Future of Financial Innovation

advertisement

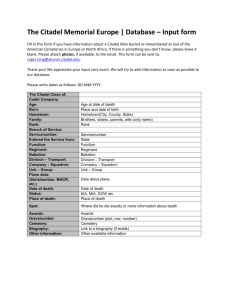

PRESENTATION TO Financial Institutions Risk Management Conference Future of Financial Innovation Gerald A. Beeson April 14, 2008 Future of Financial Innovation From Vantage Point of Market Participant There is much needed innovation within the derivatives market and many innovations of the past decade have been shut down, perhaps permanently, in risk transfer and funding Derivative Markets Continuing problems and hazards with respect to liquidity, transparency, valuation and counterparty credit risk Securitization Markets Continued impairment of the securitization market will hinder the transference of risk between providers of credit and pools of available capital Funding Markets Beginning to recover after the dislocations of Q3/Q4 and the aftermath 2 Derivatives Market Market Participant Observations “Risk is essential but it needs to be supported. It’s all about the plumbing.” Drive toward central clearinghouse (central risk pool) where derivative contracts can be submitted, matched, cleared and settled Resistance to changes that yield a standardized product that creates a more efficient market Management of gross notional exposures and mitigation of operational risks Valuation concerns Valuation reconciliation between counterparties, particularly during periods of market stress Counterparty credit concerns Utilization of collateral posted in the ordinary course of their capital markets activities • Conversely, counterparties have credit risk that they want to mitigate Movement to exchange based and cleared products eliminates this asymmetrical benefit • Relieves potential “run on the bank” concerns seen in 2008 3 OTC Margin Dispute Trends Example 10 9 8 Scale Factor 7 6 5 4 3 2 1 0 Jul 2008 Aug Sep Oct Nov 4 Dec Jan 2009 Feb Mar Apr Commitment to Innovative Solutions 5 Impaired Securitization Markets 6 Shutdown of the Securitization Market Market Participant Case Study In 2001, Citadel launched a Bermuda based reinsurance business offering large scale, collateralized risk transfers of property and catastrophe risks Positive performance as business grew (ex 2005); however, needed longer term risk management and capital efficiency strategy in order to grow Asymmetrical return distributions in best and worst cases Experience in capital markets led to offering of insurance risk-linked securitization with several benefits • Active market demand and diversified investor base • Fully collateralized protection • Multi-year coverage • Fixed pricing terms Placed largest bank debt indemnity deal done to date in July 2007 at $500 M 7 Alignment of Interest Citadel and investors’ interests remain aligned throughout the term of the transaction Pro Forma Cedants Exposure Limits Written Cedant Retention Citadel must cede all policies within the subject business lines – no potential for adverse selection $1,200mm/P(E) = 0.2 bps $1,015mm/P(A) = 0.7 bps Term Loan A Net Losses At inception Citadel funds retained 100% of the first approximately $650mm of losses each year Cedants covenant to retain at least 50% of ground up losses below the securitized layer Term Loan B $875mm/P(A) = 15.6 bps Term Loan C $710mm/P(A) = 90.4 bps Term Loan D $650mm/P(A) = 140.0 bps Cedant Retention Losses above the securitized layers are retained by Cedants 8 Risk Exposure All Peril Occurrence PMLs Analysis of the pro forma portfolio for calendar year 2007 illustrates per occurrence PMLs Term Loan A Exhaustion $1,200 Term Loan A Attachment $1,050 Term Loan B Attachment $805 $684 Term Loan C Attachment Term Loan D Attachment $710 $650 $596 $532 $450 $307 20 50 100 250 Return Period (yrs) Per Occurrence PML Note: MPCI and property per risk are not included in the above analysis. 9 1,000 $875 25,000 Low Probability of Loss Impact Remodeled Key Historical Events1 Term Loan A Exhaustion $1,200 Term Loan A Attachment $1,050 Term Loan B Attachment $875 Term Loan C Attachment Term Loan D Attachment $710 $650 $350 $239 $36 $63 $39 $28 $28 AndrewNorthridge Lothar Charley Frances Jeane (1992) (1994) (1999) (2004) (2004) (2004) $27 $45 Ivan Katrina Rita (2004) (2005) (2005) $48 Wilma (2005) 1. 2004 and 2005 hurricanes are modeled using RMS recommended event IDs . Events prior to 2004 are based on stochastically generated storms that are representative of the historical events. Loss figures gross of reinstatement premiums. 2. Katrina does not include marine gulf or flood. 