Accounting

Changes

and Error

Corrections

Insert Book Cover

Picture

20

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved.

20-2

Learning Objectives

Differentiate between the three types of

accounting changes and between the

retrospective and prospective approaches to

accounting for and reporting accounting

changes.

20-3

Accounting Changes

Type of Accounting

Change

Change in Accounting

Principle

Change in Accounting

Estimate

Change in Reporting

Entity

Definition

Replaces one GAAP with

another GAAP

Revision of an estimate

because of new

information or new

experience

Change from reporting as

one type of entity to

another type of entity

20-4

Accounting Changes

Error corrections are . . .

Transactions that are either

recorded incorrectly or not

recorded at all.

Not actually accounting changes,

but are accounted for similarly.

20-5

Accounting Changes and

Error Corrections

Retrospective

Two

Reporting

Approaches

Prospective

20-6

Accounting Changes and

Error Corrections

Retrospective

Revise prior year’s statements that are

Two

presented

for comparative purposes to reflect

the Reporting

impact of the change.

The

balance in each account affected is revised to

Approaches

appear as if the newly adopted accounted method

had been applied all along or that the error had

never occurred.

Prospective

Adjust the beginning balance of retained earnings

for the earliest period reported.

20-7

Accounting Changes and

Error Corrections

The change is implemented in the

current

Retrospective

period and its effects are reflected in the

financial statements of the current and

futureTwo

years only.

Prior years’ statements are not revised.

Reporting

Account balances are not revised.

Approaches

Prospective

20-8

Learning Objectives

Describe how changes in accounting principle

typically are reported.

20-9

Change in Accounting Principle

Qualitative

Characteristics

Consistency

Comparability

Although consistency and comparability are desirable,

changing to a new method is sometimes appropriate.

20-10

Motivation for Accounting Choices

Effect on

Compensation

Changing

Conditions

Motivations

for Change

Effect on Debt

Agreements

New Standard

Issued

Effect on Union

Negotiations

Effect on

Income Taxes

20-11

Retrospective Approach

Let’s look at an examples of a change from LIFO to

FIFO that is reported using the retrospective approach.

At the beginning of 2006, Air Parts Corporation changed

from LIFO to FIFO. Air Parts has paid dividends of $40 million

each year since 1999. Its income tax rate is 40 percent.

Retained earnings on January 1, 2004, was $700 million;

inventory was $500 million. Selected income statement

amounts for 2006 and prior years are (in millions):

Cost of goods sold (LIFO)

Cost of goods sold (FIFO)

Difference

Revenues

Operating expenses

Previous

2006

2005

2004

Years

$

430 $

420 $

405 $

2,000

370

365

360

1,700

$

60 $

55 $

45 $

300

$

950 $

230

900 $

210

875 $

205

4,500

1,000

20-12

Retrospective Approach

For each year reported, Air Parts makes the comparative

statements appear as if the newly adopted accounting

method (FIFO) had been in use all along.

Income Statements (Millions)

Revenues

Less: Cost of goods sold (FIFO)

Operating expenses

Income before tax

Less: Income tax expense (40%)

Net income

2006

2005

2004

$

950 $

900 $

875

370

365

360

230

210

205

$

350 $

325 $

310

140

130

124

$

210 $

195 $

186

20-13

Retrospective Approach

For each year reported, Air Parts makes the comparative

statements appear as if the newly adopted accounting

method (FIFO) had been in use all along.

Cost of goods sold (LIFO)

Cost of goods sold (FIFO)

Difference

Previous

2006

2005

2004

Years

$

430 $

420 $

405 $

2,000

370

365

360

1,700

$

60 $

55 $

45 $

300

Comparative balance sheets will report 2004 inventory $345

million higher than it was reported in last year’s statements.

Retained earnings for 2004 will be $207 million higher.

[$345 million × (1 – 40% tax rate)]

20-14

Retrospective Approach

For each year reported, Air Parts makes the comparative

statements appear as if the newly adopted accounting

method (FIFO) had been in use all along.

