change in the cpa profession and the challenge of the future

advertisement

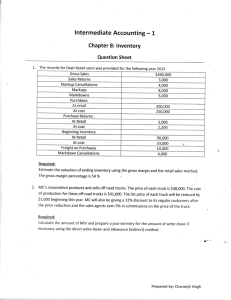

HIGHLIGHTS OF CHAPTER 9: Additional Issues March 2004 SIGNIFICANT ISSUES Lower of cost or market Gross profit method Retail method Dollar-value retail method Change in inventory method Correction of error Purchase commitments LOWER OF COST OR MARKET Principle of conservatism Replacement cost v NRV Applying floor & ceiling Designated market value v Cost 3 application approaches FLOOR & CEILING Ceiling - Net Realizable Value Replacement cost Floor - NRV less normal profit APPLYING RULE Ceiling: Sales price Cost to complete NRV Floor: NRV Normal profit NRV less profit 1,200 100 1,100 1,100 120 980 APPLYING RULE Cost 1,000 Ceiling - NRV 1,100 Replacement cost 950 Floor - NRV less profit 980 Designated market value 980 ALWAYS CHOOSE THE VALUE IN THE MIDDLE THREE APPROACHES Item by item By group Entire inventory GROSS PROFIT METHOD Estimate ending inventory Based on normal gross profits Only an estimate! GROSS PROFIT METHOD Beginning inventory (at cost) Purchases (at cost) Total goods available for sale Sales (at selling price) $280,000 Less: Gross profit at 30% 84,000 Sales (at cost) Estimated inventory (at cost) $60,000 200,000 260,000 196,000 $64,000 GROSS PROFIT RATIO % of sales Alternative is markup on cost -Stated as % of cost Cost $100 Gross profit 50 Markup on cost 50% RETAIL METHOD COST $1,000 30,000 600 (1,500) RETAIL Beginning inventory $1,800 Purchases 60,000 Freight-in Purchase returns (3,000) Net mark-ups 9,000 Abnormal shortages (1,200) (2,000) Total $28,900 $65,800 Cost-to-retail % = 28900/65800 = 43.9% RETAIL METHOD RETAIL Total available for sale at retail $65,800 Less: Net markdowns 1,400 Sales $36,000 Sales returns (900) 35,100 Employee discounts 800 Normal shortages 1,300 Ending inventory at retail $27,200 Cost-to-retail % 43.9% Ending inventory at cost $11,941 LIFO RETAIL METHOD COST $27,000 346,500 Beginning inventory 2001 Purchases, net Net mark-ups Net mark-downs _______ Total $346,500 Net sales Ending inventory 2001 at retail RETAIL $45,000 480,000 20,000 ( 5,000) $495,000 484,000 $ 56,000 2001 Cost-to-retail % (346,500/495,000) 70.0% LIFO RETAIL METHOD Ending inventory 2001 at retail Layer 2000 2001 Retail $45,000 11,000 $56,000 Cost-toretail % 60% 70% $ 56,000 LIFO Cost__ $27,000 _ 7,700 $34,700 DOLLAR-VALUE LIFO COST $27,000 346,500 Beginning inventory 2001 Purchases, net Net mark-ups Net mark-downs _______ Total $346,500 Net sales Ending inventory 2001 at retail RETAIL $45,000 480,000 20,000 ( 5,000) $495,000 484,000 $ 56,000 2001 Cost-to-retail % (346,500/495,000) 70.0% DOLLAR-VALUE LIFO Ending inventory 2001 at retail Price indexes: 2000 100% 2001 112% $ 56,000 Ending inventory 2001 at retail deflated to baseyear prices (56,000 /112%) $ 50,000 DOLLAR-VALUE LIFO Ending inventory 2001 at retail Ending inventory 2001 at base-year Beginning inventory 2001 at base-year Inventory increase at base-year prices Price Cost-toLayer Retail Index retail % 2000 $45,000 100% 60% 2001 5,000 112% 70% $50,000 $ 56,000 $ 50,000 45,000 5,000 LIFO Cost__ $27,000 _ 3,920 $30,920 DOLLAR-VALUE LIFO Ending inventory 2002 at retail Ending inventory 2002 at base-year Beginning inventory 2002 at base-year Inventory increase at base-year prices Price Cost-toLayer Retail Index retail % 2000 $45,000 100% 60% 2001 5,000 112% 70% 2002 4,000 120% 75% $54,000 $ 64,800 $ 54,000 50,000 4,000 LIFO Cost__ $27,000 3,920 _ 3,600 $34,520 CHANGE IN METHOD Cumulative effect on prior years included in current P/L Change to LIFO reported on prospective basis Change from LIFO reported on retroactive basis by restating prior year statements CORRECTION OF ERROR Restating prior year statements Record adjustments EFFECT OF INVENTORY ERRORS Beginning inventory Ending inventory Purchases Cost of goods sold Retained earnings Following years PURCHASE COMMITMENTS Record loss when price declines – not when sold Record purchase at market value Loss on future purchases creates a future estimated liability