Study on the Performance Evaluation of the Parent

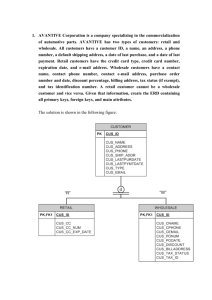

advertisement

Study on the Performance Evaluation of the Parent-Subsidiary Corporation’s Financial Management and Control Xi Zhao, Guo-hong Li, Jia-yin Liu, Hang Xu Department of Management and Economics,Tianjin University,Tianjin 300072,P.R.China, (summarljy@sina.com) Abstract - Focusing on 84 listed parent corporations, this paper examines their performance after implementing financial management and control, adopting two methods, financial index analysis and factor analysis. Next, a comparison was made among different industries concerning financial performance, and also a trend analysis on years after conducting financial management and control. A conclusion can be drawn that not all corporation undergoing financial management and control meet their goals successfully. Therefore to optimize corporate resources and maximize their performance, an effective pattern of financial management and control should be established in accordance with certain industry characteristics and the specific internal and external environment in which the company stand. Key Words - Parent-Subsidiary Corporation, Financial Management and Control, Performance Evaluation, Factor Analysis I.INTRODUCTION In recent years, with the acceleration of economic globalization, many companies are faced with internal management issues deriving from complex corporate structure and expanding size. Being the inevitable choice for most companies, Parent-Subsidiary Corporation have made significant progress on financial management and control. However problem emerges accompanying with the progress: firstly, irrational structure designs. When designing their organization structure, some companies fail to integrate financial management with internal and external environment. As a result, they are unable to relocate resources reasonably. Second, devoid of the awareness on account of financial management and incomplete control techniques, risk concerning the loss of asset is aggravated. Thirdly, conflicts within the company arouse when parties within the corporation fail to recognize their function. Last, as the group members are independent legal person, and capital is the main link connecting members within the group, in order to make the company become one economic composition, financially enhancing the integration of control has become very necessary. II.CASE STUDY A. SAMPLE AND INDEX Samples are chosen from companies listed on the main board of the Shanghai Stock Exchange (hereinafter referred to as SHE) and Shenzhen Stock Exchange (hereinafter referred to as the SZSE) from2009 to 2011. As the group 's consolidated financial statements is prepared by parent company, according to the December 31, 2009 stock holding ratio, screen in 50% and above, which have control over the company. Then, on the basis of the information concerning financial control disclosed in financial reporting and internal control evaluation report eliminates those who does not disclose or not clearly disclosed by the company. Finally, some listing corporation financial condition are in the presence of abnormalities, or continuous loss of two years of above, or insolvent, if these companies are taken into the sample, the validity and applicability will be greatly affected. Thus eliminate the PT, ST, *ST listing corporation. More over leave out companies with data omission or deletion of the index. After screening, a total of 84 listing corporation meet the requirement. In order to thoroughly evaluate the company's performance, this paper choose 15 indicators reflecting the company profit ability, cash flow ability, operation ability, growth ability and the debt paying ability, respectively. B.HYPOTHESIS The fundamental purpose of parent company financial management and control is to regulate subsidiary financial operation, to achieve final group benefit maximization. In order to highlight the focus of this paper, put forward the following research hypothesis: (1) the financial data is true and reliable We suggest that listing Corporation financial report is true and reliable, and its disclosure has been audited; the compilation of financial data strictly abide by the laws and regulations and related financial system requirements. (2) the parent company financial control goal is to realize the group benefit maximization Financial management and control plays a core role in the group of the whole control system. Its establishment is beneficial to strengthen the group's cash flow and the use of risk prevention, and is conducive to the assets operation, r the cost reduction. (3) the selection of the financial index is appropriate This paper selects15 financial indexes which comprehensively reflecting profitability, operating cash flow ability, operation ability, growth ability and the debt paying ability. It is highly relevant with the company's performance evaluation. C.FACTOR ANALYSIS This paper uses factor analysis method to study the performance of company which going through financial management and control. The starting point is to use fewer independent factor variables