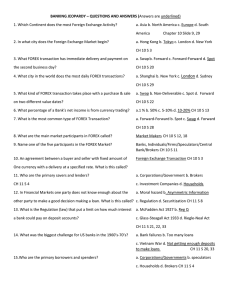

CH 11, Section 3, p. 300 Terms

advertisement

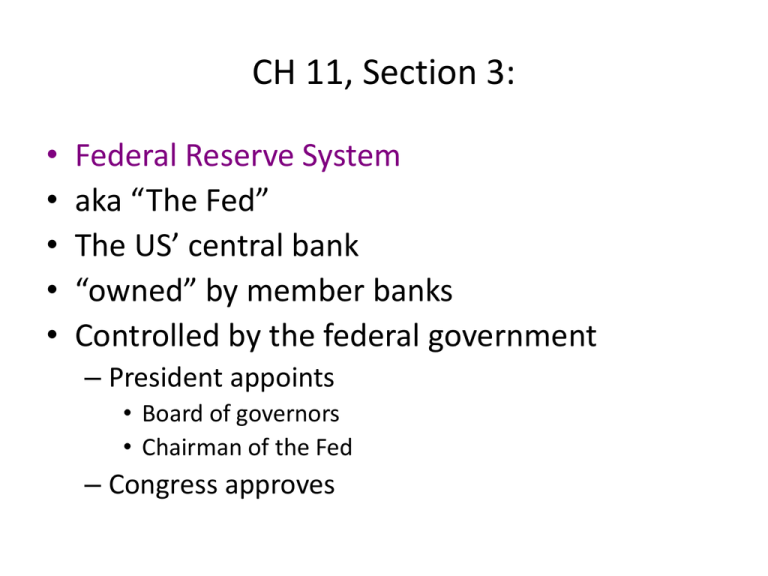

CH 11, Section 3: • • • • • Federal Reserve System aka “The Fed” The US’ central bank “owned” by member banks Controlled by the federal government – President appoints • Board of governors • Chairman of the Fed – Congress approves Central bank • a bank that can lend to other banks in times of need. • National banks required to join • State-chartered banks may opt to join. • Since banks pay to join, they become owners of the Federal Reserve System. Federal Reserve notes • paper currency used by the national system. • Has replaced all other forms of paper currency. – Inconvertible fiat money, since 1934 Run on the bank • a rush by panicked depositors to withdraw their funds from a bank before it fails Bank holiday • brief period where government required banks to close. • In 1933, was done to give Congress time to pass emergency legislation reorganizing the banks. – Banks would have to prove that they could operate effectively and safely or they could not open • Restore public confidence • Took a long time to end the public fear. Commercial bank • • • • handle business and commerce interests. Demand deposit accounts (DDAs) Checking accounts Funds may be removed easily by check or ATM Thrift institution • separate financial institution • Investor accounts • Now allow DDAs Mutual Savings Bank • • • • (MSB) depositor-owned financial organization Benefits only its depositors. Savings bank Many MSBs sold stock and lost their exclusive member-only benefit status. NOW Account • negotiable order of withdrawal. • Checking account that pays interest. • More popular since 1980. Savings and Loan Association • (S&L) depository institution that invests the majority of its depositors funds in home mortgages. • Mortgage payments and interest sustain depositors’ accounts. Credit union • non-profit service cooperative • Owned by and operated for the members • Members usually in the same company or type of work. • Lower fees and interest rates for members • Easier financing Share draft account • Interest-earning checking account • Compete with NOW accounts. Deregulation • to remove or relax government restrictions on business. • 1980s • 1. max interest rate on savings accounts phased out • 2. NOW accounts allowed nation-wide. • 3. all depository institutions could borrow from Fed in time of need. creditor • a person or institution to whom money is owed. • A lender, direct or indirect Chapter 12 Financial Markets Section 1 : • • • • Saving abstinence of spending, not spending Savings dollars that become available when people abstain from spending (do not consume) Financial system • a network of savers, investors, money managing institutions that work to transfer savings to investors. Certificate of deposit • a receipt showing that an investor has made a loan to a bank—or a government or corporate bond. • Considered a savings Financial assets • claims on the property and income of a borrower. Financial intermediaries • financial institutions that lend the funds that investors save to borrowers Nonbank financial institution • nondepository institutions that channel savings to borrowers. – Life insurance companies – Pension funds – Real estate investment trusts Finance company • a firm that specializes in making loans directly to consumers • Buys installment contracts from merchants who sell goods on credit. – Merchants sell credit accounts of debtors to the finance companies. Bill consolidation loan • consumers use this loan to pay off all other debts – Debtor now pays one loan at one interest rate – Advice: do NOT use your other credit sources after you do this….. premium • the installment price one pays for insurance – Monthly, quarterly, annually • Insurance companies store so much money from these accounts and often loan money to others. Mutual fund • a company sells stock in itself to investors • Invests funds in stocks and bonds of other companies. • Used by investors as they would use ordinary stock. – Most funds have expert managers so risk is low. – EX. General Motors would use a mutual fund to raise money to buy stock in Ford and Coca Cola, etc.. Net asset value • (NAV) the value of the mutual fund divided by the number of shares issued by the mutual fund. • = market value of the mutual fund share. Pension • a regular payment made for income security of the investor • Collected after investor – Works a number of years in a career – Reaches a certain age – Suffers an injury (disability) Pension fund • an annuity fund set up to collect investor income and disburse pension payments. • Run by private firms and various levels of government. • Payments are stored money – Pension funds invest these huge amounts of money in stocks and bonds • Private companies make profit doing this • Government insures a large money pool to pay pensions Real estate investment trust • (REIT) a company organized to make loans to construction companies that build homes. • Note: An indicator used to measure the growth of the economy. Assessments: Checking for Understanding • 1 Why was the federal reserve system created? • To give the country a central bank that could lend to other banks in time of need Assessment • 3 Explain why the National Banking System was created • To bring the state banks under control and to help finance the US Civil War Assessment • 4 Explain why deposit insurance developed in the 1930s. • To strengthen banking and insure deposits Assessment • • • • 5 Identify three depository institutions. Savings banks Savings and loan associations Credit unions Assessment • 6 Describe four factors contributing to the S&L crisis. • Deregulation • High interest rates • Inadequate financial reserves • fraud Assessments: Checking for Understanding • 1 Describe the difference between saving and savings. • Saving is not spending • Savings are dollars left over after you buy your necessities and not spent on other goods and services. Image, p. 301 • What is the purpose of the Federal Deposit Insurance Corporation? • To ensure customer deposits in the event of a bank failure. • Current emergency legislation until 2014 = $250,000 • Jan. 1, 2014 = $100,000 Image, p. 302 • What can you infer about the ratio of state banks to national banks? • At present, there are almost 2/3s as many state banks as there are national banks Images, p. 315 • What do lenders receive in return for their funds? • Financial assets—claims on the property/income of borrowers • New term for the current financial disaster: • Toxic assets: • claims on property/income of borrowers that will probably go bankrupt or into foreclosure – Means anyone owning these assets will take a large loss or not get any of the debts back. Quick Write • Why do you think we began policies of deregulation in the 1980s? Do you think we should return to more regulatory policies?