Business Start-Up Information

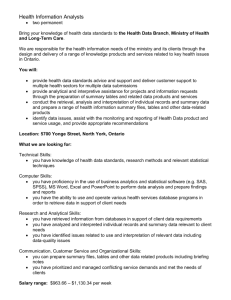

advertisement

2016 Business Start-up Information Business Start-Up Information 2016 Economic Partners Sudbury East / West Nipissing is a community-based, non-profit organization that is dedicated to creating opportunities for entrepreneurship and to the pursuit of economic growth in our community. We are your local branch of the Community Futures Development Corporation (CFDC) and a member of the Ontario Association of Community Futures Development Corporations (OACFDC). Funded by Industry Canada and FedNor, CFDC is a community economic development initiative designed to help find local solutions for local economies. Who We Serve We service a total catchment population of 21,277 people that includes the following communities: Sudbury East Dokis First Nation French River Markstay-Warren St. Charles West Nipissing Nipissing First Nation Nipissing What We Do We are people helping people. Run by a board of local volunteers and professional staff, we take a grass roots approach to investing in local entrepreneurs, exporters, and community initiatives. Here are the key services that we offer you: o o o Community economic planning and development Access to funding for community projects and small businesses Business counselling, services, and resources 30 Front Street, Unit A Sturgeon Falls, ON P2B 3L4 Telephone: 705-753-5450 Fax: 705-753-3456 Website: www.economicpartners.com Email: info@economicpartners.com Page 2 of 21 Business Start-Up Information 2016 Table of Contents Business Start-Up Checklist ..................................................................................................................... 4 Business structures.................................................................................................................................... 5 Option 1: Sole proprietorship ................................................................................................................ 6 Option 2: Partnerships ........................................................................................................................... 7 Option 3: Corporations .......................................................................................................................... 8 Option 4: Cooperatives .......................................................................................................................... 9 Licenses, permits and registrations ....................................................................................................... 10 Municipal................................................................................................................................................ 11 Provincial ............................................................................................................................................... 11 Master Business License ................................................................................................................ 11 Ontario’s Workplace Safety and Insurance Board ...................................................................... 13 Ontario’s Employer Health Tax (EHT) .......................................................................................... 14 Ontario’s Employment Standards .................................................................................................. 15 Ontario Tax Services (ONT-TAXS) ............................................................................................... 16 Retail Sales Tax ............................................................................................................................... 16 Federal ................................................................................................................................................... 17 GST/HST ........................................................................................................................................... 17 Payroll Deductions (Source Deductions) ...................................................................................... 18 Business Insurance.................................................................................................................................. 19 Industry Specific Contacts ...................................................................................................................... 19 Useful Internet Sites................................................................................................................................. 