Presentation - Global Capital Allocation Fund

advertisement

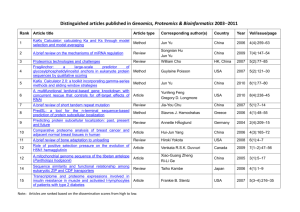

Summary Managed Futures Program • • • • • • • • Profit from upward and downward long-term price movements in assets Systematic and automated Low trading frequency 130 futures contracts monitored across 25 global exchanges Low correlation to traditional investments Liquid investment in exchange traded futures contracts Quarterly entry and exit; no lock-up 5-Year+ investment horizon Exposure to all major asset classes • • • • • • • • • Currencies Energy Equity Indices Grains Interest Rates Meats Metals Soft Commodities Volatility Investment Philosophy Axiom: “... a premise or starting point of reasoning. As classically conceived, an axiom is a premise so evident as to be accepted as true without controversy.” * Axiomatic regularities emerge when an asset is traded in a marketplace • Shorter term patterns • • • • • • Tend to be axiomatic regularities – emerge from the interplay of fundamental drivers and crowd behaviour Are well known market phenomena – the source of profits are less susceptible to degradation, competition and market frictions * http://en.wikipedia.org/wiki/Axiom It is self-evident that • Tend to be transient Are easily arbitraged away Are fragile to the need for continued evolution, improvement in speed and execution Longer term patterns • Long-term price trends are axiomatic of all asset markets • • Asset price movements are distributed nonnormally; and at times tend to persist in one direction or another These regularities are reliable sources of trading edge; however • • • One must face a long-term investment horizon One must face long periods of under-performance punctuated by short periods of high profitability One must be comfortable utilising crude heuristics that are not fragile to changing market regimes Methodology The Global Positioning System (GPS) • • • • A long-term trend following system Algorithmically simple – aims to mitigate fragility to changing market regimes via simple heuristics consistently applied to all markets Applied to a basket of 130 futures markets across all major asset classes Automated order entry, execution, portfolio monitoring and risk management The Trading Process • • • • • GPS continues to monitor and manage the trade so long as the price trend continues in the same direction Conducted on an individual trade basis • • Allocated capital is in part determined by recent volatility and liquidity conditions A covering stoploss order is activated, monitored and adjusted throughout the life of the trade If the potential trend emerges • Risk Management • Employs a variety of order types A risk controlled long (short) position is taken when GPS signals the potential for an upward (downward) price trend Each position is small enough to mitigate the risk of volatile inter-market correlations Automated and algorithmically defined • If the trend fails to materialise • The position is exited with a small loss when the predefined stoploss is executed Performance CHARTS CUMULATIVE PERFORMANCE ASSETS UNDER MANAGEMENT $2,000,000 140% $1,500,000 120% $1,000,000 100% $500,000 80% $0 Jun 2011 60% 40% Jun 2012 Jun 2013 Jun 2014 MONTHLY AVERAGE MARGIN-TO-EQUITY 35% 30% 20% 0% Jun 2011 25% 20% Jun 2012 Jun 2013 15% Jun 2014 10% -20% 5% 0% Jun 2011 -40% Jun 2012 Jun 2013 Jun 2014 PERIOD RETURNS ^ Global Positioning System (GPS) May 0.88% 3mth -3.12% YTD FYTD* 1yr 3yr 32.2% 82.39% 100.47% 115.92% 5yr - 10yr - Total 104.84% Performance MONTHLY PERFORMANCE ^ Year 2015 2014 2013 2012 2011 Jan 37.96 0.58 2.63 -3.16 Feb -1.08 2.79 -2.04 -2.12 Mar 6.01 2.50 3.34 -0.76 Apr -9.42 8.41 1.51 0.62 May 0.88 8.98 0.62 -3.05 Jun Jul Aug Sep Oct Nov Dec 9.91 -3.23 -9.01 3.79 -4.18 1.73 3.77 6.14 -1.19 -5.14 -3.80 6.53 -2.52 -3.01 0.83 -6.43 2.49 -0.52 -3.08 18.87 1.29 2.64 4.01 5.68 -1.40 1.99 1.90 YTD 32.20 89.85 -3.00 -18.62 3.39 FYTD* 82.39 30.00 0.08 -13.68 DD -9.42 -6.43 -10.69 -22.26 -6.00 STATISTICS Mgmt Fee Performance Fee High Water Mark 2% 20% Yes Annual Vol Sharpe (1%) Annual Return 25.5% 0.79 20.09% Assets Worst DD Min Investment $1,572,254 -23.17% $50,000 Avg Margin to Equity 16.91% Trading Frequency** 1258 CONTRACT UNIVERSE Currency 23% Energy 6% Equity Index 17% Interest Rate 20% Meat 2% Metal 5% Soft Commodity / Grain 21% Volatility 4% Glo bal Capital A llo catio n Fund is o nly available to eligible investo rs who qualify as "who lesale investo rs" under sectio n 761G o f the Co rpo ratio ns A ct. Glo bal Capital A llo catio n Fund is managed by Ho bereau Investments P ty Ltd (A FS Licence No 244539) please co ntact M ax M erven (max@ho bereau.co m.au; max@gcaf.co m.au) to check if yo u qualify. This statement is intended to pro vide