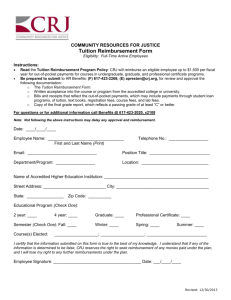

employee handbook - Community Resources for Justice

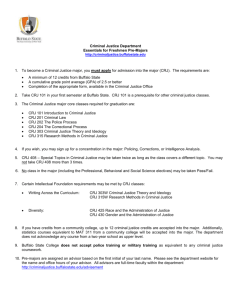

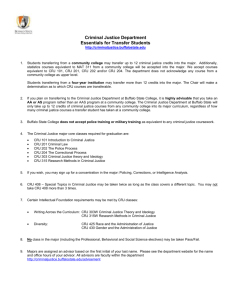

advertisement