20 Page 3 of 21 Business Start-Up Information 2016 Business Start-Up Checklist Business Preparation Business Idea Chose an option (start a new business, buy an existing one or purchase a franchise) Chose ownership (sole proprietorship, partnership, or corporation) Chose your business name Prepare a business plan Business Start-Up Register your business name with the province of Ontario(Master Business License) Register for HST/GST and/or payroll deductions with Canada Revenue Agency (if applicable) Check zoning and land use regulations with the municipality Register and apply for all Municipal licenses and permits (if applicable) Contact the Ministry of Labour for any Employment Standard questions Register with Workplace Safety and Insurance Board (if applicable) Register with industry specific agencies (if applicable) Open a business bank account Lease or purchase appropriate business premises and equipment Purchase appropriate insurance for your business activities Interview and hire expert help (lawyer, accountant) Determine your employee needs and hire capable people (if applicable) Determine your marketing initiatives and launch them Page 4 of 21 Business Start-Up Information 2016 Business structures Choosing the structure that is suitable for your business can sometimes be challenging. However, it is wise to evaluate each form of business organization to determine which one is appropriate. Now that you have decided on starting your own business, you will have to determine what business structure or form of organization suits your needs. The structure of your business will depend on whether you want to run your business yourself or with a partner or associates. There are four types of business structures: Sole proprietorship Partnerships Corporations Cooperatives. Page 5 of 21 Business Start-Up Information 2016 Option 1: Sole proprietorship With this type of business organization, you would be fully responsible for all debts and obligations related to your business and all profits would be yours alone to keep. As a sole owner of the business, a creditor can make a claim against your personal or business assets to pay off any debt. This form of business organization is the most simple and common for self-employed people. Any income generated and expenses incurred are claimed through personal income taxes each year. If the business will operate in your given name, you are not required to register the business. If you attach any word to your given name, you are required to register under the Business Names Act. Example: Frank Ford – Does not need to register Frank Ford Trucks – Needs to register Advantages: easy and inexpensive to form a sole proprietorship (you will only need to register your business name provincially, except in Newfoundland and Labrador); relatively low cost to start your business lowest amount of regulatory burden direct control of decision making minimal working capital required to start-up tax advantages if your business is not doing well, for example, deducting your losses from your personal income, lower tax bracket when profits are low, and so on all profits will go to you directly Disadvantages: unlimited liability (if you have business debts, personal assets would be used to pay off the debt) income would be taxable at your personal rate and, if your business is profitable, this may put you in a higher tax bracket lack of continuity for your business, if you need to be absent difficulty raising capital on your own Page 6 of 21 Business Start-Up Information 2016 Option 2: Partnerships A partnership would be a good business structure if you want to carry on a business with a partner and you do not wish to incorporate your business. With a partnership, you would combine your financial resources with your partner into the business. You can establish the terms of your business with your partner and protect yourself in case of a disagreement or dissolution by drawing up a specific business agreement. As a partner, you would share in the profits of your business according to the terms of your agreement. You may also be interested in a limited liability partnership in the business. This means that you would not take part in the control or management of the business, but would be liable for debts to a specified extent only. There must be at least one managing partner, and that one partner has unlimited liability. The limited partner will become a general partner if they take on ANY part of the management in the partnership. When establishing a partnership, you should have a partnership agreement drawn up with the assistance of a lawyer, to ensure that: you are protecting your interests that you have clearly established the terms of the partnership with regards to issues like profit sharing, dissolving the partnership, and more that you meet the legal requirements for a limited partnership (if applicable) Advantages: easy to start-up a partnership start-up costs would be shared equally with you and your partner equal share in the management, profits and assets tax advantage, if income from the partnership is low or loses money (you and your partner include your share of the partnership in your individual tax return) Disadvantages: similar to sole proprietorship, as there is no legal difference between you and your business unlimited liability (if you have business debts, personal assets would be used to pay off the debt) hard to find a suitable partner possible development of conflict between you and your partner you are held financially responsible for business decisions made by your partner (for