Financial Services Ombudsman

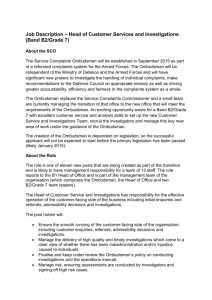

advertisement

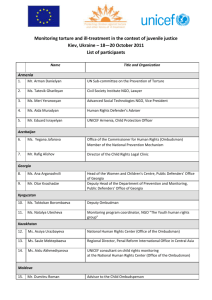

Joe Meade World Bank Workshop Bratislava -13 June 2007 What is an Ombudsman? An independent and impartial means of resolving disputes outside the courts. Investigates matters after a complaint that has been made to the financial service provider has not been resolved to the complainant’s satisfaction. 2006 complaints Insurance Insurance* 1886 Health 100 Intermediaries 142 Others 101 Total 2229 *Non life 1289 Life 597 Credit Institutions Banks 1302 Building Socs. 116 Credit Unions 33 Stockbrokers 30 Intermediaries 54 Others 31 Total 1566 Complaints trends Complaints received since April 2005 Insurance Credit Institutions 2007 –End May 950 2006 2229 1566 April 05 – December 05 1734 870 750 (+21% over 2006 period) 14% increase in 2006 with a 37% for credit institutions-credit unions, stockbrokers, intermediaries account for some of this 60% of complaints upheld; 40% not upheld Travel insurance is largest area of complaint followed by motor and life assurance Account transactions, mortgages and credit cards are the largest credit institutions complaints 33 Credit union,30 stockbrokers and 200 intermediaries complaints included in the 2006 figures Why have a Financial Services Ombudsman? Voluntary ombudsman schemes in Ireland both for the credit institutions and parts of the insurance sector since the early 1990s. Recognition by these sectors that a complaints resolution process outside of the Courts was necessary and appropriate. However all financial service providers were not part of these Financial scandals in Ireland during the 1990s McDowell Report 1999-new Regulatory regime including a statutory Financial Ombudsman. The Central Bank and Financial Services Authority of Ireland Act 2004 Section 16 and Schedules 6 and 7. What is the Financial Services Ombudsman Statutory body funded by statutory levies from the financial services providers Operational on 1 April 2005. Existing voluntary schemes were subsumed into it Number of financial service providers covered by its remit was expanded considerably. What is the role of the Financial Services Ombudsman? The Financial Services Ombudsman is a statutory officer who deals independently with complaints from consumers about their individual dealings with all financial services providers that have not been resolved by the providers. Decisions can be appealed by either party to the High Court. The Ombudsman is therefore the arbiter of unresolved disputes and is impartial. It is a free service to the complainant. Broader issues of consumer protection are the responsibility of the Financial Regulator. What organisations can be subject to investigation by the Ombudsman? All financial service providers (FR and Cr) including: Banks Building Societies Insurance companies both life and general Credit Unions Mortgage, Insurance and other credit intermediaries Stockbrokers Pawnbrokers Moneylenders Bureaux de change Hire Purchase providers Leasing companies Credit sales companies Health Insurance companies Who can complain to the Financial Services Ombudsman? All personal customers Limited companies with a turnover of €3m or less Unincorporated bodies, charities, clubs, partnerships, trusts etc. What complaints can be dealt with? Any kind of complaint by consumers where they feel they have not got satisfaction about: The provision of a financial service by the financial service provider An offer by the provider to provide such a service Failure by the provider to provide a particular financial service that has been requested What complaints cannot be made? A consumer is not entitled to make a complaint if the matter complained of: Is or has been the subject of legal proceedings before a court or tribunal Occurred more than six years before the complaint is made Is within the jurisdiction of the Pensions Ombudsman Can the Ombudsman decline to investigate a complaint? A complaint may not be investigated by the Ombudsman if in his opinion: It is vexatious or frivolous or not in good faith The subject matter is trivial The conduct complained of occurred at too remote a time to justify investigation Other redress means were available Complainant had no interest or an insufficient interest in the conduct complained of If a complaint is upheld what redress can the Ombudsman order for the consumer? The Ombudsman can