wk14 - Tu.ac.th

advertisement

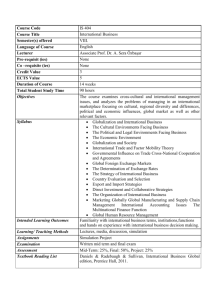

IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Strategy and Master Budget Chapter 8 Objectives: • Describe the role of budget in planning, controlling, and performance evaluation • Discuss the importance of strategy and its role in budgeting and identify factors common to successful budgets • Outline the budgeting process 1 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Role of Budget • A budget is an organization’s operation plan for a specified period • It identifies the resources and commitments required to fulfill the organization’s goals for the period. • Budget is… a plan of operations. a basis for allocating resources. a communication and authorization device. a device for motivating and guiding implementation. a guideline for operations and gauge for controlling operations. 2 a basis for performance evaluation. IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Budget Relationship Strategic Goals Long-Term Objectives Capital Budgeting Long-Range Plan Short-Run Objectives Master Budgets Controls Operations 3 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Master Budget • • • • A master budget is a comprehensive budget for a specific period It consists of many interrelated operating and financial budgets A sales budget often is regarded as the cornerstone of the entire budget The starting point in preparing a sales budget is sales forecasts 4 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Sales Budget • A sales budget shows expected sales in units at their expected selling prices • A firm prepares the sales budget for a period based on the forecasted sales level, production capacity for the budget period, and long-term plan and short-term goal of the firm • A sales budget is the cornerstone of budget preparation because a firm can complete the plan for other activities only after it identifies the expected sales level 5 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Sales Budget Kerry Industrial Products Company Sales Budget For the First Quarter Ended June 30, 2007 Sale Forecast Sales in units Selling price per unit Total sales April May June 20,000 25,000 35,000 x $30 $600,000 Quarter 80,000 x $30 x $30 x $30 $750,000 $1,050,000 $2,400,000 6 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Production Budget • A firm prepares a production budget after determining the number of units that it expects to sell • A production budget is a plan for acquiring the resources needed to carry out the manufacturing operations to satisfy the expected sales and maintain the desired ending inventory • The total number of units to be produced depends on the budgeted sales, the desired units of finished goods ending inventory, and the units of finished goods beginning inventory. 7 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Production Budget Kerry expects to have 5,000 units on hand on April 1 and wants to have 30% of the following month’s projected unit sales on hand at the end of each month. Determining the budgeted units of production: Budgeted Production (in units) = Budgeted Sales (in units) + Desired Ending Inventory (in units) – Beginning Inventory (in units) 8 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Production Budget Kerry Industrial Products Company Production Budget For the Quarter Ended June 30,2007 April May June Quarter Budgeted sales in units 20,000 25,000 35,000 80,000 Desired ending inventory 7,500 10,500 30% of June’s Units needed 27,500 35,500 budgeted sales Beginning inventory 5,000 7,500 Budgeted production 22,500 28,000 July sales are budgeted at 40,000 units, 9 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Direct Material Budget • The information in the production budget becomes the basis for preparing several manufacturingrelated budgets • A direct materials usage budget shows the direct materials required for production and their budgeted cost Total direct Desired direct materials + materials needed in ending inventory production = Total direct Direct materials materials + beginning purchase for inventory the period 10 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Direct Material Budget Each unit produced requires 3 pounds of alloy at a cost of $2.45 per pound. Kerry expects to manufacture 36,000 units in July. On April 1, 7,000 pounds of alloy were in inventory. Budgeted unit production in April is 22,500. At 3 pounds per unit direct material needs are 67,500 pounds. Desired ending inventory is 10 % of the next period’s production needs. In May production needs will be 28,000 units, so 28,000 × 3 pounds = 84,000 × 10% = 8,400 pounds. Determine the total cost of direct material purchase pf April. 11 See Exhibit 8.8 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Direct Material Budget 12 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Direct Material Budget 13 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Direct Labor Budget • To prepare the direct labor budget, a company would use its production budget • The direct labor budget enables the personnel department to plan for hiring and repositioning of employees • A good labor budget helps the firm to avoid emergency hiring, prevent labor shortages, and reduce or eliminate the need to lay off workers • Firms usually prepare labor budget for each type of labors. For example, for each skill requirement. 