example, contracts that are broken) Page 7 of 21 Business Start-Up Information 2016 Option 3: Corporations Another business structure is to incorporate your business. This can be done at the federal or provincial level. When you incorporate your business, it is considered to be a legal entity that is separate from the owners and shareholders. As a shareholder of a corporation, you will not be personally liable for the debts, obligations or acts of the corporation. Advantages: limited liability ownership is transferable continuous existence separate legal entity easier to raise capital possible tax advantage as taxes may be lower for an incorporated business Disadvantages: a corporation is closely regulated more expensive to incorporate than a partnership or sole proprietorship extensive corporate records required, including shareholder and director meetings, and documentation filed annually with the government possible conflict between shareholders and directors possible problem with residency of directors, if they are in another province or the majority are not Canadian It is important to note: If the owner personally guarantees a contract, then that owner is taking on liability. If the owner personally does something that affects the business, they will be held responsible/liable. If the owner files the incorporation papers themselves, if there are any mistakes or missing clauses, they would become personally liable once again. Page 8 of 21 Business Start-Up Information 2016 If you have decided to incorporate your business, you have some options to consider. 1. Two types of Incorporation: Provincial Federal 2. Incorporating the business name (IE. Ford Inc.) Or Registering as a numbered company (IE. 123456 Ford Ltd.) 3. Two options for filing the Articles of Incorporation Independently (file by yourself) Hiring a lawyer to complete the process on your behalf (suggested) Note: If you register as a numbered company and you wish to use an “operating as” name, you must register that name under the corporation with the province (Master Business License). Option 4: Cooperatives The last business structure you could create is a cooperative. With a cooperative, you would have a business that would be owned by an association of members. This is the least common form of business, but can be appropriate in situations where a group of persons or businesses decide to pool their resources to provide access to common needs, such as the delivery of products or services, the sale of products or services, employment, and more. Advantages: owned and controlled by members democratic control (one member, one vote) limited liability profit distribution Disadvantages: possible conflict between members longer decision-making process participation of members needed for success extensive record keeping less incentive to invest additional capital Page 9 of 21 Business Start-Up Information 2016 Licenses, permits and registrations This checklist shows the different licenses, permits, or registrations that you may be required to obtain from the different level of governments. Municipal - Licenses and permits - Zoning regulations Provincial -Provincial Incorporation -Master Business License -WSIB Insurance - Employer Health Tax (EHT) -Ministry of Labour -RST (retail sales tax) Federal -Federal Incorporation -GST/HST -Payroll Deductions Page 10 of 21 Business Start-Up Information 2016 Municipal Ensure that you review the business licenses, by-laws, zoning, and business taxes with your Municipality. The Corporation of the Municipality of West Nipissing 225 Holditch Street, Suite 101 Sturgeon Falls, Ontario P2B 1T1 Tel: (705)753-2250 Fax: (705)753-3950 www.westnipissingouest.ca Jean-Pierre Barbeau, Chief Administrative Officer Marc Gagnon, Director or Public Works Louise Laforge, Tax Collector & Deputy Treasurer Roger Kennedy, Hydro Superintendant Melanie Ducharme ,Planning Director Peter Ming, Water & Sewer Ginette Rochon, Environmental & Power Generation Provincial Master Business License This license is required for all businesses operating in Ontario under a trade/business name. The license allows the business to advertise the name and to open a business bank account. Financial institutions require proof of registration to open a business account. The Master Business License will provide them with the business identification number (9 digit ID number). Registration Activity Cost @ OBC Sole Proprietorship $60 Partnership $60 Name Check $8 Online Registration $60 Current fees* (as of March 17, 2011) Cost via mail $80 $80 $12 Page 11 of 21 Business Start-Up Information 2016 Please Note: You are only able to search for records in the Ministry of Government Services' current database. The database only contains business names registered within the past five years. Also, the registration of the business name does not grant you exclusive use of the name. In order to legally protect your business name, you would have to register a trademark/trade name or incorporate that name in the area you wish to be protected. To register and/or obtain more information, contact: Sole proprietorship or partnerships in Ontario are registered through Ontario Business Connects (OBC). These consist of workstations in business help centers, and registration can also be done online. Your business registration is valid for five years, after which time you need to renew your registration. In person: Economic-Partners Sudbury East West Nipissing 30 Front Street, Unit A Sturgeon Falls, ON P2B 3L4 705-753-5450 (payment by credit card only) Service Ontario Unit 111, 447 McKeown Avenue North Bay, ON General Inquiries: 1-800-267-8097 (payment by credit card or cash) Online: https://www.ibsa.serviceontario.ca/ibsa/servlet/com.visionmax.servlet. CommandServlet?command=screenflownoscript&screenid=26 By phone: Service Ontario Toll-free 1-800-267-8097 By mail: Ministry of Government Services 393 University Avenue Toronto, ON M5G 2M2 $80.00 fee Page 12 of 21 Business Start-Up Information 2016 Ontario’s Workplace Safety and Insurance Board (Formerly Worker’s Compensation) Most businesses in Ontario must register with the WSIB within 10 days of hiring their first worker. Registering provides workplace insurance coverage for all of your workers, gives you peace of mind, and lets you access experts in health and safety. The benefits of registration are clear: No-fault insurance. Greater protection, since in most cases workers can't sue you following a work-related injury or illness. Benefits for your workers — WSIB insurance replaces lost earnings and covers health care costs resulting from work-related injuries and illnesses. Help in returning your workers to the job — and returning your business to full productivity. Training and prevention programs. To register and/or obtain more information, contact: Registration Hotline at 1-866-734-9742 Workplace Safety and Insurance Board 128 McIntyre Street West North Bay, ONP1B 2Y6 Tel: 705-472-5200 1-800-461-9521 www.wsib.on.ca Page 13 of 21 Business Start-Up Information 2016 Ontario’s Employer Health Tax (EHT) The Employer Health Tax is a payroll tax that applies to all employers in Ontario. Eligible employers do not pay tax on the first $400,000 of annual Ontario payroll. If you are associated with another employer, you have to share the tax exemption. You have to pay EHT if you are an employer and you: Have employees who report for work at your permanent establishment in Ontario pay your employees from your Ontario permanent establishment if they don't report for work at your permanent establishment, and have Ontario remuneration over your share of the tax exemption. To register for an EHT account you must provide the following information: legal name trade name business address mailing address telephone and fax numbers name of contact person or authorized representative payroll start date payroll frequency and amount to determine if you are a yearly, monthly or special filer federal business number employer type to determine if you are an associated employer, multiple account employer or public sector employer. To register and/or obtain further information, contact: Employer Health Tax The Ministry of Revenue toll-free at 1 866 ONT-TAXS (1 866 668-8297) http://www.rev.gov.on.ca/en/tax/eht/ Page 14 of 21 Business Start-Up Information 2016 Ontario’s Employment Standards Fairness in the workplace is the right of all Ontarians. Employment standards are enforced under the Employment Standards Act, 2000 (ESA), which sets out the minimum standards that employers and employees must follow. The Ministry of Labour, through its Employment Standards Program: enforces the ESA and its regulations provides information and education to employers and employees, making it easier for people to understand and comply voluntarily investigates possible violations resolves complaints To obtain more information, contact: Employment Standards Information Centre 416–326–7160 1–800–531–5551 (Toll–free) http://www.labour.gov.on.ca/english/es/ Ontario Ministry of Labour 159 Cedar Street Sudbury, ON P3E 6A5 Fax: 1-705-564-7435 Page 15 of 21 Business Start-Up Information 2016 Ontario Tax Services (ONT-TAXS) At the Ministry of Revenue we continuously address the changing needs of Ontario's 600,000 tax clients and have made it simpler for Ontario businesses to comply with their tax obligations. Businesses will now find themselves more connected and dealing with less paper. Some of our improvements include: one toll-free number; 1 866 ONT-TAXS (1 866 668-8297) one business number; new Internet services providing self-serve options system improvements to provide you with convenient one-window service delivery. To register and/or obtain more information, contact: Ontario Tax Services 1 866 ONT-TAXS http://www.rev.gov.on.ca/en/services/onttaxs/index.html Retail Sales Tax On July 1, 2010, the Retail Sales Tax (RST) was replaced by the Harmonized Sales Tax (HST). The provincial portion of the HST is eight per cent and the federal portion is five per cent, for a combined HST rate of 13 per cent. To register and/or obtain information, contact: 1 866 ONT TAXS (1 866 668 8297). Page 16 of 21 Business Start-Up