Cost of goods sold (LIFO)

Cost of goods sold (FIFO)

Difference

Previous

2006

2005

2004

Years

$

430 $

420 $

405 $

2,000

370

365

360

1,700

$

60 $

55 $

45 $

300

Comparative balance sheets will report 2005 inventory $400

million higher than it was reported in last year’s statements.

Retained earnings for 2005 will be $240 million higher.

[$400 million × (1 – 40% tax rate)]

20-15

Retrospective Approach

For each year reported, Air Parts makes the comparative

statements appear as if the newly adopted accounting

method (FIFO) had been in use all along.

Cost of goods sold (LIFO)

Cost of goods sold (FIFO)

Difference

Previous

2006

2005

2004

Years

$

430 $

420 $

405 $

2,000

370

365

360

1,700

$

60 $

55 $

45 $

300

Comparative balance sheets will report 2006

inventory $460 million higher than it would have

been if the change from LIFO had not occurred.

Retained earnings for 2006 will be $276 million higher.

[$460 million × (1 – 40% tax rate)]

20-16

Retrospective Approach

On January 1, 2006, the date of the change,

the following journal entry would be made

to record the change in principle:

GENERAL JOURNAL

Date

Description

Inventory

PR

Debit

Page 4

Credit

400,000,000

Retained Earnings

240,000,000

Deferred Tax Liability

160,000,000

40% of $400,000,000

20-17

Retrospective Approach

In the first set of financial statements after the

change is made a disclosure note is needed to:

Provide

justification

for the change.

Point out that

comparative

information has

been revised.

Report any per

share amounts

affected for the

current and all

prior periods.

20-18

Learning Objectives

Explain how and why some changes in

accounting principle are reported

prospectively.

Explain how and why changes in estimates are

treated prospectively.

20-19

Prospective Approach

The prospective approach is used when it is:

Impracticable to determine some periodspecific effects.

Impracticable to determine the cumulative

effect of prior years.

Mandated by authoritative pronouncements.

FASB

Statement

Update

20-20

Prospective Approach

A change in depreciation method

is considered to be a change in

accounting estimate that is

achieved by a change in

accounting principle. It is

accounted for prospectively as

a change in accounting

estimate.

20-21

Changing Depreciation Methods

Universal Semiconductors switched from SYD

depreciation to straight-line depreciation in 2006.

The asset was purchased at the beginning of 2004

for $63 million, has a useful life of 5 years and

an estimated residual value of $3 million.

Sum-of-the-Years-Digits Depreciaton (millions)

2004 depreciation

2005 depreciation

Accumulated depreciation

$ 20

16

$ 36

($60 x 5/15)

($60 x 4/15)

20-22

Changing Depreciation Methods

÷

20-23

Changing Depreciation Methods

Depreciation adjusting entry

for 2006, 2007, and 2008.

GENERAL JOURNAL

Date

Description

Depreciation Expense

Accumulated Depreciation

PR

Debit

Page 4

Credit

8,000,000

8,000,000

20-24

Changing an Estimate

Changes in accounting

estimates are also accounted

for prospectively.

Let’s look at an example

of a change in a

depreciation estimate.

20-25

Changing an Estimate

On January 1, 2002, Towing, Inc. purchased

specialized equipment for $243,000. The

equipment was depreciated using straight-line

and had an estimated life of 10 years and

salvage value of $3,000. In 2006 the total

useful life of the equipment was revised to 6

years. The 2006 depreciation expense is

a.

b.

c.

d.

$24,000

$48,000

$72,000

$73,500

20-26

Changing an Estimate

On January 1, 2002, Towing, Inc. purchased

specialized equipment for $243,000. The

equipment was depreciated using straight-line

and had an estimated life of 10 years and

salvage value of $3,000. In 2006 the total

useful life of the equipment was revised to 6

years. The 2006 depreciation expense is

a.

b.

c.

d.