direct the service provider to do one or more of the following: Review, rectify ,mitigate or change the conduct complained of or its consequences provide reasons or explanation for that conduct change that practice pay compensation up to a maximum of €250,000 or €26,000 annuity take any other lawful action What if financial service providers refuse to cooperate? The Ombudsman has extensive legal powers to require the financial service provider to provide information including the power to require employees to provide information under oath. If necessary the Ombudsman can enter premises of providers and demand the production of documents etc. In the case of non compliance the Ombudsman can seek a Court Order. Anyone who obstructs the Ombudsman commits an offence and is liable to a fine of up to €2,000, imprisonment for three months or both. Financial Consumer Protection in an Irish context Central Bank Financial Regulator Financial Services Ombudsman and Pensions Ombudsman Prudential role Consumer role Statutory Consumer Protection Code Surveys and Publicity Liaison with Ombudsman Co-operation with the Financial Regulator, the Pensions Ombudsman and the Financial Services Ombudsman Close co-operation between the Ombudsman, the Financial Regulator and the Pensions Ombudsman. When investigating a complaint if a matter comes up that is felt to be indicative of some kind of pattern or a systemic matter, the Ombudsman will inform the Regulator so that appropriate regulatory action may be taken. However, would like to emphasise that the Financial Services Ombudsman is essentially an arbiter in disputes between customers and institutions and is not a Regulator. Also cooperate with the Pensions Ombudsman so as to avoid unnecessary overlap in the pension’s area. Pensions Ombudsman deals with occupational pensions disputes but not their sales. A memorandum of understanding has been signed by the three organisations Ombudsman considerations Did you act fairly and can you prove that to me-transcripts or tapes Was the investment advice appropriate Was documentation clear Did you take advantage of a particular situation-troublesome customer or vulnerable person Were the refusal reasons reasonable or justified Too zealous perhaps in applying money laundering aspect Did you take advantage of a person’s age Were you discriminatory because of another matter perhaps-deeds of house Was commission more important than necessity-PPI Was complaint dealt with properly and reasonably at all stages Duty of care goes both ways Would I be happy-or could I defend- if I was the customer who was refused service or not properly treated Ombudsman’s decisions Penalty interest charge on early redemption of commercial loansjudicial review on one of the cases not successful; look back by Building Society €5m+ Application of accounting adjustment to an investment fund- €7.4m compensation awarded- under Court appeal Insurance matter-appeal on look back Error by insurance brokers- €140,000 and €50,000 settlements €40,000 against a stockbroker for not acting on instructions €16,500 – conflict of interest mortgage broker in sale of a property €90,000 insurance award as only Courts can determine whether an illegal had occurred Phone records access €80,000 claim for storm damage not upheld on technical advice Credit Unions- €24,000 for not respecting elderly persons instructions €38,500 award re derivative investment advice to elderly Medical treatment abroad- prior approval and not upheld Courts and International comparisons Informal by nature and legislation- without regard to technicality or legal form ( 57BK 4) Directions Judicial review Appeals Point of law referral during investigation Evidence under oath Enforcement orders Injunctive powers Ireland's Ombudsman is significantly different to all other countries-voluntary schemes What is needed Independent Strong and unpopular if necessary Removal not to be an easy matter Adequately Resourced Strong Powers Financial Resources Fair and impartial No Confusion about role-not an advocate or a champion but an independent arbiter Appropriate to your custom and legal situation Contact Details Financial Services Ombudsman 3rd Floor Lincoln House, Lincoln Place Dublin 2 Ireland Lo Call: 1890 88 20 90 Tel: +353 1 6620899 Fax: +353 1 6620890 Public Office Hours 09.30hrs - 13.00hrs 14.00hrs - 17.00hrs Email enquiries@financialombudsman.ie Website www.financialombudsman.ie