HNDA2 - Sup Doc 7 Final Oxford Economics HNDA Tool

advertisement

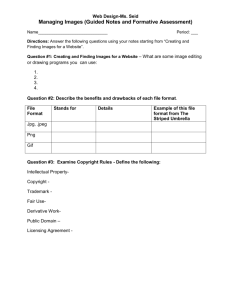

SES Areas: Selecting appropriate scenarios in the CHMA tool Oxford Economics were commissioned to evaluate the range of available housing scenarios in the CHAM HoNDA toolkit and recommend the range of scenarios selected for each of the 6 SES areas. This short report seeks to outline our selection and justify each, based on the evidence. Prepared for Edinburgh City Council Overview Executive summary Introduction and approach Evidence and rationale 2 Executive summary Executive summary – approach Oxford Economics were asked to examine the range of alternative scenarios available in the Centre for Housing Market Assessment’s (CHMA) HNDA model for the 6 South Eastern Scotland areas. The research undertaken and recommendations made consider the above factors in relative independence. Thus, we did not consider what impact the factors or scenarios chosen would have on housing market demand. Instead, we focussed solely on our expectations of which scenarios best reflected the future outlook for the area. Oxford Economics’ Local Model of Administrative Districts (LOMAD) produces economic forecasts for income, house prices and affordability. These were utilised in the comparison of HNDA scenarios, with our methodology to recommend the scenario that best represented our baseline expectations. We applied bespoke methods to inform our thinking regarding income distribution and intermediate (rental market) demand. An overview of our baseline modelling methodology is included within the report, and a brief overview of our approach to income distribution and intermediate demand is below: Income distribution: Firstly (and primarily), we focussed on historical trends within the ASHE data. This was augmented by a review of research we previously undertook in the US and finally checked against baseline sectoral employment forecasts. Intermediate (rental market) demand: we developed a bespoke model based on the average house price*Bank of England base rate and expected income levels (drawn from our earlier forecasts). From this, we forecast private rent values across the SES area. Guidance within the HNDA model suggests that this element of the tool should only be used when the user has a strong inclination that rental values will move considerably different from house prices 4 Executive summary – scenario recommendations Area / Input 3a) Income growth 3b) Income distribution 4) Prices & affordability 5) Intermediate demand East Lothian Modest Increase Creeping Inequality No Real Growth No Real Growth Edinburgh Modest Increase Creeping Equality OBR Estimates Modest Increase Fife Modest Increase Creeping Inequality No Real Growth No Real Growth Midlothian Modest Increase Creeping Inequality No Real Growth No Real Growth Scottish Borders Modest Increase Creeping Equality No Real Growth No Real Growth West Lothian Modest Increase Flat Strong Recovery Modest Increase 5 Executive summary – rationale The table above outlines the scenarios we would recommend from the HNDA. Our rationale was to prioritise the longer term trends over those in the short / medium term. There is a suitable degree of similarity across the SES areas; indeed, only Edinburgh and West Lothian show significant variation. The rationale for this is below: Edinburgh: Oxford Economics expect the economic recovery to be focussed around professional (‘tradable’) services, most concentrated in urban areas. As a result, our forecast for the City of Edinburgh suggests 36,100 additional jobs and 71,100 additional people by 2030. Therefore, it is not unexpected that the scenario recommendations for the city would vary on the upside from those in the surrounding areas. West Lothian: Development around Edinburgh Airport, in conjunction with the on-going tram line development in Western Edinburgh has led to an increase in economic activity in the west of the City which creeps out into the surrounding city region areas. As a result, population in West Lothian has expanded by over 12% since 2000, and is forecast to grow by a further 12% by 2030 (22,000 additional people). Similarly, employment is expected to grow by 14%. The increased economic prosperity results in increased demand for housing, thus increasing house prices. The historical data for income distribution is considerably volatile, hence resulting in ‘flat’ being chosen as the most appropriate outcome. A comprehensive evidence base underpinning our rationale is provided in the main body of the report. We believe the primary recommendations are the most likely outcomes, but in certain cases, have suggested an alternative, secondary recommendation. 