Everything Old Is New Again

advertisement

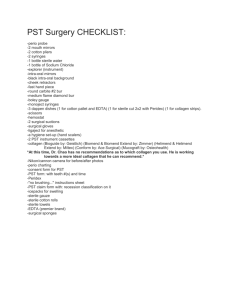

Everything Old is New Again Get ready – PST makes its return in B.C. on April 1 We are rapidly coming to the end of the brief HST (Harmonized Sales Tax) era in B.C. with the return to PST (Provincial sales Tax) looming on April 1. I was reminded of this rapidly approaching transition date this week. When the Province opened its PST registration, I received a flurry of messages from clients wondering about the need to register. With very few exceptions, this is a straightforward return to the PST regime that existed prior to July 1, 2010. The province is in the process of creating new bulletins and notices to provide more guidance as to how the New PST will apply to specific sectors. At this point, we need to rely on the PST Bulletin issued by the B.C. Government on October 15, 2012 entitled “General Transitional Rules for the Reimplementation of the Provincial Sales Tax”. In this Bulletin, the government indicates that “the PST will generally apply to the same tangible personal property (goods) and services that were subject to PST prior to the implementation of the HST”. In order to refresh everyone’s memory, here are some key points about the PST in B.C.: PST is a retail sales tax. This means it applies when a good or service is acquired for personal or business use. Unlike the GST/HST, a PST registrant can not get a tax credit for PST paid. PST will apply to most goods and taxable services at a rate of 7%. Short term accommodations are taxed at 8% and alcoholic beverages will be taxed at 10%. PST generally applies to the purchase or lease of new or used goods in B.C., or goods acquired outside B.C. for use in B.C. It also applies to the purchase of software, services relating to taxable goods (such as installation and repair), legal services and telecommunication services (including internet). Gifts of vehicles, boats and aircraft are also subject to PST. The main exemptions are food for human consumption (e.g. basic groceries and prepared food such as restaurant meals), books, newspapers and magazines, children’s clothing and bicycles. In addition, sales of real property (real estate), admissions and memberships, professional services (other than legal services) and transportation services and fares are also generally exempt from PST. PST does not generally apply to equipment used in a manufacturing process. This means a winery should not be subject to PST on the purchase of equipment it uses directly in the wine production process, but would pay PST on equipment purchased for administration or sales functions. PST does not apply to goods purchased for resale. A winery would not have to collect PST on wine it sells to a PST registered licensee for resale as long as it obtains the licensees PST number. Farmers generally do not need to register for PST as their farm produce is generally exempt from PST. An exception would be an estate winery which grows its own grapes, then uses them to produce and sell wine within the same entity. We have been advised that Farmers will be entitled to exemptions for purchases of certain qualifying equipment and other supplies, as they previously were. At the time of writing we are awaiting the release of the Regulations. On April 1, the PST will apply again to the sale of alcoholic beverages, such as wine, at a rate of 10%. This will mean that the 12% HST will be replaced with 5% GST and 10% PST. The government has indicated that it will adjust mark-ups in government and private liquor stores in order to keep shelf prices constant. For wineries selling wine direct to consumer, this means 3% more tax to charge and remit and a choice to either increase prices or accept a lower margin. Taxable goods that are brought in to B.C. are generally subject to PST. Vendors in other provinces who sell into B.C. may be required to register and collect PST from their B.C. customers. If PST has not been charged on taxable goods, the purchaser is required to selfassess and remit the PST. Depending on your business needs, the PST could be far more complex than you anticipate. To ensure you have considered the impact from every angle, review the following checklist: Are you planning a major purchase? Do you ship across provincial borders? Do you sell intangibles (memberships, copyrights, access to software, digital files) to clients in B.C.? Do you have contracts that will overlap April 1, 2013? Do you provide taxable benefits to your employees? Do you expect any sales returns immediately before or after April 1, 2013? Do you pre-sell products or services that are delivered on a future date? Do you bid on projects for future start dates? Do you embark on multi-month contracts? Do you work with sub trades? Are you involved with the construction of real property? Do you provide services to real property? Do you own a reserve-based business? Do you provide services to someone on a reserve? If you answered yes to any of these questions, you should consider additional consultation with a business advisor who is familiar with the PST transition process. A little pre-planning now could save you dollars and headaches in the months to come. Geoff McIntyre, CA is a business advisor to the Agrifood industry in MNP’s Kelowna office. To find out what Geoff can do for you, contact him at 250.763.8919 or geoff.mcintyre@mnp.ca.