Information 2016 Federal GST/HST As of July 1, 2010, Ontario harmonized its retail sales tax with the GST to implement the HST at the rate of 13%. The HST rate of 13% includes the 5% federal part and 8% provincial part. To register and/or obtain more information, contact: Canada Revenue Agency 1-800-959-5525 www.cra.gc.ca Before you register Before you register, you need to know the following information: Social Insurance Number Business structure Name of business Location of business Business activity Representative/contact person Obligations Sales amount/reporting period Fiscal year-end Effective date Accounting periods The BN is a numbering system that simplifies and streamlines the way businesses deal with the federal government. It is based on the idea of one business, one number. Not all businesses require a BN and CRA program accounts. Page 17 of 21 Business Start-Up Information 2016 Payroll Deductions (Source Deductions) As an employer, trustee, or payer, you are responsible for deducting Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums and income tax from remuneration or other types of income you pay, remitting them to us and reporting them on the applicable slips. After you have made the deductions, you have to remit these deductions, plus your share, to us. You then report the employee's income and deductions on the appropriate information return. Income Tax As an employer, you are responsible for deducting income tax from the remuneration or other income you pay. There is no age limit for deducting income tax and there is no employer contribution required. http://www.cra-arc.gc.ca/tx/bsnss/tpcs/pyrll/clcltng/ncmtx/menu-eng.html Canada Pension Plan (CPP) You have to deduct CPP contributions from an employee's remuneration if that employee: Is 18 years or older, but younger than 70; is in pensionable employment during the year; is not considered to be disabled under the CPP or QPP; and does not receive a CPP or QPP retirement pension. As an employer, you must also contribute the same amount of CPP that you deduct from your employees' remuneration. http://www.cra-arc.gc.ca/tx/bsnss/tpcs/pyrll/clcltng/cpp-rpc/menu-eng.html Employment Insurance (EI) You have to deduct EI premiums from your employees insurable earnings on each dollar up to the yearly maximum.. As an employer, you must also contribute 1.4 times the EI premium withheld for each employee. Insurable employment includes most employment in Canada under a contract of service (employer-employee relationship). There is no age limit for deducting EI premiums. http://www.cra-arc.gc.ca/tx/bsnss/tpcs/pyrll/clcltng/ei/menu-eng.html To register and/or obtain more information, contact: Canada Revenue Agency 1-800-959-5525 www.cra-arc.gc.ca Page 18 of 21 Business Start-Up Information 2016 Business Insurance Needs for insurance will vary widely with the different types of businesses. Insurance coverage at some level is required by most businesses and is usually necessary as a condition of a loan from a financial institution. As a sole proprietor, having sufficient insurance coverage is especially important because you are personally liable for all debts. For those of you that are starting a home-based business, your existing homeowner’s policy does not automatically cover business assets and operations. The latter also holds true for vehicle insurance policies. There are several types of commercial insurance to consider for your business, some of which include: Liability insurance Home insurance Vehicle insurance Disability insurance Property insurance Contact an insurance broker to discuss your specific business insurance needs. Industry Specific Contacts For information on industry specific guides, please visit Canada Business Ontario Service Centre: http://www.canadabusiness.ca 1-888-745-8888 Page 19 of 21 Business Start-Up Information 2016 Useful Internet Sites General Information Economic Partners Sudbury East West Nipissing Inc. Canada Business Ontario Service Business Development Bank of Canada www.economicpartners.com www.canadabusiness.ca www.bdc.ca Market Research Canada Business Ontario Service StatsCan The Corporation of the Municipality of West Nipissing Industry Canada www.canadabusiness.ca www.statcan.gc.ca www.westnipissingouest.ca www.ic.gc.ca Others Provincial Ministry of Economic Development & Trade Ministry of Finance Ministry of Revenue Northern Ontario Heritage Fund Corporation Health Unit e-laws www.ontariocanada.com www.fin.gov.on.ca www.rev.gov.on.ca www.nohfc.com www.e-laws.gov.on.ca Federal Service Canada Canada Revenue Agency (GST/HST, payroll, etc.) Canadian Intellectual Property Office (patents, trademarks, etc.) Canadian Boarder Services Agency (Import, Export) Strategis – Industry Canada FedNor – Industry Canada www.servicecanada.gc.ca www.cra-arc.gc.ca www.cipo.ic.gc.ca www.cbsa.gc.ca www.ic.gc.ca www.fednor.ic.gc.ca Page 20 of 21 Business Start-Up Information 2016 30 Front Street, Unit A Sturgeon Falls, ON P2B 3L4 Tel: 705-753-5450 / 1-866-448-4478 Fax: 705-753-3456 www.economicpartners.com neil.fox@economicpartners.com Page 21 of 21