HW 1 Solution - University of New Mexico

advertisement

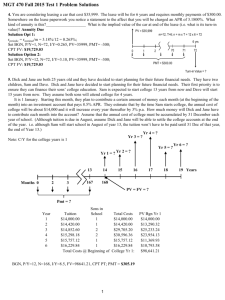

MGT 470 HW 1 1. A basketball player has been offered a “$15 million contract”. He will be paid $1.5 million each year for 10 years beginning today. (A cash flow diagram is optional) a. What is the contract worth if the player’s opportunity cost of capital is 10%. $10,138,536.72 P/Y=1, SET BGN, N=10, I/Y=10, PMT=1500000; CPT, PV: PV = $10,138,536.72 b. How much is the contract worth if the first payment is in one year? $921,685.07 P/Y=1, N=10, I/Y=10, PMT=1500000; CPT, PV: PV = $9,216,850.86 c. How much is the contract worth if the first payment is paid immediately but the payments are $750,00 for 20 years? $7,023,690.07 P/Y=1, SET BGN, N=20, I/Y=10, PMT=750000; CPT, PV: PV = $7,023,690.07 2. A man inherited $1,000,000 of common stock on his 21 st birthday. Beginning on his 22nd birthday and continuing each year until his 61st birthday he withdrew $50,000. He is now broke. He spent twice as much as he inherited (i.e. 40 x $50,000 = $2,000,000) and he thinks that was a good deal. What rate of return did he earn on his inheritance? (Draw a cash flow diagram) 3.9302% PV = $1m P/Y=1, N=40, I/Y=7, PV=-1000000, PMT=100000; CPT, I/Y: I/Y = 3.9302% 0 1 2 38 39 40 PV = $50,000 3. Two banks are offering different interest rates. One bank pays 5% p.a. compounded annually and the other pays 4.95% p.a. compounded monthly. What is the difference between the effective annual interest rates offered by the two banks? (A cash flow diagram is not necessary) 0.0639% 1st Bank: EAR = quoted rate (annual compounding) = 5.0000% 2nd Bank: EAR = (1 + 0.0495 /12)12 – 1 = (1.004125)12 – 1 = 1.050639 – 1 = 5.0639% 2nd Option: 2nd ICONV; NON=4.95, C/Y=12; CPT EFF: EAR = 5.0639% Difference: 5.0639% - 5.0000% = 0.0639% 4. What nominal rate of interest compounded quarterly is equivalent to 10% p.a. compounded semi-annually? (A cash flow diagram is not necessary) 9.8780% Step 1: Find the EAR of 10% compounded semi-annually: 2nd ICONV; NON=10, C/Y=2; CPT EFF: EAR = 10.2500% Step 2: Convert the value found in Step 1 to a nominal rate with quarterly compounding: 2nd ICONV; EFF=10.25, C/Y=4; CPT NOM: NOM = 9.8780% 1 MGT 470 HW 1 5. a. How much will you be willing to pay for a promise of $1,500 per year for 10 years beginning 4 years from today if your required rate of turn is 8% p.a.? (Draw a cash flow diagram) $7,990.02 b. How much would you be willing to pay if your ROR is 8% compounded semi-annually? $7,897.52 a. Find the PV of the 10-yr annuity at t=4 then discount that PV = ? Value to t=0 1) P/Y=1, SET BGN, N=10, I/Y=8, PMT=1500; CPT PV: 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 PV = $10,870.33 2) P/Y=1, N=4, I/Y=8, FV=10870.33; CPT PV: PV = $7,990.02 b. Find the EAR of 8% compounded semi-annually and repeat part a. using this for I/Y $1,500 1) Find EAR 8% s.a.: 2nd ICONV; NON=8, C/Y=2; CPT EFF: EAR = 8.16% 2) P/Y=1, SET BGN, N=10, I/Y=8.16, PMT=1500; CPT PV:PV = $10,808.31 3) P/Y=1, N=4, I/Y=8.16, FV=10808.31; CPT PV: PV = $7,897.52 6. You want to buy a new Chevrolet Corvette Z51on your 28 th birthday. You have priced these cars and found that the current price of a base model Z51 is $59,000. You believe that the price will increase by 3% per year until your are ready to buy. Your best investment opportunity is 13.5000%. (A cash flow diagram is optional) a. If you just turned 22 years old, how much must you invest each month at the end of each month for the next 6 years to be able to purchase the Z51 on your 28th