THE National Child Care Association brings you:

advertisement

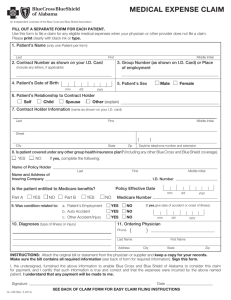

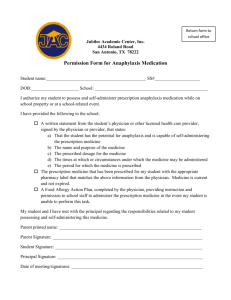

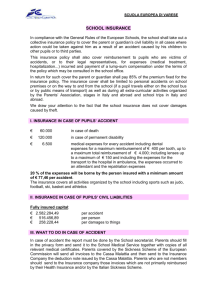

THE NATIONAL CHILD CARE ASSOCIATION BRINGS YOU: NEW 2014 VOLUNTARY BENEFITS WHAT ARE KEY ISSUES FACING WORKING AMERICANS TODAY? Most employed Americans have little disposable income due to everyday living expenses. Millions – nearly 20% - are either ineligible for or unable to afford health insurance through their workplace According to a recent Harris poll, the average family cannot financially survive more than 7 weeks without income Only 44% of US households had individual life insurance as of 2010 – a 50 year low, compared with 72% in 1960 and 55% in 1992. HOW CAN COMPANIES HELP THEIR EMPLOYEES? The Majority of financial decisions today are made in the workplace. Surveys indicate that 20% of employees are more likely to choose voluntary benefits if premiums are taken out of their paychecks, seeing it as easy, convenient and less expensive than private policies. This same study also indicated that these employees trust their employers’ choices and offerings in these areas. YOUR PARTNERS Who we are What our role is National Child Care Association Britton Gallagher Spotlite Key Benefit Administrators PLANS AND SERVICES Accident Expense Insurance Short Term Disability Limited Medical Plan Term Life Insurance Telemedicine PerkSpot Individual Health Insurance ACCIDENT EXPENSE INSURANCE Why Accident Expense Insurance? With the high cost of medical care today, a trip down the stairs can hurt your bank account as much as your body Accident expense insurance can pay you benefits based on the injury and the treatment you receive, whether it is a simple sprain or something more serious No one plans to have an accident but it can happen at any moment throughout the day, whether at home or at play Most major medical plans only pay a portion of the bills, accident coverage can help pick up where other insurance leaves off and provide cash to help cover the expenses ACCIDENT EXPENSE INSURANCE Key Benefits Benefits paid in addition to any other coverage The money is paid directly to YOU and YOU decide how to spend it! Coverage that is guaranteed issue, meaning there are no medical exams or tests for you to complete You have the option to purchase coverage for your spouse and dependent children Accident coverage goes with you when you change jobs or retire, up to the age of 70 Accidental Death Benefits included SHORT TERM DISABILITY Why Short Term Disability? Losing your income can be a life-changing event! Short Term Disability provides weekly income replacement if you become disabled and you are unable to work SHORT TERM DISABILITY Key Benefits Benefit amounts from $150 to $350, not to exceed 50% of weekly earnings All amounts are guaranteed issue – No health questions! Cash benefits paid directly to you to help you pay for everyday living expenses – from groceries to daycare – whatever you need! Benefits for sickness, injuries and even maternity leave! LIMITED MEDICAL PLAN What is Limited Medical? Pays fixed cash payments for a wide range of covered services – such as doctor visits, outpatient procedures, prescriptions or the everyday expenses that arise when you have to get medical care. Note:This coverage does not meet the requirements of essential medical coverage as defined in the Affordable Care Act. It is intended to be supplemental coverage that pays “first dollar” benefits with no deductibles to meet. LIMITED MEDICAL PLAN Why do you need limited medical? Benefits for covered expenses can be paid directly to you or your health care provider – so you decide how the money is used. If you have a health insurance plan with a deductible and no co-insurance payment, Limited Medical coverage can help you cover those out-of-pocket expenses. What does it cover? Inpatient benefits Outpatient benefits Term Life and AD&D Wellness benefits Prescription drug benefits Note:This coverage does not meet the requirements of essential medical coverage as defined in the Affordable Care Act. It is intended to be supplemental coverage that pays “first dollar” benefits with no deductibles to meet. TERM LIFE INSURANCE What is Term Life Insurance? Life insurance protect those who depend on you and your paycheck. Provides your loved ones with the money they can use to help do things like: pay off debts and funeral costs, pay the monthly rent or mortgage, create a savings fund for education or retirement, etc. TERM LIFE INSURANCE Key Benefits Employee coverage from $20,000 to $60,000 Spouse option at $20,000 and child option at $10,000 Benefits are guaranteed issue – NO QUESTIONS ASKED! Also offers a living care benefit and coverage goes with you when you change jobs or retire TELEMEDICINE Consult, Diagnose and Prescribe 24/7 Access to a Board Certified Doctor--On the Go or at Home! On-Demand Physician Care: Call or e-mail a doctor 24/7, without long waits at the doctor’s office, urgent care or emergency room. Obtain information, treatment recommendations, and prescription medication, when appropriate. Request Prescription Medication: Get timely prescriptions and prescription refills, enjoy convenient pickup at your nearest pharmacy. Coverage for your entire family: Instant, affordable coverage for all ages – from children to senior citizens – no age limit, even if living at different addresses! Nationwide medical expertise: All physicians are U.S.