A Case Study of Activity

advertisement

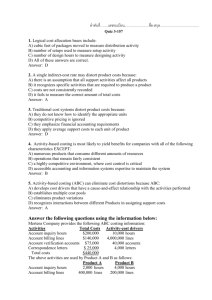

Running head: ACTIVITY-BASED COSTING A Case Study of Activity-Based Costing R. Scott Felter Bellevue University 1 ACTIVITY-BASED COSTING 2 Abstract The purpose of this essay is to perform a case study of Activity-Based Costing (ABC) analysis. The facts of the analysis involves an enterprise trying to secure a contract on two separate products. However, to ensure the Sales Team has vetted the purposed sales price of each unit correctly for the bid submittal, an ABC analysis of variable cost for each respective product needs to be accomplished. Once this is completed, a clearer picture of each product will be ascertained either vetting the purposed sales price or not. Furthermore, a comparison of traditional Cost-Volume-Profit (CVP) analysis will be discussed with potential outcomes versus the ABC analysis. Keywords: Activity-Based Costing analysis, Break-Even Point, Cost Drivers, Cost-Volume-Profit analysis. ACTIVITY-BASED COSTING 3 A Case Study of Activity-Based Costing A manufacturing company that produces specialty tools has a direct customer requesting price quotes for two of your products: a portable flammable-gas sensing tool (SKU A1) and a self-contained radon measuring device (SKU B1). There are at least two other competing manufacturers that are submitting bids for these products. Your sales manager believes that quotes of $335.00 for SKU A1 and $725.00 for SKU B1 per unit would secure the customer’s orders, leading to significant additional orders in the future. Your company’s typical profit markup is 25% of the total unit cost. Reference Figure 1 for the costs and specifications for the two products. As part of the vetting process, I have been asked to run an ABC analysis to ensure we can produce the units for profit; all calculations are for per unit cost. I am tasked with answering what should be the Target Cost (TC) for SKU 1A and SKU 1B? What is the projected total unit cost of production and delivery for SKU 1A and SKU 1B? Based on the given information and the answers to afore mentioned questions, should the company produce the products or even offer to bid the customer? ABC Analysis SKU 1A SKU 1A will be reviewed first to ascertain if the suggested bid price is in alignment of internal targeted cost. We know that the sales manager has suggested a bid price of $335.00 per unit. Working backwards to calculate the TC is simply dividing $335.00 by ratio of 1.25 (1 is the factor and .25 representing the 25% markup) providing the TC of $268.00 per unit. Now that the TC has been established, the ABC analysis can begin by using the variable cost figures from Figure 1. The raw and purchased materials, manufacturing ACTIVITY-BASED COSTING 4 and assembly labors, machine hours, material handling, and product delivery cost will be calculated providing the total cost of SKU 1A; reference Figure 2 for calculations of SKU 1A. Moreover, this cost will vet the viability of producing the product and if the sales manager’s purposed sales price is correct. As the ABC analysis calculated the total unit cost for SKU 1A as $239.16, this is under the targeted unit cost of $268.00 with positive reserve for variances of $28.84. The company sales manager can proceed with the bid process to obtain the contract for the anticipated demand of 26,500 units of SKU 1A. The company can with this analysis build the product under targeted cost and maintain the company standard markup of 25% for total sale price of $335.00. ABC Analysis SKU 1B SKU 1B will be reviewed now to ascertain if the suggested bid price is in alignment of internal targeted cost. We know that the sales manager has suggested a bid price of $725.00 per unit. Working backwards to calculate the TC is simply dividing $725.00 by ratio of 1.25 (1 is the factor and .25 representing the 25% markup) providing the TC of $580.00 per unit. Now that the TC has been established, the ABC analysis can begin by using the variable cost figures from Figure 1. The raw and purchased materials, manufacturing and assembly labors, machine hours, material handling, and product delivery cost will be calculated providing the total cost of SKU 1B; reference Figure 3 for calculations of SKU 1B. Moreover, this cost will vet the viability of producing the product and if the sales manager’s purposed sales price is correct. As the ABC analysis calculated the total unit cost for SKU 1B as $594.83, this is over the targeted unit cost of $580.00 with negative reserve for variances of -$14.83. The company sales manager cannot proceed ACTIVITY-BASED COSTING 5 with the bid process to obtain the contract for the anticipated demand of 18,500 units of SKU 1B. The company cannot with this analysis build the product under targeted cost and maintain the company standard markup of 25% for total sale price of $725.00. ABC vs CVP If conventional costing methods had been deployed, it would have changed the managerial decision-making process in this case, as presented values would differ from the ABC analysis (Velmurugan, 2010). In my studied opinion, the company would have a false positive for SKU 1B unit, and submitted the purposed bids for each SKU not knowing that SKU 1B was not profitable at the bid cost of $725.00. As I do not have the overhead values or fixed cost that would have been