$24,000

$48,000

$72,000

$73,500

$243,000 – $3,000 = $24,000 (2002 – 2005)

10 years

$24,000 × 4 years = $96,000 Accum. Depr.

$243,000 – $96,000 = $147,000 Book Value

$147,000 – $3,000 = $72,000 (2006 – 2007)

2 years

20-27

I wonder why

companies make

accounting changes?

It seems like a lot of

trouble to me!

20-28

Learning Objectives

Describe the situations that constitute a

change in reporting entity.

20-29

Change in Reporting Entity

A change in reporting entity occurs as a result of:

presenting consolidated financial statements

in place of statements of individual companies, or

changing specific companies that constitute the

group for which consolidated statements are

prepared.

20-30

Change in Reporting Entity

Summary of the Retrospective Approach for

Changes in Reporting Entity

Recast all previous periods’ financial statements as if

the new reporting entity existed in those periods.

In the first financial statements after the change:

A disclosure note should describe the nature of

and the reason for the change.

The effect of the change on net income, income

before extraordinary items, and related per share

amounts should be shown for all periods

presented.

20-31

Learning Objectives

Understand and apply the four-step process of

correcting and reporting errors, regardless of

the type of error or the timing of its discovery.

20-32

Error Correction

Examples include:

Use of inappropriate principle

Mistakes in applying GAAP

Arithmetic mistakes

Fraud or gross negligence in reporting

For all years disclosed, financial statements

are retrospectively restated to reflect the error

correction.

20-33

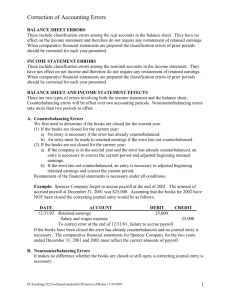

Correction of Accounting Errors

Four-step process

Prepare a journal entry to correct any

balances.

Retrospectively restate prior years’

financial statements that were incorrect.

Report error as a prior period adjustment

if retained earnings is one of the incorrect

accounts affected.

Include a disclosure note.

20-34

Prior Period Adjustments

Prior Period

Adjustment Required

Counterbalancing

error discovered in

the second year.

Noncounterbalancing

error discovered in

any year.

Use the retrospective approach.

Errors Occurred and Discovered

in the Same Period

Corrected by reversing the incorrect

entry and then recording the correct

entry (or by making an entry to correct

the account balances).

20-35

Error Not Affecting Prior Year’s

Net Income

Involves incorrect classification of

accounts.

Requires correction of previously issued

statements (retrospective approach).

Is not classified as a prior period

adjustment since it does not affect prior

income.

Disclose nature of error.

20-36

Error Affecting Prior Year’s Net Income

Requires correction of previously issued

statements (retrospective approach).

All incorrect account balances must be

corrected.

Is classified as a prior period adjustment

since it does affect prior income.

Disclose nature of error.

20-37

Error Affecting Prior Year’s Net Income

20-38

In 2006, the accountant at Orion, Inc. discovered the depreciation

of $50,000 on a new asset purchased in 2005 had not been

recorded on the books. However, the amount was properly

reported on the tax return. This is the only difference between

book and tax income. Accounting income for 2005 was $275,000

and taxable income was $225,000. Orion, Inc. is subject to a 30%

tax rate and prepares current period statements only.

The entry made in 2005 to record income taxes was:

GENERAL JOURNAL

Date

Description

Dec 31 Income Tax Expense

2005

PR

Debit

Page 6

Credit

82,500

Deferred Tax Liability

15,000

Income Tax Payable

67,500

Error Affecting Prior Year’s Net Income

20-39

This error affected the following accounts:

Depreciation expense for 2005 - understated

$

50,000

Accumulated depreciation for 2005 - understated

50,000

Net income in 2005 - overstated ($50,000 x 70%)

35,000

Income tax expense in 2005 - overstated

15,000

Deferred tax liability for 2005 - overstated

15,000

Remember that the 2005 expense

accounts have been closed.

