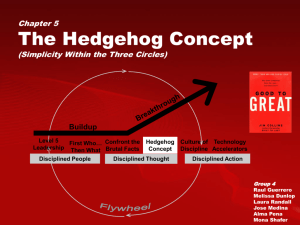

The Hedgehog Concept (Simplicity within the Three Circles

Kelly Bredensteiner

Christine Cox

Cailtin Greenwood

Michele Haynes

Hedgehog or Fox

Fox

Knows many things

See the world in all its complexity and pursue many things at one time

Moving on many levels and are then scattered and are not unified on one concept

Hedgehog

Knows one big thing

Simplify a complex into a single organized idea

Reduces all challenges and dilemmas

Walgreens

Took a simple concept and implemented with fanatical consistency …“The best, most convenient drugstores, with high profit per customer visit.”

Replace all inconvenient locations with convenient ones

Pioneered drive-through pharmacies

Idea of profit per customer visit

Tight clustering of stores - local economies of scale

High-margin services - Increase profit per customer visit

More convenience – more visits more profit per visit

The Three Circles

“A hedgehog Concept is a simple, crystalline concept that flows form deep understanding about the intersection of the following three circles:”

What you can be the best in the world at?

What drives your economic engine?

What are you deeply passionate about?

Three Circles Concept

What Drives

Your

Economic

Engine

What you Are

Deeply

Passionate

About

What you

Can Be the

Best In The

World At

Understanding what you can and cannot be the best at

Put away the ego and understand:

1.

What are you best at?

2.

What are you not best at?

3.

What do you need to change or dump? (outsource?)

Plans vs. Ability

Hedgehog Concept is NOT

what you plan or intend to be the best at

It IS

What you CAN be best at.

Wells Fargo- Keeping it Simple

What it didn’t do well:

International operations

What it did well:

Running a bank like a business esp. in the western US

How it kept it simple:

Dropped most of its IOs

Conclusion:

When deregulation occurred, Wells Fargo was king

Core vs. Ability

Just because its your core.

Just because it’s what you have been doing for years.

Does NOT mean its what you’re best at.

Abbott vs. Upjohn: Changing Cores

Both similar companies in 1964

Why did Abbott change so dramatically?

How it employed the Hedgehog Concept:

Lost chance to be best in pharmaceuticals to Merck

Still chance to provide cost effective health care with

Nutritional and diagnostic services

Money and Growth vs. Greatness

Just because you’re growing and making money,

Does NOT mean you are the best in the world.

“Doing only what you are good at will only make you

good.” (pg 101) Greatness focuses on your best attributes

Ex: SAT’s and the exceptional math student vs. the average student

Companies Employing the

Hedgehog Concept

Gillette

Kimberly-Clark

Kroger

Nucor

Philip Morris

Pitney Bowes

Walgreens

Wells Fargo

Insight Into Your Economic Engine- What is

Your Denominator?

A company does not need to be in a great industry to become a great company

Each good-to-great company built an excellent economic engine

They attained profound insights in their economies

Attained a deep understanding of the key drivers in its economic engine and built its system in accordance with this understanding

Economic Denominator

All good-to-great companies have an economic denominator

Asking one question can lead to profound insight into the inner workings of an organization’s economics

This question is “if you could pick one and only one ratio- profit per x (or, in the social sector, cash flow per x)- to systematically increase over time, what x would have the greatest and most sustainable impact on your economic engine?

Economic Denominator Example

The denominator can be quite subtle, sometimes even unobvious.

The key is to use the question of the denominator to gain understanding and insight into your economic model

You can have more than one economic denominator, but it is better for the company to strive for only one.

Examples of Economic

Denominators

Abbott: per employee

Circuit City: per geographical region

Fannie Mae: per mortgage risk level

Gillette: per customer

Kimberly-Clark: per consumer brand

Kroger: per local population

Nucor: per ton of finished steel

Philip Morris: per global brand category

Pitney Bowes: per customer

Walgreens: per customer visit

Wells Fargo: per employee

Successful Companies Without

Hasbro

Economic Denominators

More sustainable cash flow than big one time hits

Understood all three circles of the Hedgehog Concept

Reintroduced classic brands at the right time

Employees had a passion for the business

Didn’t stay within the three circles after the CEO

Stephen Hassenfeld Died

If you successfully apply these ideas, but then stop doing them, you will slide backward, from great to good, or worse. The only way to remain great is to keep applying the fundamental principles that made you great.

Understanding Your Passion

Many CEOs of companies are passionate consumers of their products

In 1979, Ross Millhiser, then vice chairman of Philip

Morris and a dedicated smoker, said, “I love cigarettes.

It’s one of the things that makes life worth living.”

Passion became a big part of the Hedgehog Concept in good-to-great companies

You cant manufacture passion or “motivate” people to feel passionate. You can only discover what ignites your passion and the passion of those around you.

Understanding Your Passion Cont.

You don’t necessarily have to be passionate about the product but more on what the company stands for.

For example, employees of Fannie Mae were not passionate about the mechanical process of packaging mortgages into market securities. But they were motivated by the whole idea of helping people of all classes. Backgrounds, and races realize the American dream of owning their own home.

The Triumph of Understanding Over

Bravado

Pre-hedgehog

State of fog creating a slow progression on a long march

Hedgehog

Fog lifts and less deliberation is required at each juncture

Post-hedgehog

Quickly make decisions

Great Western vs. Fannie Mae

Great Western

Focused on growing in every way possible

Found itself in finance, leasing, insurance, and manufactured houses on an expansion binge

Fannie Mae

Focused on being the best capital markets player in anything related to mortgages

Inspired workers by its vital role in democratizing home ownership

After 1984 when Fannie Mae clarified its Hedgehog

Concept, the company’s stock charts exploded upward while Great Western lagged around until its acquisition in

1997

Acquiring a Hedgehog Concept

It took about 4 years for the good-to-great companies to clarify their hedgehog concepts

It is an inherently iterative process, not an event

Essence of the process is to get the right people engaged in dialogue and debate, infused with the brutal facts and guided by the questions formed by the 3 circles

The Council can be a useful device for stimulating the process of acquiring a hedgehog concept

The Council

Consists of a group of the right people who participate in dialogue and debate guided by the three circles

Ask the right questions

Engage in dialogue and debate

Make decisions

Autopsy the results

Learn

Hedgehog Concept

Does every organization have a Hedgehog Concept to discover?

Most good to great companies were not the best in the world at anything

Infused with the Stockdale Paradox, every company prevailed in its search

When you get the concept right, it has the quite ping of truth