6 Introduction Introduction Oxford Economics were asked to examine the range of alternative scenarios available in the Centre for Housing Market Assessment’s (CHMA) HNDA model for the 6 South Eastern Scotland areas. In particular, we were asked to make recommendations regarding: Income growth, Income distribution, house prices / affordability and Intermediate (rental market) demand. The research undertaken and recommendations made consider the above factors in relative independence. Thus, we did not consider what impact the factors or scenarios chosen would have on housing market demand. We focussed solely on our expectations of which scenarios best reflected the future outlook for the area. We feel this is the most appropriate approach to achieve genuine independence, as the factors above are likely to move with independence against the housing market. Oxford Economics’ Local Model of Administrative Districts (LOMAD) produces economic forecasts for income, house prices and affordability. These were utilised in the comparison of HNDA scenarios, with our methodology to recommend the scenario that best represented our baseline expectations (Within reason – there were no instances where the difference between our expectations and HNDA’s options were sufficiently different to require a user-defined input). . We applied bespoke methods to inform our thinking regarding income distribution and intermediate (rental market) demand. These are discussed on the next slide. It should be noted that the scenario growth rates for income, house prices and rental market demand within the HNDA do not vary by area. In the interest of transparency, we have provided a table outlining the growth rate for each immediately following our approach 8 Approach – Income forecasting Relative workplace based wages Historical Imposed forecast Aim: Manually checked forecast Scotland weekly wage Scaled to Scotland forecasts Final LGD workplace based weekly wages 9 Oxford Economics’s LOMAD model uses the Annual Survey of Hours and Earnings (ASHE) data and forecasts the average weekly wage on both a resident and workplace basis. Our approach to forecasting wages considers the local authority's ■ Relative wage in comparison to the Scottish average; ■ Actual wage / expected wage (ensuring the sectoral composition of the local economy has an impact) Scotland annual The income data are forecast in nominal earnings from terms and are aggregated to ‘average MRM annual income’ by multiplying by 52. Resident based income was used as a comparator to the HNDA, in line with the CACI data used within. HNDA growth rates – income CHMA Growth rate, forecast, Income, All areas, selected years Source: CHMA 10 Approach – income distribution Primarily, we focussed on historical statistical trends, using the Annual Survey of Hours and Earnings (ASHE). We examined the interquartile range (25th / 75th decile) from 2002-2012; we then forecast this based on either: a) a trend formula, b) compound annual growth rate formula or c) set it flat (largely due to volatility in the data). We then considered which outcome was most feasible. The vast majority of projected income distribution were set on trend; only West Lothian was set as a ‘flat’ forecast, due to considerable annual volatility in the data. This approach was augmented by considering previous research undertaken on income distribution (Household income distribution in the US, 2011), which suggested a greater creeping equality of incomes across the US, with more people moving into the higher income brackets. However, where this viewpoint varied from the empirical evidence, we opted for the latter. Finally, we compared the forecast interquartile range trends against sectoral employment forecasts as a final check. The sectors were broadly classed as ‘high income’ and ‘low income. The aim of this element of the approach was to ensure that the local economic structure did not vary sufficiently to suggest the presence of more higher income sectors / lower income sectors over the forecast period. Whilst there are expected changes in sectoral composition, none were deemed sufficiently prominent to warrant a change in our initial recommendation. (We wanted to ensure that, for example, a high income sector such as financial services did not move from employing 10% of the local workforce to employing 20%; such a move could have led to increasing income inequality). 