birthday? $640.31 Step 1: Estimate the price of the car six years from now: P/Y=1, N=6, I/Y=3, PV=59000; CPT FV: FV = $70,449.09 Step 2: Determine the annual PMT you need to invest: P/Y=12, N=72, I/Y=13.5, FV= $70,449.09; CPT PMT: PMT = $640.31 b. If you purchased the Z51 today with no down payment and you finance the car with a 6-year loan with monthly payments @5.2000% p.a. interest, what would your monthly payments be? $955.67 P/Y=12, N=72, I/Y=5.2, PV= $59,000; CPT PMT: PMT = $955.6 7. A wealthy manufacturer of gunpowder deposited 5,000,000 Krona in a Bank of Sweden account for the purpose of offering a peace prize. The first prize is to be awarded in exactly 10 years, and thereafter every two years in perpetuity. The bank of Sweden guaranteed in perpetuity an interest rate of 4% compounded semi-annually. What is the maximum feasible size of the prize? (Draw a cash flow diagram(s)) Kr 612,449.27 PV = ? PV = Kr 5,000,000 Yrs 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Translate into this 0 1 Compounding Periods 2 3 4 5 6 7 8 9 (Yr 8) Prize = ? Prize = ? Step 1: Find the value of the investment 10 years from now. This will be the PV of the perpetuity (shown on the right above): P/Y=2, N=20, I/Y=4, PV=5000000; CPT FV: FV = Kr 7,429.737.00 PV = ? 2 yr Step 2: Find the effective annual rate of 4% compounded semi-annually over a two year period: Periods n 4 4 EAR = (1 + r/m) -1 = (1 + 0.04/2) – 1 = (1.02) – 1 = 1.082432 – 1 = 8.2432% Step 3: Solve for the bi-annual payment: PVperpetuity = PMT/EAR PMT = PVperpetuity(EAR) = 1 2 3 4 Kr 7,429.737.00(0.082432) = Kr 612,449.27 Prize = ? r = 8.2432 per period 2 MGT 470 HW 1 8. A family is having difficulty making ends meet. They believe that they need an additional $2,000 per year to spend. (For example, if their net income is $20,000, they need $22,000). They expect this condition to continue for the next 10 years. They wonder about the feasibility of borrowing to make ends meet and repaying later. If the rate of interest they expect is 14% p.a. and they borrow at the beginning of each year for 10 years, how much will they have to pay to retire their debt if they begin equal annual payments 2 years after the date of their last borrowing, and they make 10 annual payments? (Draw a cash flow diagram) $8,452.46 Step 1: Find the FV of the borrowed cash flows. This will be the PV of the repayment cash flows. P/Y=1, SET BGN, N=10, I/Y=14, PMT=2000; CPT FV: FV = $44,089.03 Step 2: Find the amount that must be repaid annually: P/Y=1, N=10, I/Y=14, PV=44089.03; CPT PMT: PMT = $8,452.46 PMT = ? (Repay) 0 1 2 8 $2,000 (Borrow) 9 10 11 12 18 19 20 FV / PV 9. A woman wants to provide for her son’s tuition expenses by making 5 equal deposits in her bank. The first deposit will be today and she will make one each year for the next four years. Her son will start university 10 years from today. His tuition is expected to be $5,000 per year for 4 years, with the first payment in exactly 10 years and the others at intervals of one year. How large must her deposits be if the bank pays 6% p.a.? (Draw a cash flow diagram) $2,296.69 PMT = ? Step 1: Find the value of the four tuition payments at year 10 P/Y=1, SET BGN, N=4, I/Y=6, PMT=5000; CPT PV: PV = $18,365.06 0 1 2 3 4 5 6 7 8 9 10 11 12 Step 2: Discount the value found in Step 1 to t = 0. This will be the PV of the 5-yr annuity due beginning at t=0: P/Y=1, N=10, I/Y=6, FV=18365.06; CPT PV: PV = $10,254.95 $5,000 Step 3: Compute the PMT: P/Y=1, SET BGN, N=5, I/Y=6, PV= 10254.95; CPT PMT; PMT = $2,296.69 13 3 14