PowerPoint Presentation - North Carolina Biotechnology Center

Life Sciences Economic Development

“How Does Your Community Stack Up?”

Life Science Economic Development Summit

March 26, 2015

Robert T. Skunda

Senior Consultant, Innovation Centers and Technology Parks

President Emeritus, Virginia Biotechnology Research Park

Virginia Biotechnology Research Park

•

Joint initiative of the Commonwealth of Virginia, City of Richmond and Virginia

Commonwealth University

• Planning undertaken in 1992 as regional initiative

•

State created political subdivision in 1993 (VBRP Authority)

•

34 acres adjacent to VCU Medical Center

•

1.5 million s.f. R&D/office space

•

Employment center for more than 3,000 high technology workers

2

McGuireWoods Consulting, LLC

Formed in 1998 as subsidiary of McGuireWoods LLP

Top 20 National Law Journal’s “Influence 50” law firms

Services include: o Infrastructure & Economic Development o Public-Private Partnerships o State & Federal Government Relations o Communications and Public Relations o Capital Market Strategies and Business Performance

National Economic Development Experience

• Site selection services for major clients in over ½ of

U.S. states

• Lead incentive negotiations

• Secure necessary legislative or regulatory changes

• Negotiate and finalize performance and incentive agreements

www.mcguirewoodsconsulting.com

Presentation Overview

Introduction and Background

Biotechnology Industry

Life Sciences Economic Development

Community Readiness

Closing Comments

6

www.mcguirewoodsconsulting.com

What is Biotechnology?

“From Beer to Biofuels and

Human Growth Hormones ”

7

Biotechnology Industry Segments

“Healing, Fueling, Feeding and

Supplying the World”

• Agricultural Biotech

• Bio Defense

• Biofuels

• Biomanufacturing

• Vaccines

• Human Health

• Regenerative Medicine

• Nanobiotechnology

• Marine Biotechnology

NC Biotechnology Center

8

Future of Biotech and Impact on our Lives

• Ag biotech now in 30 countries

• Growth surpassing traditional industries

Regenerative Medicine 13%/yr

Biobased plastics 20%/yr

Industrial Biotech 85%/yr

• 2012 Biofuel production fell for first time since 2000

• Biotech is subject to market conditions just like traditional industries

9

www.mcguirewoodsconsulting.com

Creating a Life Sciences Cluster

“Big Bang versus Incremental Approach”

10

Factors for Creating Successful Biosciences Cluster

• Research magnet

• Venture capital

• Funding (federal/state) for research

• Specialized facilities & equipment

• Workforce & talent pool

• Entrepreneurial culture

• Create “critical mass”

“Big Bang” Strategy

Creating a Research Base and Industry Cluster in Unison

• Necessary in absence of an existing research magnet

• Also a major expansion of an existing research institution

• Can apply to greenfield and brownfield sites

• Common denominator:

“Lots of $$$”

12

Florida Biotechnology Strategy

• Instituted in 2003 to attract satellite facilities of world class bioscience research labs

• Scripps, Max Planck, Sanford-

Burnham, Torrey Pines Institute among notable successes

• Public criticism about average cost/job ($1.4 M) to taxpayers

• Be careful of “Castle on the Hill” syndrome coming into play

13

North Carolina Research Campus

• Site of former Cannon Mills in Kannapolis, NC

• $1.5 B scientific and economic revitalization project led by David H.

Murdock

• Multiple institutions and private corporations on site with room for growth

14

Incremental Growth Strategy

• Model most often used by most

U.S. research parks

• University partner usually will occupy space in initial phase(s) in addition to providing funding

• Organizational structure often a university foundation, 501-c-3, or government entity

• Mixed-use (live, work, play) is new emphasis in planning

Association of University Research Parks

• 175+ university-affiliated research parks in U.S. today

• 50% governed by affiliated institution

• Access to skilled workforce #1 reason tenants choose parks

• 64% of parks have programs to facilitate collaboration between industry and the university

2012 Battelle Survey

“Typical” U.S. Research Park:

• 119 acres

• 7 buildings/250,000 s.f.