11 HNDA growth rates – income distribution CHMA Growth rate, forecast, Income distribution, All areas, Selected years Source: CHMA 12 Approach – house prices / affordability Scotland new House price data at a local authority level is notably LGD new house prices house prices volatile. (This is a UK-wide problem and is not unique Historical Historical to Scotland). Oxford Economics source our house Relative new price data from the Registers of Scotland. Our house prices approach to forecasting local authority house prices Historical utilised the behavioural effects within the Scottish forecasts (derived from our regional model). The local dimension is driven by: Imposed forecast ■ Relative wage levels between the local authority and Scotland; ■ Relative labour market performance (measured through unemployment levels) Our expectations are largely that house prices will grow in line with inflation – outside Edinburgh and West Lothian (discussed later), and hence the ‘no real growth’ option was common. In reality, there is likely to be a greater upside risk, thus suggesting house price growth could be stronger than forecast here. 13 Aim: Manually checked forecast Scotland new house price from MRM Raw LGD new house price Scaled to Scotland new house prices Final LGD new house price Weighted average of new house prices and population HNDA growth rates – house prices CHMA Growth rate, forecasts, House Prices, All areas, Selected Areas Source: CHMA 14 Approach – intermediate (rental market) demand The intermediate rental market demand scenarios were informed by recent research undertaken on rental prices and rental demand by Oxford Economics for the National Housing Federation across English regions. The literature review undertaken in this research was utilised to inform our thinking about what the factors that drive rental prices. Fahri and Young (2010, University of Auckland) examined private residential rents across New Zealand cities and noted that private rents are primarily driven by: ■ Supply side; mortgage interest payments on buy-to-let properties); and ■ Demand side: ability to pay (income). Thus we developed a bespoke model based on the average house price*Bank of England base rate and expected income levels (drawn from our earlier forecasts). From this, we forecast private rent values across the SES area. Guidance within the HNDA model suggests that this element of the tool should only be used when the user has a strong inclination that rental values will move considerably differently from house prices. Therefore, in instances where rental growth was suitably similar to house price growth – East Lothian, Fife, Midlothian, and Borders), we recommend keeping rents in line with house prices. Only in Edinburgh and West Lothian, where house price growth is expected to be strongest, do we suggest a different outcome – that intermediate demand be set ‘1 scenario slower’ than house prices. 15 HNDA growth rates – intermediate demand CHMA Growth rate, forecasts, Intermediate Demand, All areas, Selected Years Source: CHMA 16 Approach – datasets used (1) Scenario Dataset Last year of data Notes Income growth Annual Survey of Hours and Earnings (AHSE) 2012 Median, Gross pay, all workers, residence based Oxford Economics LOMAD Model 2012, with forecasts to 2030 Median, Gross pay, all workers, residence based Annual Survey of Hours and Earnings (AHSE) 2012 Median wage and percentile data, with distribution measures as the ratio of the 25/75 deciles (as it the methodology in CHMA). All workers, residence based. Oxford Economics LOMAD Model 2012, with forecasts to 2030 Employment by sector forecasts were utilised to provide an insight into employment structure and what the implications of this might be for income distribution Register of Scotland: Local Authority Residential Property Data June 2013 Mean values. The quarterly data are converted to an annual series using a weighted average based on transactions (from the same report). Income distribution House prices 17 Approach – datasets used (2) Scenario Dataset Last year of data Notes House prices Register of Scotland: Local Authority Residential Property Data June 2013 Mean values. The quarterly data are converted to an annual series using a weighted average based on transactions (from the same report). Oxford Economics LOMAD Model 2013 (half year), with forecast to 2030 The forecasts are driven by demand for housing (as measured by population increases), relative income increases (using personal disposable income, which incorporates interest rate changes) and changes in unemployment as a labour market proxy. Scottish Government – Housing Statistics for Scotland (key information and summary tables) 2012 The intermediate demand figures were estimated using a regression equation based on leading academic literature. The Scottish social rental data by local authority was used to ‘sense check’ the estimates. Intermediate demand 18 Rationale and evidence Rationale – the evidence (overview) This section relays the empirical evidence on which the recommendations are based. Specifically: ■ Income growth: A line chart compares the Oxford Economics baseline (our basis for the recommendation) against the scenario chosen from HNDA. This will allow the reader to compare the variation in the two. In no instance did we feel it sufficient to warrant the development of a new scenario. A table also compares the Oxford baseline growth rate against the range of scenarios in the HNDA. ■ Income distribution: For each area, a line chart is plotted to show how the income distribution measure (the interquartile range) is forecast to change. This shows the Oxford expectation, the scenario we recommend and all other scenarios. ■ House prices / affordability: A line chart highlighting how the Oxford baseline compares against the scenario chosen is provided, along with a table of annual average growth rates, to allow the user to compare how the range of scenario options (and OE baseline) compare. ■ Intermediate (rental market demand): A table comparing the annual average growth rate of our rent prices against the house prices is included to show how they compare. As noted earlier, the emphasis of this scenario within HNDA is that the core assumption should be the same as the expectation of house prices, unless there is sufficient reason to believe otherwise. 20 East Lothian – Income growth East Lothian Income Growth Index, 2011 - 2032 The ‘modest increase’ scenario suggests that the average income will increase to £57,550 in 2030, from £29,700 currently. Note: Option highlighted in yellow is the desired scenario 21 East Lothian – income distribution East Lothian Income Distribution, 2011 - 2032 Forecast 22 We recommend scenario creeping inequality, which forecasts that the average higher earner will earn 3.8 times the average lower earner, a change of 1.9 from current levels. East Lothian – house prices East Lothian House Price Index, 2011 - 2030 The ‘no real growth’ scenario suggests that the average income will increase to £544,000 in 2030, from £371,800 currently. Note: Option highlighted in yellow is the desired scenario 23 East Lothian – intermediate demand Rental market price Increases, In Comparison with House Prices, East Lothian, 2013 - 2030 Note: Option highlighted in yellow is the desired scenario Additional Note: Rental market – median growth House Prices – Mean growth 24 Edinburgh – Income growth Edinburgh Income Growth Index, 2011 - 2032 The ‘modest increase’ scenario suggests that the average income will increase to £57,800 in 2030, from £31,500 currently. Note: Option highlighted in yellow is the desired scenario 25 Edinburgh – income distribution Edinburgh Income Distribution, 2011 -2032 Forecast We recommend scenario creeping equality, which forecasts that the average higher earner will earn 2.7 times the average lower earner, a change of 0.7 from current levels. Alternatively, the second choice – should it be required, would be a flat income distribution, as it is likely there will always be a presence of high value added jobs in Edinburgh with high levels of remuneration. 26 Edinburgh – house prices Edinburgh House Price Index, 2011 - 2030 The ‘OBR estimate’ scenario suggests that the average income will increase to £539,500 in 2030, from £269,000 currently. A modest recovery would be an alternative choice; the growth rate over the period is similar, but the modest recovery suggests a higher level of growth in the short term. OE Forecast OBR Estimate No Real Growth Flat Modest Recovery Strong Recovery Gradual Decline 27 Average Annual % growth 2011-2030 3.8 3.8 2.2 1.2 3.5 4.6 0.1 Note: Option highlighted in yellow is the desired scenario Edinburgh – intermediate demand Rental market price Increases, In Comparison with House Prices, Edinburgh, 2013 - 2030 Based on the analysis undertaken, no real growth is our recommended scenario. However, modest increase is an alternative option. Note: Option highlighted in yellow is the desired scenario Additional Note: Rental market – median growth House Prices – Mean growth 28 Fife – Income growth Fife Income Growth Index, 2011 - 2032 The ‘modest increase’ scenario suggests that the average income will increase to £51,600 in 2030, from £28,050 currently. Note: