ScripsAmerica Presentation Winter 2015

advertisement

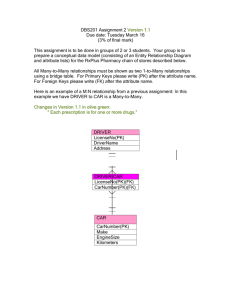

Winter 2015 Safe Harbor Statement This presentation may contain forward-looking statements which are made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Investors are cautioned that statements which are not strictly historical statements, including, without limitation, statements regarding the plans, objectives and future financial performance of ScripsAmerica, constitute forward-looking statements which involve risks and uncertainties. The Company’s actual results may differ materially from those anticipated in these forward-looking statements based upon a number of factors, including anticipated operating losses, uncertainties associated with research, development, testing and related regulatory approvals, unproven markets, future capital needs and uncertainty of additional financing, competition, uncertainties associated with intellectual property, complex manufacturing, high quality requirements, dependence on third-party manufacturers, suppliers and collaborators, lack of sales and marketing experience, loss of key personnel, uncertainties associated with market acceptance and adequacy of reimbursement, technological change, and government regulation. For a more detailed description of the risk factors associated with the Company, please refer to the Company’s periodic reports filed with the U.S. Securities and Exchange Commission from time to time, including its Annual Report on Form 10-K for the year ended December 31, 2013. Undue reliance should not be placed on any forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to update any forward-looking information contained in this presentation. ScripsAmerica, Inc. A leading, vertically integrated provider of a range of specialty prescription and over the counter pharmaceuticals and medical supplies Serving large and growing markets: Specialty Pharmaceuticals & Medical Supplies Rapid Growth, Improving Financial Performance, Projecting Q1 Profits: 2014 (P) 2013 Q1 15 (P) Increase (in millions, except EPS) (in millions, except EPS) (3/31/2015) Revenues $ 31.50 $ 0.60 $ 30.90 Revenues $ 9.60 Net (Loss) $ (1.20) $ (11.30) $ 10.10 Net Income $ 0.40 EPS $ (0.01) $ (0.17) $ EPS $ Solid 0.16 - Balance Sheet/Minimal Debt ($4MM LOC w/Triumph Healthcare) Exciting growth opportunities: New Products New Geographies New Distributors/Manufacturers Trading Snapshot Symbol Exchange Price (3/16/15) Market Capitalization (3/16/15) 52- Week Range Average Daily Volume Shares Outstanding/Authorized Corporate Headquarters SCRC OTCBB $0.12 ~ $17 MM $0.08 - $0.22 500,000 138MM/250MM Tysons Corner, Virginia ScripsAmerica: Evolution of A Healthcare Leader 2008 Founded 2010 Operations Commence 2010 – 2012 Pharmaceutical distribution services (primarily McKesson) Retail, hospitals, long-term care facilities and government and home care agencies 2013 2013-2014 McKesson squeezes margins, increases chargebacks ScripsAmerica Pivots to New Growth Strategy - Initial (majority) investment in Main Avenue Pharmacy New Strategy o Enter Specialty Pharmacy and Independent Pharmacy distribution markets o Adding other, complementary products One Platform – Multiple Opportunities ScripsAmerica Evolving Operations Established Operations Main Avenue Pharmacy PIMD E2014 Revenues @$29,000,000.00 February ‘15 Revenues @$554,000.00 Evolving Businesses Wholesale Rx RapiMed $200,000 Order Pending Physician Dispensing Diabetic Supplies 700+ Patients Signed The Specialty Pharmaceuticals Market Estimated 1% - 5% of population cannot tolerate medications in standard formulas* Specialty pharmacy industry growth drivers: Shortages of mass-produced drugs Growth in the senior citizen population Increased awareness of compounding pharmacies and pharmaceutical applications Physicians concerned about prescribing narcotic pain medication (e.g. Oxycontin, Vicodin, Hydrocodone) and are looking for alternative delivery systems Compounding industry: $5 billion in Annual Revenues “A growing number of doctors and patients will likely turn to compounding pharmacies to prepare medications with alternate doses and strengths”* *source: IBIS Worldwide ScripsAmerica’s Specialty Pharma Business Main Avenue Pharmacy acquired Feb. 14, 2014 (100% effective October 2014) Offering a wide variety of specialty pharmaceutical products to treat pain, scars, wounds, vitamin deficiencies among others FDA approved and licensed in 10 states Additional states being added Capacity of hundreds of compounding prescriptions/month In process of expanding No manufacturing (subject to more restrictive regulations) Pre-Approval Avoids Collection Risk Doctor writes prescription Submitted for payment to Insurance Company/Third party payers No Medicaid, Medicare 2006 Prescription approved for payment Order to compound transmitted to Main Avenue Pharmacy Bill generated & sent to Insurer/3rd Party Payer Prescription sent FedEx to patient - who must sign return receipt Total Payment Cycle Time: 35 days Case Study: Just One of ScripsAmerica’s Many Products More than 100 million Americans suffer from chronic pain 83% reported significant reduction in their pain after using custom-compounded prescription pain creams On average, survey respondents said the creams reduced their pain levels by more than half Five percent of respondents say the creams completely eliminated their pain 38 % reported reducing other oral pain medications while using the creams > 83 % of respondents said their pain had eased since starting their use of the non-opioid prescription creams They reported an average reduction of 57 percent in their pain level after directly applying the creams to the site of their pain, for most recent 24-hour