Digital Culture Panel Event Slide Deck

advertisement

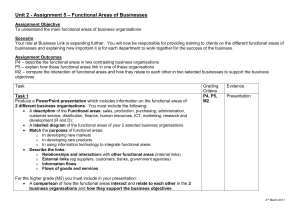

This document may not be reproduced or distributed in any manner without the prior permission of MTM Digital Culture 2013-2015 How arts and cultural organisations in England use technology Client logo 28th January 2016 │Contact ed.corn@mtmlondon.com │ Tel +44 (0) 20 7395 7510 1 MTM helps its clients take advantage of digital-driven change Consumer insight Market and policy research Strategy and growth Service design Digital transformation 2 In 2012 MTM was commissioned to run a three-year study into how arts and cultural organisations use technology 7,476 Number of organisations invited (2015) 2,822 Total responses across three years of study (2013-15) 239 1.3m! Organisations that responded in all three years Approx. number of data points collected (2013-15) 3 Digital plays a crucial role for many organisations, across a range of functions The importance of digital to different business areas Essential Important 20% 28% 22% 70% 52% Marketing Preserving and archiving 24% 27% 28% 27% Distribution and exhibition Creation 20% 52% Operations 25% Business models 4 Impact varies with artform and size, but remains high across all subgroups The overall impact of digital – major positive impact 72% 81% 82% 80% 77% 73% 70% 78% 63% 60% 72% 69% 5 In particular, we have seen the role of digital in revenue generation and business models increase significantly Digital and revenue generation, for example: 45% Now see digital as important to business models (up from 34%) 41% 16% Report a major positive impact on revenue generation (up from 11%) Now accept donations online (up from 35%) 6 However, there have been drops in importance for operations, distribution and creation since 2013 The importance of digital (sig. changes marked with arrows) Essential Important 18% 20% 27% 28% 24% 22% 30% 73% 70% 57% 52% 28% 27% 24% 56% 52% 32% 28% 36% 20% 17% 27% 17% 25% 2013 2015 2013 2015 2013 2015 2013 2015 2013 2015 2013 2015 Marketing Preserving and archiving Operations Distribution and exhibition Creation Business models 7 This has fed through into small but significant declines across a range of activity and impact measures Activities Impacts • Six activities are now less common, e.g.: • Falls in six impact areas, e.g.: Publishing content to website Exhibiting the end product Live streaming Making recordings available digitally • Two data activities also less common, e.g.: Use data to inform online strategy Audience engagement Collaborating with other orgs • Drops most likely to be reported by medium-size orgs, and by music and combined arts 8 It seems that organisations are finding it difficult to deliver on ambitious plans Reality vs. aspirations Chg. in take-up (2015 vs. 2014) Planning to introduce new activity (2014) 1% Crowdfunding 21% 3% Accept online donations 19% -4% Sell products online 16% -2% Educational content 14% -5% Digital experiences used alongside exhibition 12% -4% Educational interactive experiences 12% -4% Make recordings available digitally 12% Blog with commentary -6% 11% -5% Track discussion on social 10% -4% Post video/audio 9% 9 Qualitative feedback suggests a number of potential explanations for these declines • Financial pragmatism – orgs scaling back in non-core areas as budgets tighten? • Experimentation – many still in test and learn, dropping things that aren’t working? • Consolidation – orgs realising they need to refocus on fixing basics, e.g. website? • Barriers increasing – lack of digital skills and suppliers, reduced appetite for risk? Our initial live-streaming pilot in 2014 did not lead to high-quality video, so we want to re-assess our options in this area before attempting it again Our website…is clearly not doing justice to the scale and reach of our work…As a strategic priority we have earmarked a major investment in a new website as part of a broader digital communications strategy 10 The data show us that barriers have become more widespread since 2013 Top 10 barriers (sig. changes marked with arrows) Lack of internal funding for digital 73% Lack of in-house staff time 71% Difficulty in accessing external funding 61% No senior digital manager 39% Slow/limited IT systems 37% Lack of in-house skills 37% Lack of expert advice Lack of external suppliers Lack of in-house confidence Lack of control over IT systems 36% 32% 30% 27% 2013 2015 11 And the situation has also got more difficult from the point of view of digital skills and R&D behaviours Digital skills R&D behaviours (NB. change since 2014) • 4 of 13 skills gaps have widened, e.g.: Website design • 2 areas have become less common: Digital production Rights clearance What we are never truly aware of is the amount of time and therefore cost required to train and develop the skills needed for the successful application of new technologies Experiment & take risks Evaluate impact of digital work • Small orgs considerably worse off, e.g.: Use research Small and data for decision-making Large 9% 34% 12 Against this backdrop we do, however, see organisations which are having great success with digital Digital leaders 10% of orgs that ascribe highest importance to digital… 1. Do a wider range of activities 13.7 Number of activities (average 9.5) 2. Do more complex activities 57% Doing standalone digital exhibits (average 23%) 3. Exhibit R&D behaviours 68% Experiment and take risks (average 28%) 4. Realise benefits 97% Report overall major positive impact (average 72%) 5. Especially on financial measures 38% Report positive impact on profitability (average 14%) 13 In conclusion, we observe a sector transformed by technology, but with significant issues to address Digital has had a profound impact… …but the study reveals important risks • Benefits widely felt – 72% feel a major positive impact • Difficult conditions for innovation – skills gaps and barriers getting worse • Orgs want to do more – 78% intend to try something new next year • Late adopters – 10%+ have no email marketing, website or Facebook • Leaders showing the way – doing, more, realising more benefits • Small organisations – unable to sustain R&D, risk of falling behind How can the sector respond to these challenges? 14 Ed Corn MTM Associate Director 20-22 Shelton Street London 020 7395 7519 WC2H 9JJ Ed.corn@mtmlondon.com United Kingdom