GENERAL JOURNAL

Date

Description

2006

Retained Earnings

35,000

Deferred Tax Liability

15,000

Accumulated Depreciation

PR

Debit

Page 6

Credit

50,000

Error Affecting Prior Year’s Net Income

Let’s assume the following:

Retained earning as 1/1/06 was $922,000. In 2006, the

company paid $65,000 in dividends. Net income for 2006

is $184,000.

The Statement of Retained Earnings would be as follows:

Retained earnings, January 1, 2006

As previously reported

Correction of error in depreciation

Less: Income tax reduction

$

922,000

$ 50,000

15,000

(35,000)

Retained earnings as restated, January 1, 2006

887,000

Add: Net income

184,000

Less: Dividends

(65,000)

Retained earnings, December 31, 2006

$ 1,006,000

20-40

20-41

Correction of Accounting Errors

Identify the type of accounting error for the

following item:

Ending inventory was incorrectly counted.

a. Counterbalancing error affecting net

income.

b. Noncounterbalancing error affecting net

income.

c. Error not affecting net income.

d. None of the above.

20-42

Correction of Accounting Errors

Identify the type of accounting error for the

following item:

Ending inventory was incorrectly counted.

a. Counterbalancing error affecting net

income.

b. Noncounterbalancing error affecting net

income.

c. Error not affecting net income.

d. None of the above.

20-43

Correction of Accounting Errors

Identify the type of accounting error for the

following item:

Loss on sale of furniture was incorrectly

recorded as depreciation expense.

a. Counterbalancing error affecting net

income.

b. Noncounterbalancing error affecting net

income.

c. Error not affecting net income.

d. None of the above.

20-44

Correction of Accounting Errors

Identify the type of accounting error for the

following item:

Loss on sale of furniture was incorrectly

recorded as depreciation expense.

a. Counterbalancing error affecting net

income.

b. Noncounterbalancing error affecting net

income.

c. Error not affecting net income.

d. None of the above.

20-45

Correction of Accounting Errors

Identify the type of accounting error for the

following item:

Depreciation expense was understated.

a. Counterbalancing error affecting net

income.

b. Noncounterbalancing error affecting net

income.

c. Error not affecting net income.

d. None of the above.

20-46

Correction of Accounting Errors

Identify the type of accounting error for the

following item:

Depreciation expense was understated.

a. Counterbalancing error affecting net

income.

b. Noncounterbalancing error affecting net

income.

c. Error not affecting net income.

d. None of the above.

20-47

Correction of Accounting Errors

A prior period adjustment is not required for a

a. Counterbalancing error affecting net income

discovered in the second year.

b. Counterbalancing error affecting net income

discovered after the second year.

c. Noncounterbalancing error affecting net

income.

d. None of the above.

20-48

Correction of Accounting Errors

A prior period adjustment is not required for a

a. Counterbalancing error affecting net income

discovered in the second year.

b. Counterbalancing error affecting net income

discovered after the second year.

c. Noncounterbalancing error affecting net

income.

d. None of the above.

Summary of Accounting Changes and

Errors

Change in Accounting Principle

Most

Prospective

Changes

Exceptions

Method of accounting

Retrospective

Prospective

Restate prior years?

Yes

No

Pro forma disclosure

of income and EPS?

No

No

Cumulative effect on An adjustment to

prior years' income

earliest reported

Not

reported?

retained earnings.

reported.

Journal entries?

Adjust affected

None

balances to new

method.

Disclosure note?

Subsequent

accounting is

affected by

change.

Yes

Subsequent

accounting is

affected by

change.

Yes

20-49

Change in

Estimate

Change in

Reporting

Entity

Error

Prospective

No

Retrospective

Yes

Retrospective

Yes

No

No

Not

reported.

None

Not

reported.

None

No

An adjustment to

earliest reported

retained earnings.

Involves any

incorrect balances

as a result of the

error.

Subsequent

accounting is

affected by

change.

Yes

Consolidated

statements are

discussed in

other courses.

Yes

Yes

20-50

End of Chapter 20