25 $30 $34 $37 $39 NPV Today $20.0 $22.7 $24.8 $25.5 $25.3 $24.2 Decision rule for investment timing: Choose the investment date which results in the highest NPV today. Copyright © 2006 McGraw Hill Ryerson Limited 2-35 Project Interactions Long- vs Short-Lived Equipment Suppose you must choose between buying two machines with different lives. Machines D and E are designed differently, but have identical capacity and do the same job. Machine D costs $15,000 and lasts 3 years. It costs $4,000 per year to operate. Machine E costs $10,000 and lasts 2 years. It costs $6,000 per year to operate. Which machine should the firm acquire? Copyright © 2006 McGraw Hill Ryerson Limited 2-36 Project Interactions Long- vs Short-Lived Equipment Cash Costs [outflows] in Dollars Project: C0 C1 C2 C3 PV @ 6% Machine D 15 4 4 4 $25.69 Machine E 10 6 6 - $21.00 a We cannot compare the PV of costs of assets with different lives. Copyright © 2006 McGraw Hill Ryerson Limited . 2-37 Project Interactions Long- vs Short-Lived Equipment For comparing assets with different lives, we need to compare their Equivalent Annual Costs. The Equivalent Annual Cost is the cost per period with the same PV as the cost of the machine. Copyright © 2006 McGraw Hill Ryerson Limited . a 2-38 Project Interactions Calculating Equivalent Annual Cost: Cash Flows in Dollars Project: C0 C1 C2 C3 Machine D 15 4 4 4 $25.69 9.61 ? 9.61 ? 9.61 ? $25.69 Equivalent Annual cost: PV @ 6% The equivalent annual cost is calculated as follows: Equivalent Annual Cost = PV of Costs / Annuity Factor = $25.69 / 3 Year Annuity Factor = $25.69 / 2.673 = $9.61 per year Copyright © 2006 McGraw Hill Ryerson Limited . 2-39 Project Interactions Long- vs Short-Lived Equipment If mutually exclusive projects have unequal lives, then you should calculate the equivalent annual cost of the projects. Picking the lowest EAC allows you to select the project which will maximize the value of the firm. Cash Flows in Dollars Project: PV @ 6% Equivalent Annual Cost D $25.69 $9.61 E $21.00 $11.45 Copyright © 2006 McGraw Hill Ryerson Limited 2-40 Capital Rationing Capital Rationing Limit is set on the amount of funds available to a firm for investment. Soft Rationing Limits imposed by senior management. Hard Rationing Limits imposed by the unavailability of funds in the capital markets. Copyright © 2006 McGraw Hill Ryerson Limited 2-41 Capital Rationing Rules for Project Selection A firm maximizes its value by accepting all positive NPV projects. With capital rationing, you need to select a group of projects which is within the company’s resources and gives the highest NPV. Copyright © 2006 McGraw Hill Ryerson Limited 2-42 Capital Rationing Profitability Index (PI) The solution is to pick the projects that give the highest NPV per dollar of investment. We do this by calculating the Profitability Index: PI = NPV / Initial Investment (C0) Copyright © 2006 McGraw Hill Ryerson Limited 2-43 Capital Rationing Profitability Index (PI) Suppose your firm had the following projects and only $20 million to spend: Project L M N O P Budget C0 -3.00 -5.00 -7.00 -6.00 -4.00 -25.00 C1 2.20 2.20 6.60 3.30 1.10 C2 2.42 4.84 4.84 6.05 4.84 NPV @ 10% 1.00 1.00 3.00 2.00 1.00 Which Projects should your firm select? Copyright © 2006 McGraw Hill Ryerson Limited 2-44 Capital Rationing Profitability Index Project L M N O P C0 3.00 5.00 7.00 6.00 4.00 NPV @ 10% 1.00 1.00 3.00 2.00 1.00 PI 1/3 = 0.33 1/5 = 0.20 3/7 = 0.43 2/6 = 0.33 1/4 = 0.25 Copyright © 2006 McGraw Hill Ryerson Limited ACCEPT ACCEPT ACCEPT ACCEPT 2-45 Summary of Chapter 7 NPV is the only measure which always gives the correct decision when evaluating projects. The other measures can mislead you into making poor decisions if used alone. The other measures are: IRR Payback Discounted Payback Book Rate of Return Profitability Index (PI) Copyright © 2006 McGraw Hill Ryerson Limited 2-46 Summary of Chapter 7 Type of Decision: NPV IRR Payback Discounted Payback Book Rate of Return Profitability Index Independent Projects Mutually Exclusive Projects Capital Rationing Copyright © 2006 McGraw Hill Ryerson Limited 2-47