general backgro und info rmatio n o nly and is no t a "pro duct disclo sure statement" as defind in P art 7.9 o f the A ct and may no t co ntain info rmatio n that may be expected to be fo und in either a regulated pro duct disclo sure statement, o r any o ther regulated disclo sure do cument. P ast perfo rmance is no t necessarily indicative o f futures results. The risk o f lo ss in trading futures is substantial. While all reaso nable care has been taken to ensure that this do cument is co mplete and co rrect, Ho bereau Investments P ty Ltd accepts no liability fo r any erro rs o r o missio ns in this do cument. ^ Net o f fees * Calendar year (YTD) figures are pro vided fo r co mparative purpo ses; GCA F o perates o n a July-June financial year (FYTD) ** A verage Ro und Turns P er Year P er $ millio n www.gcaf.com.au Comparison Managed Futures Funds * Altis Partners Beach Horizon Campbell & Company Chesapeake Capital Covenant Capital Management Drury Capital Dunn Capital Eckhardt Trading EMC Capital Hawksbill Capital Hyman Beck and Co Mark J Walsh & Co Rabar Market Research Tactical Investment Management Transtrend Winton 2011^ -7.67 1.87 1.30 -5.83 3.60 -6.05 25.02 -13.43 -0.86 -11.95 0.74 2.62 -7.06 -12.46 -3.43 6.57 2012 -10.04 -19.51 1.42 -15.81 2.12 -4.64 -18.63 3.83 6.19 -13.66 -19.60 -4.96 -6.74 1.03 0.73 -3.24 2013 -3.79 -8.37 10.07 25.38 0.55 9.58 34.16 0.76 -7.42 -19.68 7.51 -10.68 -0.79 -14.56 -0.61 7.98 2014 12.20 41.32 19.67 13.77 27.07 20.76 35.67 16.09 24.90 22.11 15.48 33.63 19.85 50.07 17.48 15.23 2015 3.63 -0.35 2.62 2.04 -8.29 -4.07 6.46 3.97 2.74 4.17 4.58 -2.65 -1.64 1.37 -1.62 1.31 Total Annual -7.08 5.80 38.88 15.40 23.98 13.74 97.11 9.32 25.06 -22.33 5.16 13.32 1.36 14.94 11.74 29.98 -1.86 1.45 8.75 3.72 5.64 3.34 18.92 2.30 5.88 -6.25 1.29 3.25 0.35 3.62 2.87 6.92 Average -1.69 -6.34 1.88 24.08 0.89 17.27 3.76 14.78 1.30 11.63 8.96 0.26 Global Capital Allocation Fund 3.39 -18.62 -3.00 89.85 32.20 104.84 20.09 25.50 2.61 24.25 9.29 0.79 4 14 11 1 1 1 1 17 1 Ranking Std Dev Dev Ratio ` Up Dev Down Dev Sharpe 1% Correl 15.07 1.19 11.43 9.57 -0.12 0.61 12.66 1.15 9.47 8.22 0.10 0.51 12.61 1.43 10.45 7.32 0.65 0.46 12.70 0.99 8.88 8.98 0.27 0.34 12.23 1.57 10.31 6.57 0.43 0.24 15.24 1.12 11.30 10.07 0.23 0.39 24.41 1.67 21.30 12.79 0.79 0.45 12.91 1.06 9.31 8.79 0.16 0.27 16.22 1.56 13.62 8.73 0.37 0.30 20.68 1.21 15.81 13.05 -0.26 0.39 15.61 0.98 10.81 11.05 0.10 0.49 16.11 1.48 13.26 8.93 0.21 0.48 11.27 1.07 8.15 7.62 -0.00 0.32 21.36 1.55 17.81 11.49 0.22 0.46 9.69 1.25 7.51 6.03 0.24 0.55 7.69 1.59 6.66 4.20 0.78 0.47 0.42 Assets ($m) $311 $107 $4,735 $294 $165 $231 $602 $337 $105 $65 $182 $89 $133 $68 $4,930 $26,800 $2,447 $1.57 1 * All comparison data is publically available information sourced primarily from www.managedfutures.com and www.iasg.com; and in some cases, individual fund websites. Each fund in the list is chosen based on its publically acknowledged strategy to profit from (at least in part) long-term price trends. The flagship program has been selected where a manager runs more than one program. The purposes of this comparison is to illustrate that the financial returns extracted by GCAF via the Global Positioning System have characteristics that would be reasonable to expect by targeting profits from long-term price trends. ^ From 1 July 2011. ` The Deviation Ratio is the ratio of upside deviation to downside deviation. Upside deviation is the standard deviation of monthly returns where negative months are held constant at 0. Downside deviation is the standard deviation of monthly returns where positive months are held constant at 0. The Managers Adam Tomas • Tomas Technology Pty Ltd • • • • • • • Bachelor of Commerce – First Class Honours in Finance Master of Computing (on hiatus) Hobereau Investments Pty Ltd • • • • • • Responsible Officer / Business Manager Australian Financial Services Licence – 244539 Custodial Services 30 years investing and managing risk in financial markets • • Intra-day to multi-year position taking Bonds, equities, commodities, futures, options, physical electricity and gas Specialise in computational approaches to trading Education • • Portfolio Manager Trading software and algorithm development Management of GPS and IT infrastructure 12 years trading financial and commodities markets • • Max Merven Director Risk Management Macquarie Bank Principal trader and investment manager of Hobereau since 2000 Specialising in equities, options and futures Education • • Bachelor of Commerce – Accounting and Finance Institute of Chartered Accountants in Australia

![[#DASH-191] Replace JERSEY REST implementation by](http://s3.studylib.net/store/data/005918124_1-33fb89a22bdf4f7dbd73c3e1307d9f50-300x300.png)