• 25,000 s.f. incubator space

• 26 resident organizations

• 64% for-profits

• 24% university

• 850 average employment

16

Virginia Biotechnology Research Park - 1997

17

Virginia Biotechnology Center

• 27,000 sf incubator and meeting center

• Constructed with $5 M grant from state in 1994

• 10 laboratory suites & 12 private offices for start-ups

• Over 70 companies formed at Center 1995-2013

18

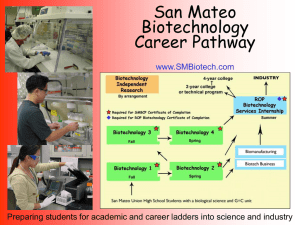

Biotech 1 & 2

Biotech 1

•

100,000 s.f. multi-tenant building

•

VCU Research Institutes

•

Vice President for Research

•

Private Sector Companies

Biotech 2

•

131,000 s.f., $30 million project

•

Build-to-suit project

•

Virginia Division of Forensic Science

•

Office of the Chief Medical Examiner

•

Central Lab for Forensic Science

19

BioHio Research Park

• Wooster, OH (100 mi. from Columbus)

• Ohio Agricultural Research &

Development Center

• Research facilities and expertise for entrepreneurs and companies in Ag biotech

• Master Plan for 350,000 sf of business attraction and meeting space

• Adjacent to OSU Agricultural Research

& Development Center

20

Non-University Affiliated Examples

Sandia Science &Technology Park

• 300 acre park adjacent to Sandia

National Laboratories and Kirkland

AFB

• No higher-ed affiliation

• Government and corporate partnerships

• C3 Center for Entrepreneurship

• Multi-tenant space

21

Perennia Research Center, N.S. Canada

• Private company created by governments of Canada, Nova

Scotia, and agricultural industry

• Serves as agricultural extension and innovation center for crops and marine resources

• 25,000 s.f. Innovation Center offering extraction, research and scale-up of bio-based products

22

Rogue Valley Research Park

• Medford, OR

• Equidistant from Portland and

Sacramento (300 mi)

• Greenfield site

• Goal is to retain talent and build technology base

• Major employers Harry & David and Rogue Regional Medical

Center

• “Highly risky real estate venture”

23

Common Themes of Successful Innovation Centers

• Capitalize on indigenous strengths of the area (human, natural, institutional and business)

• Provide key resources necessary to transform intellectual property and ideas into viable businesses (sources of funding, mentoring, proof-of-concept, networking and market access)

• Places for bringing entrepreneurs and the support networks/resources together

24

www.mcguirewoodsconsulting.com

Formulating a Community

Strategy

“If you don’t know where you’re going, you might end up someplace else”

Yogi Berra

25

North Carolina Biotechnology

• 30 year investment in life sciences

• Over 600 life science companies

• Created NC Biotech Center

• Regional offices based on market segments and strengths

• Now ranked in “Top 5” states for biotech by every measure

26

What Drives Innovation?

• Innovation is derived from collaboration

• Places don’t drive collaborationpeople do

• Our role: “build the framework to attract those who have the shared interest and innovative ideas and create the community

27

What is your Community’s Life Science “I.Q.”?

(Innovation Quotient)

• Higher education institutions

• Major employers

• Research parks

• Community colleges

• Non-Profits and major health care providers

• Business leaders

• Commercial real estate agents

• Yes– even the local Starbucks!

28

Life Sciences Economic Development Toolkit

• Workforce skills and specialized expertise

• Educational resources

• Natural resources

• Access to specialized facilities and equipment

• Research collaborations

• Site (or facility) readiness

• Capital availability

• Marketing & business support

• Additional incentives

• Programs, events, venues that bring people together

29

Virginia Life Science Investments

• Targeted to Israeli companies in

Virginia Biosciences

Commercialization Center

• $75 M locally-raised and based venture fund

• Selectively screen and recruit new companies into portfolio to commercialize technologies in

U.S. and headquarter in the

Biotech Park

30

Technology Accelerator

• Joint Initiative of 2 local gov’ts,

Biotech Park and public utility

• Initial focus on renewable energy

• Goal to create technology jobs in suburban county of Richmond

• Entrepreneur-in-Residence and technical support from Dominion

• Budget of ~$500K/yr.

• 2014- needed to change tech focus and location for budgetary and demand factors

31

Formulating Your Community Strategy

• Inventory of resources

• Identify needs and opportunities

• Meet with NC Biotech Center

• Develop strategic outline of plan

• Identify partners and approach to meeting needs

• Who will be the champion?

• Timetable and implementation strategy

• Set intermediate goals and benchmarks

• “Adopt a good dose of patience”

32

www.mcguirewoodsconsulting.com

Some Closing Thoughts

“Winning isn’t everything, but wanting to win is”

Vince Lombardi

33

Assessing your Community’s Life Sciences

Attraction for Innovation

• What are your unique strengths and resources?

• Are you starting from scratch or building on existing cluster?

• Where is innovation occurring?

• Are there unmet needs that are stifling innovation?

• Are there opportunities for stimulating life science innovation through strategic outside involvement?

• Who are potential partners and leaders?

34

Summing Up

• Understand your strengths

• Think out of the box

• Formulate a vision and plan

• Assemble the resources and support to round out your toolkit

• Don’t be afraid to adjust your strategy as you move forward

• Don’t sit back and wait for the opportunities to come to you

35

www.mcguirewoodsconsulting.com

Thank You !

36