Chapter 12

Fundamentals of Management

Control Systems

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Alignment of Managerial and

Organizational Interests

L.O. 1 Explain the role of a management control system.

• A management control system is designed

to help managers make decisions that will

increase the organization’s performance.

12 - 2

Decentralized Organizations

L.O. 2 Identify the advantages and disadvantages of decentralization.

• Decentralization is the delegation to

subordinates of authority to make

decisions in the organization’s name.

12 - 3

LO2

Advantages of Decentralization

• Better use of local knowledge

• Faster response

• Wiser use of top management’s time

• Reduction of problems to more manageable size

• Training, evaluation, and motivation of local managers

12 - 4

LO2

Disadvantages of Decentralization

• Dysfunctional decision making:

Local managers can make decisions in their interest,

which can differ from those of the organization.

• Duplication of administration:

Local managers make the same types of decisions

made at headquarters.

12 - 5

Management Control System

L.O. 3 Describe and explain the basic framework

for management control systems.

• It is a system designed to influence subordinates

to act in the organization’s interest.

• Principals (owners) use this system to influence

agents’ (managers’) behavior.

12 - 6

LO3

Elements of a Management

Control System

• Delegated decision authority

• Performance evaluation and measurement systems

• Compensation and reward systems

12 - 7

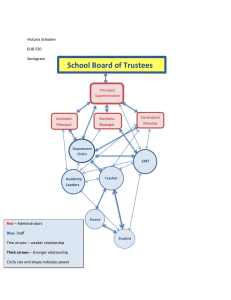

Responsibility Accounting

L.O. 4 Explain the relation between organization

structure and responsibility centers.

• Responsibility accounting reports revenues

and costs at the level within the organization

having the related responsibility.

Responsibility

Cost

centers

Revenue

centers

Profit

centers

Investment

centers

12 - 8

Evaluating Performance

L.O. 5 Understand how managers evaluate performance.

• Controllability concept:

Managers should be held responsible

for costs or profits over which they have

decision-making authority.

• Relative performance evaluation (RPE):

Compares divisional performance with that

of peer group divisions

12 - 9

Corporate Cost Allocation

L.O. 6 Analyze the effect of dual- versus single-rate allocation systems.

Global Electronics

Latin America Division

Income for the Year ($000)

Actual

Target

Revenue

$70,000 $70,000

(Percentage of corporate revenue)

16%

14%

Direct division costs

51,800

51,800

Allocated corporate overhead*

4,800

3,500

Operating profit

$13,400 $14,700

* Global Electronics allocates corporate overhead based on relative revenue.

Corporate overhead was $25 million.

12 - 10

LO6

Corporate Cost Allocation

Global Electronics

Latin America Division

Income for the Year ($000)

Revenue

Direct division costs

Actual

$70,000

51,800

Target

$70,000

51,800

My revenue

and costs

were on target.

12 - 11

LO6

Corporate Cost Allocation

Global Electronics

Latin America Division

Income for the Year ($000)

Actual

Target

Revenue

$ 70,000 $ 70,000

(Percentage of corporate revenue)

16%

14%

Corporate revenue

$437,500a $500,000b

a

$70,000 ÷ 16%

b $70,000 ÷ 14%

I'm not

responsible for

corporate

revenue.

12 - 12

LO6

Corporate Cost Allocation

Global Electronics

Latin America Division

Income for the Year ($000)

Actual

Target

Allocated corporate overhead

$ 4,800 $ 3,500

(Percentage of corporate revenue)

16%

14%

Corporate costs

$30,000a $25,000b

a

$4,800 ÷ 16%

b $3,500 ÷ 14%

I'm not

responsible for

corporate

costs.

12 - 13

LO6

Corporate Cost Allocation

Cost

Cost

• Dual rate method:

This is a cost allocation method that separates a

common cost into fixed and variable components

and then allocates each component using a

different allocation base.

Activity Level

Activity Level

12 - 14

Performance Evaluation

Systems Incentives

L.O. 7 Understand the potential link between incentives

and illegal or unethical behavior.

• Fundamental questions regarding a performance

measurement system:

• Does the measure reflect the results of those actions

that improve the organization’s performance?

• What actions might managers be taking that improve

reported performance but are actually detrimental to

organizational performance?

12 - 15

Internal Controls

L.O. 8 Understand how internal controls can help protect assets.

• Internal control is a process designed to provide

reasonable assurance that an organization will

achieve its objectives in the following categories:

• Effectiveness and efficiency of operations

• Reliability of financial reporting

• Compliance with applicable laws and regulations

12 - 16

End of Chapter 12

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.