14 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Direct Labor Budget Each unit of output requires .5 hours of semi-skilled labor at an average cost of $8.00 per hour, and .2 hours of skilled labor at an average cost of $12.00 per hour. Kerry Industrial Production Company Direct Labor Budget For the Quarter Ended June 30, 2007 April May June Budgeted production 22,500 28,000 36,500 Semi-skilled labor costs $ 90,000 $ 112,000 $ 146,000 Skilled labor costs 54,000 67,200 87,600 Total labor costs $ 144,000 $ 179,200 $ 233,600 22,500 × .5 × $8.00 = $90,000 Quarter 87,000 $ 348,000 208,800 $ 556,800 22,500 × .2 × $12.00 = $54,000 15 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Factory Overhead Budget • A factory overhead budget often includes all production costs other than direct materials and direct labor • Unlike direct materials and direct labor, manufacturing overhead costs include costs that vary in direct proportion with the units manufactured as well as costs that vary with either the kind of facilities the firm has or the way in which the firm carries out it operations 16 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Factory Overhead Budget The variable overhead rate is $4.40 per direct labor hour. Fixed factory overhead is $44,300 during April and May, and $54,300 in June. Kerry Industrial Production Company Factory Overhead Budget For the Quarter Ended June 30, 2007 April May June Production Budgeted production Budget 22,500 28, 000 36,500 Semi-skilled hours required 11,250 14, 000 18,250 Labor Budget Skilled labor hours required 4,500 5, 600 7,300 Total direct labor hours 15,750 19, 600 25,550 Variable factory overhead ($4.40 per hour) $ $ $ 112,420 69,300 86, 240 Fixed factory overhead 44,300 44, 300 54,300 Quarter 87,000 43,500 17,400 60,900 $ 267,960 142,900 17 Also see Exhibit 8.10 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Cost of Goods Manufactured Budget • The cost of goods manufactured production cost and the cost of goods sold budget reports the total budgeted cost of units sold for a period • Upon completion of the cost of goods manufactured and sold budget for a period, two items in this budget appear in other budgets for the same period • The income statement budget uses the cost of goods sold to determine the gross margin of the period, and the balance sheets includes the finished goods ending inventory it total assets 18 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Selling and General Administrative Expense Budget • A selling and general administrative expense budget delineates plans for all nonmanufacturing expenses • This budget serves as a guideline for selling and administrative activities during the budget period • Many selling and general administrative expenditures are discretionary 19 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Cash Budget • A cash budget depicts effects of all budgeted activities on cash • By preparing a cash budget, management can: 1. take steps to ensure having sufficient cash on hand to carry out the planned activities 2. allow sufficient time to arrange for additional financing that may be needed during the budget period (and thus avoid high costs of emergency borrowing) 3. plan for investments of excess cash on hand to earn the highest possible return • A cash budget includes all items that affect cash flows and pulls data from almost all parts of the master budget • A cash budget generally includes three major sections: 1. Cash available 2. Cash disbursements 3. Financing 20 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Cash Budget: Receipts Management at Kerry expects 70% of all sales to be for cash and credit card sales, of which 40% are credit card sales that result in a 3% processing fee. Of the company’s accounts receivable 80% are paid in the month following the month of sale, and 60% of these are paid within the discount period (2% discount allowed). Of the remaining accounts receivable, 15% are collected in the second month following the month of sale, and 5% of accounts receivable eventually prove uncollectible. Sales during March were $450,000. 21 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Cash Budget Total sales Total cash sales Customers paying cash Credit card collections Collection on account: Within discount period After the discount period; Previous month Two months earlier Cash collections Kerry Industrial Production Company Cash Receipts Budget For the Quarter Ended June 30, 2007 April May June $ 600,000 $ 750,000 $ 1,050,000 420,000 525,000 735,000 252,000 315,000 441,000 162,960 203,700 285,180 $ $ Quarter 2,400,000 1,680,000 1,008,000 651,840 63,504 84,672 105,840 254,016 43,200 18,000 539,664 57,600 20,250 681,222 72,000 27,000 931,020 172,800 65,250 2,151,906 $ $ $ $420,000 × 40% × 97% = $162,960 $450,000 × 30% × 80% × 40% = $43,200 $450,000 × 30% × 80% × 60% x 98% = $63,504 22 $400,000 × 30% × 15% = $18,000 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Budget Income Statement • The budgeted income statement estimates the expected operating income from the budgeted operations • A budgeted income statement allows management a glimpse of the likely operating result upon completion of the budgeted operation • Once the budget income statement has been approved, it becomes the benchmark against which the performance of the period is evaluated 23 IES 342 Industrial Cost Analysis & Control | Dr. Karndee Prichanont, SIIT Budget Balance Sheet • The last step in a budget preparation cycle usually is to prepare the budget balance sheet • The starting point in preparing the budget balance sheet is the expected financial positions at the end of the current operating period--the beginning balances of the budget period 24