used for a CVP analysis, I will state what is factual. The fact that the ABC cost drivers differentiated the materials (raw and purchased) and labor (manufacturing and assembly) into two cost pools, this provided clarification of cost drivers to each specific product. Furthermore, what normally would have been classified as overhead in a lump value, was clearly identified by afore mentioned cost drivers with additional cost drivers such as product delivery, machine hours, and materials-handling. Conventional analysis values would be less exact and cannot differentiate, as minimal or direct relationship of how each SKU uniquely consumed resources is not apparent; this will result in distorted product costs (IMA, 2006). In fact, conventional CVP analysis values used could potentially represent several products together, causing one product to appear more or less expensive and/or used more or less resources incorrectly predicting the costs of each SKU (Dalci & Tanis, 2005). ACTIVITY-BASED COSTING 6 ABC analysis avoids these problems, as ABC analysis traces indirect costs, aka “overhead”, to individual products, services, and customers by identifying resources and their costs. Moreover, ABC analysis traces the consumption of these resources by activities, and the performance of activities to produce output (IMA, 2006). Lastly, conventional CVP analysis uses only volume-based cost drivers such as the number of units produced; moreover, the products produced is the only revenue and cost driver. In addition, overhead expenses can vary due to multiple processes, which can lead to false indications of the Break-Even Point (BEP) for profitability (Dalci & Tanis, 2005). It is suggested that an ABC - CVP analysis be performed as a Best Business practice for this company. The ABC analysis requires the modification of the CVP analysis utilizing identified cost drivers, in effect ascertaining a truer projection of product total cost. For example, if the ABC analysis identified the ability to reduce cost by standardizing specific applicable parts across multiple product lines, aka the cost driver, the variable cost would change for not only one product, but multiple product lines. The CVP analysis would require the new variable cost, aka the modification, establishing the new BEP for these multiple products. The ABC-CVP process is applicable for any fixed or variable cost i.e. customer support, marketing efforts, and change in the manufacturing process (Velmurugan, 2010). Conclusion In our case study, if conventional costing methods had been deployed, it would have changed the managerial decision-making process in this case. What normally would have been classified as overhead in a lump value averaged across product lines, was clearly identified by afore mentioned cost drivers for each SKU. Because the ABC ACTIVITY-BASED COSTING 7 analysis ascertained a better projected cost for each SKU, the company was able to understand that SKU 1A was a go bid and SKU 1B was a no bid, avoiding costly loss in profitability in producing the product. CVP analysis coupled with ABC analysis should become the Best Business Practice for any enterprise serious about profitability, delivering competitive products to their customers, and longevity in a growing global business environment. ACTIVITY-BASED COSTING 8 References Dalci, I. & Tanis, V. (2005). Activity-Based Cost-Volume-Profit Analysis: Another Approach to Break-Even Analysis. Ç.Ü. Sosyal Bilimler Enstitüsü Dergisi, 14(2), 227-244. Retrieved November 8, 2015, from http://dergipark.ulakbim.gov.tr/ cusosbil/article/viewFile/5000001066/5000001757 IMA. (2006). Implementing Activity-Based Costing. Retrieved November 8, 2015, from http://www.imanet.org/docs/default-source/research/sma/implementing-activitybased-costing.pdf?sfvrsn=2 Velmurugan, M. (2010). The Success and Failure of Activity-Based Costing Systems. Journal of Performance Managment, 23(2), 3-33. ACTIVITY-BASED COSTING 9 Figures 6 5 4 3 2 1 0 Category 1 Category 2 Series 1 Category 3 Series 2 Category 4 Series 3 Figure 1. Related variable cost for each product that will be used to perform ABC analysis (Bellevue University FBUS 465 C4P4, 2015). Total Cost Unit SKU 1 A Total Material Cost raw materials @ 31.00 + purchased materials @ 15.00 total material cost = 46.00 Total Labor Cost manufacturing (2.8 hours x 12.50 rate) = 35.00 + assembly (3.6 hours x 14.50) = 52.20 total labor cost = 87.20 Machine Cost 6.8 hours x 3.45 machine cost = 23.46 Material Handling 1.25 x per dollar total material cost @ 46.00 material handling = 57.50 Delivery per Unit delivery per unit = 25.00 Total Cost Total Cost = 46.00 + 87.20 + 23.46 + 57.50 +25.00 Total Cost per Unit SKU 1 A = 239.00 Figure 2. Calculations for SKU 1A. ACTIVITY-BASED COSTING 10 Figures Total Cost Unit SKU 1B Total Material Cost raw materials @ 66.00 + purchased materials @ 45.00 total material cost = 111.00 Total Labor Cost manufacturing (5.0 hours x 15.50 rate) = 77.50 + assembly (8.4 hours x 16.50) = 138.60 total labor cost = 216.10 Machine Cost 28.4 hours x 3.45 machine cost = 97.98 Material Handling 1.25 x per dollar total material cost @ 111.00 material handling = 138.75 Delivery per Unit delivery per unit = 31.00 Total Cost Total Cost = 111.00 + 216.10 + 97.98 + 138.75 +31.00 Total Cost per Unit SKU 1 A = 594.83 Figure 3. Calculations for SKU 1B.