Option highlighted in yellow is the desired scenario 29 Fife – income distribution Fife Index Distribution, 2011 -2032 Forecast 30 We recommend scenario creeping inequality, which forecasts that the average higher earner will earn 3.9 times the average lower earner, a change of 1.5 from current levels. Fife – house prices Fife House Price Index, 2011 - 2030 The ‘no real growth’ scenario suggests that the average income will increase to £234,000 in 2030, from £159,900 currently. Note: Option highlighted in yellow is the desired scenario 31 Fife – intermediate demand Rental market price Increases, In Comparison with House Prices, Fife, 2013 - 2030 Note: Option highlighted in yellow is the desired scenario Additional Note: Rental market – median growth House Prices – Mean growth 32 Midlothian – Income growth Midlothian Income Growth Index, 2011 -2032 The ‘modest increase’ scenario suggests that the average income will increase to £54,750 in 2030, from £29,250 currently. Note: Option highlighted in yellow is the desired scenario 33 Midlothian – income distribution Midlothian Income Distribution, 2011 -2032 Forecast We recommend scenario creeping inequality, which forecasts that the average higher earner will earn 3.8 times the average lower earner, a change of 1.9 from current levels. Alternatively, the second choice – should it be required, would be a flat income distribution, 34 Midlothian – house prices Midlothian House Price Index, 2011 -2030 The ‘no real growth’ scenario suggests that the average income will increase to £265,900 in 2030, from £181,700 currently. Note: Option highlighted in yellow is the desired scenario 35 Midlothian – intermediate demand Rental market price Increases, In Comparison with House Prices, Midlothian, 2013 - 2030 Note: Option highlighted in yellow is the desired scenario Additional Note: Rental market – median growth House Prices – Mean growth 36 Scottish Borders – Income growth Scottish Borders Income Growth Index, 2011 -2032 The ‘modest increase’ scenario suggests that the average income will increase to £48,750 in 2030, from £26,500 currently. Note: Option highlighted in yellow is the desired scenario 37 Scottish Borders – income distribution Scottish Borders Income Distribution, 2011 - 2032 Forecast We recommend scenario creeping equality, which forecasts that the average higher earner will earn 2.6 times the average lower earner, a change of 0.4 from current levels. Alternatively, the second choice – should it be required, would be a flat income distribution, 38 Scottish Borders – house prices Scottish Borders House Price Index, 2011 - 2030 Forecast The ‘no real growth’ scenario suggests that the average income will increase to £307,350 in 2030, from £206,240 currently. Note: Option highlighted in yellow is the desired scenario 39 Scottish Borders – intermediate demand Rental market price Increases, In Comparison with House Prices, Scottish Borders, 2013 - 2030 Note: Option highlighted in yellow is the desired scenario Additional Note: Rental market – median growth House Prices – Mean growth 40 West Lothian – Income growth West Lothian Income Growth Index, 2011 - 2032 The ‘modest increase’ scenario suggests that the average income will increase to £55,300 in 2030, from £30,100 currently. Note: Option highlighted in yellow is the desired scenario 41 West Lothian – income distribution West Lothian Income Distribution, 2011 -2032 Forecast We recommend scenario flat, which forecasts that the average higher earner will earn 3.4 times the average lower earner, a change of 1.3 from current levels. Alternatively, West Lothian is amongst the fastest growing areas in Scotland and as such, creeping inequality could be considered as a second option. 42 West Lothian – house prices West Lothian House Price Index, 2011 - 2030 The ‘strong recovery’ scenario suggests that the average income will increase to £331,750 in 2030, from £151,800 currently. Note: Option highlighted in yellow is the desired scenario 43 West Lothian – intermediate demand Rental market price Increases, In Comparison with House Prices, West Lothian, 2013 - 2030 Note: Option highlighted in yellow is the desired scenario Additional Note: Rental market – median growth House Prices – Mean growth 44 Based on the analysis undertaken, modest growth is our recommended scenario. However, the strong growth in West Lothian could lead to it emerging as a preferred location to live, and hence strong recovery could be considered as a second option. Contact Details: Alan Mitchell Senior Economist Oxford Economics Tel: 028 9263 5412 amitchell@oxfordeconomics.com