instead of the original variables, to extract the information. The public factor is expressed as a linear combination of the original variables to get the factor score. And then take the public factor variance contribution rate as weight to calculate integrative factor scores. The model is as the following. wY = m Wi = i (2) i 1 Fj = m i 1 i ij (1) Among them, Fj is the j object composite score; wi is the public factor weight. III. RESULT According to the SPSS output of the common factor variance contribution rate and factor score coefficient matrix, the performance from ula for each year can be established by using the factor scores model. Finally we can calculate the general performance for every sample and on every year. In order to make a comparison between different industries, we divide the sample into six categories, mining industry, manufacturing industry, energy and building transportation, wholesale and retail industry, the real estate industry and other industries. A comparison was made among different industries concerning financial performance, and also a trend analysis on years after conducting financial management and control. A.HORIZONTAL COMPARISON Figure 3 performances in 2011 According to figure 1, 2, 3: in 2009, the mining industry performance scores the highest, followed by the wholesale and retail industry and real estate industry. In 2010 mining industry performance still keeps the lead, the only difference is that the general performance of manufacturing industry has greatly improved. In 2011, firms from other industries except for energy and building show a positive performance. The wholesale and retail industry scores the highest. Comprehensive performance shows, to a certain extent, the effectiveness of financial management behavior. It can also be seen in the figures that, in 2009, the performance of manufacturing, energy and building traffic industry is negative. Firms from these sectors should try to find the reasons for the low performance evaluation, taking the industry characteristics into consideration. And also from a financial perspective, strengthen the subsidiary of the financial management and control. Financial control, investment control and financial risk control are all the groundwork for the financial control system. They secure the maximization of group performance, and support the whole group to remain invincible among intense competition. B. TREND ANALYSIS In order to understand the annual performance movement of each industry, we divide the group into 6 groups: the mining industry, manufacturing industry, energy and building transportation, wholesale and retail trade and real estate. Figure1 performance in 2009 Figure 4 mining industry performance trend Figure2 performance in 2010 (1)The mining industry of integrated performance trend is decreasing year by year. In view of the mining industry with its own characteristics, its biggest problem is how to financially integrate and control important information and resources. The parent company needs to reasonably allocate and monitor resources and funds available to subsidiary, ensuring the rational use of resources and assets. The first thing is to improve the utilization of funds and management, clearly track the flow of funds. Second, regular maintenance of the fixed assets and timely recovery of the idle fixed assets can help to enhance the recovery of funds. Finally, the parent company should perfect the financial supervision mechanism to avoid the waste of funds and assets, and to record funds and assets flow, reduce asset loss. increasing year by year. Financial management structure in most companies is not perfect, and devoid of a comprehensive and effective financial information network. An excellent organizational structure helps to delegate power and keep the control process on a clear, efficient and orderly course. First of all, this group should adopt the mixed financial control mode, directly control subsidiary which makes the greatest contribution. Apply a centralized management over funds and resources; avoid weakening the executive power of the subsidiary. Namely, the parent-subsidiary company relationship of administrative subordination change for the property management mode. Secondly, financial software should be unified to strengthen the centralized management of financial information, optimize the network environment. Figure 5 manufacturing industry performances (2)Manufacturing performance scores overall is first increased and then decreased. In 2009 and 2011comprehensive performance scores are negative, whereas, in 2010 it gains a positive but not very high score. China is a manufacturing country, but with the increasingly fierce market competition, manufacturing management environment and the market environment has undergone a series of great changes. All the time since, financial control in terms of cost is the headache for manufacturers. Traditional manufacturing cost control system is limited and inaccurate especially in terms of cost allocation and accounting in the production process. Huge waste drags down the company's core competitiveness significantly. Regarding the manufacturing