period After 4 weeks, patients reported significant improvement in their physical and emotional quality of life Six percent of the patients reported minor adverse effects - such as rashes. •The results demonstrate the ability of locally-applied prescription creams to deliver significant pain relief over time to many patients, without the need for patients to rely on opioids and other narcotics. •The FDA, quoted in the New York Times, said prescription drugs account for about three-quarters of all drug overdose deaths in the United States, with the number of deaths from narcotic painkillers, or opioids, quadrupling since 1999. •A 2011 report in the journal Pain Medicine, estimated the total societal cost of prescription opioid abuse at $55.7 billion. Source: Patient Outcomes Analytics (POA), a research organization, a survey assessing patients' experience with topical prescription pain creams and their impact on the use of other oral pain medications. POA implemented an Institutional Review Board (IRB) approved protocol to survey and assess patient outcomes. Specialty Pharmaceuticals Growth Strategy Expand Licensing to New States Add Pharmacies Two Pharmacies under LOI - will add 30 states Bring on Additional Marketing Partners Introduce New Products Other Growth Platforms RapiMed – Child Pain & Fever Relief tablets- Approval Pending PIMD International Physician Diabetic Dispensing Program Medical Supplies RapiMed Oral Delivery Technology Rapid Release, Fast Dissolving Fever & Pain Relief Tablets Over The Counter Product Manufactured in United States Regulated dosage (80mg, 160mg) for children 2 – 11 Signed Contract with Distributor in China $200,000 order pending- $60,000 Cost (Attractive Margins) Oral Tablet that dissolves in 25-35 Seconds Fruit Flavors-Wild Cherry, Wild Grape Fast Absorption Into System PIMD International, LLC Problem: Small chains/individual pharmacies unable to fill prescriptions for controlled substances Product manufacturers impose minimum order quantities far beyond the needs of the smaller operations Solution: A DEA and State licensed business that represents independent pharmacies PIMD licensed by DEA and 14 states for wholesale distribution of Prescription drugs and OTC branded products Off to good start Revenues January 2015 $135,000 February 2015 $554,000 Physician Dispensing Program Nearly all States have regulations governing the dispensing of drugs by physicians Typical Regulations: Dispensing in limited situations State agencies licensure Limit profits on drugs dispensed by physicians Protect freedom of choice for consumers Procedural controls - such as labeling and record keeping ScripsAmerica’s PDP program facilitates Physician Compliance Actively Being Marketed - In Discussion with Several Doctors Goal = 100 dispensing physicians by 12/31/15 Strong, Experienced Leadership Team Robert Schneiderman, CEO & Founder Accomplished entrepreneur with proven track record building businesses and creating value for shareholders CEO of one of Philadelphia’s leading recruitment firms for 32 years Jeffrey Andrews, CFO Finance professional with extensive background creating value with public companies CFO - Global Resource Corporation, Judge Information Management Solutions, and The Judge Group Other Key Executives Peter W. Megill, CPA, Corporate Controller 25 years experience Chad Beene, National Sales Manager 11 years experience Adam Brosius, Director Business Development 15 years experience Financial Results Recent Results of Operations Significant Improvement In millions, except EPS 2014 (P) 2013 Net Revenues $ 31.5 $ 0.60 Operating Income ($ 0.01) ($ 7.4) Net (Loss) ( $ 1.2) $(11.3) + $ 29.9 + $ 7.4 + $ 10.1 EPS ($ 0.01) ($ 0.17) + $ 0.16 127.5 68.1 Shares (P) Preliminary results, subject to final audit Improvement First Quarter 2015 Profitable March 31, 2015 March 31, 2014 (Projected) (Actual) (3 months) (3 months) Revenue $ 9,600,000 $ 800,000 Operating Income* $ 1,001,000 $ Income (loss) from Operations $ 594,000 ($ 214,000) Net Income (loss)** $ 407,000 ($1,213,000) * prior to shares issued for services ** due to NOL, no tax liability recognized 612 Strong & Improving Financial Position December 31, 2014* December 31, 2013 * (000’s omitted) Cash Receivables Inventory Total Current Assets $ 730 $ 2,679 $ 1,011 $ 4,699 $ 47 $ 1,089 $ -0$ 1,490 $ 5,659 $ 1,781 Line of Credit Payables & Accruals Purchase Order Financing Deferred Revenue Total Current Liabilities $ 653 $ 2,268 $ -0 $ 225 $ 3,349 $ 99 $ 227 $ 1,037 $ -0 $ 3,188 Preferred Stock $ 1,043 $ 1,043 Total Equity/(Deficit) ($ 0.1) ($ 3,617) Total Liabilities & Stockholders Equity $ 5,659 $ 1,781 Total Assets * BALANCE SHEET EXCERPTS Capital Structure 12/31/14 Working Capital $1.350 MM 12/31/13 ($1.698 MM) 149 Shareholders of record ~ 50% owned by 10 "Friends & Family" Shareholders Preferred Convertible Debt - $1MM-Held by Board Member, Convertible into 6MM shares Term Debt – $233,000, 9% due 9/2016. Holder: Board member Convertible Debt: $616,000 convertible at $.175 Unsecured Debt $300,000 due 12/2015 A/R Financing of $4,000,000 (Secured) Rapidly decreasing high-cost debt Significant tax loss carryforwards available ScripsAmerica – Summary ScripsAmerica – Strategy Expand the Compounding Rx Business -Add new Pharmacies, Products and Formulations Launch RapiMeds Launch Physician Dispensing Program Add New Formulations of the Oral Delivery Technology Strategic Acquisitions Eliminate Convertible Notes/Pay Off Unsecured Debt Uplist to Major Exchange Valuation* Multiple of (e) sales *as of 3/13/15 2014 @0.60X CONTACT INFORMATION www.scripsamerica.com Robert Schneiderman, CEO 800-957-7622 ext 101 bob@scripsamerica.com Jeffrey J. Andrews, CFO 800-957-7622 ext 102 Jeff@scripsamerica.com