10 Projected Earnings Distribution (Combined Gross/Net) Projected Earnings Distribution as of 1/1/08 400 200 Earnings ($m) Total Gross of Emerson (200) Key Percentile Percentile Gross Net 0.000% 292 271 50.000% 220 199 75.000% 144 123 90.000% (4) (25) 95.000% (143) (164) 98.000% (297) (287) 99.000% (399) (320) 99.600% (502) (355) 99.800% (558) (370) 99.900% (610) (382) 99.998% (851) (459) Expected 169 150 Total Net of Emerson (400) (600) (800) 50% 55% 60% 65% 70% 75% 80% Cumulative Probability 11 85% 90% 95% 100% Final Analysis Q4 2008 Considerations Cost of capital Capital structure 75% equity and 25% debt • Debt layer was 3 year term structure at L+100 up for renewal in May 2009 Consideration of increased capital commitment relative to returns generated from other businesses Securitization Market Effectively closed to innovative risk management transaction like Emerson Re Asymmetrical upside/downside relationship would return to the business Decision to exit the business 12 Funding Markets View from the Eye of the Storm 13 Business Architecture Citadel Investment Group Asset Management Capital Markets Alternative Asset Management • Multi-strategy hedge funds • Planned single-strategy hedge funds Market Making / High Frequency Trading Citadel Solutions • Largest options specialist • Largest retail equity market maker • Fund administration business offering premium, tailored services to hedge funds • Citadel accounts for approx 30% of US options trading volume and over 8% of US equity volume 14 Citadel Derivatives Group LLC A Market Leader in Equities and Options Embracing “disruptive” technologies to improve liquidity and transparency in the capital markets 8% of US Equity Volume 29% of US Options Volume Sept 2008 data 15 End of an Era Disappearance of the “Shadow Banking System” 16 Treasury – Liquidity Management Philosophy Ensure the provision of adequate liquidity to meet balance sheet funding needs through all market environments. Active capital and balance sheet planning • Targeting the relationship between aggregate risk limits and capital required to support them • Balance sheet liquidation model: a business unit / strategy analysis of Citadel’s ability to reduce risk positions Liquidity Reserve • Maintenance of a pre-funded liquidity reserve to meet contingent cash needs of Citadel’s balance sheet Liquidity Management • Model Citadel’s liquidity ladders to incorporate the following parameters • Mark-to-Market exposure from stress events • Expiration of committed funding facilities • Accelerated Capital Calls Counterpart Diversity • Across both financing and trading counterparts • Broad distribution of exposures to maintain operational flexibility in a disruptive market environment • Diverse financing arrangements across highly rated counterparts in robust, efficient structures • Reductions in the Balance Sheet of the Firm 17 Crowded Financing Trade Sources of securities Sources of cash Customer Supply Mutual Funds Securities Lenders Internal Dealer Cash Prime Brokers Beneficial Owners/ Bank Portfolios Securities Lenders Cash Reinvest Dealer Desks Direct US Commercial Banks Hedge Fund Hedge Fund Hedge Fund 18 Hedge Fund Hedge Fund Non-US Commercial Banks Treasury – Centralized Execution Centralized execution of secured funding provides substantial scalability and efficiency. It also allows PMs to focus on portfolio construction and Treasury specialists to focus on funding. Central Funding Approach Assets are funded centrally through Treasury. Close collaboration to determine the long term funding needs of the business. Centralized funding through a diverse network of sources of cash and collateral. Not reliant on PB model Direct relationships with sources of cash and collateral Sources of securities Sources of cash Customer Supply Mutual Funds Securities Lenders Internal Dealer Cash Prime Brokers Beneficial Owners/ Bank Portfolios Securities Lenders Cash Reinvest Dealer Desks Direct US Commercial Banks Non-US Commercial Banks Longer term stable commitments Started effort over 6 years ago CITADEL 19 Funding Dislocation Accelerated deleveraging on the back of the financial panic and forced liquidations by banks, hedge funds and other investors in Q3 and Q4 Severe dislocation in funding markets post Lehman bankruptcy driven by several factors Inadequate funding models among firms taking term asset risk without term liability structure Concerns around systemic risk in the banking system Lenders became unwilling or restrictive in lending • Multiple asset classes impacted, even in fully hedged assets • Concerns around changing regulatory frameworks Implementation of short sale restrictions by regulators in several markets) • Ability to liquidate or hedge collateral in a default as primary concern Breakdown in the relationship between cash and derivative assets, notably in convertible and corporate bonds 20 Funding Dislocation Citadel focus in Q3 and Q4 Holder of balance sheet assets in a period of unprecedented funding dislocation Key Focus to maintain strong liquidity and capital position through utilization of management framework • Reduction in size of balance sheet/risk broadly but maintain highest quality trades • Refocus activities on skill based investment businesses • Elimination of several balance sheet intensive businesses Reinsurance Fundamental Credit U.S. Power Trading 21 Estimated US Non-Financial Convertible Discount to Fair Value January 1, 1998 to September 12, 2008 6.5 5.6 5.5 4.5 Edge (bpt) . 3.5 2.5 1.5 0.5 -0.5 -1.5 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 The US Non-Financial Convertible Discount to Fair Value time-series represent the average US non-financial convertible bond discount to fair value, weighted by amount outstanding. For this purpose, the Merrill Lynch US Convertible Index is used to define the set of securities considered for inclusion. Convertible securities whose underlyings do not have exchange-traded options, exchangeable bonds, convertible preferred stock, and mandatorily convertible securities are excluded. The Citadel proprietary valuation model is used to estimate fair value. Citadel’s model is calibrated using US Credit, Equity, and Option market data from January 2003 to present. The Estimated US Non-Financial Convertible Discount to Fair Value time-series incorporates a combination of inputs designed to provide reasonable estimates of fair value. Individuals may disagree about the design of the framework as well as the inputs and assumptions made. The framework, inputs and assumptions may not be accurate, and the inputs will change over time. The actual discount to fair value may differ materially from the estimated fair values generated by the Citadel proprietary valuation model. Furthermore, there can be no assurance that market prices will converge to fair value over time. 22 Estimated US Non-Financial Convertible Discount to Fair Value by Rating January 1, 2004 to April 6, 2009 16.0 US - All Ratings 14.0 US - High Yield 12.0 US - Investment Grade 10.5 Edge (bpt) . 10.0 8.9 8.0 6.0 5.0 4.0 2.0 0.0 -2.0 Jan 2004 Apr Jul Oct Jan 2005 Apr Jul Oct Jan 2006 Apr Jul Please see the end notes for important information about this presentation. 23 Oct Jan 2007 Apr Jul Oct Jan 2008 Apr Jul Oct Jan 2009 Apr Bond Basis Spreads Historical Data 450 Representative Bond Basis 400 350 Spread to Libor . 300 250 200 150 100 50 0 May Jun 2007 Jul Aug Sep Oct Nov Dec Jan Feb Mar 2008 Apr May 24 Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 2009 Apr Funding Dislocation – The Road “Forward” Dysfunctional Funding Market Continues Recent Fed data indicates that total bank deposits were approximately $8.8 trillion versus $3.8 trillion in the money funds with growth rates of 5% and 23%, respectively, during 2008 Over half of money fund growth during Q4 2008 Effect of “breaking the buck” Growth directed toward S/T Agency and Treasury securities as CP holdings and Repo holdings shrunk • Repo market down over 30% in Q4 2008; almost 50% in the 2008 • Bank CP market shutdown even with government guarantee programs in place • Highlights that money funds currently have little use in providing liquidity to the system Increased importance of bank deposits in traditional mix of short term, medium term and long term secured and unsecured lending by banks for the foreseeable future Will be constrained by leverage ratio/gross balance sheet concerns 25 End Notes 1. The US Non-Financial Convertible Discount to Fair Value time-series represent the average US non-financial convertible bond discount to fair value, weighted by amount outstanding. For this purpose, the Merrill Lynch US Convertible Index is used to define the set of securities considered for inclusion. Convertibles securities whose underlyings do not have exchange traded options, exchangeable bonds, convertible preferred stock, and mandatorily convertible securities are excluded. The Citadel proprietary valuation model is used to estimate fair value. Citadel’s model is calibrated using US Credit, Equity, and Option market data from January, 2003 to present. 26