Financial markets

advertisement

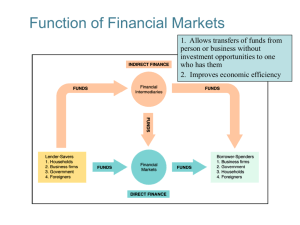

Lecture 3: Financial Intermediaries Mishkin chapter 2 – part B Page 35-42 1 Review Financial markets 1. Money markets and capital markets 2. Debt markets and equity markets 3. Primary markets and secondary markets 4. Exchanges and Over-the-Counter (OTC) markets 2 Financial system – revisited Indirect finance Money Financial Intermediaries (e.g. bank) Financial instrument A (e.g. saving account) Lender Regulation Money Financial instrument B (e.g. student loans) Borrower Financial instruments (e.g. bond, stock) Financial markets Money Direct finance 3 Financial intermediaries Financial intermediaries are institutions that borrow funds from people who have saved and make loans to other people. Financial asset transformation More important source of finance than financial markets, engage in process of indirect finance. 4 back 5 Direct and indirect finance Direct finance: through trading securities (financial instruments) in financial markets. only happen in primary market Indirect finance: transfer funds via financial intermediaries. involves financial asset transformation 6 7 Function of financial intermediaries Indirect finance Lower transaction costs Economies of scale, develop expertise Liquidity services ( but bank charges premium) Reduce risk facilitate borrowing and lending Risk Sharing (e.g. insurance companies) Diversification Alleviate ‘asymmetric information problem’ 8 Asymmetric information Adverse selection Adverse selection is a problem that arises for a buyer of a good, service, or asset when the buyer has difficulty assessing the quality of this item before purchase. ‘lemon car’ loan market: risky borrower are more likely to be ‘selected’ 9 Asymmetric information – Cont’d Moral hazard Moral hazard is said to exist in a market if, after the signing of a contract or transaction: 1. one party changes behavior which might have undesirable results; 2. only imperfectly able to monitor/control insurance, stock market: engage in undesirable (risky) activities 10 FIs come to the rescue FIs can reduce adverse selection by: Check up on borrowers/do credit research. Develop reputation (keep credit report) for repaying. reduce moral hazard by: develop monitoring expertise. joint ownership FIs make profits from producing information. 11 12 back 13 Financial asset transformation Financial asset transformation (FAT) means to purchase one kind of financial asset from borrowers (long-term loan contract, e.g., a mortgage) -- and sell a different kind of financial asset to savers (generally relatively liquid contract, e.g., a deposit account). Financial intermediaries make profits from financial asset transformation. back 14 Recap Direct vs. indirect finance Functions of financial intermediaries Adverse selection and moral hazard in financial markets. How can financial intermediaries solve these asymmetric information problems? 15