CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

CUSTOMER_CODE

SMUDE

DIVISION_CODE

SMUDE

EVENT_CODE

SMUJAN15

ASSESSMENT_CODE MB0045_SMUJAN15

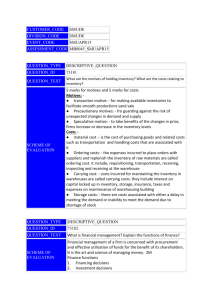

QUESTION_TYPE

DESCRIPTIVE_QUESTION

QUESTION_ID

9547

QUESTION_TEXT

What is capital budgeting decision? Highlight its types

SCHEME OF

EVALUATION

Meaning of capital budgeting: Capital budgeting is a blue–print of

planned investments in operating assets. Thus, capital budgeting is the

process of evaluating the profitability of the projects under

consideration and deciding on the proposal to be included in the

capital budget for implementation.

Types:

●Decision to replace the equipments for maintenance of current level

of business or decisions aiming at cost reductions, known as

replacement decisions

●Decisions expansion through improved network of distribution or on

expenditure for increasing the present operating level

●Decisions for production of new goods or rendering of new services

●Decisions on penetrating into new geographical area

●Decisions to comply with the regulatory structure affecting the

operations of the company, like investments in assets to comply with

the conditions imposed by Environmental Protection Act

●Decisions on investment to build township for providing residential

accommodation to employees working in a manufacturing plant

QUESTION_TYPE

DESCRIPTIVE_QUESTION

QUESTION_ID

73185

QUESTION_TEXT

What is risk? Explain the types of risk?

SCHEME OF

EVALUATION

Risk may be termed as a degree of uncertainty. It is the possibility

that the actual result from an investment will differ from the

expected result. 2M

Types

1. Stand-alone risk

2.

3.

Portfolio risk

Market risk

4. Corporate risk

2M each with explanation

QUESTION_TYPE

DESCRIPTIVE_QUESTION

QUESTION_ID

125905

QUESTION_TEXT

SCHEME OF

EVALUATION

What is Receivable Management? Examine the costs of maintaining

receivables.

Management of account receivable may be defined as the process of

making decision related to the investment of funds in receivables for

maximising the overall return on the investment of the firm. ( 2

Marks)

Costs of maintaining receivables: (Each point gets 2 marks along with

explanation)

a.

b.

c.

d.

Capital cost

Administration cost

Delinquency cost

Bad-debt or default costs

QUESTION_TYPE

DESCRIPTIVE_QUESTION

QUESTION_ID

125907

QUESTION_TEXT

What do you mean by “valuation of shares”? Explain the features and

methods of valuation of preference shares and ordinary shares.

SCHEME OF

EVALUATION

A company’s shares can be categorized in to ordinary or equity shares

and preference shares.

The following are some important features of preference and equity

shares

Dividends – Rate is fixed for preference shareholders. They can be

given cumulative rights, that is, the dividend can be paid off after

accumulation. The dividend rate is not fixed for equity

shareholders. They change with an increase or decrease in profits.

During the years of big profits, the management may declare a

high dividend. The dividends are not cumulative for equity

shareholders, that is, they cannot be accumulated and distributed

in the later years. Dividends are not taxable.

Claims – In the event of the business closing down, the preference

shareholders have a prior claim on the assets of the company.

Their claims shall be settled first and the balance, if any, will be

paid off to equity shareholders. Equity shareholders are residual

claimants to the company’s income and assets.

Redemption – Preference shares have a maturity date on which the

company pays off the face value of the shares to the holders.

Preference shares are of two types – Redeemable and

irredeemable. Irredeemable preference shares are perpetual.

Equity shareholders have no maturity date.

Conversion – A company can issue convertible preference shares.

After a particular period, as mentioned in the share certificate, the

preference shares can be converted into ordinary shares.

Valuation of preference shares – Preference shares like bonds carry a

fixed rate of dividend or return. Symbolically, this can be

expressed as

P0 – Dp/{1+Kp)n} + Pn/{1+Kp)n}

Or

P0 = Dp * PVIFA (Kp, n) + Pn * PVIF (Kp, n)

Where P0 = Price of the share

Dp = Dividend on preference share

Kp = Required rate of return on preference share

n = Number of years to maturity

Valuation of ordinary shares – People hold common stocks:

*

To obtain dividends in a timely manner

*

To get a higher amount when sold

QUESTION_TYPE

DESCRIPTIVE_QUESTION

QUESTION_ID

125910

QUESTION_TEXT

Explain the phases of capital Expenditure Decisions.

The various phases of capital expenditure decisions are

1. Identification of investment opportunities

(2 marks)

2. Evaluation of each investment proposal

3. Examination of the investment required for each investment

4. Preparation of the statement of costs & benefits of investment

proposal

SCHEME OF

EVALUATION

5. Estimation & comparison of the net present value of the

investment proposals the have been cleared of the management as

the based of screening criteria

6. Examinations of the govt policies and regulatory guidelines

7. Budgeting for capital expenditure for approval by the management

8. Implementation

9. Post completion audit

(2-9 pt caries 1 mark)

QUESTION_TYPE

DESCRIPTIVE_QUESTION

QUESTION_ID

125912

QUESTION_TEXT

What is Credit policy of a firm? Examine the variables of credit policy

SCHEME OF

EVALUATION

The credit policy of a firm can be termed as a trade-off between

increased credit sales leading to increase in profit and the cost of

having large amount of cash locked up in the form of receivables

along with the loss due to the incidence of bad debts. ( 2 Marks)

Variables are: (Each point gets 2 marks along with explanation)

a.

Credit standards

b.

Credit period

c.

Cash discount

d.

Collection programme