Chapter 9

advertisement

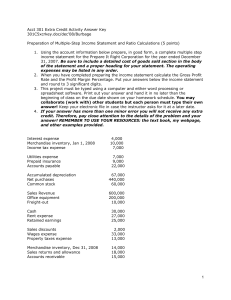

Cost Control Chapter 9 Analyzing Results Using The Income Statement Main Ideas Introduction to Financial Analysis Uniform System of Accounts The Income Statement (USAR) 1. 2. 3. 4. 5. 6. Analysis of Sales/Volume Analysis of Food Expense Analysis of Beverage Expense Analysis of Labor Expense Analysis of Other Expense Analysis of Profits Technology Tools Introduction to Financial Analysis Documenting and analyzing sales, expenses, and profits is called cost accounting or managerial accounting. It allows you to answer the questions: • • • How much money did we take in? How much money did we spend? How much profit was made? Financial statements related to the operation of a foodservice facility are of interest to management, stockholders, owners, creditors, governmental agencies, and often, the general public Uniform System of Accounts The National Restaurant Association has developed the Uniform System of Accounts for Restaurants (USAR). The USAR seeks to provide a consistent and clear manner in which to record sales, expenses, and overall financial condition. The uniform system of accounts attempts to provide operators guidelines rather than mandated methodology. The Income Statement (USAR) The Income Statement The income statement, often referred to as the profit and loss (P&L) statement, is the key management tool for cost control. Each operation’s P&L statement will look slightly different. The income statement (USAR) can better be understood by dividing it into three sections: gross profit, operating expenses, and nonoperating expenses. These three sections are arranged on the income statement from most controllable to least controllable by the foodservice manger. The Income Statement (USAR) Each revenue and expense category on the income statement can be represented both in terms of its whole dollar amount, and its percentage of total sales. All ratios can be calculated as a percentage of total sales except the following: – – – – Food Costs are divided by food sales Beverage Costs are divided by beverage sales Food Gross Profit is divided by food sales Beverage Gross Profit is divided by beverage sales The Income Statement (USAR) The income statement is an aggregate statement – summary. The details can be found in supporting schedules. Example – Question #1 (Income Statement) Analysis of Sales/Volume Foodservice operators can measure sales in terms of dollars or number of guests served. Overall sales increases or decreases can be computed using the following steps: 1. Determine sales for this accounting period 2. Calculate the following: this period’s sales minus last period’s sales. 3. Divide the difference in #2 above by last period’s sales to determine percentage variance. Analysis of Sales/Volume There are several ways a foodservice operation experiences total sales volume increases. These are: 1. Serve the same number of guests at a higher check average 2. Serve more guests at the same check average 3. Serve more guests at a higher check average 4. Serve fewer guests at a much higher check average It is not always obvious from an income statement which of these 4 things are happening. Analysis of Sales/Volume The procedure to adjust sales variance for known menu price increases is as follows: Step 1. Step 2. Step 3. • Increase prior period sales (last year) by amount of the price increase. Subtract the result in Step 1 from this period’s sales Divide the difference in Step 2 by the value of Step 1. Example – Question #2 Analysis of Food Expense A food cost percentage can be computed for each food subcategory. For instance, the cost percentage for the category Meats and Seafood would be computed as follows: Meats and Seafood Cost Total Food Sales = Meats and Seafood Cost % Analysis of Food Expense Inventory turnover refers to the number of times the total value of inventory has been purchased and replaced in an accounting period. The formula used to compute food inventory turnover is as follows: Cost of Food Consumed Average Inventory Value = Food Inventory Turnover Analysis of Food Expense The average inventory value is computed as follows: Beginning Inventory Value + Ending Inventory Value 2 = Average Inventory Value Be sure that a high inventory turnover is caused by increased sales and not by increased food waste, food spoilage, or employee theft. Analysis of Beverage Expense Beverage inventory turnover is computed using the following formula: Cost of Beverages Consumed Average Beverage Inventory Value = Beverage Inventory Turnover If an operation carries a large number of rare and expensive wines, it will find that its beverage inventory turnover rate is relatively low. Conversely, those beverage operations that sell their products primarily by the glass are likely to experience inventory turnover rates that are quite high. Analysis of Beverage Expense If you change your drink prices during the year, you need to adjust your numbers. Similar to the method for adjusting sales, the method for adjusting expense categories for known cost increases is as follows: Step 1. Step 2. Step 3. Increase prior-period expense by amount of cost increase. Determine appropriate sales data, remembering to adjust prior period sales, if applicable. Divide costs determined in Step 1 by sales determined in Step 2. Analysis of Beverage Expense All food and beverage expense categories must be adjusted both in terms of costs and selling price if effective comparisons are to be made over time. As product costs increase or decrease, and as menu prices change, so too will food and beverage expense percentages change. Analysis of Labor Expense When total dollar sales volume increases, fixed labor cost percentages will decline. Variable labor costs will increase along with sales volume increases, but the percentage of revenue they consume should stay constant. When you combine a declining percentage (fixed labor cost) with a constant one (variable labor cost), you should achieve a reduced overall percentage, although your total labor dollars expended can be higher. Declining costs of labor may be the result of significant reductions in the number of guests served. Analysis of Labor Expense Salaries and wages expense percentage is computed as follows: Salaries and Wages Expense Total Sales = Salaries and Wages Expense % COLA (Cost of living adjustments) or raises will require adjustments to your accounting files. Adjust both sales and cost of labor using the same steps as those employed for adjusting food or beverage cost percentage and compute a new labor cost as follows: Step 1. Determine sales adjustment Step 2. Determine total labor cost adjustment Step 3. Compute adjusted labor cost percentage. Analysis of Labor Expense This year’s projected labor cost is computed as follows: This Year’s Sales x Last Year's Adjusted Labor Cost Percentage = This Year’s Projected Labor Cost Increases in payroll taxes, benefit programs, and employee turnover all can affect labor cost percentage. Example – Question #4 Analysis of Other Expense Other Expenses are all Operating Expenses excluding salaries, wages, and employee benefits. For comparison purposes, use the Restaurant Industry Operations Report published by the National Restaurant Association and Prepared by Deloitte & Touche (can be ordered through www.restaurant.org) For operations that are a part of corporate chain, unit managers can receive comparison data from district and regional managers who can chart performance against those of other operators in the city, region, state, and nation. Analysis of Profits Profit percentage using the profit margin formula is as follows: Net Income Total Sales = Profit Margin % Profit variance % for the year can be measured by the following formula: Net Income This Period – Net Income Last Period Net Income Last Period = Profit Variance % Analysis of Profits Profit margin is also knows as Return on Sales, or ROS. For the foodservice manager perhaps no figure is more important than the ROS. This percentage is the most telling indicator of a manager’s overall effectiveness at generating revenues and controlling costs in line with forecasted results. While it is not possible to state what a “good” return on sales figures should be for all restaurants, industry averages, depending on the specific segment, range from 1% to over 20%. Technology Tools The best programs on the market will: 1. Analyze operating trends (sales and costs) over management-established time periods. 2. Analyze food and beverage costs. 3. Analyze labor costs. 4. Analyze other expenses. 5. Analyze profits. 6. Compare operating results of multiple profit centers within one location or across several locations. 7. Interface with the facilities point of sales (POS) system or even incorporate it completely. 8. Red flag areas of potential management concern. 9. Evaluate the financial productivity of individual servers, day parts, or other specific time periods establish by management. 10. Compare actual to budgeted results and compute variance percentages as well as suggest revisions to future budget periods based on current operating results.