Vietnam's distribution services

advertisement

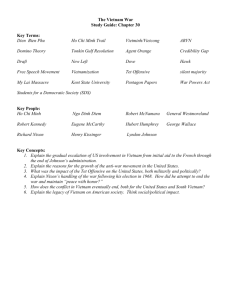

Distribution Services: Vietnam Case Dang Nhu Van Hanoi 23-27 May 2005 Outline Overview Vietnam Case: Legal Framework & existing regulations Vietnam: Sector profile Benefit of liberalization Overview - GATS Classification Distribution Services Include: 1. Commissioned Agent 2. Wholesale 3. Retail 4. Franchise Overview – Role of distribution Link between producers & consumers Facilitate trade in goods (e.g. promote export of goods) and other services Contribute to competitiveness of other sectors Create jobs Integrated part of the domestic/global value/supply chain Overview – Common barriers to trade in distribution services Economic needs test Forms of investment Trading rights (e.g. import for domestic sale) Types of goods to be distributed Using domestic suppliers & services Advertisement regulations & restrictions Zoning and location restrictions Foreign ownership restrictions Regulations on shop opening hours Rules of competition and trademark protection Restrictions in goods trade (e.g. customs, TBT, parallel imports, etc.) due to close link Vietnam Case: Legal Framework and existing regulations Regulations on distribution services and foreign service suppliers are scattered in different laws and sub-law decrees: commercial code, foreign investment law, decree on export and import, price control, restriction on exports and imports by foreign companies’ branches and representative offices, negative list of goods. Vietnam Case - Legal Framework and existing regulations Regulations by mode of supply: Mode 1: - Only regulations on trade in goods, export and imports are found. - VN-US BTA commitments: unbound Legal Framework and existing regulations Mode 2: - No direct restriction on consumption abroad, - But there are foreign exchange control regulations - BTA commitment: none, but existing regulations are inconsistent with BTA/GATS rules. Legal Framework and existing regulations Mode 3: - Subject to Prime Minister decision or competent authority on ad hoc basis - Trade balance requirements and restrictions of export and import items for branches or rep office - Foreign commissioned agents are not allowed - Trading rights are provided in the licence on the case by case basis - Conditionality: investment in own store facilities - Inconsistency between regulations, practice, and international commitments: No wholly foreign owned firm is allowed by regulations. Metro is German wholly owned. BTA: jointventure allowed from 2004, 49% by 2007, and 100% by 2008. WTO: case-by-case approval Foreign distributors are not allowed to buy goods in Vietnam to sell in Vietnam (Metro is doing this). Legal Framework and existing regulations Mode 4: General regulations on expatriates applied across the board. Vietnam case - Sector Profile A market of $20 billion of private consumption in 2004 Retail sales growth of 30% in big cities 10% accounted for by supermarkets Inefficiency – producers distribute own products, rather than outsourcing Foreign distributors show big interest in enterring. Poor statistics Vietnam case – Foreign presence Very limited compared to the region Existing Metro Cash & Carry (Germany) Big C - Bourbon (France) Seiyu (Japanese) Parkson (Malaysia) Coming soon Dairy Farm (Hong Kong) Vietnam Case – Metro Cash & Carry, a link between service and goods trade Lisenced foreign wholesaler, 100% foreign ownership (Mode 3) Lisenced as pilot for distribution service liberalization 90% of goods supplied to Metro supermarkets are sourced from Vietnam (exception to the rule) Export agricultural and fishery products from Vietnam: buying directly from farmers to sell globally through its supermarket chain Benefit of liberalization Higher efficiency thanks to competition, rationalization, economies of scale Facilitating trade in goods (e.g. agricultural product export by global distributors) Poverty reduction by connecting poor farmers with world market Liberalization on MFN basis would avoid market concentration and power by a few large foreign firms Challenges of liberalization Social impacts of displacement of small traders IPR enforcement, especially in franchising and commisioned agents Institutional capacity in regulating health, environment, and preventing fraud (abuse of direct selling). Thank you for your attention