industry, intensive cost control mode must be established to cast off this kind of situation. The parent company need to improve the cost control system of execution and supervision, and constantly adjust the cost accounting and allocation mode, having a clear idea of production, supply, sales process costs took place in subsidiary companies. Figure 7 wholesale and retail industry performance (4) Wholesale and retail trade integrated performance scores were decreased and then increased above the 0 level. The form of Wholesale and retail trade in China is fragmented, and came to form at a relatively late time scale. The traditional financial control mode is simple bookkeeping and accounting, lack of management and prediction. Therefore, to the wholesale and retail industry, the key is to improve the financial management control mode, so as to better survival and development. Parent company should strive to introduce high-quality personnel and training, strengthen financial accounting and financial analysis. the financial analysis, especially, should not only attach importance to afterwards analysis, but also the accuracy of analysis, to provide a reliable data base for the group's scientific management. Large wholesale and retail group also should improve control over the logistics costs management, as a reasonable cost control contributes to the group profit. Figure 6 energy and building industry performance (3) In Energy and building transportation area the annual performance is negative, but the trend was Figure 8 estate industry performance (5) Real estate industry comprehensive performance score is also a first down after the increasing tendency. Real estate industry is one of pillar industries of China. The financial control issues are mainly concentrated in three aspect capital, investment and cost. Real estate company is characterized by large investment, long construction period, slow turnover of capital. Therefore, one issue to deal with is the return of capital. Parent company financial management should be strengthened to guarantee the safety and high efficiency of fund circulation. At the same time, the investment arrangement of the subsidiary company should closely monitored and managed. Parent company should pay special attention to company cost, because cost in estate is bigger and relatively more complex, the parent company should perfect the budget control and regulate the cost analysis, by implementing a internal and external audit mechanism. IV. CONCLUSION Enterprise groups play a decisive role in economic development, and to establish a scientific and sound financial management and control system is essential for the group's survival and development. Good financial control system helps to ensure that the group runs normally, and to gain an invincible position in the increasingly intense international competition. First of all, the parent company has special property right relation, so its financial control system appears a multi level composite structure. The parent company, referring to the group's overall strategic, prepares for annual plans and decompose them to affiliates; subsidiaries then establish their annual budget, and reports to the parent company. The parent company is also responsible for the entire group fund distribution, control, supervision and assessment. The subsidiary operates financial activities under the monitor of the parent company. Secondly, according to the empirical data and results can be seen, even though each group company has undergone the implementation of financial control, given the industry's own characteristics and problems, focus are different. Moreover, the financial aspects of the content are different in control modes and means, for different industries, the financial control is not universal. Parent company must combine the life cycle with development strategy, the strategic objectives of the group and the financial control mode to strive to achieve the maximization of group performance. REFERENCE [1] Fama ,and Jensen. The Modem Industrial Revolution, Exit and the Failure of Internal Control Systems .The Journal of Finance, 1983, (3) :831-880 . [2] Jensen,M.C.W.HMeckling.Theory of the firm:managerial behavior,agency cost and ownership structure[J] .Journal ofFinancial Economics, 1976, (3) :305-360 . [3]R.I.Tricker, Corporate Governance, Gower Publishing Company, 1984 [4]Michael J.Sandretto, Controlling Financial Instruments , Management Accounting . 1993(5) [5] Ron Mcgrath,Financiallanning and Control Syetems,Public Administration and Development ,1997 [6] William H.Beaver.Financial Ratios as Predictors of Failure.The Accounting Review,2008,(6):201-220 [7] KoseW.S.Corporate Governance and Board Effectiveness[J].Journal of Banking & Finance, 1998, 22 (22) :371-403 [8] P.T.Menzies, Financial Control As an Aid to Management, Management Decision, 2000(3) [9] Paul Martinkovic, Financial Control for Creative Process Companies, Management Accounting,1995(3) [10]Michael J. Sandretto, Controlling Financial Instruments . Management Accounting,1993(5) [11] Alan Levinsohn, Preparing to Publicize Financial Controls , Strategic Finance, 2003(July)