-based, statelicensed, NCQA-certified, with an average of 15 years experience. Easy-to-use online health tools: Powerful online applications to help identify and optimize lifestyle factors. Store and share your personal health records HOW IT WORKS You have cold-like symptoms but don’t have the time to sit in an urgent care waiting room. Instead you use Telemedicine! Step 1. Step 2. Step 3. Medical history Request consult Talk with a physician You are required to complete your medical history online, by phone, or by faxing a paper form prior to requesting a consultation. You simply log on to your account or call Teladoc, 24/7/365, to request either a telephone or video consultation. A board-certified physician licensed in your state reviews your medical history and provides a consultation over the phone or through video, just like an in-person visit. Step 4. Step 5. Step 6. Resolve the issue Continuity of care The physician recommends the right treatment for your medical issue. If a prescription is necessary, it is electronically sent to your pharmacy of choice. The physician documents the results of the consultation in your medical history. Consultation information can be sent to your primary care physician. Follow-up Teladoc sends you a follow up email to ensure that you got the care you needed and to see if you have any feedback on your experience. COMMON USE Top 10 Diagnoses 1. Sinus Problems Prescription Management Electronic prescribing (SureScripts) or by phone. Frequency of prescribing lower than same diagnoses when comparing best provider practices (about 80% vs. 83%) Use of antibiotics limited to short durations; patient education and physician reminders for appropriate use No prescribing of DEA-controlled substances, medication for psychiatric illness, or lifestyle drugs. Generic drugs automatically recommended 2. Urinary Tract Infection 3. Pink Eye 4. Bronchitis 5. Upper Respiratory Infection 6. Nasal Congestion 7. Allergies 8. Flu 9. Cough 10. Ear Infection PLUS THESE ADDITIONAL SERVICES! Aetna RFL Consultants Bill Review & Mediation Speak directly with highly educated consultants who are ready to help guide you through life’s challenges. Let our Patient Advocacy team work directly with the hospital on your behalf to lower your payments. WellCard Discount Card Legal & Financial Advisors Savings on a wide range of healthcare products and services like prescription drugs, lab tests, vision and dental care. Talk with a network attorney or financial consultant for up to 30 minutes free per issue, for an unlimited number of issues. ID Theft & Fraud Resolution Victims of ID theft or fraud related crimes receive the education, guidance & legal and financial assistance they need. Online Worklife Resources In-depth resources and guides for daily issues from adoption to college planning, elder care, disaster relief and more. YOU CAN EARN FUNDS FOR YOUR CHILD CARE CENTER BY PARTICIPATING! WWW.TELEMEDFUNDRAISER.COM HOW THE FUNDRAISER WORKS How it works: When you have your families, friends, neighbors and community enroll in TeleMedicine, a portion of the proceeds go back to your child care center each month! You can use the funds earned to purchase much needed materials to continue to educate, entertain and support your center. How to enroll: Direct people to enroll online at www.telemedfundraiser.com. They will enter a unique code for your child care center to ensure you receive the funds. FUNDRAISING MARKETING SUPPORT We have created marketing pieces to help you promote the TeleMedicine fundraiser in your community. Simply add your child care center code before distributing. Not sure of your center’s code? Contact us at (216) 658-8577. Invoice stuffers or mailers to send out to your child care center families or vendors. Flyers to pass out to your center’s families, your friends, neighbors & community businesses. EXCLUSIVE RETAIL DISCOUNTS WITH PERKSPOT What is it PerkSpot? PerkSpot is a private, members-only marketplace that provide deals from popular merchants You will find a range of exclusive ways to save no matter what you are in the market for – travel, electronics, tickets, flowers & much more! NO COST TO YOU! The NCCA has made PerkSpot available at no cost to employees. EXCLUSIVE RETAIL DISCOUNTS WITH PERKSPOT What kind of discounts? Take an extra $7 off order of $70 at Target.com Save an extra 5% on all Southwest Vacation packages Receive up to 40% off on electronics and accessories from Panasonic Save an extra 15% off at Kohls Get 15% off all flowers and gifts from 1800flowers.com Save up to 30% on select computers, electronics and accessories at Dell AND MORE! INDIVIDUAL HEALTH INSURANCE Through the NCCA benefits program, you will have the opportunity to access individual health insurance at the Health Insurance Marketplace in November. QUESTIONS? TOLL FREE 1-844-735-3362 childcare@brittongallagher.com www.nccabenefits.com www.yourtelemed.com www.telemedfundraiser.com