Chapter

17

McGraw-Hill/Irwin

Common and

Preferred Stock

Financing

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter Outline

• Common stockholders – Rights and

privileges

• Cumulative voting and its characteristics

• Rights offering

• Poison pills and other regulatory provisions

• Preferred stock

17-2

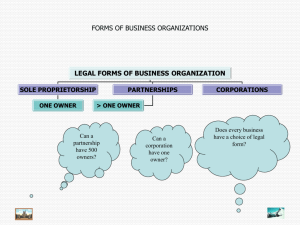

Common Stock

• Represents the ultimate ownership of a firm

• Though stockholders directly control the

business, it is practically wielded by

management on an everyday basis

17-3

Preferred Stock

• Plays a secondary role in financing the

corporate enterprise

• Represents a hybrid security by combining

some of the features of debt and common

stock

• Preferred stockholders do not have an

ownership interest in the firm

• They have a priority to claim dividends over

common stockholders

17-4

Common Stockholders – Rights

• Three key rights:

– Residual claim to income

– Voting right

– Right to purchase new shares

17-5

Common Stockholders’ Claim to

Income

• Common stockholders have a residual claim

to income regardless of payment of

dividends or retention by the firm

• They do not have a legal or enforceable

claim to dividends

• A firm may have several classes of common

stock outstanding that carry different rights

to dividends and income

17-6

Institutional Ownership of U.S.

Companies

17-7

The Voting Right

• Common stockholders have the right to:

– Vote in the election of board of directors

– Vote on all other major issues

– Assign a proxy or “power to cast their ballot”

• Companies can have different classes of

common stock with unequal voting rights

17-8

Cumulative Voting

• Majority voting

– Stockholders owning above 50% of common

stock may elect all of the directors

• Cumulative voting

– Stockholders with less than 50% interest may

elect some of the directors

17-9

Cumulative Voting Process

• To determine the number of shares needed to elect a given number of

directors under this method of voting:

•

If the number of minority shares outstanding under cumulative voting is known,

the number of directors that can be elected can be determined:

17-10

The Right to Purchase New Shares

• A corporate charter containing preemptive right

provision requires:

– Holders of common stock must be given the first option

to buy new shares

• This ensures that management cannot subvert the

position of present stockholders

• Stockholders may choose to sell their rights, rather

than exercise them in the purchase of new shares

• A corporate that does not include preemptive right

provision can include “rights offering” in its charter

17-11

The Use of Rights in Financing

• Used by many U.S. companies and is

popular as fund raising method in Europe

• Questions to consider:

– How many rights should be necessary to

purchase one new share of stock?

– What is the monetary value of these rights?

17-12

Monetary Value of a Right

• When a rights offering is announced a stock

initially trades “rights-on”

– Acquiring a right toward a future purchase of the stock

– The value of the right when a stock is trading rights-on

is:

R = (M0 – S) ÷ (N + 1)

Where: M0= market value – rights-on; S = subscription price; N =

number of rights required to purchase a new share of stock

• Ex-rights: Buying shares with no right toward future

purchase

– The value of the right when a stock is trading at ex-right

is:

R = (Me – S) ÷ N

Where: Me= market value – ex-rights

17-13

Effect of Rights on Stockholders

Position

Option 1:

• Suppose Stockholder A owns 9 shares before the rights offering and

has $30 in cash. His holdings would appear as:

• If he receives and exercises 9 rights to buy one new share at $30:

17-14

Effect of Rights on Stockholders

Position (cont’d)

Option 2:

• Sell rights in the market and stay with his position of owning only nine

shares and holding cash. The outcome would be:

• If a stockholder neither exercises his rights nor sells the rights, he would

be at a loss as the total value of his holdings would come down as

shown below:

17-15

Desirable Features of Rights

Offering

• The position of the current stockholders is

protected in regard to voting rights and claims to

earnings

• Use of rights offerings gives the firm a built-in

market for new security issues

• It may also generate more interest in the market

than a straight public issue

• Stock purchased through a rights offering carries

lower margin requirements

– Margin requirement is the cash or equity that must be

deposited with brokerage house or bank, with a balance

fund eligible for borrowing

17-16

Poison Pills

• A rights offering made to existing

shareholders of a company

– Allows existing shareholders to buy additional

shares of the stock at a very low price

– Used to avoid a takeover

– Makes hostile takeovers very expensive and

unattractive

17-17

American Depository Receipts

• Certificates that have a legal claim on an

ownership interest in a foreign company’s

common stock

– Also referred to as American Depository Shares

(ADSs)

– Allows foreign shares to be traded in the United

States much like common stock

17-18

Advantages of ADRs for the U.S.

Investor

• Annual reports and financial statements are

presented in English according to GAAP

• Dividends are paid in dollars and are more

easily collected

• Considered to be:

– More liquid

– Less expensive

– Easier to trade than buying foreign companies’

stock directly on that firm’s home exchange

17-19

Drawbacks of ADRs for the U.S.

Investor

• ADRs are also traded in their own country

subjecting investors to currency risk

• Infrequent reporting of financial results

• Information lag due to the time for translation

of reports into English

17-20

Preferred Stock Financing

• An intermediate or hybrid form of security

• Lacks the desirable characteristics of debt

and common stock

– Merely entitled to receive a stipulated dividend

– Receive payment of dividends before common

stockholders

– Rights to annual dividends is not mandatory for

corporations

17-21

Justification for Preferred Stock

• May be issued to achieve a balance in

capital structure

• A means of expanding the capital base

without:

– Diluting the common stock ownership position

– Incurring contractual debt obligations

• A drawback is that dividend payments are

not tax-deductible

17-22

Investor Interest

• Primary purchasers of preferred stock are

corporate investors, insurance companies,

and pension funds

– Under the tax law, the corporate investor must

need to add only 30% of preferred or common

dividends received from another corporation, to

its taxable income

– By contrast, all the interest of bonds are taxable

to the recipient except for municipal bond

interest

17-23

Summary of Tax Considerations

• Tax considerations for preferred stock work

in two opposite directions:

– They make the after-tax cost of debt cheaper

than preferred stock to the issuing corporation

• Interest is deductible to the payer

– Tax considerations generally make the receipt of

preferred dividends more valuable than bond

interest

• Since 70% of the dividend is exempt from taxation

17-24

Provisions Associated with Preferred

Stock

• The following stipulations and provisions

define preferred stockholder’s claim to

income and assets

– Cumulative dividends

– Conversion feature

– Call feature

– Participation provision

– Floating rate

– Auction rate preferred stock

– Par value

17-25

Cumulative Dividends

• Cumulative preferred stock have a cumulative

claim to dividends

– If preferred stock dividends are not paid in any one year,

they accumulate and must be paid in total before

common stockholders can receive dividends

– This feature makes a corporation aware of its obligations

to preferred stockholders

• A financial recapitalization may occur if a

financially troubled firm has missed a number of

dividend payments

– Under this arrangement, preferred stockholders receive

new securities in place of the dividend that is unpaid

17-26

Conversion Feature

• Allows a company to convert preferred stock

into a specified number of shares of

common stock

• Allows a company to force conversion from

convertible preferred stock into convertible

debt

– Company can take advantage of falling interest

rates, or

– Company can prefer to change the preferred

dividends into tax-deductible interest payments

17-27

Call Feature

• Allows corporations for the retirement of

security before maturity

– At some small premium over par, at the

discretion of the corporation

• A preferred issue carrying a call provision

will be accorded a slightly higher yield than a

similar issue without this feature

17-28

Participation Provision

• A small percentage of preferred stock issues

are participating preferreds

– They may participate over and above the quoted

yield

– If the common stock dividend equals the

preferred stock dividend:

• The two classes of securities may share equally in

additional payouts

17-29

Floating Rate

• Floating rate preferred stocks have

dividends adjustable in nature

• Dividend is changed based on the current

market conditions

– Investors can minimize the risk of price changes

– Investors can take advantage of tax benefits

associated with preferred stock corporate

ownership

– The price stability makes it equivalent to a safe

short-term investment

17-30

Auction Rate Preferred Stock

• Also known as Dutch auction preferred stock

– The stock is issued to the bidder willing to accept the

lowest yield and then to the next lowest bidder, and so

on until all the preferred stock is sold

• Long-term in nature, behaves like a short-term

security

– The auction periods vary for each issue, re-auctioned at

a subsequent bidding

– This is much like the Treasury bill auction

– Allows investors to keep up with the changing interest

rates in the short-term market

– Allows corporate investors to invest at short-term rates

and get tax-benefits as well

17-31

Par Value

• Par value of preferred stock is set at the

anticipated market value at the time of the

issue

– Establishes the amount due to preferred

stockholders in the event of liquidation

– Determines the base against which the

percentage or dollar return on preferred stock is

computed

17-32

Comparing Features of Common,

Preferred Stock and Debt

• Highest return and risk is associated with

common stock

• Preferred stock generally pays a lower return

– Due to the 70% tax exemption status for

corporate purchasers

• Increasingly high return requirement on debt,

based on:

– The presence or absence of security provision

– The priority of claims on unsecured debts

17-33

Features of Alternative Security

Issues

17-34

Risk and Expected Return for

Various Security Classes

17-35